TIDMROC

RNS Number : 4579Q

Rockpool Acquisitions PLC

21 October 2019

Press release 21 October 2019

The information contained within this announcement is deemed by

the Company to constitute inside information stipulated under the

Market Abuse Regulation (EU) No. 596/2014. Upon the publication of

this announcement via the Regulatory Information Service, this

inside information is now considered to be in the public

domain.

Rockpool Acquisitions Plc

("Rockpool" or "the Company")

Potential Investment in the Company

-- Rockpool, the special purpose acquisition company, is pleased

to announce that it has signed Heads of Terms ("Heads of Terms")

with a private investment company incorporated in Nevada ("the

Nevada Investor"). Key points of the Heads of Terms, which are

non-legally-binding other than in respect of the exclusivity

period, are as follows.

-- The Nevada Investor and / or parties connected with the

Nevada Investor ("the Investors") will make a subscription of a

total of GBP1.6m ("Subscription") for a mixture of ordinary shares

of GBP0.05 of Rockpool ("Ordinary Shares") and convertible loan

notes. The shares element will comprise 2,545,001 Ordinary Shares

to be issued at a price of GBP0.12 per share and the loan notes

will convert into a further 10,788,333 Ordinary Shares at a price

of GBP0.12 per share.

-- The Investors will nominate three directors to the board of

the Company and Neil Adair, currently a non-Executive Director,

will step down from the board with effect from the completion of

the Subscription.

-- Subject to formal agreement with the board of Greenview,

Rockpool will make a further loan of GBP750,000 to Greenview Gas

Limited ("Greenview") which will not be repayable for a period of

30 months. GBP910,000 of the total amounts owed by Greenview will

be convertible into 40% of the equity of Greenview at the option of

Rockpool. The Nevada Investor will establish an office in

Greenview's premises.

-- Cordovan Capital, Rockpool's corporate finance adviser, will

receive a fee in connection with the transaction, some of which

will be settled by the issue of 916,667 Ordinary Shares at a price

of 12p per share with the balance being settled in cash. Those

Ordinary Shares will be issued on the earlier of the first

anniversary of completion of the Subscription or the completion of

a reverse takeover ("RTO") by the Company. Some of the Cordovan

Capital fees will be shared with Neil Adair and Richard

Beresford.

-- Changes will be made to the anticipated option awards to the

Company's founders and current directors, Neil Adair, Richard

Beresford and Mike Irvine. Instead of receiving options over 10% of

the Company's fully diluted share capital following the completion

of its first RTO, which were expected (at the time of the Company's

admission to the Official List) to be exercisable at a price of 15p

per Ordinary Share, the three will receive between them options

over such number of Ordinary Shares as (subject to the minimum and

maximum number set out below) has a value (at a price of 12p per

share) equal to 1% of the value of the Ordinary Shares issued as

consideration for acquisitions made within the first 36 months of

completion of the Subscription or, if completed after that 36 month

period, as consideration of the first RTO by the Company. The

exercise price of the options will be 12p per Ordinary Share. The

three directors will be entitled to options over a minimum of

2,400,000 Ordinary Shares and a maximum of 10,400,000 Ordinary

Shares.

-- The Investors will be granted an exclusivity period of 45

days in order to allow time for binding documents to be signed. The

exclusivity period is terminable if the Investor fails to make

certain initial payments within specified time limits.

It is currently anticipated, on completion of the Subscription,

Rockpool will terminate the option agreement which it entered into

in relation to the acquisition of Greenview and then immediately

apply to the FCA to have the suspension of its shares lifted on the

basis that a particular reverse takeover is no longer in

contemplation.

Commenting on the potential transaction, Richard Beresford,

non-Executive Chairman of Rockpool, said: "The proposed substantial

investment into the Company is an exciting step forward and allows

the Company to fulfil its mandate to provide additional working and

growth capital to a growing Northern Ireland-based company.

"The subscription price represents a 20% premium to the

Company's IPO price and a 33.3% premium to the price of the

Company's shares at suspension. Whilst the transaction remains

subject to contract, the board is very excited by this development

and is confident that Rockpool can bring the transaction to a

successful completion on the agreed terms, which the board

considers to be in the interests of all shareholders. Rockpool

looks forward to working actively with the investors going forward,

in what should be a very exciting period for the Company."

For further information please contact:

Rockpool Acquisitions Plc

Mike Irvine, Non-Executive Director mike@cordovancapital.com

Shard Capital (Broker)

Damon Heath / Erik Woolgar Tel: +44 (0)20 7186 9952

Abchurch (Financial PR)

Julian Bosdet Tel: +44 (0)20 4594 4070

julian.bosdet@abchurch-group.com

Notes to Editors.

Rockpool Acquisitions Plc ("Rockpool"), a Special Purpose

Acquisition Company based in Northern Ireland, whose shares have

been admitted to the Official List of the London Stock Exchange by

way of a Standard Listing, was formed to undertake the acquisition

of a company or business headquartered, or materially based in

Northern Ireland. Once the first acquisition is completed, the

Company may consider further complementary acquisitions.

Rockpool announced on 20 November 2017 that it had entered into

a loan agreement with Greenview Gas Ltd (Greenview) to finance the

acquisition of two businesses in the air conditioning and the

electrical and mechanical installation, maintenance and facilities

management sectors and it included the right to an option to

acquire the entire share capital of Greenview and if the option

were to be granted and exercised it would

constitute a Reverse Take Over (RTO). That option was entered into in January 2019.

The Directors are of Northern Irish origin and have over 60

years' combined experience of the local market. Between them they

have considerable industry, acquisitions, legal, public markets

and

financial and operational experience.

For more information about Rockpool, please visit

www.rockpoolacquisitions.plc.uk

- Ends -

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCKMMZGDGVGLZG

(END) Dow Jones Newswires

October 21, 2019 02:00 ET (06:00 GMT)

Rockpool Acquisitions (LSE:ROC)

Historical Stock Chart

From Jan 2025 to Feb 2025

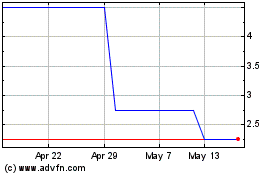

Rockpool Acquisitions (LSE:ROC)

Historical Stock Chart

From Feb 2024 to Feb 2025