Rentokil Initial PLC Q1 Trading Update (6538C)

April 19 2017 - 1:00AM

UK Regulatory

TIDMRTO

RNS Number : 6538C

Rentokil Initial PLC

19 April 2017

RENTOKIL INITIAL PLC (RTO)

FIRST QUARTER TRADING UPDATE

19 April 2017

(GBPm) Q1 2017 Growth

AER AER CER

Ongoing Revenue(1) 579.0 23.8% 10.0%

Revenue 580.0 22.9% 9.2%

Overview (CER)

Ongoing Revenue increased by 10.0% in Q1, of which 3.1% was

Organic Revenue(2) growth (Q1 2016: 2.8%, FY 2016: 3.0%) and 6.9%

was from acquisitions. On 16 December 2016 the Company announced

the proposed transfer of its workwear and hygiene businesses in

Germany and the Benelux to a joint venture (JV) with Haniel. The

transaction remains on track to complete by mid-year, subject to

competition clearance. Excluding those businesses transferring to

the JV the Organic Revenue growth rate was 3.5%. Pest Control grew

by 19.1% (5.6% Organic Revenue growth) while Hygiene revenues rose

by 3.7% (3.1% Organic Revenue growth). Ongoing Revenue growth in

our Emerging and Growth markets has once again been strong,

increasing by 24.5% and 12.6% respectively. Our businesses in

Manage for Value markets delivered Ongoing Revenue growth of 2.5%

while those in the Protect and Enhance markets delivered in line

with last year.

There has been continuing strong performance in Asia, Pacific,

Latin America, the UK and in our largest market, North America.

Europe delivered improved Ongoing Revenue growth in Q1, with

revenues in France broadly flat year on year.

M&A

We have acquired 12 businesses this year to date, ten in Pest

Control, one in Hygiene and one in Property Care, principally in

Emerging and Growth markets. Combined annualised revenues of the

businesses acquired totalled GBP101.7m in the 12 months immediately

prior to acquisition.

In February we announced the acquisition of Atlanta-based pest

control company Allgood Pest Solutions. The business generated

annualised revenues for the 12 months prior to acquisition of

$26.6m.

Also, as previously announced, in March we completed the

transaction to create a joint venture with PCI Pest Control Pvt.

Ltd. (PCI), India's largest pest control company, which offers a

comprehensive range of pest control services and products through

its countrywide network. Rentokil, which has management control of

the JV, is integrating its Indian operations into the JV and the

combined business has revenues of 4.5bn rupees (c. GBP50m), will

operate from c. 250 locations and employ c. 6,900 people.

On 11 April our JV in the Kingdom of Saudi Arabia (KSA) acquired

Sames, the market leader in the commercial pest control sector in

KSA with c. 2,500 customers covering most major cities, making us

the number one pest control company in KSA and the Gulf Cooperation

Council countries. The business generated revenues of GBP9m in the

last 12 months prior to acquisition.

Commenting on today's announcement Andy Ransom, Chief Executive,

said:

"We have made a good start to 2017. Pest Control has performed

well across the regions and we remain encouraged by the progress we

are continuing to deliver in Hygiene. We have been very active in

M&A in the first three months of the year, reinforcing our

strategy of acquiring high quality pest control and hygiene

businesses in Emerging and Growth markets. We are particularly

pleased with our JV with PCI in India, which is an outstanding

business in a country with significant growth potential for

commercial and residential pest control services.

"We are confident that the Company will deliver a performance in

line with expectations for 2017."

Enquiries:

Rentokil

Investors Katharine Initial

/ Analysts: Rycroft plc 07811 270734

Rentokil

Malcolm Initial

Media: Padley plc 07788 978 199

John Sunnucks Bell Pottinger 0203 772 2549

AER - actual exchange rates; CER - constant 2016 exchange

rates

(1) Ongoing Revenue represents the performance of the continuing

operations of the Group (including acquisitions) after removing the

effect of disposed or closed businesses.

(2) Organic Revenue represents the growth in Ongoing Revenue

excluding the effect of businesses acquired during the year.

Acquired businesses are included in organic measures in the year

following acquisition, and the comparative period is adjusted to

include an estimated full year performance for growth

calculations.

This announcement contains statements that are, or may be,

forward-looking regarding the group's financial position and

results, business strategy, plans and objectives. Such statements

involve risk and uncertainty because they relate to future events

and circumstances and there are accordingly a number of factors

which might cause actual results and performance to differ

materially from those expressed or implied by such statements.

Forward-looking statements speak only as of the date they are made

and no representation or warranty, whether expressed or implied, is

given in relation to them, including as to their completeness or

accuracy or the basis on which they were prepared. Other than in

accordance with the Company's legal or regulatory obligations

(including under the Listing Rules and the Disclosure and

Transparency Rules), the Company does not undertake any obligation

to update or revise publicly any forward-looking statement, whether

as a result of new information, future events or otherwise.

Information contained in this announcement relating to the Company

or its share price, or the yield on its shares, should not be

relied upon as an indicator of future performance. Nothing in this

announcement should be construed as a profit forecast.

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTMMGMDRRDGNZM

(END) Dow Jones Newswires

April 19, 2017 02:00 ET (06:00 GMT)

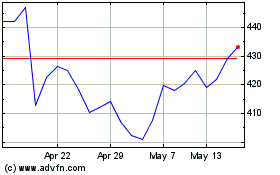

Rentokil Initial (LSE:RTO)

Historical Stock Chart

From Apr 2024 to May 2024

Rentokil Initial (LSE:RTO)

Historical Stock Chart

From May 2023 to May 2024