TIDMPEG

RNS Number : 1866P

Petards Group PLC

30 September 2013

30 September 2013

PETARDS GROUP PLC

INTERIM RESULTS ANNOUNCEMENT

Petards Group plc ('Petards'), the AIM quoted developer of

advanced security and surveillance systems, reports its interim

results for the six months to 30 June 2013.

Highlights

-- Revenues of GBP3.6 million (2012: GBP4.7 million)

-- Gross margin 40% (2012: 41%)

-- Operating loss GBP299,000 (2012: GBP51,000 profit)

-- Loss before tax GBP338,000 (2012: GBP22,000 profit)

-- Basic and diluted loss per share of 3.11 p (2012: 0.35p earnings)

-- Net cash outflow from operating activities of GBP1.0 million (2012: GBP0.9 million inflow)

-- Net debt of GBP1.0 million (30 June 2012: GBP0.8 million; 31 December 2012: GBP0.1 million)

Commenting on the current outlook, Raschid Abdullah, Chairman,

said:

"The Company currently has no bank borrowings. However the Board

recognises that to sustain and grow the business additional working

capital finance is required and it is presently reviewing its

options for raising additional equity and debt. The 'Fit for

Growth' programme which has already produced savings in the cost

base will continue into 2014.

While orders have been slow in the first half of 2013 all of the

signs are that order intake will improve in the second half

although it is largely 2014 that will see the benefit of this

trend."

Contacts:

Petards Group plc www.petards.com

Raschid Abdullah, Chairman +44 (0) 7768 9050 004

WH Ireland Limited www.wh-ireland.co.uk

Mike Coe +44 (0) 117 945 3470

Chairman's Statement

Corporate Overview

So far 2013 has proven to be one of the most challenging periods

in Petards' history.

During the period and the third quarter of 2013 the Company has

undergone a restructuring of its operations, acquired its largest

shareholder providing much needed cash for development of the

business, won a three year contract from another new international

train building customer, Hitachi Rail Europe, commenced shipments

of product on the circa GBP8 million order it was awarded last year

by Siemens Rail Systems and laid the groundwork for future long

term orders such that it is expected that in 2014 Petards will be

working with at least five of the world's largest train

builders.

The Company presently has no bank or trade finance borrowings.

To meet its present and forecast commitments the directors are

considering the merits of seeking borrowings in a market where

there is a perceived reluctance to lend to smaller companies such

as Petards. It will also consider raising equity.

Another alternative which might be considered is that of forming

strategic alliances with financially stronger partners. However,

this would be done with some reluctance as at this stage of the

Company's development such moves would be unlikely to achieve the

underlying value the directors believe exists and should accrue to

Petards' shareholders.

Operating Review

Trading conditions for the first half of the year have proven

difficult with order intake across most areas of the Company's

business, particularly orders for delivery in the current year,

falling considerably below expectations as delays have been

experienced in contracts being placed.

Initial costs on the previously referred to GBP8 million

contract for the supply of on board CCTV systems to Siemens Rail

Systems ("Siemens") for the Thameslink Rolling Stock Procurement

Project ("Thameslink") have also been higher than expected. The

principal reason for the cost overrun was the further development

of our eyeTrain product to meet the high specification and exacting

quality requirements of this prestigious project.

While the cost overrun is disappointing the product range

developed lends itself to being used on other similar Siemens

global projects and we are presently discussing the possibility of

it being used on the first phase of a new build train project

outside of the EU between 2014 and 2016.

In addition decisions are now expected in the final quarter of

the current year and the first quarter of 2014 on a number of

contracts which have experienced delays. These possible contracts

relate to all our product areas but would be of particular benefit

to those areas of transport and defence.

On the plus side we were pleased to have been recently awarded a

multi-million euro framework contract by Hitachi Rail Europe for

automatic passenger counting systems to be installed on its Class

800 series trains for the Inter City Express programme. The initial

"call off" order is for the Great Western Main Line, the value of

which is in excess of EUR1 million for delivery over the next three

years.

Petards through its wholly owned subsidiary Petards Joyce-Loebl

has had a long relationship with the MOD based on its proven

technical capability and high service levels. The completion of the

Chinook Defensive Aids Suite upgrade contract in the second half of

2012 served to reduce year on year revenues within the defence area

of the business as in 2013 order inflow was reduced while the UK

Government reviewed its medium-term commitments. However, Petards

Joyce-Loebl has several tenders outstanding with the MOD, orders

for which are expected to be placed during 2013.

Orders for our emergency services products continued to be

affected by budgetary constraints within law enforcement agencies.

However, the launch of our new in-car speed detection and video

system Provida 4000, following receipt of its UK Home Office

approvals, resulted in some early sales as several police forces

placed initial orders which it is anticipated will lead to further

sales. Export markets continue to have the potential for further

sales of our complete range of emergency services products in

particular in the Middle East where a number of tenders remain

outstanding.

In July of this year the board introduced the 'Fit for Growth'

programme. This is an on-going programme designed to evaluate all

personnel for their capabilities and to ensure that they are

positioned correctly within the organisation and to refine or in

some cases redesign operational practices to improve efficiencies

and make the Company's products more effective and competitive in

their markets.

The majority of personnel have responded positively to the

challenges the 'Fit for Growth' programme presented, with the

result that for 2014 the operational side of the business is

expected to be a leaner and much improved performer in its market

places for the benefit of all its stakeholders, not least customers

and shareholders.

On 2(nd) September Paul Negus (48) was appointed as Business

Development Director for Petards Joyce-Loebl. Paul has had a long

involvement in the provision of CCTV and automatic number plate

recognition (ANPR) solutions. He brings to Petards considerable

experience having until recently held the post of Managing Director

at PIPS Technology Limited both as a privately owned company and

also following its acquisition by New York Stock Exchange listed

Federal Signal Inc.

Overview of the Results

The financial information contained within this interim report

is based upon the Group's unaudited results

for the six months to 30 June 2013.

Revenues for the first six months of 2013 were GBP3.6 million

(2012: GBP4.7 million), the loss before and after tax for the

period was GBP338,000 (2012: GBP22,000 profit) and the loss per

share was 3.11p (2012: 0.35p earnings).

The reduction in revenues mainly related to our defence

products; lower shipments of electronic countermeasure equipment

being partly offset by strong demand for communication systems from

the UK MOD. Gross margins at 40% remained similar to those achieved

in the first half of last year (2012: 41%) with overheads 8% lower

at GBP1.7 million (2012: GBP1.9 million).

Net cash outflows from operations were GBP1.0 million (2012:

GBP0.9 million inflow), a substantial proportion of which was in

respect of an increase in inventories relating to the non-recurring

costs referred to above for the Siemens Thameslink contract. Net

debt at 30 June 2013 was GBP1.0 million (31 December 2012: GBP0.1

million).

Acquisitions

On 1 July 2013 Petards announced an agreed offer for the entire

issued share capital of Water Hall Group plc for a consideration

valued at GBP3.067 million. The consideration is comprised of

10,954,854 new Petards ordinary shares of 1 pence each and

1,752,775 new convertible redeemable loan notes of GBP1 each with a

coupon of 7% p.a. The loan notes have a five year term and may be

converted at any time into new Petards shares at a subscription

price of 8 pence per share.

The benefit to Petards was that of a much needed injection of

cash at a time when other forms of funding were not immediately

available to it.

I am pleased to report that on 30 August 2013 the offer was

declared wholly unconditional and on 20 September 2013 acceptances

in excess of 90% of Water Hall's issued share capital had been

received thereby enabling Petards to implement compulsory 'buy out'

procedures for the outstanding minority shareholders which it will

formally announce at the time of the next closing date for the

offer.

Outlook

Petards operates in a long term business built on long term

relationships with its customers and suppliers. There are other

related areas in which the business has the ability to develop, in

particular but not exclusively within transport which is not only a

growing sector but also a global one.

To succeed it is important that the strength of the balance

sheet, financing mechanisms for export sales in particular and

profitability are all improved such that the directors and

management can pursue commercial opportunities on a sustainable

basis. In addition it needs an appropriate cost base. The 'Fit for

Growth'programme which has already produced savings in the cost

base will continue into 2014.

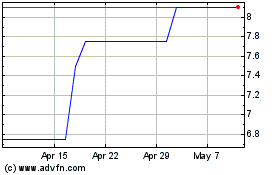

Petards (LSE:PEG)

Historical Stock Chart

From Jun 2024 to Jul 2024

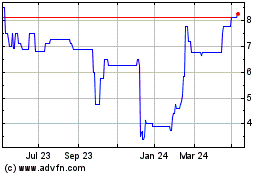

Petards (LSE:PEG)

Historical Stock Chart

From Jul 2023 to Jul 2024