Rockpool Acquisitions PLC XT Energy Group Inc update statement (8153U)

November 27 2019 - 2:00AM

UK Regulatory

TIDMROC

RNS Number : 8153U

Rockpool Acquisitions PLC

27 November 2019

Press release 27 November 2019

The information contained within this announcement is deemed by

the Company to constitute inside information stipulated under the

Market Abuse Regulation (EU) No. 596/2014. Upon the publication of

this announcement via the Regulatory Information Service, this

inside information is now considered to be in the public

domain.

Rockpool Acquisitions Plc

("Rockpool" or "the Company")

XT Energy Group, Inc. Statement

The board of Rockpool Acquisitions PLC ("Rockpool") notes the

statement made on 5 November 2019 by XT Energy Group, Inc. ("XT

Energy"), a Nevada corporation, that on 29 October 2019 it had

entered into a letter of intent with certain other parties

(including Stanley Hutton Rumbough) to effect a series of

transactions, including an acquisition of Rockpool (the "LOI").

The board of Rockpool is pleased to note the further statement

(the "Second Statement") made on 26 November 2019 by XT Energy

making it clear that that no acquisition (by XT Energy, Stanley

Hutton Rumbough or any person acting in concert with either of

them) of Rockpool is now contemplated by the LOI (as amended on 22

November 2019 (the "Amended LOI")). The Second Statement further

states that it is in fact the current intention that a newly

incorporated entity ("the Investor") to be controlled by David

Chen, the Chief Operating Officer of XT Energy, and Jian Zhou,

Chairman of XT Energy (rather than XT Energy itself) will make a

subscription for 2,545,000 ordinary shares of Rockpool at a price

of 12 pence per ordinary share of Rockpool and a loan in the amount

of GBP1,294,600. The Investor will also be entitled to the issue of

warrants allowing it to subscribe for a further 10,788,333 ordinary

shares of Rockpool at a price of 12 pence per ordinary share.

The Second Statement goes on to state that XT Energy has been

advised in writing by Stanley Hutton Rumbough that he will make a

loan to Rockpool in which case, the Second Statement states, he

will be entitled to the issue of warrants entitling him to

subscribe for 416,667 ordinary shares of Rockpool at a price of 12

pence per ordinary share. The issue of both sets of warrants would

be conditional upon the obtaining of a Rule 9 "whitewash" pursuant

to the UK City Code on Takeovers and Mergers (the "Code") in

respect of the issue of the ordinary shares of Rockpool pursuant to

the warrants.

The subscription and loans referred to are the latest proposed

terms relating to the potential investment in Rockpool announced by

Rockpool on 21 October 2019.

It should be noted that Rockpool has not yet entered into

binding contracts in relation to the aforementioned contemplated

transactions.

Ends -

For further information please contact:

For further information please contact:

Rockpool Acquisitions Plc

Mike Irvine, Non-Executive Director mike@cordovancapital.com

www.rockpoolacquisitions.plc.uk

Shard Capital (Broker)

Damon Heath / Erik Woolgar Tel: +44 (0)20 7186 9952

Abchurch (Financial PR)

Julian Bosdet Tel: +44 (0)20 4594 4070

julian.bosdet@abchurch-group.com

- Ends -

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCDDLBLKFFLFBD

(END) Dow Jones Newswires

November 27, 2019 03:00 ET (08:00 GMT)

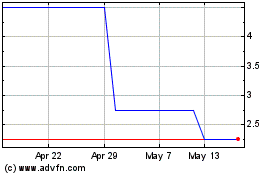

Rockpool Acquisitions (LSE:ROC)

Historical Stock Chart

From Jan 2025 to Feb 2025

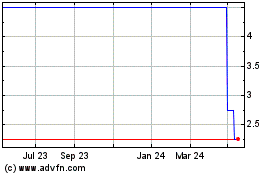

Rockpool Acquisitions (LSE:ROC)

Historical Stock Chart

From Feb 2024 to Feb 2025