RNS Number:6695F

Petaling Tin Berhad

31 December 2002

PETALING TIN BERHAD

Quarterly Report on Consolidated Results For the Fourth Quarter Ended 31st

October 2002

(The figures have not been audited)

CONDENSED CONSOLIDATED INCOME STATEMENT

INDIVIDUAL QUARTER CUMULATIVE QUARTER

CURRENT PRECEDING CURRENT PRECEDING

YEAR YEAR YEAR TO CORRESPONDING

QUARTER CORRESPONDING DATE YEAR TO

QUARTER DATE

31 Oct 02 31 Oct 01 31 Oct 02 31 Oct 01

RM'000 RM'000 RM'000 RM'000

Revenue 42,109 1,888 84,758 23,827

Gross Profit 18,642 637 36,453 10,879

Other Operating Income 241 119 1,535 1,213

Operating Expenses (7,486) (5,161) (12,627) (9,540)

Profit /(Loss) From Operations 11,397 (4,405) 25,361 2,552

Finance Cost (3) (5) (14) (46)

Share of profits and losses of

associated companies - - - -

Profit/(loss) before taxation 11,394 (4,410) 25,347 2,506

Income tax (5,456) (122) (10,043) (1,917)

Net profit/(loss) attributable to

shareholders of the Company 5,938 (4,532) 15,304 589

Earning Per Share (Sen)

- Basic 1.90 (2.03) 5.81 0.36

- Fully Diluted 1.72 (1.31) 4.42 0.17

(The Condensed Consolidated Income Statements should be read in conjunction with

the Annual Financial Report for the year ended 31 October 2001)

Registered Office :

PETALING TIN BERHAD Level 19, Menara PanGlobal

CONDENSED CONSOLIDATED BALANCE SHEET No. 8 Lorong P. Ramlee

50250 Kuala Lumpur.

Tel : 03-2026 4491

Fax : 03-2031 2263

(UNAUDITED) (AUDITED)

AS AT AS AT

CURRENT PRECEDING FINANCIAL

QUARTER YEAR ENDED

ENDED

31 Oct 2002 31 Oct 2001

RM'000 RM'000

1 Property, Plant & Equipment 16,897 14,260

2 Investment in Associated Companies - -

3 Long Term Investments 239,043 249,203

4 Intangible Assets - -

5 Current Assets

Development properties and expenditure 109,530 127,698

Stocks 17,745 15,658

Trade debtors & other receivable 88,423 39,780

Short term investments 448 373

Fixed deposits with financial institutions 531 484

Cash and bank balances 2,733 2,335

219,410 186,328

6 Current Liabilities

Trade creditors 15,610 8,112

Other creditors and accrued liabilities 11,830 17,854

Borrowings 15 1,096

Taxation 28,025 10,614

55,480 37,676

7 Net Current Assets 163,930 148,652

419,870 412,115

8 Shareholders' Funds

Share Capital 344,292 247,223

Reserves 40,702 9,867

384,994 257,090

9 Deferred Taxation 32,722 40,256

10 Long Term Borrowings 54 69

11 Irredeemable Convertible Unsecured

Loan Stocks 2000/2010 ("ICULS") 2,100 114,700

419,870 412,115

12 Net Tangible Assets Per Share (RM) 1.12 1.04

(The Condensed Consolidated Balance Sheets should be read in conjunction with

the Annual Financial Report for the year ended 31 October 2001)

PETALING TIN BERHAD

Quarterly Report on Consolidated Results For the Fourth Quarter Ended

31st October 2002 (The figures have not been audited)

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

TOTAL

SHARE SHARE RESERVES ACCUMULATED SHAREHOLDERS'

CAPITAL PREMIUM PROFIT/(LOSSES) EQUITY

RM'000 RM'000 RM'000 RM'000 RM'000

At 1 November 2001 247,223 28,133 2,584 (20,850) 257,090

Conversion of Irredeemable

Convertible Unsecured

Loan Stocks 97,069 15,531 - - 112,600

Net Profit for the Year - - - 15,304 15,304

At 31 October 2002 344,292 43,664 2,584 (5,546) 384,994

At 1 November 2000 100,844 4,712 2,584 (21,439) 86,701

Conversion of Irredeemable

Convertible Unsecured

Loan Stocks 146,379 23,421 - - 169,800

Net Profit for the Year - - - 589 589

At 31 October 2001 247,223 28,133 2,584 (20,850) 257,090

(The Condensed Consolidated Statements of Changes in Equity should be read in

conjunction with the Annual Financial Report for the year ended 31 October 2001)

PETALING TIN BERHAD

Quarterly Report on Consolidated Cashflow For the Fourth Quarter Ended

31st October 2002 (The figures have not been audited)

CONDENSED CONSOLIDATED CASH FLOW STATEMENT

(UNAUDITED) (AUDITED)

CURRENT PRECEDING CORRESPONDING

YEAR YEAR TO DATE

TO DATE

31 Oct 2002 31 Oct 2001

RM'000 RM'000

Cash Flows From Operating Activities

Net Profit Before Tax 25,347 2,506

Adjustment for:-

Non-cash Items 1,583 2,847

Non-operating Items 4,796 (642)

Operating Profit before Working

Capital Changes 31,726 4,711

Changes in Working Capital

Net Change in Current Assets (32,753) (12,380)

Net Change in Current Liabilities 1,382 (25,723)

Cash Generated From/(Used In) Operations 355 (33,392)

Tax Paid (166) (148)

Interest Received 116 665

Interest Paid (52) (43)

Net Cash Generated From/(Used In)

Operations 253 (32,918)

Cash Flow From Investing Activities

Equity Investments 20 20

Other Investments 1,221 (591)

1,494 (33,489)

Cash Flow From Financing Activities

Bank Borrowings (1,096) (2,707)

Net Changes in Cash & Cash Equivalents 398 (36,196)

Cash & Cash Equivalents At Beginning

of Year 2,335 38,531

Cash & Cash Equivalents At End of

Period/Year 2,733 2,335

(The Condensed Consolidated Cash Flow Statements should be read in conjunction

with the Annual Financial Report for the year ended 31 October 2001)

PETALING TIN BERHAD

QUARTERLY REPORT ENDED 31/10/2002

Notes

1. Basis of Preparation

The interim financial report has been prepared in accordance with MASB 26,

Interim Financial Reporting and Paragraph 9.22 of the KLSE Listing Requirements.

The accounting policies and methods of computation adopted by the Group in this

interim financial report are consistent with those adopted in the financial

statements for the year ended 31 October 2001.

The interim financial report should be read in conjunction with the audited

financial statements of the Group for the year ended 31 October 2001.

2. Qualification of Financial Statements

The Group's audited financial statements for the preceding year ended 31 October

2001 was not subject to any qualification.

3. Seasonality or Cyclical Factors

The Group's current quarter performance was not affected nor influenced by

seasonal or cyclical factors.

4. Items of unusual Nature and Amount

There were no items affecting the assets, liabilities, equity, net income, or

cash flow of the Group that are unusual because of their nature, size or

incidence, except for the items as disclosed in Note 6 and Note 9.

5. Changes in Estimates

There were no changes in the estimates of amounts reported in prior quarters of

the current financial year or estimates of amounts reported in prior financial

years that have a material effect in the current quarter.

6. Issuance and Repayment of Debt and Equity Securities for the Financial

Year to Date

On 2 September 2002, RM112,600,000 nominal value of ICULS (2000/2010) was

converted into 97,068,965 new ordinary shares of RM1.00 each in the Company at a

conversion price of RM1.16 per share.

There were no other issuance and repayments of debt and equity securities, share

buy-backs, share cancellations, shares held as treasury shares and resale of

treasury shares for the financial year to date.

7. Dividends Paid

There were no dividend paid during the financial year to date.

8. Segmental Reporting for the Current Financial Year to Date

Profit/(loss) before

taxation, minority interest

Turnover and extraordinary items Assets Employed

Analysis by activity RM'000 RM'000 RM'000

Investment holding - (641) 1,352

Manufacturing - (7,419) 6,607

Property Development 84,758 33,407 467,391

84,758 25,347 475,350

The geographical analysis is not presented as the Group's operations are solely

based in Malaysia.

PETALING TIN BERHAD

QUARTERLY REPORT ENDED 31/10/2002

9. Property, Plant and Equipment

The values of property, plant and equipment have been brought forward without

amendment from the previous annual financial statements except for the valuation

of property, plant and equipment of a subsidiary company which have been written

down to their recoverable amount estimated by independent valuation based on

Forced Sale Value carried out on 27 December 2002. Consequently, an amount of

RM5.587 million was written off in the current quarter ended 31 October 2002.

10. Material Events Subsequent to the Financial Year to Date

There were no material events subsequent to the fourth quarter ended 31 October

2002 till the date of this report that have not been reflected in the financial

statements in the said quarter.

11. Changes in the Composition of the Group

There were no changes in the composition of the Group for the current quarter

and financial year to date.

12. Changes in Contingent Liabilities and Contingent Assets

There were no contingent liabilities and contingent assets that had arisen since

the last annual balance sheet date.

Additional information required by the KLSE's Listing Requirements

1. Review of Performance of the Company and its Principal Subsidiaries

(a) For the current quarter ended 31 October 2002, the Group has

recorded a pre-tax profit of RM11.394 million as compared to pre-tax loss of

RM4.41 million for the preceding year's corresponding quarter ended 31 October

2001. The profits generated mainly from sales of completed and uncompleted

development properties of Bandar Domain in Karambunai, Sabah and Desa Bukit

Magilds in Sungai Buloh.

(b) For the current financial year to date ended 31 October 2002, the

Group has recorded a pre-tax profit of RM25.347 million as compared to pre-tax

profit of RM2.506 million for the preceding year to date ended 31 October 2001.

The profits generated mainly from sales of completed and uncompleted development

properties of Bandar Domain in Karambunai, Sabah and Desa Bukit Magilds in

Sungai Buloh.

2. Material Changes in the Quarterly Results Compared to the Results of the

Preceding Quarter

For the current quarter ended 31 October 2002, the Group has recorded a pre-tax

profit of RM11.394 million as compared to a pre-tax profit of RM11.632 million

for the previous quarter ended 31 July 2002. The current quarter pre-tax profit

of RM11.394 million accrues mainly from the sales of completed and uncompleted

development properties of Bandar Domain in Karambunai, Sabah and Desa Bukit

Magilds in Sungai Buloh.

PETALING TIN BERHAD

QUARTERLY REPORT ENDED 31/10/2002

3. Prospects for the Remaining Period of the Financial Year

Financial year 2003 is expected to present its own challenges to the Group in

the face of continued global economic uncertainties through a phase of recovery.

The country's moderate growth forecast and an expected weak consumer sentiment

will bear challenges for players in the property development business. However,

pro-active measures and stimulus packages introduced by the Government to revive

the country's economy will provide impetus to stimulate spending and domestic

consumption. Barring any unforeseen circumstances, the Board is optimistic that

the Group will remain profitable in the next financial year.

4. Shortfall in the Profit Guarantee

There is no shortfall in aggregate actual profits achieved as compared to the

aggregate minimum profit guarantee for the three (3) financial years ended 31

October 2002 by the vendors of Golden Domain Holdings Sdn Bhd.

5. Taxation

Quarter Year

Ended To Date

31.10.2002 31.10.2002

RM'000 RM'000

Taxation comprises of the followings:

Malaysian taxation based on profit for

the period:

Current 10,339 17,932

Deferred (4,527) (7,533)

5,812 10,399

Over provision in prior period (356) (356)

5,456 10,043

The Group effective tax rate for the current quarter and financial year to date

is higher than the standard tax rate as there is no Group relief for losses

suffered by the Company and certain subsidiary companies and certain expenses

were disallowed for tax purposes.

6. Profit on sales of Unquoted Investments and/or Properties

There were no profit on sales of unquoted investments and properties as there

were no disposal of investment or properties for the current quarter and

financial year to date other than disposal of development properties.

7. Quoted securities

a) There were no purchases nor disposal of quoted securities

for the financial year to date.

b) Total investments in quoted securities as at 31 October

2002 are as follows:

RM'000

Quoted shares, at cost 1,152

Provision for diminution in value (704)

At book value 448

Market value 455

PETALING TIN BERHAD

QUARTERLY REPORT ENDED 31/10/2002

8. Status of Corporate Proposals

As at the date of the report the rescue exercise duly approved by the

shareholders at an Extraordinary General Meeting held on 20 August 1999 ("Rescue

Proposals") has been completed, save and except for the transfer of land title

of the Ulu Kelang Project, which is in progress.

9. Group Borrowings and Debt Securities

Total Group borrowings as at 31 October 2002 are as follows:

Secured RM'000

Long Term Borrowings

Total outstanding balances 69

Repayment due within the next 12 months (15)

Total 54

Short Term Borrowings

Current portion of term loan and hire

purchase 15

The above borrowings are denominated in Ringgit Malaysia.

10. Off Balance Sheet Financial Instruments

The Group does not have any financial instruments with off balance sheet risk as

at the date of this report.

11. Material Litigation

Save as disclosed below, the Group is not engaged in any material litigation as

at the date of this report.

(a) On 12 April 1996, Lam Hong Kee Sdn. Bhd. ("LHKSB") entered

into a Sale and Purchase Agreement with Magilds Park Sdn. Bhd. ("MPSB"), a

subsidiary of the Company, for the purchase of an industrial lot held under the

land title HS(D) 37590 P.T. No. 19694, Mukim Batu, District of Kuala Lumpur at

the purchase price of RM786,258.00. On 18 April 2000 LHKSB as the Plaintiff

filed a suit against MPSB. LHKSB is claiming among others for a refund of

RM314,503.20 which they have paid in respect of the progressive payment towards

the purchase price and a claim for the sum of RM92,394.90 being interest of the

progressive purchase price paid. The case has been fixed for hearing in Court on

15 April 2003.

(b) On 24 October 1996, Excel Chemical Trading Sdn. Bhd. ("Excel")

entered into a Sale and Purchase Agreement with MPSB for the purchase of an

industrial lot held under the land title HS(D) 37590 P.T. No. 19694, Mukim Batu,

District of Kuala Lumpur at the purchase price of RM996,912.00. On 4 December

2000, Excel as the Plaintiff filed a suit against MPSB. Excel is claiming among

others for a refund of RM398,764.80 which they have paid in respect of the

progressive payment towards the purchase price and late delivery of vacant

possession in the sum of RM93,682.41. The Senior Assistant Registrar (SAR) has

passed a judgement in favour of the Plaintiff. MPSB has appealed to the High

Court Judge in Chamber against the SAR's decision. The case has been fixed for

hearing in the High Court on 13 January 2003.

Provision has been made in the accounts of MPSB in accordance to legal advice.

PETALING TIN BERHAD

QUARTERLY REPORT ENDED 31/10/2002

12. Dividend

There was no dividend proposed for the financial year to date.

13. Earnings Per Share

a. The calculation of basic earnings per share for the

current quarter and the financial year to date are based on the Group profit

after tax of RM5,938,060 for the current quarter and RM15,303,673 for the

financial year to date divided by weighted average ordinary shares in issue of

311,936,013 for the current quarter and 263,401,531 for the financial year to

date.

b. The calculation of diluted earnings per share for the

current quarter and the financial year to date are based on the Group profit

after tax of RM5,938,060 for the current quarter and RM15,303,673 for the

financial year to date divided by weighted average ordinary shares in issue of

346,102,681, on the assumption that the outstanding 2,100,000 nominal value of

ICULS (2000/2010) have been exercised and converted into new ordinary shares of

RM1.00 each in the Company on 1 November 2001.

By Order of The Board

PETALING TIN BERHAD

LAI GIN NYAP

Chief Financial Officer

Kuala Lumpur

Date : 31 December 2002

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR FDWSUFSESESE

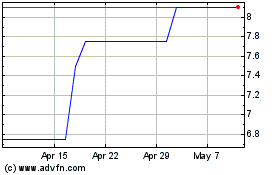

Petards (LSE:PEG)

Historical Stock Chart

From Jun 2024 to Jul 2024

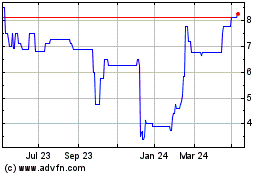

Petards (LSE:PEG)

Historical Stock Chart

From Jul 2023 to Jul 2024