Preliminary Results

June 25 2007 - 6:14AM

UK Regulatory

PHSC PLC Preliminary Results 2006/07

MANAGING DIRECTOR'S STATEMENT

for the year ended 31 March 2007

Highlights:

- Pre-tax profits (net of goodwill) up from �411,000 to �634,000

- Earnings per share rise from 2.6p to 3.67p

- Group revenues increased to �4.65m from �3.70m

- Proposed dividend raised to 0.80p per Ordinary Share (2006: 0.75p)

- One subsidiary acquired and another disposed of in the period

I report on a very encouraging financial performance of the company over the year, and comment on some of the

activities that have taken place during that period and prospects for the future.

In January 2007 we disposed of our Health and Safety Click Limited subsidiary for reasons outlined later on in

this statement. This resulted in an (exceptional) charge of �34,000. Shortly thereafter we acquired Envex

Company Limited. Reference to the acquisition and disposal is made later in this statement.

This leaves the Group with four trading subsidiaries, through which we offer a wide range of consultancy and

advisory services. Geographically our offices are based in Kent, Essex, Northamptonshire and Berkshire.

We purchased additional premises for Adamson's Laboratory Service Limited (ALS) at Raunds in Northamptonshire,

adjacent to the existing offices leased by RSA Environmental Health Limited (RSA). The new premises have been

refurbished and laboratory facilities have been installed. This leaves ALS well placed to expand its activities

from the company's traditional south-east catchment area into the Midlands and beyond.

During the year, ALS were pleased to announce a contract that included work to an initial value of

approximately �375,000, rising to a potential total fee income exceeding �750,000, over a three-year period at

the Shell Centre in London. Separately, ALS was awarded a contract valued at �105,000 to carry out asbestos

surveying at a top London hotel.

RSA continued to win work from local authorities, with notable works including a contract valued at �32,000 for

London Borough of Tower Hamlets. London Borough of Bromley has commissioned the company to carry out a survey

related to the delivery, provision, preparation and consumption of school meals in a project worth �67,800 in

revenues.

Our subsidiary Personnel Health & Safety Consultants Ltd was commissioned to undertake an auditing programme

across Newsquest Media Group's print sites and offices, worth approximately �70,000 over a 12-month period.

Further information on the activities of each operating subsidiary will be contained within the Annual Report

and Accounts to be sent to shareholders in due course and which will be available during normal working hours

from the offices of Ruegg & Co Limited, 39 Cheval Place, London SW7 1EW. This information will also be

accessible on our corporate website at www.phsc.plc.uk

Acquisition and Disposal

The Group acquired Envex Company Limited (Envex) in January 2007 for an initial consideration of �35,000. There

will be further payments of up to �37,000 on each of the first and second anniversaries funded by profits

generated in those periods. In the year before acquisition, Envex had revenues of �238,000 and a pre-tax profit

of �7,150. Envex provides general health and safety consultancy and training service to clients in Berkshire

and the surrounding areas. In addition, it delivers the Management of Risk and Uncertainty training course for

the Institute of Risk Management.

In January 2007 we disposed of Health and Safety Click Limited (HSCL). Originally acquired in August 2005, that

company is now in the hands of its Managing Director. As explained in last year's annual report, acquiring

HSCL was a speculative venture for PHSC plc in an area of business where the Group had no representation. HSCL

delivers a low cost health and safety protection and advisory service via a web-based system. Although the

concept remained an attractive one, the Board took the view that shareholders' best interests would be served

by concentrating our energies on companies that were more established and cash generative. The terms of the

disposal provide that PHSC plc will be entitled to 33% of any profits that are generated by HSCL in the next

twelve months, and 25% of any profits in the twelve months thereafter. HSCL made a trading loss of �30,000 in

the nine months prior to disposal.

PHSC plc is currently involved in discussions with two companies that would be attractive acquisition targets,

and will report on progress in due course.

Institutional Investment

Following the appointment of Hichens, Harrison & Co. plc as brokers to the Group in January 2007, we placed

1,886,792 new ordinary shares at 53p per share with institutional investors. This raised �1,000,000 for the

Company before expenses. We are pleased to welcome, in particular, financial investment from Unicorn and

Framlington as this will assist in improving the profile of PHSC plc within the investor community. Between the

dates of the new issue and the publication of this statement, the mid-price of our ordinary shares has risen

from 52.5p to 54.5p per share.

Corporate Governance

In addition to myself, Nicola Coote is an executive director. There are two non-executive directors on the

Board: Mike Miller, who chairs the Audit Committee, and Graham Webb MBE who chairs the Remuneration Committee.

A Chartered Secretary, Lorraine Young, supports the Board and its committees. The corporate resource is

strengthened by the presence of our Group Accountant, Candy Wilton.

Performance by Trading Subsidiaries

Profit figures below are stated before tax and management charges. Note that some general health and safety

training and consultancy assignments carried out by particular trading subsidiaries will have been invoiced by

other Group companies as in previous years, thus it is difficult to make direct performance comparisons.

Reference should be made to the Group's overall performance.

Personnel Health and Safety Consultants Limited

Sales of �1.12 million, yielding a profit of �528,000.

In the previous year there were sales of �1.22 million and a profit of �337,000.

RSA Environmental Health Limited

Sales of �966,000, yielding a profit of �68,000.

In the previous year there were sales of �788,000 and a profit of �110,000.

Adamson's Laboratory Services Limited

Sales of �2.44m, yielding a profit of �542,000 including a Work in Progress uplift of �45,000.

Sales for the 9� months post-acquisition (17.6.05 - 31.03.06) were �1.6 million, yielding a profit of �283,000.

Health & Safety Click Limited

Invoiced sales prior to disposal of �60,000 leading to a loss of �24,000.

For the period 17.8.05 to 31.03.06 there were sales of �86,000, resulting in a pre-tax loss of �26,000.

Envex Company Limited

Invoiced sales since acquisition on 09.01.07 were �55,000, resulting in a profit of �3,000.

Dividend

The Board is proposing a final dividend of 0.80p per ordinary share to be paid on 21 September 2007 to

shareholders on the register as at 24 August 2007.

Prospects

The Board continues to believe that there are good trading prospects within the health, safety and

environmental consultancy marketplace and we look forward to another successful and profitable year. We will

endeavour to make at least one major acquisition during the period, ensuring that any new subsidiary is

earnings-enhancing.

Trading in the first two months of 2007/08 generated Group revenues of �725,000 (2006/07: �698,000).

AGM

The Annual General Meeting will be held on 13 September 2007 at The Old Church, 31 Rochester Road, Aylesford,

Kent ME20 7PR at 10:00am.

Stephen King, Managing Director

Group profit and loss account

for the year ended 31st March 2007 2007 2006

�'000 �'000

Turnover

Continuing operations - existing 4,534 2,012

Continuing operations - acquired 55 1,692

Discontinued operations 60 -

4,649 3,704

Cost of sales

Continuing operations - existing 2,274 1,010

Continuing operations - acquired 32 784

Discontinued operations 6 -

2,312 1,794

Gross profit 2,337 1,910

Administrative expenses (1,683) (1,515)

Other operating income 2 30

(1,681) (1,485)

Operating profit

Continuing operations - existing 676 259

Continuing operations - acquired 3 166

Discontinued operations (23) -

656 425

Interest receivable 10 21

Interest payable (32) (35)

Profit on ordinary activities before taxation 634 411

Loss on sale of discontinued operation (34) -

Tax charge on profit on ordinary activities (239) (163)

Retained profit on ordinary activities 361 248

after taxation for the financial period

Earnings per ordinary share 3.67p 2.60p

Diluted earnings per ordinary share 3.61p 2.56p

Group balance sheet

for the year ended 31st March 2007 2007 2006

�'000 �'000

Fixed assets

Intangible assets 2,140 2,280

Tangible assets 817 720

Total fixed assets 2,957 3,000

Current assets

Stocks 389 297

Debtors 951 689

Cash at bank and in hand 1,469 487

2,809 1,473

Creditors:

Amounts falling due within one year (968) (750)

Net current assets 1,841 723

Total assets less current liabilities 4,798 3,723

Creditors:

Amounts falling due after more than one year (287) (417)

Provisions for liabilities and charges:

Deferred taxation (13) (13)

Net assets 4,498 3,293

Capital and reserves

Called up share capital 1,165 983

Share premium accounts 1,464 728

Revaluation reserve 203 206

Profit and loss account 1,666 1,376

4,498 3,293

Group statement of total recognised

gains and losses

for the year ended 31st March 2007 2007 2006

�'000 �'000

Profit for the financial year -attributable to the

shareholders of the parent company 353 248

Unrealised surplus on revaluation of properties - 105

Total gain recognised since 31st March 2006 353 353

Group cash flow statement

for the year ended 31st March 2007 2007 2006

�'000 �'000

Net cash inflow from operating activities 629 631

Returns on investments and servicing of finance (22) (13)

Taxation (185) (222)

Capital expenditure (159) (2)

Acquisitions and disposals (129) (1,345)

Equity dividends paid (74) -

Net cash inflow/(outflow) before financing 60 (951)

Financing 922 630

Increase/(decrease) in cash in period 982 (321)

Reconciliation of net cash flow to movement in net funds

Increase/(decrease) in cash in the period 982 (321)

Cash inflow from increase in debt (3) (285)

Loans transferred with disposal of subsidiaries 45 (125)

Change in net debt resulting from cash flows 1,024 (731)

Net funds at beginning of period 75 806

Net funds at end of period 1,099 75

Reconciliation of operating profit to operating cash flow

Operating profit 656 425

Depreciation/amortisation 182 216

Loss on disposal fixed assets 3 -

Increase in stock and WIP (92) (95)

(Increase)/decrease in debtors (266) 93

Increase/(decrease) in creditors 146 (8)

Net cash inflow from operating activities 629 631

Reconciliation of net cash flow to movement in net debt

Increase/(decrease) in cash in period 982 (321)

Net cash outflow/(inflow) from bank overdrafts 1 (1)

Net cash inflow from bank loans (21) (349)

Net cash outflow/(inflow) from other loans 62 (62)

Cash outflow in respect of hire purchase - 2

Change in net debt 1,024 (731)

For further information please contact:

PHSC plc

Stephen King 01622 717700

www.phsc.plc.co.uk

Ruegg & Co Limited

Gavin Burnell 020 7584 3663

Hichens, Harrison & Co. plc

Daniel Briggs 020 7382 7776

PHSC plc

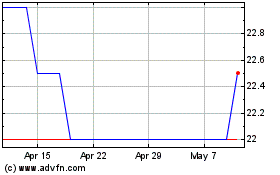

Phsc (LSE:PHSC)

Historical Stock Chart

From Jun 2024 to Jul 2024

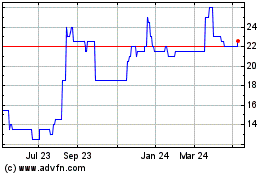

Phsc (LSE:PHSC)

Historical Stock Chart

From Jul 2023 to Jul 2024