ONESAVINGS BANK PLC One Savings Bank Plc : Director/Pdmr Shareholding

September 29 2016 - 3:50AM

UK Regulatory

TIDMOSB

OneSavings Bank plc

(the 'Company')

Director/PDMR Dealings

The Company announces that it has received notifications that Mr Andrew

Doman, a Non-Executive Director of the Company, made the following share

purchases:

-- on 26 September 2016 he purchased 15,000 ordinary shares in the Company

at an average price of 259.60 pence per share; and

-- on 27 September 2016 he purchased a further 85,499 ordinary shares in the

Company at an average price of 261.25 pence per share.

Following these transactions Mr Doman is interested in 100,499 ordinary

shares in the Company, representing approximately 0.04 per cent of the

ordinary shares in issue.

For further information contact:

Enquiries:

OneSavings Bank plc

Alastair Pate, Head of Investor Relations t: 01634 838973

Brunswick

Robin Wrench / Simone Selzer t: 020 7404 5959

Notes to Editors

About OneSavings Bank plc

OneSavings Bank plc ('OSB') began trading as a bank on 1 February 2011

and was admitted to the main market of the London Stock Exchange in June

2014 (OSB.L). OSB joined the FTSE 250 index in June 2015.

OSB is a specialist lending and retail savings group authorised by the

Prudential Regulation Authority, part of the Bank of England, and

regulated by the Financial Conduct Authority and Prudential Regulation

Authority.

OSB primarily targets underserved market sub-sectors that offer high

growth potential and attractive risk-adjusted returns in which it can

take a leading position and where it has established expertise,

platforms and capabilities. These include private rented sector

Buy-to-Let, commercial and semi-commercial mortgages, residential

development finance, bespoke and specialist residential lending and

secured funding lines. OSB originates organically through specialist

brokers and independent financial advisers. It is differentiated

through its use of high skilled, bespoke underwriting and efficient

operating model.

OSB is predominantly funded by retail savings originated through the

long established Kent Reliance name, which includes online and postal

channels, as well as a network of branches in the South East of England.

Diversification of funding is currently provided by participation in the

Funding for Lending Scheme and access to a securitisation programme.

This announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the information

contained therein.

Source: ONE Savings Bank PLC via Globenewswire

http://www.osb.co.uk/

(END) Dow Jones Newswires

September 29, 2016 04:50 ET (08:50 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

Osb (LSE:OSB)

Historical Stock Chart

From Apr 2024 to May 2024

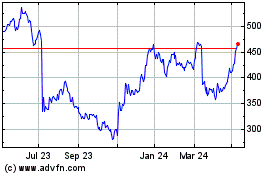

Osb (LSE:OSB)

Historical Stock Chart

From May 2023 to May 2024