Capital Reorganisation

May 19 2010 - 1:00AM

UK Regulatory

TIDMPEG

RNS Number : 1492M

Petards Group PLC

19 May 2010

PETARDS GROUP PLC

(AIM: PEG)

Capital Reorganisation

Petards Group plc ("Petards" or "the Company"), the AIM quoted developer of

advanced security and surveillance systems, announces that the Notice of 2010

AGM and Annual Report and Accounts for the year ended 31 December 2009 are being

sent to shareholders today. In addition, the Company is also sending notice of a

circular and notice of a general meeting convened to approve a proposed capital

reorganisation. The above documents can be viewed from the Company's website,

www.petards.com.

Background to and reasons for the Capital Reorganisation

The Company's share price has been below the nominal value of its Existing

Ordinary Shares for some time. Company law prohibits companies from issuing new

shares at less than the nominal value, therefore at present the Company is

restricted as to how it can use its shares: for example, it would currently be

unable to raise new share capital from investors.

At close of business on 13 May 2010, the latest practical date prior to

publication of this Circular, the Company had 14,331 Shareholders of which

13,632 had shareholdings of less than 10,000 shares. These 13,632 Shareholders

account for 95 per cent. of the Shareholders by number, but represent less than

1.5 per cent. of the total number of Existing Ordinary Shares.

At the closing bid price of 0.48 pence on 13 May 2010, the latest practical date

prior to the publication of this Circular, the market value of 10,000 shares

would be GBP48. The Directors consider that should a shareholder with less than

10,000 shares choose to sell their shares, the proceeds will be significantly

reduced or even completely eliminated by the dealing costs of selling.

Therefore the Directors recognise that for small Shareholders it is uneconomic

for them to dispose of their shares. The Capital Reorganisation will allow

certain small Shareholders to realise value for their shares free of dealing

costs.

Another benefit of the Capital Reorganisation is it will allow the Company to

reduce certain costs associated with maintaining a large shareholder register in

particular printing, postage and registrars' costs.

For the reasons set out above, the Directors are proposing to reorganise the

Company's share capital on the terms set out below.

Capital Reorganisation

Under the Capital Reorganisation, the Existing Ordinary Shares will be

consolidated into New Consolidated Ordinary Shares on the basis of one New

Consolidated Ordinary Share for each 10,000 Existing Ordinary Shares. Each New

Consolidated Ordinary Share will then be sub-divided into 100 New Ordinary

Shares and 9,900 Deferred Shares.

Since the number of Existing Ordinary Shares is not exactly divisible by 10,000,

Mr Wonnacott has agreed to subscribe for 3,577 ordinary shares of 1 pence each

at a subscription price of 1 pence per share to increase the number of Existing

Ordinary Shares to 636,710,000.

Any fractions arising as a result of the Consolidation will be aggregated and,

following the Sub-division, the Directors will, in accordance with the Articles

sell the aggregated shares in the market for the benefit of the relevant

Shareholders.

The proceeds from the sale of the fractional entitlements shall be distributed

pro rata amongst the relevant Shareholders save that where a Shareholder is

entitled to an amount which is less than GBP3 it will (in accordance with the

Articles) not be distributed to such Shareholder but will be retained by the

Company for its benefit.

One consequence of the Capital Reorganisation is that Shareholders holding less

than 10,000 Existing Ordinary Shares will receive no New Ordinary Shares.

Shareholders holding 10,000 Existing Ordinary Shares will receive 100 New

Ordinary Share and 9,900 Deferred Shares.

The rights attaching to the New Ordinary Shares will be identical in all

respects to those of the Existing Ordinary Shares.

The Deferred Shares will have no voting rights and will not carry any

entitlement to attend general meetings of the Company. They will carry only the

right to participate in any return of capital to the extent of the amount paid

up or credited as paid up on each Deferred Share but only after the holder of

each New Ordinary Share has received in aggregate capital repayments amounting

to GBP10,000,000 per New Ordinary Share. Accordingly, the Deferred Shares will,

for all practical purposes, be valueless and it is the Board's intention, at an

appropriate time, to cancel the Deferred Shares.

Existing share certificates will cease to be valid following the Capital

Reorganisation. New share certificates in respect of the New Ordinary Shares

will be issued by 9 July 2010. No certificates will be issued in respect of the

Deferred Shares, nor will CREST accounts of Shareholders be credited in respect

of any entitlement to the Deferred Shares. No application will be made for the

Deferred Shares to be admitted to trading on AIM or any other investment

exchange.

A CREST Shareholder will have their CREST account credited with their New

Ordinary Shares following their Admission, which is expected to be on 25 June

2010.

A General Meeting to obtain the necessary approval has been convened for 24 June

at 2.15 p.m. Capital Reorganisation. The Capital Reorganisation is conditional

upon the approval of the Shareholders at the GM as required by the Companies Act

2006 and the Articles.

The Definitions which apply in the Circular have been used in this announcement.

+-----------------------------------+-----------------------------------+

| Contacts: | |

+-----------------------------------+-----------------------------------+

| | |

+-----------------------------------+-----------------------------------+

| Petards Group plc | www.petards.com |

+-----------------------------------+-----------------------------------+

| Andy Wonnacott, Finance Director | +44 (0) 191 420 3000 |

+-----------------------------------+-----------------------------------+

| | |

+-----------------------------------+-----------------------------------+

| WH Ireland Limited | www.wh-ireland.co.uk |

+-----------------------------------+-----------------------------------+

| Mike Coe / Marc Davies | +44 (0) 117 945 3470 |

+-----------------------------------+-----------------------------------+

| | |

+-----------------------------------+-----------------------------------+

| Walbrook PR Limited | www.walbrookpr.com |

+-----------------------------------+-----------------------------------+

| Paul McManus | Tel: +44 (0) 20 7933 8787 |

+-----------------------------------+-----------------------------------+

| paul.mcmanus@walbrookpr.com | Mob: +44 (0) 7980 541 893 |

+-----------------------------------+-----------------------------------+

This information is provided by RNS

The company news service from the London Stock Exchange

END

CAREASSPFLSEEFF

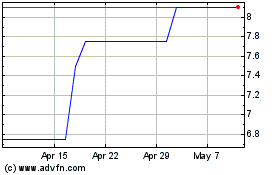

Petards (LSE:PEG)

Historical Stock Chart

From Jun 2024 to Jul 2024

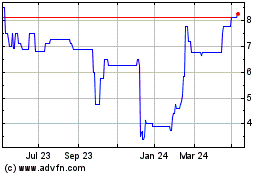

Petards (LSE:PEG)

Historical Stock Chart

From Jul 2023 to Jul 2024