TIDMMSI

RNS Number : 5145D

MS International PLC

22 June 2023

Chairman's statement

Results and Review

It is pleasing to report that the year ended April 2023 was one

of further, considerable progress for the Company, even if this may

not yet be immediately apparent from the results.

A delay by a customer in taking delivery of a significant

contract, relating to the first sales of our 'VSHORAD' counter

drone land-based weapon system, because of the continuing war in

Europe, meant that, although the equipment was virtually complete

and ready for despatch, it could not be delivered before our year

end. I am confident this will be fully resolved shortly, but the

timing issue negatively impacted the year's reported figures.

Accordingly, a pre-tax profit of GBP5.08m (2022-GBP5.97m) was

achieved on increased revenue of GBP83.96m (2022-GBP74.53m). Basic

earnings per share amounted to 25.6p (2022-30.9p).

More significantly, the value of the Group's order book has

almost doubled over the period to stand at a record GBP115 million

at the year end (2022-GBP64 million) while the balance sheet

remained strong with total cash of GBP15.52m (2022-GBP19.25m).

'Defence'

Another year of record revenue for this division, complemented

by the successful launch of our first 'in-house', developed,

land-based military product namely 'VSHORAD'. This was designed and

produced by us as an effective counter to the many threats posed to

strategic infrastructure by drone warfare.

Following extensive and comprehensive performance proving

trials, we were delighted to have been awarded our first order for

the supply of seven 'VSHORAD' systems to an overseas customer.

Meantime, our determined endeavours in the United States are

being rewarded. We continue to make positive headway towards our

goal to gain appropriate US military product approval for our

MSI-DS 30mm naval gun system following rigorous testing trials

conducted on our weapon system.

'Forgings'

This was another good business performance from our

manufacturing operations based in the UK, the United States and

Brazil, at a time when not only we, but also our many international

customers, were focused on seeking to realign raw material and

component availability to match current demand, following the

disruptions inflicted by the global pandemic.

'Petrol Station Superstructures'

High levels of business activity across the markets we serve and

a dynamic performance from our UK and Polish operations, resulted

in both sales and profitability exceeding expectations whilst

delivering strong cash positions at the year end.

With many years of experience in constructing petrol station

superstructures, not only in the UK but also in mainland Europe, we

are extremely well placed to address a changing marketplace that is

reflecting the demands of an ever-increasing number of electric

vehicles. Forecourt operators are intensifying their efforts to

upgrade sites to become broader 're-fuelling - hubs' that can

facilitate a wide variety of liquid fuels, under-canopy electric

charging and vehicle valeting combined with increasing facilities

for retail shopping and roadside convenience food.

'Corporate Branding'

Our UK operations have continued to expand and prosper,

providing our petrol station forecourt customers with a quality

service for both new projects and the important maintenance and

repair of existing site branding.

In contrast, we experienced a much slower recovery in business

activity in our Netherlands based mainland Europe operations which

was disappointing and is accordingly being addressed.

Outlook

'Defence'

I am pleased to report that we have recently received

encouraging confirmation that matters have been resolved relating

to the delayed significant contract caused by the continuing war in

Europe. We expect to receive payment shortly and then the equipment

can be delivered.

Following the successful launch of our 'VSHORAD' counter drone

land-based weapon system with this first order, there continues to

be considerable international market interest and excitement that,

we believe, should result in a significant number of further sales

opportunities. In this regard, we are pleased to report that we

have received a new order to supply a number of these systems with

a contract value of circa GBP54m.

Regarding the ongoing opportunities in the US, we cautiously

believe that we are well placed to be awarded a contract to supply

our MSI-DS 30mm naval weapon system to the US Navy. We have been

invited to visit the US to continue commercial negotiations.

In the meantime, we continue to invest in expanding the Defence

business. The ongoing refurbishment and reorganisation of our

Norwich manufacturing and weapon assembly facility is central to

achieving that objective.

'Forgings'

This division already holds a strong international market

presence and excellent reputation as an all-round, top-quality

supplier of forged fork-arms for the global materials handling

industry.

We believe that, with the continuing planned investment in

upgrading facilities and manufacturing equipment across our plants,

we shall continue to perform at an outstanding and acceptable

level.

'Petrol Station Superstructures'

Forecourt operators are adapting very positively to the rising

number of electric vehicles by increasing the number of roof

covered charging points and reorganising site layout to accommodate

a complete range of motor vehicle refuelling facilities. MSI, with

a wealth of experience and detailed construction records for

thousands of petrol station sites, remains well placed to provide

an excellent and efficient service to the market.

'Corporate Branding'

Our UK operation will continue to consolidate and grow its

current leading position in the UK market.

Summary

We perceive that we are achieving a significant, upward step

change in the further development of the Company that will again

bring additional rewards and success for the business. I look to

the future with confidence.

All matters considered the Board recommends the payment of a

final dividend of 13p per share (2022-7.5p) making a total for the

year of 15p (2022-9.25p).

The dividend is expected to be paid on the 18th of August 2023

to those shareholders on the register at the close of business on

the 6th July 2023.

Michael Bell

21(st) June 2023

MS INTERNATIONAL plc

Michael Bell Tel: 01302 322133

Shore Capital (Nominated Adviser

and Broker)

Patrick Castle Tel: 020 7408 4090

Daniel Bush

Copies of this announcement are available from the Company's

registered office at MS INTE RNATIONAL plc, Balby Carr Bank,

Doncaster, DN4 8DH, England. The Notice of AGM will be posted to

shareholders on or before 17(th) July, 2023. The full Annual Report

and Accounts will be posted to shareholders in the week commencing

17(th) July, 2023 at the latest. They will be made available on the

Company's website at www.msiplc.com and will be delivered to the

Registrar of Companies after it has been laid before the Company's

members at the Annual General Meeting to be held on 9(th) August,

2023 at The Holiday Inn, Warmsworth, Doncaster.

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No 596/2014 which is part of UK law

by virtue of the European Union (Withdrawal) Act 2018.

Consolidated income statement

For the year ended 30th April, 2023

2023 2022

Continuing operations Total Total

GBP'000 GBP'000

Revenue 83,956 74,524

Cost of sales (60,556) (54,121)

---------------------------------------------------------------------------------------- --------- ---------

Gross profit 23,400 20,403

Distribution costs (3,402) (3,304)

Administrative expenses (14,748) (12,097)

O ther operating income - 1,185

----------------------------------------------------------------------------------------

(18,150) (14,216)

--------- ---------

Group operating profit 5,250 6,187

Share of net loss of joint venture (36) -

---------

Interest received 134 1

Interest paid (134) (95)

Other finance costs - pensions (136) (126)

---------

(136) (220)

--------- ---------

Profit before taxation 5,078 5,967

Taxation (963) (1,035)

---------------------------------------------------------------------------------------- --------- ---------

Profit for the year attributable to equity holders of the parent 4,115 4,932

---------------------------------------------------------------------------------------- --------- ---------

Basic earnings per share 25.6p 30.9p

Diluted earnings per share 24.2p 29.6p

Consolidated statement of comprehensive income

For the year ended 30th April, 2023

2023 2022

Total Total

GBP'000 GBP'000

Profit for the year attributable to equity holders of the parent 4,115 4,932

Exchange differences on retranslation of foreign operations 97 (603)

---------------------------------------------------------------------------------------- --------- ---------

Net other comprehensive gain/(loss) to be reclassified to profit or loss in subsequent

years 97 (603)

--------------------------------------------------------------------------------------- --------- ---------

Remeasurement (losses)/gains on defined benefit pension scheme (35) 1,601

Deferred tax on remeasurement on defined benefit pension scheme 9 (145)

Revaluation of land and buildings - 3,868

Deferred tax on revaluation surplus on land and buildings (252) (798)

Net other comprehensive (loss)/income not being reclassified to profit or loss in

subsequent

years (278) 4,526

--------------------------------------------------------------------------------------- --------- ---------

Total comprehensive income for the year attributable to equity holders of the parent 3,934 8,885

--------------------------------------------------------------------------------------- --------- ---------

Consolidated and company statement of changes in equity

For the year ended 30th April, 2023

Share Capital Other Revaluation Special Currency Treasury Retained Total

capital redemption reserves reserve reserve translation shares earnings shareholders'

reserve reserve funds

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

(a) Group

At 30th April,

2021 1,784 957 2,815 6,055 1,629 186 (2,789) 20,399 31,036

Profit for the

year - - - - - - - 4,932 4,932

Other

comprehensive

income/(loss) - - - 3,868 - (603) - 658 3,923

------- -------- -------- -------------

Total

comprehensive

income/(loss) - - - 3,868 - (603) - 5,590 8,855

Dividends paid - - - - - - - (1,316) (1,316)

------- ---------- -------- ----------- ------- ----------- -------- -------- -------------

At 30th April,

2022 1,784 957 2,815 9,923 1,629 (417) (2,789) 24,673 38,575

Profit for the

year - - - - - - - 4,115 4,115

Other

comprehensive

income/(loss) - - - - - 97 - (278) (181)

------- ---------- -------- ----------- ------- ----------- -------- -------- -------------

Total

comprehensive

income/(loss) - - - - - 97 - 3,837 3,934

Share option

expense - - - - - - - 86 86

Exercise of

share options - - - - - - 408 (408) -

Dividends paid - - - - - - - (1,520) (1,520)

---------------

At 30th April,

2023 1,784 957 2,815 9,923 1,629 (320) (2,381) 26,668 41,075

--------------- ------- ---------- -------- ----------- ------- ----------- -------- -------- -------------

(b) Company

At 30th April,

2021 1,784 957 7,620 - 1,629 - (2,789) 16,581 25,782

Profit for the

year - - - - - - - 3,362 3,362

Other

comprehensive

income - - - - - - - 1,232 1,232

------- ---------- -------- ----------- ------- ----------- -------- -------- -------------

Total

comprehensive

income - - - - - - - 4,594 4,594

Dividends paid - - - - - - - (1,316) (1,316)

--------------- ------- ---------- -------- ----------- ------- ----------- -------- -------- -------------

At 30th April,

2022 1,784 957 7,620 - 1,629 - (2,789) 19,859 29,060

Profit for the

year - - - - - - - 305 305

Other

comprehensive

loss - - - - - - - (1) (1)

------- ---------- -------- ----------- ------- ----------- -------- -------- -------------

Total

comprehensive

income - - - - - - - 304 304

Share option

expense - - - - - - - 86 86

Exercise of

share options - - - - - - 408 (408) -

Dividends paid - - - - - - - (1,520) (1,520)

---------------

At 30th April,

2023 1,784 957 7,620 - 1,629 - (2,381) 18,321 27,930

--------------- ------- ---------- -------- ----------- ------- ----------- -------- -------- -------------

Consolidated and company statements of financial position

At 30th April, 2023

Group Company

2023 2022 2023 2022

GBP'000 GBP'000 GBP'000 GBP'000

ASSETS

Non-current assets

Property, plant and equipment 24,886 24,537 1,161 1,017

Right-of-use assets 1,162 1,479 4,571 5,029

Intangible assets 2,396 3,002 - -

Investments in subsidiaries - - 15,669 18,126

Investment in joint venture - 34 - -

Deferred income tax asset 1,677 1,435 1,216 1,374

------------------------------------ -------- -------- --------

30,121 30,487 22,617 25,546

-------- -------- -------- --------

Current assets

Inventories 24,764 16,327 2,765 2,592

Trade and other receivables 9,031 12,754 14,344 15,612

Contract assets 144 1,773 - -

Cash and cash equivalents 12,336 18,092 8,016 3,258

Restricted cash held in Escrow 2,917 1,158 - -

------------------------------------ -------- -------- --------

49,192 50,104 25,125 21,462

-------- -------- -------- --------

TOTAL ASSETS 79,313 80,591 47,742 47,008

------------------------------------ -------- -------- -------- --------

EQUITY AND LIABILITIES

Equity

Share capital 1,784 1,784 1,784 1,784

Capital redemption reserve 957 957 957 957

Other reserves 2,815 2,815 7,620 7,620

Revaluation reserve 9,923 9,923 - -

Special reserve 1,629 1,629 1,629 1,629

Currency translation reserve (320) (417) - -

Treasury shares (2,381) (2,789) (2,381) (2,789)

Retained earnings 26,668 24,673 18,321 19,859

------------------------------------ -------- -------- -------- --------

TOTAL EQUITY SHAREHOLDERS' FUNDS 41,075 38,575 27,930 29,060

------------------------------------ -------- -------- -------- --------

Non-current liabilities

Defined benefit pension liability 4,216 4,720 4,216 4,720

Deferred income tax liability 2,943 2,578 - -

Lease liabilities 829 1,158 4,388 4,807

------------------------------------ -------- -------- -------- --------

7,988 8,456 8,604 9,527

-------- -------- -------- --------

Current liabilities

Trade and other payables 15,286 14,878 9,933 7,392

Contract liabilities 14,585 18,329 856 622

Lease liabilities 379 353 419 407

------------------------------------ -------- -------- -------- --------

30,250 33,560 11,208 8,421

-------- -------- -------- --------

TOTAL EQUITY AND LIABILITIES 79,313 80,591 47,742 47,008

------------------------------------ -------- -------- -------- --------

Consolidated and company cash flow statements

For the year ended 30th April, 2023

Group Company

2023 2022 2023 2022

GBP'000 GBP'000 GBP'000 GBP'000

Profit/(loss) before taxation 5,078 5,967 (1,233) 2,509

Adjustments to reconcile profit/(loss) before taxation to cash

generated from operating activities:

Depreciation charge of owned assets and right-of-use assets 2,044 1,746 965 931

Amortisation charge 239 227 - -

Impairment of goodwill 390 349 - -

Impairment of investment - - 2,457 -

Profit on disposal of property, plant and equipment (107) (169) (66) (163)

Share option expense 86 - 86 -

Share of net loss of joint venture 36 - - -

Finance costs 136 220 246 292

Foreign exchange losses (369) (142) - -

Increase in inventories (8,326) (3,657) (173) (1,094)

Decrease/(increase) in receivables 5,510 (930) 1,268 344

(Decrease)/increase in payables (5) 1,340 2,194 1,518

(Decrease)/increase in progress payments (3,726) (3,660) 234 (252)

Pension fund deficit reduction payments (675) (900) (675) (900)

----------------------------------------------------------------- -------- -------- -------- ----------

Cash generated from operating activities 311 391 5,303 3,185

Net interest (received)/paid 50 (43) 44 (1)

Taxation (paid)/received (758) (447) (363) 151

----------------------------------------------------------------- -------- -------- -------- ----------

Net cash (outflow)/inflow from operating activities (397) (99) 4,984 3,335

----------------------------------------------------------------- -------- -------- -------- ----------

Investing activities

Dividends received from subsidiaries - - 2,439 1,249

Purchase of property, plant and equipment (1,971) (2,703) (705) (578)

Purchase of intangible assets - (54) - -

Proceeds on disposal of property, plant and equipment 237 227 120 185

(Increase)/decrease in cash held in the Escrow account maturing

in more than 90 days (1,759) 5,007 - -

Net cash (outflow)/inflow from investing activities (3,493) 2,477 1,854 856

----------------------------------------------------------------- -------- -------- -------- ----------

Financing activities

Lease payments (415) (405) (560) (560)

Dividends paid (1,520) (1,316) (1,520) (1,316)

Net cash outflow from financing activities (1,935) (1,721) (2,080) (1,876)

----------------------------------------------------------------- -------- -------- -------- ----------

(Decrease)/increase in cash and cash equivalents (5,825) 657 4,758 2,315

Opening cash and cash equivalents 18,092 17,390 3,258 943

Exchange differences on cash and cash equivalents 69 45 - -

Closing cash and cash equivalents 12,336 18,092 8,016 3,258

----------------------------------------------------------------- -------- -------- -------- ----------

The financial information set out above does not constitute the

Company's statutory accounts for the periods ended 30(th) April,

2023 or 30th April, 2022 but is derived from those accounts.

Statutory accounts for 2022 have been delivered to the Registrar of

Companies and those for 2023 will be delivered following the

Company's Annual General Meeting. The auditors have reported on

those accounts; their reports were unqualified and did not contain

a statement under section 498 (2) or (3) of the Companies Act

2006.

1. Segment information

The following table presents revenue and profit and certain assets and liability information

regarding the Group's divisions for the years ended 30th April, 2023 and 30th April, 2022.

The reporting format is determined by the differences in manufacture and services provided

by the Group. The 'Defence' division is engaged in the design, manufacture, and service of

defence equipment. The 'Forgings' division is engaged in the manufacture of forgings. The

'Petrol Station Superstructures' division is engaged in the design, manufacture, construction,

branding, maintenance, and restyling of petrol station superstructures. The 'Corporate Branding'

division is engaged in the design, manufacture, installation, and service of corporate brandings.

Management monitors the operating results of its business units separately for the purpose

of making decisions about resource allocation and performance assessment. Group financing

(including finance costs and finance revenue) and income taxes are managed on a group basis

and are therefore not allocated to operating segments.

'Defence' 'Forgings' 'Petrol Station 'Corporate Total

Superstructures' Branding'

2023 2022 2023 2022 2023 2022 2023 2022 2023 2022

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Segmental

revenue

Total revenue 32,433 30,219 23,266 16,482 16,336 15,143 12,412 13,009 84,447 74,853

Revenue from

other segments - - - - (316) (245) (175) (84) (491) (329)

--------------- ------- ------- ------- ------- --------- ------- ------- ------- ------- -------

Revenue from

external

customers 32,433 30,219 23,266 16,482 16,020 14,898 12,237 12,925 83,956 74,524

--------------- ------- ------- ------- ------- --------- ------- ------- ------- ------- -------

Segment result

Operating

profit/(loss) 2,023 4,123 3,864 2,245 2,053 1,074 (2,690) (1,255) 5,250 6,187

Share of net

loss of joint

venture (36) -

Net finance

costs (136) (220)

--------------- ------- -------

Profit before

taxation 5,078 5,967

Taxation (963) (1,035)

--------------- ------- -------

Profit for the

year 4,115 4,932

--------------- ------- -------

Segmental

assets

Assets

attributable

to segments 28,145 33,393 9,394 7,883 10,732 9,380 6,744 8,050 55,015 58,706

Unallocated

assets* 24,298 21,885

Total assets 79,313 80,591

--------------- ------- -------

Segmental

liabilities

Liabilities

attributable

to segments 19,012 23,643 3,942 3,547 3,402 3,109 3,391 3,591 29,747 33,890

Unallocated

liabilities * 8,491 8,126

--------------- ------- -------

Total

liabilities 38,238 42,016

--------------- ------- -------

Other

segmental

information

Capital

expenditure 1,065 1,933 213 389 353 195 340 186 1,971 2,703

Depreciation 322 210 644 561 728 714 350 261 2,044 1,746

Amortisation 18 10 - - 43 43 178 174 239 227

Impairment - - - - - - 390 349 390 349

* Unallocated assets include certain fixed assets (including all UK properties), current assets

and deferred income tax assets. Unallocated liabilities include the defined pension benefit

scheme liability, the deferred income tax liability, and certain current liabilities.

Assets and liabilities attributable to segments comprise the assets and liabilities of each

segment adjusted to reflect the elimination of the cost of investment in subsidiaries and

the provision of financing loans provided by MS INTERNATIONAL plc.

Revenue between segments is determined on an arm's length basis. Segment results, assets,

and liabilities include items directly attributable to the segment as well as those that can

be allocated on a reasonable basis.

Geographical analysis

The following table presents revenue and expenditure and certain assets and liabilities information

by geographical segment for the years ended 30th April, 2023 and 30th April, 2022. The Group's

geographical segments are based on the location of the Group's assets.

United Kingdom Europe USA South America Total

2023 2022 2023 2022 2023 2022 2023 2022 2023 2022

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

External revenue by

origin 51,424 41,665 12,333 11,599 17,270 18,917 2,929 2,343 83,956 74,524

Non-current assets 20,529 20,160 3,365 4,327 6,107 5,913 120 87 30,121 30,487

Current assets 40,269 37,235 5,158 6,147 2,844 6,024 921 698 49,192 50,104

Liabilities 23,281 28,380 3,345 4,112 11,380 9,223 232 301 38,238 42,016

Capital expenditure 1,569 2,377 162 133 240 193 - - 1,971 2,703

Revenue disaggregated by destination is shown as follows:

2023 2022

GBP'000 % GBP'000 %

United Kingdom 28,354 34% 31,287 42%

Europe 21,158 25% 17,103 23%

USA 17,270 21% 19,406 26%

South America 3,036 3% 2,421 3%

Rest of World 14,138 17% 4,307 6%

Total revenue 83,956 100% 74,524 100%

------------------------ --------- --------- ------- ------- ------- ------- ------- --------- --------- --------

The Group's largest customer, which is reported in the 'Defence'

division, contributed 12.6% to the Group's revenue (2022 - 14.2% in

the 'Defence' division from a different customer). There are no

other customers which contributed more than 10% to the Group's

revenue (2022 - 11.4% in the 'Defence' division).

During the year, the Group recognised GBP2.2m of profit in

relation to a contract in the 'Defence' division that was

terminated in April 2023.

2. Other operating income

2023 2022

GBP'000 GBP'000

Settlement of contractual dispute - 1,185

------------------------------------------------------------- --------- --------- ------------- ----------

- 1,185

------------------------------------------------------------ --------- --------- ------------- ----------

In the prior year the Group settled a contractual dispute, the terms of which are confidential.

The amount received was recognised in other income. The Group incurred GBP0.6m of legal costs

in the prior year in relation to this matter. These costs were included in administrative

expenses.

3. Employee information

The average number of employees, including executive directors, during the year was as follows:

Group Company

2023 2022 2023 2022

Number Number Number Number

Production 263 252 78 74

Technical 71 71 21 23

Distribution 26 26 2 2

Administration 94 98 39 39

------------------------------------------------------------- --------- --------- ------------- ----------

454 447 140 138

--------- --------- ------------- ----------

(a) Staff costs

Including executive directors, employment costs were

as follows:

Group Company

2023 2022 2023 2022

GBP'000 GBP'000 GBP'000 GBP'000

Wages and salaries 21,024 18,942 7,415 7,139

Covid-19 job retention scheme income - (1,636) - -

Social security costs 3,853 3,233 822 722

Pension costs 667 570 423 352

Share options expense 30 29 30 29

------------------------------------------------------------- --------- --------- ------------- ----------

25,574 21,138 8,690 8,242

--------- --------- ------------- ----------

The Covid-19 job retention scheme income has been received in the following countries:

2023 2022

GBP'000 GBP'000

The Netherlands - 1,310

USA - 251

Poland - 75

--------- ---------

- 1,636

------------------------------------------------------------ --------- --------- ------------- ----------

(b) Directors' emoluments

2023 2022

GBP'000 GBP'000

Aggregate directors' emoluments 2,072 1,810

Pension contributions 65 52

Gain on exercise of share options 1,042 -

------------------------------------------------------------ --------- --------- ------------- ----------

3,179 1,862

------------------------------------------------------------ --------- --------- ------------- ----------

On 8th December, 2022 two directors exercised LTIP share options

totalling 250,000 at an exercise price of GBP0 per share. The gain

on the exercise of these share options is the difference between

market price at the date of exercise of GBP4.17 and the exercise

price of GBP0 per share.

4. (a) Taxation

The charge for taxation comprises:

2023 2022

GBP'000 GBP'000

Current tax

United Kingdom corporation tax 860 667

Foreign corporation tax 311 120

Adjustments in respect of previous years (76) (10)

----------------------------------------------------------------------------- -------- --------

Group current tax expense 1,095 777

----------------------------------------------------------------------------- -------- --------

Deferred tax

Origination and reversal of temporary differences (122) 261

Adjustments in respect of previous years (2) (5)

Adjustments in respect of difference in applicable tax rate (8) 2

----------------------------------------------------------------------------- -------- --------

Group deferred tax (credit)/expense (132) 258

----------------------------------------------------------------------------- -------- --------

Total tax expense on profit 963 1,035

----------------------------------------------------------------------------- -------- --------

Tax relating to items charged to other comprehensive income:

2023 2022

GBP'000 GBP'000

Deferred tax charged through other comprehensive income

Deferred tax on measurement gains on pension scheme current year (9) 145

Deferred tax on revaluation surplus on land and buildings 252 798

Deferred tax expense in the Consolidated statement of comprehensive income 243 943

----------------------------------------------------------------------------- -------- --------

(b) Factors affecting the tax charge for the year

The tax charge assessed for the year is lower than (2022: lower than) the standard rate of

corporation tax in the UK of 19.5% (2022 - 19%). The differences are explained below:

2023 2022

GBP'000 GBP'000

Profit before tax 5,078 5,967

--------------------------------------------------------------------------------- -------- --------

Profit multiplied by standard rate of corporation tax of 19.5% (2022 - 19%) 990 1,134

Effects of:

Expenses not deductible for tax purposes 35 29

Permanent timing differences (293) (276)

Adjustments in respect of overseas tax rates 125 132

Dual residency tax 232 29

Current tax adjustment in respect of previous years (76) (10)

UK deferred tax not previously recognised (40) -

Deferred tax adjustment in respect of previous years (2) (5)

Deferred tax adjustment in respect of different applicable rates (8) 2

--------------------------------------------------------------------------------- -------- --------

Total taxation expense for the year 963 1,035

--------------------------------------------------------------------------------- -------- --------

(c) Factors affecting future tax charge

On 1st April 2023 the rate of corporation tax in the UK increased from 19% to 25%. Therefore,

deferred income tax has been provided at 25%.

5. Earnings per share

The calculation of basic earnings per share of 25.6p (2022 - 30.9p) is based

on the profit for the year attributable to equity holders of the parent of

GBP4,115,000 (2022 - GBP4,932,000) and on a weighted average number of ordinary

shares in issue of 16,045,581 (2022 - 15,949,691). At 30th April, 2023 there

were 1,270,000 (2022 - 1,055,000) dilutive shares on option with a weighted

average effect of 980,875 (2022 - 716,575) giving a diluted earnings per share

of 24.2p (2022 - 29.6p).

2023 2022

Number of ordinary shares in issue at start of the year 17,841,073 17,841,073

Cancellation of ordinary shares during the year - -

------------------------------------------------------------- ------------ ------------

Number of ordinary shares in issue at the end of the year 17,841,073 17,841,073

-------------------------------------------------------------- ------------ ------------

Weighted average number of shares in issue 17,841,073 17,841,073

Less weighted average number of shared held in the ESOT (245,048) (245,048)

Less weighted average number of shares purchased by the

Company (1,550,444) (1,646,334)

-------------------------------------------------------------- ------------ ------------

Weighted average number of shares to be used in basic

EPS calculation 16,045,581 15,949,691

Weighted average number of the 1,270,000 (2022 - 1,055,000)

dilutive shares 980,875 716,575

Weighted average diluted shares 17,026,456 16,666,266

-------------------------------------------------------------- ------------ ------------

Profit for the year attributable to equity holders of

the parent in GBP 4,115,000 4,932,000

Basic earnings per share 25.6p 30.9p

Diluted earnings per share 24.2p 29.6p

6. Dividends paid and proposed 2023 2022

GBP'000 GBP'000

Declared and paid during the year:

Final dividend for 2022: 7.5p (2021 - 6.5p) 1,196 1,037

Interim dividend for 2023: 2p (2022 - 1.75p) 324 279

-------------------------------------------------------------- ------------

1,520 1,316

------------ ------------

Proposed for approval by shareholders at the AGM:

Final dividend for 2023: 13p (2022 - 7.5p) 2,106 1,196

-------------------------------------------------------------- ------------ ------------

7. Trade and other receivables

Group Company

2023 2022 2023 2022

GBP'000 GBP'000 GBP'000 GBP'000

Trade receivables (net of allowance for expected credit

losses) 6,931 10,167 2,756 2,366

Amounts owed by subsidiary undertakings - - 11,356 13,024

Amounts owed by joint venture - 228 - -

Prepayments 1,027 1,352 228 218

Other receivables 1,071 1,001 4 4

Income tax receivable 2 6 - -

--------

9,031 12,754 14,344 15,612

-------- -------- -------- -----------

(a) Trade receivables

Trade receivables are denominated in the following currencies:

Group Company

2023 2022 2023 2022

GBP'000 GBP'000 GBP'000 GBP'000

Sterling 3,946 5,554 1,739 1,576

Euro 1,973 1,786 1,017 790

US dollar 736 2,406 - -

Other currencies 276 421 - -

---------------------------------------------------------- -------- -----------

6,931 10,167 2,756 2,366

-------- -------- -------- -----------

Trade receivables are non-interest bearing, generally have 30 day terms, and are shown net

of provision for expected credit losses. The aged analysis of trade receivables after provision

for expected credit losses is as follows:

Group Company

2023 2022 2023 2022

GBP'000 GBP'000 GBP'000 GBP'000

Not past due 5,059 7,234 2,282 2,316

< 30 days 1,745 2,062 482 24

30-60 days 90 64 18 19

60-90 days 37 11 - 8

> 90 days - 796 (26) (1)

---------------------------------------------------------- -------- -------- -------- -----------

Total 6,931 10,167 2,756 2,366

----------------------------------------------------------- -------- -------- -------- -----------

In the Group, trade receivables with a nominal value of GBP36,000 (2022 - GBP52,000) were

impaired and fully provided as at 30th April, 2023. During the year, expected credit losses

of GBP42,000 (2022 - GBP20,000) were recovered and expected credit losses of GBP26,000 (2022

- GBP29,000) were incurred.

In the Company, trade receivables with a nominal value of GBP16,000 (2022 - GBP33,000) were

impaired and fully provided as at 30th April, 2023. During the year, expected credit losses

of GBP30,000 (2022 - GBP7,000) were recovered and expected credit losses of GBP13,000 (2022

- GBP29,000) were incurred.

(b) Amounts owed by joint venture

Amounts owed by joint venture are non-interest bearing and have 30 day terms. The aged analysis

of amounts owed by joint venture net of provision for expected credit losses as follows:

Group

2023 2022

GBP'000 GBP'000

Not past due - 135

< 30 days - 47

30-60 days - 34

60-90 days - 12

---------------------------------------------------------- -------- -------- -------- -----------

Total - - 228

----------------------------------------------------------- -------- -------- -------- -----------

At 30th April, 2023 there was no provision for expected credit losses relating to amounts

owed by joint venture (2022 - nil).

(c) Intercompany receivables

All amounts due from Group companies are repayable on demand and are not charged interest.

The majority of intercompany balances are to group entities with liquid assets and are capable

of being repaid on demand. An impairment charge of GBP1,470,000 relating to 'MSI-Sign Group

BV' and 'MSI-Sign Group GmbH' has been recognised on intercompany receivables in the company

(2022 - nil).

There are loans to 'MS INTERNATIONAL Estates Limited' and 'MS INTERNATIONAL Estates LLC',

which although repayable on demand, are supported by properties, which will not be immediately

realisable. The directors have assessed the likelihood of default and the loss in the event

of default as well as the balance at the reporting date and conclude that there is no material

impairment of the receivable.

The amounts receivable at the reporting date can be categorised as:

Company

2023 2022

GBP'000 GBP'000

Amounts due from companies backed by liquid assets 3,607 3,880

Amounts due from 'MS INTERNATIONAL Estates Limited' 5,461 5,925

Amounts due from 'MS INTERNATIONAL Estates LLC' 2,288 3,219

------------------------------------------------------------------------------- --------

11,356 13,024

8. Cash and cash

equivalents

Group Company

2023 2022 2023 2022

GBP'000 GBP'000 GBP'000 GBP'000

Cash at bank and in hand 12,336 18,092 8,016 3,258

Restricted cash held in

Escrow - maturing in

more than 90 days 2,917 1,158 - -

Total cash 15,253 19,250 8,016 3,258

The balance held in Escrow provides security to Lloyds Bank plc in respect of specific guarantees,

indemnities, and performance bonds given by the Group in the ordinary course of business.

9. Net funds

(a) Analysis of net

funds

Group Company

2023 2022 2023 2022

GBP'000 GBP'000 GBP'000 GBP'000

Cash and cash equivalents 12,336 18,092 8,016 3,258

Restricted cash held in

Escrow 2,917 1,158 - -

Lease liabilities (1,208) (1,511) (4,807) (5,214)

14,045 17,739 3,209 (1,956)

(b) Group movement in

net funds

Cash and cash Restricted cash held Lease liabilities Total

equivalent in Escrow

At 30th April, 2021 17,390 6,165 (545) 23,010

Cash flows 657 (5,007) 405 (3,945)

Foreign exchange

adjustments 45 - 7 52

New leases - - (1,327) (1,327)

Other changes - - (51) (51)

At 30th April, 2022 18,092 1,158 (1,511) 17,739

Cash flows (5,825) 1,759 415 (3,651)

Foreign exchange

adjustments 69 - (61) 8

Other changes - - (51) (51)

At 30th April, 2023 12,336 2,917 (1,208) 14,045

(c) Company movement

in net funds

Cash and cash Lease liabilities Total

equivalents

At 30th April, 2021 943 (5,609) (4,666)

Cash flows 2,315 560 2,875

Other changes - (165) (165)

At 30th April, 2022 3,258 (5,214) (1,956)

Cash flows 4,758 560 5,318

Other changes - (153) (153)

At 30th April, 2023 8,016 (4,807) 3,209

9. Reserves

Capital redemption reserve

The balance classified as capital redemption reserve represents the nominal value of issued

share capital of the Company, repurchased.

Other reserves

Following the transfer of assets held at valuation by the Company to a subsidiary company,

a reserve has been created which is non-distributable. This is equal to the revaluation reserve

previously arising.

Additionally, it includes the non-distributable retained reserve for the revaluation reserve

previously showing in the Company for properties now transferred to other members of the Group.

Revaluation reserve

The asset revaluation reserve is used to record increases in the fair value of land and buildings

and decreases to the extent that such decrease relates to an increase on the same assets

previously

recognised in equity.

Special reserve

The special reserve is a distributable reserve created following the cancellation of a share

premium account by way of court order in March 1993.

Currency translation reserve

The foreign currency translation reserve is used to record exchange differences arising from

the translation of the financial statements of foreign subsidiaries. It is also used to record

the effect of hedging net investments in foreign operations.

Treasury shares

The treasury share reserve is detailed as follows:

2022 2021

GBP'000 GBP'000

Employee Share Ownership Trust (a) 100 100

Shares in treasury (b) 2,689 2,959

2,789 3,059

(a) The Employee Share Ownership Trust ("ESOT") provides for the issue of options over ordinary

shares in the Company to Group employees, including executive directors, at the discretion

of the Remuneration Committee. The trustee of the ESOT is Ocorian Ltd, an independent company

registered in Jersey.

The trust has purchased an aggregate 245,048 (2022 - 245,048) ordinary shares, which represents

1.49% (2022 - 1.51%) of the issued share capital of the Company excluding treasury shares

at an aggregate cost of GBP100,006. The market value of the shares at 30th April, 2023 was

GBP1,250,000 (2022 - GBP728,000). The Company has not made any payments (2022 - nil) into

the ESOT bank accounts during the year. Details of the outstanding share options for directors

are included in the Directors' remuneration report.

The assets, liabilities, income, and costs of the ESOT have been incorporated into the Company's

financial statements. Total ESOT costs charged to the income statement in the year amounts

to GBP8,000 (2022 - GBP1,000). During the year, 20,000 options have been granted over shares

(2022 - nil) and 250,000 options on shares were exercised (2022 - nil).

(b) The Company made the following purchases and cancellations of its own 10p ordinary shares

to be held in Treasury:

Number GBP'000

Purchase of 1,000,000 shares from the Group's pension scheme on 11th

December, 2013 1,000,000 1,722

Purchase of 646,334 shares on 30th January, 2014 646,334 1,237

Purchase of 555,000 shares on 15th January, 2021 555,000 636

Consideration paid for purchase of own shares 2,201,334 3,595

Cancellation of 555,000 shares at weighted average rate (555,000) (906)

Exercise of LTIP share options (250,000) (408)

Net value of treasury shares 1,396,334 2,281

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR FFFFIRSILFIV

(END) Dow Jones Newswires

June 22, 2023 02:00 ET (06:00 GMT)

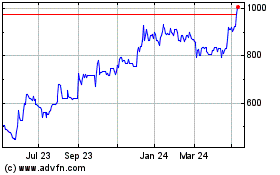

Ms (LSE:MSI)

Historical Stock Chart

From Nov 2024 to Dec 2024

Ms (LSE:MSI)

Historical Stock Chart

From Dec 2023 to Dec 2024