TIDMSIHL

RNS Number : 2288W

Symphony International Holdings Ltd

11 December 2023

Symphony International Holdings Limited ("Symphony or the

"Company")

11 December 2023

Dear Shareholders,

-- Symphony International Holdings Limited's ("Symphony" or the

"Company") unaudited Net Asset Value ("NAV") at 30 September 2023

was US$362,310,346 and NAV per share was US$0.7058. This compares

to NAV and NAV per share at 30 June 2023 of US$403,587,911 and

US$0.7862, respectively. The decrease in NAV by 10.2% quarter over

quarter is due to a decline in value of unlisted investment,

particularly in the lifestyle and new economy sectors, and Minor

International Public Company Limited ("MINT").

-- Symphony's share price continued to trade at a discount to

NAV. At 30 September 2023, Symphony's share price was US$0.46,

representing a discount to NAV per share of 34.5%. This compares to

a share price discount to NAV of 47.3% at 30 June 2023.

We would like to highlight some of the key developments in our

portfolio companies during the quarter:

-- Minor International Public Company Limited ("MINT"): In 3Q23,

MINT reported a record-high third quarter core net profit of THB

2.3 billion, an increase of 13% y-o-y. For 9M23, MINT's performance

also reached an all-time high with core profit of THB 4.6 billion.

During 3Q23, MINT declared an interim dividend of THB 0.25 per

share as a result of its operating performance during the first

half of 2023.

-- Indo Trans Logistics Corporation ("ITL"): : The logistics

sector in Vietnam continued to face headwinds, which affected ITL

in Q3 2023. Management have indicated they have begun to see a slow

recovery with freight volumes and yields improving since September.

ITL's ports operations remain stable and the group is expanding

this part of the business.

-- WCIB International Co. Ltd. ("WCIB"): The school's enrolments

continue to be ahead of expectations, which is expected to drive

stronger profitability for the current academic year. Symphony

participated in a further capital raising during Q3 2023 with other

shareholders to fund further expansion and enhance facilities that

will allow for more student capacity.

-- Liaigre Group ("Liaigre"): The market remained challenging in

Q3 2023 for showroom furniture sales, particularly in Europe and

the US. Management expect the market for high-end furniture to

remain subdued for the rest of the year in these markets. Showrooms

in Asia have been less impacted and remain a key source of growth

within the group.

-- ASG Hospital Private Limited ("ASG"): Management continue to

execute on an extensive pipeline of organic and inorganic

opportunities to expand the business. The group reported double

digit revenue growth for the six-months ended 30 September 2023.

The integration and revitalisation of Vasan Health Care Pvt. Ltd,

which was consolidated in March this year and added approximately

90 eye-hospitals to the group, is on track with strong growth in

inpatient and outpatient admissions.

-- Meesho, Inc ("Meesho"): Meesho had the first profit after tax

quarter in the history of the company. It is also the first quarter

with positive cash flow leading to positive cash flow on a YTD

basis. The company saw Monthly Transacting User ("MTU") growth

despite a high base effect from the prior year .

MARKET OVERVIEW AND OUTLOOK

Economic growth and future growth prospects continued to diverge

amongst major economies. The United States continued to report

strong growth, where GDP in the third quarter came in at 4.9% on an

annualised basis according to the commerce department's Bureau of

Economic Analysis. This was driven by strong consumer spending and

a strong labour market. Meanwhile, although China's GDP grew by

4.9% in the third quarter, beating market expectations, Chinese

officials struck a cautious tone indicating domestic demand

remained weak. A modest cyclical rebound in exports is unlikely to

reverse the ongoing diversification of value chains away from China

and negative demographic trends. In Europe, Mario Draghi, the

European Central Bank president delivered a downbeat view of

European economic growth, forecasting a recession by the end of

this year. Moreover, Russia's invasion of Ukraine caused major

commodity markets to fragment, and geopolitical tensions in the

Middle East could make matters worse.

Despite two years of rapid economic growth, S&P Global

reported that India continues to show a strong upward trajectory

for the coming year underpinned by private consumption and

investment. India has become an attractive location for

multinationals that have contributed to strong foreign direct

investment ("FDI") flows, particularly into manufacturing and

technology. For example, companies such as Google and Meta, Inc.

have announced multi-billion dollar investments into India. By 2030

S&P projects that 1.1 billion people will have internet access,

more than doubling from the estimated 500 million internet users in

2020. India's GDP is forecast to rise from US$3.5 trillion in 2020

to US$7.3 trillion in 2030, making it the third largest economy in

the world.

The IMF reported that Thailand's economy is projected to grow

2.7% in 2023, slightly higher than 2.6% in 2022 as the tourism

industry slowly recovers post the pandemic. In November, the Thai

Government announced a 500 billion Thai baht (US$13.87 billion)

stimulus policy in order to boost the economy. The government also

announced visa free travel to visitors from countries like China

and India. Chinese tourists made up 11% of 40 million tourists in

2019, but in 2023 against a projection of 4.4 million only 2.5

million have entered the country so far. The government hopes that

these measures will bring in more tourists by the end of the

year.

Vietnam's GDP in the third quarter of 2023 grew by 5.3% compared

to the same period the previous year. The figure is an improvement

from the second quarter's 4.1% growth. According to estimates

released by the General Statistics Office ("GSO"), the economy

continued to be buoyed by the ongoing recovery in the tourism

sector, a brighter manufacturing outlook and improved exports.

National Assembly Chairman Vuong Dinh Huy said that Vietnam will

likely struggle to meet the official full-year growth target of

6.5% which is already down from the previous year's 8.02%.

While global macro-conditions reveal heightened risks, we

continue to work with our investee companies to monitor and guide

their progress during these tumultuous times. We believe they are

well positioned to grow despite the near-term volatility.

COMPANY UPDATE

Symphony's listed investments accounted for 14.5% of NAV at 30

September 2023 (or US$0.1026 per share), which compares to 14.7% of

NAV (or US$0.1158 per share) at 30 June 2023.

The value of Symphony's unlisted investments (including

property) comprised 89.9% of Symphony's NAV (or US$0.6342 per

share), which compares to 88.8% (or US$0.6980 per share) at 30 June

2023.

Temporary investments accounted for (4.4%) of NAV (or

(US$0.0310) per share), which compares to (3.5%) of NAV (or

(US$0.0277) per share), per share at 30 June 2023.

Symphony's share price continued to trade at a discount to NAV.

At 30 September 2023, Symphony's share price was US$0.46,

representing a discount to NAV per share of 34.5%. This compares to

a share price discount to NAV of 47.3% at 30 June 2023.

PORTFOLIO DEVELOPMENTS

HOSPITALITY

Minor International Public Company Limited ("MINT"): is a global

company focused on three core businesses: hospitality, restaurants

and lifestyle brands distribution. MINT is a hotel owner, operator

and investor with a portfolio of over 530 hotels under the

Anantara, Avani, Oaks, Tivoli, NH Collection, NH, nhow, Elewana,

Marriott, Four Seasons, St. Regis and Radisson Blu brands in 55

countries across Asia Pacific, the Middle East, Africa, the Indian

Ocean, Europe and the Americas. MINT is also one of Asia's largest

restaurant companies with over 2,600 outlets system-wide in 24

countries under The Pizza Company, The Coffee Club, Riverside,

Benihana, Thai Express, Bonchon, Swensen's, Sizzler, Dairy Queen,

Burger King, Coffee Journey and GAGA brands, as well as over 1,000

further outlets held through MINT's strategic alliances (i.e.

S&P and BreadTalk). MINT is one of Thailand's largest

distributors of lifestyle brands and contract manufacturers. Its

brands include Anello, BergHOFF, Bossini, Charles & Keith,

Joseph Joseph, Zwilling J.A. Henckels and Minor Smart Kids.

Company Update: In 3Q23, MINT reported record-high third quarter

core net profit of THB 2.3 billion, a 13% y-o-y increase over 3Q22.

For 9M23, MINT's performance also reached an all-time high with

core profit of THB 4.6 billion. During 3Q23, MINT declared an

interim dividend of THB 0.25 per share in respect of its operating

performance during the first half of 2023.

Minor Hotels reported 8% y-o-y core net profit growth,

increasing to a record-high third-quarter net profit of THB 1.7

billion. This growth was fuelled by strong results from its

European hotel business as well as operational improvement from its

Thailand hotels and Anantara Vacation Club. Europe achieved its

highest-ever third quarter RevPAR and Bangkok hotels outperformed

pre-pandemic levels. In 3Q23, MINT opened three new hotels and

acquired a luxury resort in the Maldives with a partner- ADFD.

Minor Food reported core profit of THB 584 million in 3Q23, a

47% increase from THB 399 million in 3Q22. In 3Q23 the total core

restaurant revenue grew by 4% y-o-y, attributable to top-line

growth of Thailand, Australia and Singapore hubs, together with an

increase in profit contribution from joint ventures. Leveraging

higher operating efficiency and effective cost management, 9M23

core EBITDA increased by 33% y-o-y to THB 5,060 million. Core

EBITDA margin increased to 21.8% in 9M23, compared to 18.9% in

9M22.

MINT has strengthened its balance sheet by reducing debt and an

increasing equity base resulting from continued improved financial

performance. MINT's net interest-bearing debt to equity ratio has

reduced to 1.05x at the end of 3Q23 from 1.17x at the end of

2022.

Mr. Dillip Rajakarier, Group CEO of MINT expressed confidence in

the full-year 2023 performance and further growth prospects. MINT

Group looks forward to strong year-over-year results in the next

few quarters, particularly driven by the hotel high season in Asia

during 4Q23 and 1Q24.

During the quarter, the value of Symphony's investment in MINT

decreased from US$59.5 million at 30 June 2023 to US$52.7 million

at 30 September 2023. The change in value is predominantly due to a

decrease in MINT's share price by 8.8% and a deprecation in the

onshore Thai baht by 2.7%.

LIFESTYLE/ REAL ESTATE

Minuet Limited ("Minuet"): is a joint venture between the

Company and a Thai partner. The Company has a direct 49% interest

in the venture and is considering several development and/or sale

options for the land owned by Minuet, which is located in close

proximity to central Bangkok, Thailand. Since the original

investment, several parcels of land have been sold to local

developers and a large piece has been used to develop the

Wellington International School in Bangkok. As at 30 September 2023

Minuet held approximately 186.75 rai (29.88 hectares) of land in

Bangkok, Thailand.

Company Update: The value of Symphony's interest 30 September

2023 was US$57.8 million. This compares to US$59.9 million at 30

June 2023 based on an independent third party valuation. The change

in value is predominantly due to a depreciation in the Thai baht by

3.7% during the same period.

Symphony's original investment in Minuet was $78.3 million.

Total distribution receipts from partial sales of land have

amounted to US$65.2 million. We believe, that barring unforeseen

developments, and given the development activity in the area, the

remaining land should enable us to realise proceeds well in excess

of the current valuation.

SG Land Co. Ltd ("SG Land") : SIHL, through a subsidiary,

acquired approximately 50% of the outstanding shares of SG Land in

a JV with JCK International Pcl ("JCK") (formerly Thai Factory

Development Pcl). SG Land owns the leasehold rights to SG Tower and

Millenia Tower, which are office buildings in central Bangkok,

Thailand. The lease for SG Tower expired at the end of October 2023

and the lease for Millenia Tower expires at the end of November

2025.

Company Update : SG Land continues to make regular distributions

to its shareholders. In addition to a distribution during Q2 2023,

a further distribution was made in Q3 2023 bringing total

distributions for the year to US$1.0 million. SIHL, through a

subsidiary, agreed to sell its interest in SG Land and expects to

complete the sale in Q4 2023.

Niseko Property Joint Venture ("Niseko JV") : Symphony invested

in a property development venture that acquired land in Niseko,

Hokkaido, Japan. Symphony has a 37.5% interest in this venture, The

Niseko JV sold 31% of the development site to Hanwha Hotels &

Resorts with a further 39% to a new joint venture company that is

equally held and being co-developed by the Niseko JV and the Hanwha

Group. The Niseko JV continues to effectively hold approximately

50% of the total site, which includes a 100% interest in one parcel

of land which is being held for future development and/or sale.

Company Update : The property market in Niseko continues to be

vibrant with a number of developments being launched and end-user

demand remaining strong. The coming ski season is expected to

result in strong visitor numbers and property sales.

The part of the site to be co-developed by the Niseko JV and the

Hanwha Group remains in the planning phase. We expect to accelerate

design and marketing work streams following the 2023/2024 ski

season.

Desaru Property Joint Venture in Malaysia : The Company has a

49% interest in a property joint venture in Malaysia with an

affiliate of Destination Resorts and Hotels Sdn Bhd, a hotel and

destination resort investment subsidiary of Khazanah Nasional

Berhad, the investment arm of the Government of Malaysia. The joint

venture has developed a beachfront resort with private villas for

sale on the south-eastern coast of Malaysia and that are branded

and managed by One&Only Resorts ("O&O"). The hotel

operations were officially launched in September 2020.

Company Update: The hotel performance continued to improve with

higher average room rates and longer lengths of stay in Q3 2023

y-o-y. Management has been successful in activating facilities for

banqueting and events, which has driven growth of F&B revenues.

However, weekday occupancy continues to remain below expectation. A

number of initiatives are being undertaken by management to address

this, including the enhancement of the resort's spa offering. The

preparation related to the launch of the private residences is

ongoing.

Symphony has invested an aggregate of US$58.8 million in the

joint venture as of 30 September 2023. The fair value on the same

date was US$24.3 million. This compares to a fair value of US$27.5

million at 30 June 2023. The change in value is due to different

assumptions used in the valuation for this investment.

Isprava Vesta Private Limited. ("Isprava") : is a company in the

business of construction, designing and sale of branded villas in

non-urban markets in India such as Alibagh, Goa and Kasauli. The

company is also in the in the business of renting luxury holiday

homes under the brand name of "Lohono Stays" and includes both

homes constructed and sold by Isprava and third-party homes in

India and overseas.

Company Update: Isprava closed the quarter with a strong order

book. The gross profit margin came ahead of budget by 10% due to

process enhancements, operational efficiencies and streamlining

vendor billing management. The company launched a firm-wide ERP

solution. At the close of the quarter, Isprava had 159 homes at

various stages of development which are on track as per the

original timeline commitments.

Lohono had 121 operational homes on its platform at the close of

the quarter. This is slightly below target due to the

rationalization of the portfolio as part of cost optimization

initiatives and included homes that had fixed leases and minimum

guarantees. However, in core locations, the number of operational

homes increased above target. Prudent cost optimization of direct

and corporate costs have led to increased contribution and EBITDA

margins for the quarter.

HEALTHCARE

ASG Hospital Private Limited ("ASG"): is a full-service eye-

healthcare provider with operations in India, Africa, and Nepal.

ASG was founded in Rajasthan, India in 2005. ASG's operations have

since grown to 149 eye-hospitals, which offer a full range of

eye-healthcare services, including outpatient consultation and a

full suite of inpatient procedures. ASG also operates optical and

pharmacy businesses that are located within hospitals. Symphony

invested in ASG in tranches from October 2019 through to July 2020

and subsequently acquired secondary shares in October 2021. In

2022, Symphony sold approximately a third of its shares at 2.4

times its cost of shares sold.

Company Update: Management continue to execute on an extensive

pipeline of organic and inorganic opportunities to expand the

business. The group reported double digit revenue growth for the

six-months ended 30 September 2023. The integration and

revitalisation of Vasan Health Care Pvt. Ltd, which was

consolidated in March this year and added approximately 90

eye-hospitals to the group, is on track with strong growth in

inpatient and outpatient admissions.

Symphony's net investment cost in ASG was US$3.7 million at 30

September 2023, which is after reducing net proceeds received from

the sale of shares amounting to US$17.0 million in 2022. The fair

value of Symphony's investment at 30 September 2023 was US$36.1

million, which compares to US$31.0 million at 30 June 2023. The

change in value reflects the improved performance of the business

and higher market multiples of comparable companies used in the

valuation of this business.

Soothe Healthcare Pvt. Ltd. ("Soothe"): was founded in 2012 and

operates within the fast-growing consumer healthcare products

market segment in India. Soothe's core product portfolio includes

feminine hygiene and diaper products. Symphony completed an initial

investment in Soothe in August 2019 and subsequently made

investments through convertible notes and securities from 2020 to

2023.

Company Update: Soothe's management has been successful in

improving margins by refocusing distribution to more profitable

channels and reducing costs. The rationalization of certain

distribution has had some impact on overall sales, but management

have reported positive momentum with the initiatives

undertaken.

Symphony's gross and net investment cost in Soothe was US$13.4

million at 30 September 2023. The fair value of Symphony's

investment on the same date was US$20.7 million, which compares to

US$19.5 million at 30 June 2023. The difference in value is due to

changes in certain assumptions used in the valuation for this

investment.

LIFESTYLE

Liaigre Group ("Liaigre"): was founded in 1985 in Paris and is a

brand synonymous with discreet luxury, and has become one of the

most sought-after luxury furniture brands, renowned for its

minimalistic design style. Liaigre has a strong intellectual

property portfolio and provides a range of bespoke furniture,

lighting, fabric & leather, and accessories. In addition to

operating a network of 24 showrooms in 11 countries across Europe,

the US and Asia, Liaigre has a Design Studio which undertakes

exclusive architecture and interior design projects for select

yachts, hotels, restaurants and private residences.

Company Update: The market remained challenging in Q3 2023 for

showroom furniture sales, particularly in Europe and the US.

Management expect the market for high-end furniture to remain

subdued for the rest of the year in these markets. Showrooms in

Asia have been less impacted and remain a key source of growth

within the group. Asian showroom orders for the nine-months ended

30 September 2023 are 70% higher than the same period a year

earlier. The interior architecture business is also a bright spot

for the business as the pipeline of projects continue to grow.

Symphony's gross investment cost in Liaigre was US$79.7 million

at 30 September 2023. The net cost on the same date, after

deducting partial realisations, was US$67.6 million. The fair value

of Symphony's investment was US$31.9 million at 30 September 2023.

This compares to US$43.5 million at 30 June 2023. The difference in

value is predominantly due to a decrease in comparable company

market multiples used to value this investment and trailing

12-month EBITDA for the company.

CHANINTR ("Chanintr") : Chanintr is a luxury lifestyle company,

based in Thailand, which primarily distributes high- end U.S. and

European furniture and household accessory brands, including

Liaigre, Barbara Barry, Baker, Herman Miller, Marquee, Minotti,

Bulthaup kitchens amongst others. Chanintr also provides FF&E

solutions for real estate and hotel projects. In 2019, Chanintr

launched a new program called Chanintr Residences which will

showcase custom-designed luxury residences as turnkey projects.

Company Update: In Q3FY2023 and YTD2023, Chanintr's sales were

down for both developer and residential projects compared to the

same periods a year earlier. Sales closed for the 9-months to 30

September 2023 were down 25% y-o-y, however, there are several

projects in the pipeline that will enable the company to partially

catch-up in sales for 2023 compared to last year. The company is in

the product development stage for sustainable luxury products and

will initially test the concept with ChanintrX Co and then extend

it via Martha Stewart and Chanintr Home brands.

EDUCATION

WCIB International Co. Ltd. ("WCIB") : Symphony entered into a

joint venture with WCIB International Co. Ltd. ("WCIB"), that

developed and operates Wellington College International Bangkok,

the fifth international addition to the Wellington College family

of schools from the UK. WCIB operates a co- educational school that

began operations in August 2018 and will ultimately cater to over

1,500 students aged 2-18 years of age when all phases are fully

complete.

Company Update: The school's enrolments continue to be ahead of

expectations, which is expected to drive stronger profitability for

the current academic year. Symphony participated in a further

capital raising during Q3 2023 with other shareholders to fund

further expansion and enhance facilities that will allow for more

student capacity.

Creative Technology Solutions DMCC ("CTS") : is a UAE-based

company that provides technology solutions to K12 schools in the

UAE and the Kingdom of Saudi Arabia ("KSA"). The company was

founded in 2013 to provide customized IT solutions to the education

sector, including hardware, software and training. Symphony made

its investment in CTS in June 2019.

Company Updat e: Symphony completed the sale of its interest in

CTS during Q3 2023 and received further related contingent amounts

in November 2023. The sale generated a net return per annum and

times the original cost of investment (taking into account dividend

distributions and contingent amounts received) of approximately

24.0% and 2.5 times, respectively.

LOGISTICS

Indo Trans Logistics Corporation ("ITL ") : was founded in 2000

as a freight-forwarding company and has since grown to become

Vietnam's largest independent integrated logistics company with a

network that is spread across Vietnam, Cambodia, Laos, Myanmar, and

Thailand. ITL has grown to national champion status in Vietnam with

over 2,000 employees across its business units and joint ventures.

ITL's strategic plans include supporting small and medium

enterprises in Vietnam and across the Indochina region. Symphony

bought the shares that had originally been held by Singpost, the

Singapore Post office, at a cost of $42.6 million for a roughly

28.6% interest. Following the sale of a small number of shares in

Q2 2023 to a strategic Asian logistics company (at 4.6 times

Symphony's cost of shares on a net basis) as part of a larger

secondary offering, Symphony's interest was 27.4% at 30 September

2023.

Company Update: The logistics sector in Vietnam continued to

face headwinds, which affected ITL in Q3 2023. Management have

indicated they have begun to see a slow recovery with freight

volumes and yields improving since September. ITL's ports

operations remain stable and the group is expanding this part of

the business.

Symphony's gross and net investment cost related to ITL at 30

September 2023 was US$42.6 million and US$35.3 million,

respectively. The fair value for Symphony's interest in ITL on the

same date was US$61.8 million, which compares to US$63.6 million at

30 June 2023. The change in value is predominantly due to a decline

in trailing EBITDA used to value this business.

NEW ECONOMY

Smarten Spaces Pte. Ltd. ("Smarten") : In November 2019,

Symphony invested in Smarten Spaces Pte. Ltd ("Smarten"), a

Singapore based SaaS (Software-as-a-Service) company that provides

software solutions for space management in commercial and

industrial properties. Smarten was founded in 2017 by Dinesh

Malkani and offers an end-to-end solution for workplace flexibility

on a single technology platform, to help businesses navigate the

new hybrid workplace. The SaaS technology includes four key aspects

- Desk Management, Workforce Rostering, Demand & Supply,

Expenses & Chargeback, and Asset Management; bringing together

key workforce and workplace considerations for a future-ready

solution.

Company Update: The adoption of the hybrid workplace model has

led to growth in user activity with clients including a number of

Fortune 500 companies . Smarten Spaces currently operates in over

30 countries, with significant traction in North America.

The Company has been faced with a restricted funding and has

therefore focused on cost reductions in order to reach a cashflow

neutral position. This has led to reduced resources for sales and

marketing and as a result the Q3 2023 ARR showed a modest increase

of 0.8% q-o-q. Symphony made a further investment in Smarten in Q3

2023 that amounted to less than 1% of NAV.

August Jewellery Pvt. Ltd. ("Melorra") : Founded in January

2015, Melorra is an omni-channel fast fashion Indian jewellery

company that introduces a fresh collection of new designs every

Friday. Melorra adopts a minimal inventory model that uses 3-D

printing technology to achieve just-in-time manufacturing to bring

products to market efficiently. The company currently has 24

operational experience centres across India.

Company Update: Melorra continues to pivot towards more

profitable channels, which include stores and marketplaces. As a

result, the company is reducing the focus on online channels, which

are are also more capital intensive. The stores have shown all-time

high gross margins on higher diamond sales, while the demand from

marketplace channels continues to remain strong. In the last two

months Melorra has successfully opened eight franchise stores

taking the total number of stores, including both company owned and

operated and franchise stores, to 31. The company plans to open an

additional 10 stores before 31 December. The company has been able

to reduce EBITDA burn by 76.8% from March 2023 by reducing

marketing spend and overall headcount. The company has a target to

reach 50 stores by March 2024.

Good Capital Partners ("Good Capital" or "GCP") and Good Capital

Fund I ("GCF1")& Good Capital Fund II ("GCF2") : GCP is

majority owned by brothers Rohan and Arjun Malhotra who have been

investing their own capital since 2014 to create a thriving

ecosystem of technology start-ups. Symphony announced its

investment in July 2019 with a 10% stake in GCP and serving as an

anchor investor in its first fund, GCF1 and in November 2022

committed to GCF2.

Company Update: Good Capital Fund I made no new fund investments

in the quarter. The Fund's cumulatively deployed capital is

currently US$12.2 million across 19 core fund investments and 58

Bharat Founders Fund investments ("BFF"), where the cheque size is

US$25,000. Currently, the Fund is in closing conversations for one

new core investment. At an aggregate level, the MOIC at the close

of this quarter is approximately 2.25x.

Good Capital Fund II made one new fund investment in the quarter

and is in the process of closing an additional five new investments

in Q4FY2023. The Fund's cumulatively deployed capital is currently

US$2.9 million across one core fund investment.

Catbus Infolabs Private Limited ("Blowhorn") : In August 2021,

Symphony invested in Catbus Infolabs Private Limited, the owner of

the Blowhorn platform. Blowhorn is a same-day intra-city last-mile

logistics provider headquartered in Bangalore, India. The company

provides seamless transportation, warehousing, and a fully

technologically integrated system to manage the end-to-end supply

chain process through an asset-light transportation and distributed

micro-warehousing network.

Company Update: The adoption of e-commerce and

direct-to-consumer business models in India is continuing to grow,

creating tailwinds for the logistics industry. However, due to the

challenging fundraising environment, the company has reduced cash

spending in order to extend runway which has led to LTM revenues

decreasing by -12% q-o-q. At the end of Q3 2023 the company

received funding from existing investors and is currently working

on securing further funding from external investors.

House of Kieraya Private Limited ("Furlenco"): Founded in

October 2012 in Bangalore, India, Furlenco is a residential

furniture rental services business. The business has since expanded

to include selling refurbished & recycled furniture; UNLMTD, an

annual furniture and appliance subscription service and KreateOne,

an in-house furniture manufacturing facility.

Company Update: Furlenco completed an investment by Sheela Foams

Limited in the quarter ended 30 September 2023. The infusion of

US$36.6 million has put the company on track towards meeting its

business plan targets. The company used the capital to reduce debt

and has started its marketing initiatives to grow the customer

base. The company is working towards achieving profitability

without compromising on growth.

Meesho, Inc ("Meesho"): Founded in March 2016 in Bangalore,

India, Meesho is a social e-commerce platform to sell to the next

500 million Indians coming online. Meesho is the most downloaded

app globally and is currently the third largest e-commerce platform

in India behind Flipkart and Amazon.

Company Update: Meesho had the first profit after tax quarter in

the history of the company . It is also the first quarter with

positive cash flow leading to positive cash flow on a YTD basis.

The company saw Monthly Transacting User ("MTU") growth despite a

high base effect from the prior year. Delivered orders grew due to

a decline in Average Order Value ("AOV") due to better pricing on

the platform. NMV has been growing due to significant reductions in

cancellations and Return to Origin ("RTO"). The company also

witnessed sustained improvement in its take-rate and an increase in

the gross profit margin.

SolarSquare Energy Private Limited ("Solar Square") : Solar

Square was founded in 2015 and is a rooftop solar power services

company that focuses on residential homes, primarily standalone

houses, gated societies, and small commercial centres. The company

aims to make clean energy affordable and accessible and become the

trusted brand in the space.

Company Update: The company had a strong quarter growing by 2x

over Q3FY2022 and is currently acquiring on average 550 homes per

month. By monthly volumes Solar Square is the number two player in

the market behind Tata Power. Cumulatively Solar Square has

acquired 9,000+ individual homes till now; each powered by an

average 3.5-4 kW of solar power. Each individual home which goes

solar saves an average of INR 45,000 per year in electric bills and

offsets 4 metric tons of CO2 per year. Less than 0.5% homes in

India have rooftop solar compared to 7% in Brazil, 15% in Germany

and 33% in Australia. The Government of India's pro-active

policy-making in the residential solar space will lead to further

expansion of the market in the years to come. Solar Square has

played a part in assisting the Government of India to shape policy

in this space.

MAVI Holding Pte. Ltd. ("Mavi") : In December 2022 Symphony

invested in Mavi, a B2B insurance and warranty programme

administration services company headquartered in Singapore with

operations in India, Thailand, and Singapore. Household wealth is

growing in South and South-East Asia with the middle class

expanding rapidly. Yet these regions are highly under-insured with

a lack of access to insurance products. Mavi is an early-stage

start-up business with a goal to develop insurance products that

are accessible, competitively priced, and tailored for the Asian

markets. The company will provide insurance and warranty programme

management services and partner with insurance and carriers in the

region to bring these products to market.

Company Update: Mavi continued to generate revenues in Q3 2023

through both the insurance business in Singapore as well as the

automotive warranty business in India. The Company is continuing to

build and secure partnerships for its insurance and warranty

services across Asia and has launched with an insurance provider to

bring Mavi's insurance products to the Indian market.

SUBSEQUENT EVENTS

Subsequent to 30 September 2023:

-- Subsequent to 30 September 2023, Symphony received proceeds

from the sale of the Wine Connection Group. Work is ongoing to

determine whether conditions for incremental contingent sale

proceeds have been met.

-- Subsequent to 30 September 2023, Symphony received contingent

proceeds related to the sale of CTS. The contingent proceeds

amounted to less than 1% of NAV.

-- Subsequent to 30 September 2023, Symphony funded capital

calls related to Good Capital Fund II. The total consideration was

less than 1% of NAV.

-- Subsequent to 30 September 2023, Symphony participated in a

capital raising for Catbus Infolabs Private Limited together with

other key shareholders. The total consideration was less than 1% of

NAV.

For further information:

Symphony Asia Holdings Pte. Ltd.:

Anil Thadani +65 6536 6177

Rajgopal Rajkumar

Dealing codes

The ISIN number of the Ordinary Shares is VGG548121059, the

SEDOL code is B231M63 and the TIDM is SIHL.

The LEI number of the Company is 254900MQE84GV5DS6F03.

Notes:

NAV takes into account the fair value of unrealised investments.

In accordance with the valuation policies of the Company, real

estate related investments are valued by third parties on 30

September and 31 December each year. In addition and in accordance

with the Company's valuation policies, investments that have been

held for less than 12-months are held at cost unless there is

evidence of a diminution in the value of that investment. Although

the investment manager believes there not to be a diminution in the

value of investments held for less than 12- months, the Covid-19

pandemic has led to a significant increase in economic uncertainty

which is evidenced by more volatile asset prices and currency

exchange rates and therefore cost may not correspond to an

appropriate measure of fair value in the current environment.

IMPORTANT INFORMATION

A more detailed Shareholder Update is available on request from

the Company and can be accessed via www.symphonyasia.com .

THIS DOCUMENT IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION,

IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED

STATES OR ANY OTHER JURISDICTION INTO WHICH THE PUBLICATION OR

DISTRIBUTION WOULD BE UNLAWFUL. THESE MATERIALS DO NOT CONSTITUTE

AN OFFER TO SELL OR ISSUE OR THE SOLICITATION OF AN OFFER TO BUY OR

ACQUIRE SECURITIES IN THE UNITED STATES OR ANY OTHER JURISDICTION

IN WHICH SUCH OFFER OR SOLICITATION WOULD BE UNLAWFUL. THE

SECURITIES REFERRED TO IN THIS DOCUMENT HAVE NOT BEEN AND WILL NOT

BE REGISTERED UNDER THE SECURITIES LAWS OF SUCH JURISDICTIONS AND

MAY NOT BE SOLD, RESOLD, TAKEN UP, TRANSFERRED, DELIVERED OR

DISTRIBUTED, DIRECTLY OR INDIRECTLY, WITHIN SUCH JURISDICTIONS.

NO REPRESENTATION OR WARRANTY IS MADE BY THE COMPANY OR ITS

INVESTMENT MANAGER AS TO THE ACCURACY OR COMPLETENESS OF THE

INFORMATION CONTAINED IN THIS DOCUMENT AND NO LIABILITY WILL BE

ACCEPTED FOR ANY LOSS WHATSOEVER ARISING IN CONNECTION WITH SUCH

INFORMATION.

THIS DOCUMENT CONTAINS (OR MAY CONTAIN) CERTAIN FORWARD-LOOKING

STATEMENTS WITH RESPECT TO CERTAIN OF THE COMPANY'S CURRENT

EXPECTATIONS AND PROJECTIONS ABOUT FUTURE EVENTS. THESE STATEMENTS,

WHICH SOMETIMES USE WORDS SUCH AS "ANTICIPATE", "BELIEVE", "COULD",

"ESTIMATE", "EXPECT", "INT", "MAY", "PLAN", "POTENTIAL", "SHOULD",

"WILL" AND "WOULD" OR THE NEGATIVE OF THOSE TERMS OR OTHER

COMPARABLE TERMINOLOGY, ARE BASED ON THE COMPANY'S BELIEFS,

ASSUMPTIONS AND EXPECTATIONS OF ITS FUTURE PERFORMANCE, TAKING INTO

ACCOUNT ALL INFORMATION CURRENTLY AVAILABLE TO IT AT THE DATE OF

THIS DOCUMENT. THESE BELIEFS, ASSUMPTIONS AND EXPECTATIONS CAN

CHANGE AS A RESULT OF MANY POSSIBLE EVENTS OR FACTORS, NOT ALL OF

WHICH ARE KNOWN TO THE COMPANY AT THE DATE OF THIS ANNOUNCEMENT OR

ARE WITHIN ITS CONTROL. IF A CHANGE OCCURS, THE COMPANY'S BUSINESS,

FINANCIAL CONDITION AND RESULTS OF OPERATIONS MAY VARY MATERIALLY

FROM THOSE EXPRESSED IN ITS FORWARD-LOOKING STATEMENTS. NEITHER THE

COMPANY NOR ITS INVESTMENT MANAGER UNDERTAKE TO UPDATE ANY SUCH

FORWARD LOOKING STATEMENTS

STATEMENTS CONTAINED IN THIS DOCUMENT REGARDING PAST TRS OR

ACTIVITIES SHOULD NOT BE TAKEN AS A REPRESENTATION THAT SUCH TRS OR

ACTIVITIES WILL CONTINUE IN THE FUTURE. THE INFORMATION CONTAINED

IN THIS DOCUMENT IS SUBJECT TO CHANGE WITHOUT NOTICE AND, EXCEPT AS

REQUIRED BY APPLICABLE LAW, NEITHER THE COMPANY NOR THE INVESTMENT

MANAGER ASSUMES ANY RESPONSIBILITY OR OBLIGATION TO UPDATE PUBLICLY

OR REVIEW ANY OF THE FORWARD-LOOKING STATEMENTS CONTAINED HEREIN.

YOU SHOULD NOT PLACE UNDUE RELIANCE ON FORWARD-LOOKING STATEMENTS,

WHICH SPEAK ONLY AS OF THE DATE OF THIS ANNOUNCEMENT.

THIS DOCUMENT IS FOR INFORMATION PURPOSES ONLY AND DOES NOT

CONSTITUTE AN INVITATION OR OFFER TO UNDERWRITE, SUBSCRIBE FOR OR

OTHERWISE ACQUIRE OR DISPOSE OF ANY SECURITIES OF THE COMPANY IN

ANY JURISDICTION. ALL INVESTMENTS ARE SUBJECT TO RISK. PAST

PERFORMANCE IS NO GUARANTEE OF FUTURE RETURNS. SHAREHOLDERS AND

PROSPECTIVE INVESTORS ARE ADVISED TO SEEK EXPERT LEGAL, FINANCIAL,

TAX AND OTHER PROFESSIONAL ADVICE BEFORE MAKING ANY INVESTMENT

DECISIONS.

THIS DOCUMENT IS NOT AN OFFER OF SECURITIES FOR SALE INTO THE

UNITED STATES. THE COMPANY'S SECURITIES HAVE NOT BEEN, AND WILL NOT

BE, REGISTERED UNDER THE UNITED STATES SECURITIES ACT OF 1933 AND

MAY NOT BE OFFERED OR SOLD IN THE UNITED STATES ABSENT REGISTRATION

OR AN EXEMPTION FROM REGISTRATION. THERE WILL BE NO PUBLIC OFFER OF

SECURITIES IN THE UNITED STATES .

NEITHER THE CONTENT OF THE COMPANY'S WEBSITE (OR ANY OTHER

WEBSITE) NOR THE CONTENT OF ANY WEBSITE ACCESSIBLE FROM HYPERLINKS

ON THE COMPANY'S WEBSITE (OR ANY OTHER WEBSITE) IS INCORPORATED

INTO, OR FORMS PART OF, THIS DOCUMENT.

TO ENSURE THE COMPANY'S COMPLIANCE WITH SUB-SECTION 8(3)(A)(I)

OF THE PRIVATE INVESTMENT FUNDS REGULATIONS, 2019, THE DIRECTORS

WILL KEEP THE FINANCIAL SERVICES COMMISSION OF THE BRITISH VIRGIN

ISLANDS INFORMED OF THE NUMBER OF SHAREHOLDERS ON THE COMPANY'S

REGISTER OF SHAREHOLDERS.

THE COMPANY AND THE INVESTMENT MANAGER ARE NOT ASSOCIATED OR

AFFILIATED WITH ANY OTHER FUND MANAGERS WHOSE NAMES INCLUDE

"SYMPHONY", INCLUDING, WITHOUT LIMITATION, SYMPHONY FINANCIAL

PARTNERS CO., LTD.

End of Announcement

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDZVLFBXLLEFBX

(END) Dow Jones Newswires

December 11, 2023 02:00 ET (07:00 GMT)

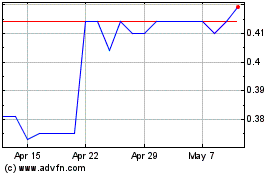

Symphony International H... (LSE:SIHL)

Historical Stock Chart

From Dec 2024 to Jan 2025

Symphony International H... (LSE:SIHL)

Historical Stock Chart

From Jan 2024 to Jan 2025