TIDMSUN

RNS Number : 8338M

Surgical Innovations Group PLC

19 September 2023

Surgical Innovations Group plc

("Surgical Innovations", the "Group" or the "Company")

Half-year Report

Interim results for the six months ended 30 June 2023

Surgical Innovations Group plc (AIM: SUN), the designer,

manufacturer and distributor of innovative medical technology for

minimally invasive surgery, reports its unaudited financial results

for the six-month period ended 30 June 2023 ("2023 H1") and

provides an update on current trading and the outlook for the

Group.

Commercial and operational highlights:

-- Strong sales in key markets, UK, Japan and Europe driving overall sales growth

-- New strategy in key new geographical markets gaining traction

after slower than anticipated start

-- Improvement plan being implemented mid Q2 to drive future

efficiencies and improve margins throughout operations

-- Overhaul of supply chain process and structure to drive down costs

-- Transition to MDR remains on track and UKCA mark achieved

-- Higher levels of inventory maintained to support service levels to customers

-- Positive orderbook for Q3, including a positive OEM forecast for H2

Financial highlights:

-- Revenues increased 4.4% on prior year to GBP5.65m (2022 H1: GBP5.41m)

-- Commercial gross margins at 40.5% within target range but

decreased compared to 2022 due to short-term operational

inefficiencies (2022 H1: 45.5%; 2022 FY: 42.6%)

-- Adjusted EBITDA(1) profit of GBP0.01m (2022 H1: GBP0.29m)

-- Small adjusted operating loss(1) of GBP0.28m (2022 H1: GBP0.01m profit)

-- Adjusted EPS amounted to a loss(1) of 0.037p per share (2022 H1: 0.004p)

-- Net cash(2) at end of period of GBP0.38m (31 Dec 2022: GBP0.99m)

-- Gross cash headroom at the end of period of GBP2.41m (as at

31 Dec 2022: GBP3.20m), including GBP1.0m undrawn invoice

discounting facility

1 Adjusted EBITDA, adjusted operating (loss)/ profit and

adjusted EPS are stated before deducting non-recurring exceptional

costs of GBP0.01m (2022 H1: GBP0.03) and share based payment costs

of GBP0.02m (2022 H1 GBP0.02m).

2 Net cash equals cash less bank debt

Current Trading and Outlook

-- Sales in key markets have continued the strong growth

momentum from H1 and, in addition, the backlog of OEM orders has

been addressed and there is an encouraging positive orderbook for

H2

-- Group revenues have continued to grow in H2 in line with the

Board's expectations, with key markets and OEM in particular

performing strongly

-- The Group continues to trade profitably at the adjusted

EBITDA level, notwithstanding some operational challenges

-- Planned destocking for H2 has commenced and is expected to

return working capital towards normal levels

-- Evaluations in UK continue to gain pace and it is anticipated

the measures to address the significant backlog of patients waiting

for treatment will provide further opportunity for the UK team to

drive sales through the sustainability message

-- Initial growth in new markets was slower than anticipated but

new strategies and closer support has seen new momentum and

traction starting to be seen in these markets

-- Operational review initiated in Q2 to identify supply chain

efficiencies and productivity gains

-- Resultant improvements are already being implemented to

process and structure, although nominal in the current year, these

and others to follow are expected to help drive the future

profitability of the Group from 2024 onwards

Chairman of SI, Jonathan Glenn, said:

"Revenues in the period to 30 June 2023 have continued to grow

and strengthen, with key markets showing positive growth which we

expect to continue for the remainder of the year. New geographical

territories have been slower than anticipated but are now gaining

traction. Our OEM business is back on track after a challenging H1

with the backlog of orders addressed in the period since the

half-year end and the supply chain delays resolved for these

activities. Overall, the revenue prospects for the Group are

encouraging.

"Despite recently reported operational challenges with

manufacturing productivity and supply chain disruptions, we are

confident the measures being implemented will help overcome these.

We have engaged an industry specialist to lead this project which

is well underway, and we expect to see significant benefits flowing

though into the P&L during the first half of the next financial

year."

Surgical Innovations Group plc www sigroupplc com

David Marsh, CEO Tel: 0113 230 7597

Charmaine Day, CFO

Singer Capital Markets (Nominated Adviser Tel: 020 7496 3000

& Broker)

Aubrey Powell / Oliver Platts

Walbrook PR (Financial PR & Investor Tel: 020 7933 8780 or si@walbrookpr.com

Relations)

Paul McManus / Lianne Applegarth Mob: 07980 541 893 / 07584 391

303

About Surgical Innovations Group plc

Strategy

The Group specialises in the design, manufacture, sale and

distribution of innovative, high quality medical products,

primarily for use in minimally invasive surgery. Our product and

business development is guided and supported by a key group of

nationally and internationally renowned surgeons across the

spectrum of minimally invasive surgical activity.

We design and manufacture and source our branded port access

systems, surgical instruments and retraction devices which are sold

directly in the UK home market through our subsidiary, Elemental

Healthcare, and exported widely through a global network of trusted

distribution partners. Many of our products in this field are based

on a

"resposable" concept, in which the products are part reusable,

part disposable, offering a high quality and environmentally

responsible solution at a cost that is competitive against fully

disposable alternatives.

Elemental also has exclusive UK distribution for a select group

of specialist products employed in laparoscopy, bariatric and

metabolic surgery, hernia repair and breast reconstruction. In

addition, we design and develop medical devices for carefully

selected OEM partners. We have a number of long-term relationships

with key partner including the design, development and manufacture

of the FIX8 device for AMS and more recently for a new

collaboration with a Robotic company, CMR Surgical ('CMR') to

design and develop and access device for their unique

instrumentation.

We aim for our brands to be recognised and respected by

healthcare professionals in all major geographical markets in which

we operate and provide by development, partnership or acquisition a

broad portfolio of cost effective,

procedure specific surgical instruments and implantable devices

that offer reliable solutions to genuine clinical needs in the

operating theatre environment.

Operations

The Group currently employs approximately 100 people across one

site in the UK. Elemental Healthcare was acquired by the Group on 1

August 2017 and provides direct sales representation in the UK home

market and a range of third- party products for UK distribution.

Elemental was originally based in Berkshire and was successfully

relocated in 2021, with all operations now located at the Leeds

site.

Further information

Further details of the Group's businesses are available on

websites: www.sigroupplc.com

www.surginno.com , and www.elementalhealthcare.co.uk

Investors and others can register to receive regular updates by

email at si@walbrookpr.com

Surgical Innovations Group plc Chairman's Statement

For the six-month period ended 30 June 2023

Market and Financial Overview

The Group recorded strong revenue growth in 2022 and we have

seen this continue, trading in the first half of the year increased

4.4% to GBP5.65m on the comparable period last year (2022 H1:

GBP5.41m). Sales continue to strengthen in the second half of the

year and remain on track to meet management's expectations.

The UK business continues to be strong which is driven by the

sustainability messaging, having a positive impact on activity.

SI-branded product sales were GBP0.92m (2022 H1: GBP0.68m) and UK

distribution sales were GBP2.11m (2022 H1: GBP2.01m), together up

12.7%. This will continue to grow as the NHS pushes its focus

sustainability and the implementation of its 'Net Zero' commitment

and implements measures to address the increasing backlog of

patients on waiting lists.

In Europe, the increased investment in sales and marketing is

starting to gain traction, achieving underlying sales growth of

18.2% which delivered revenue of GBP0.69m (2022 H1: GBP0.59m).

Despite being hindered by missed opportunities in component delays

with the new Optical trocar, this is expected to gain traction with

new business wins in the second half.

Revenues from the US are progressing more slowly than planned,

marginally lower than the comparable period for SI-branded products

as the first half decreased to GBP0.48m (2022 H1: GBP0.59m).

Progress with YelloPort Elite was slower than anticipated, but

increased focus, training and sales support has seen momentum

gained through the conversion of a number of smaller accounts in

H1.

The APAC region continued to generate strong revenue growth to

GBP0.54m, an 11.8% increase (2022 H1: GBP0.48m). The majority of

the growth was from our Japanese distributor as they continue to

gain market share, despite having delays with product registration

with the 5mm Elite launch. The launch is now expected in Q4, and

this presents a significant future opportunity. In addition, the

initial orders for India were sent out in the first half of the

year and we are encouraged by the initial interest from early

evaluations.

OEM revenues have endured the majority of challenges with supply

chain delays, with reported revenues of GBP0.68m (2022 H1:

GBP0.92m). Notwithstanding this, the order book remains strong for

the remainder of the year and the manufacturing disruption is

starting to ease for these product lines.

Commercial or underlying margins remained just within target

range at 40.5% (2022 H1: 45.3%, 2022 FY: 42.6 %). At the end of

2022 a review was undertaken to analyse the overhead absorption

rate, as operating expenses had continued to increase with

inflationary pressures, the overhead rate was uplifted, in addition

the pressures from material suppliers continue. A series of planned

price increases has been implemented across the period however,

some of these will be phased in over time due to the fixed term

nature of contractual agreements.

The reported gross margin of just under 33.0% (2022 H1: 34.6%,

2022 FY: 34.6%) includes the net cost of manufacturing, reflecting

the operational challenges the business continues to experience.

Manufacturing productivity and supply chain disruptions will impact

profitability in the second half of the year, as reported in the

recent trading update. A complete operational review of both

manufacturing operations and supply chain is currently being

undertaken, utilising an industry specialist. While measures are

already being introduced to improve efficiencies and productivity,

we expect the majority of the benefit to flow through to the

P&L in the next financial year.

Other operating expenses increased to GBP2.17m (2022 H1:

GBP1.93), driven by additional investment in Sales and Marketing to

enhance revenue and continued investment in regulatory costs due

the change in certification to Medical Device Regulation (MDR). In

addition, the inflationary pressure in employee remuneration has

continued to impact profitability. Excluding the effects of

non-recurring items and share based payments, operating expenses

increased by GBP0.26m to GBP2.14m (2022 H1: 1.88m). The Group is

trading at an adjusted EBITDA profit for the period of GBP0.01m

(2022 H1: GBP0.29m). The full effect of these additional costs will

impact the second half of the year, but management expects the

Group will continue to be profitable at the adjusted EBITDA level,

as a result of the operational review initiatives starting to be

implemented.

Adjusted operating loss before tax for the period (before

non-recurring items and share based payment charges) was GBP0.28m

(2022 H1: GBP0.01m). The reported net loss before taxation amounted

to GBP0.37m against a net loss before taxation of GBP0.11m in the

first half last year.

The Group reported a tax credit in the period of GBPnil (2022

H1: GBP0.09m) which related to an enhanced research and development

("R&D") claim for 2021. The Group received a tax credit of

GBP0.22m in August 2023, relating to its claim for 2022. In terms

of deferred tax, the Group continues to hold substantial

corporation tax losses on which management takes a cautious view,

and consequently the Group does not recognise a corresponding

deferred tax asset.

Adjusted net earnings per share amounted to a loss of 0.037p

(2022 H1: GBP0.004p). The net total comprehensive income for the

period amounted to a loss of GBP0.37m (2022 H1: loss of

GBP0.01m).

For the first half of 2023, cash used in operations was GBP0.07m

(FY 2022: GBP0.23m generated, 2022 H1: GBP0.22m generated). After

continued investment into R&D of GBP0.12m (FY 2022: GBP0.42m,

2022 H1: GBP0.17m), capital expenditure of GBP0.18m (FY 2022:

GBP0.66m, 2022 H1: GBP0.19m) and the refinancing of the existing

bank loan and lease liabilities, the Company had available cash

balances, including the unused invoice discounting facility of

GBP1.0m, totalling GBP2.41m (31 Dec 2022: GBP3.20m). The covenant

test (EBITDA to debt service) for the period ending 30 June 2023

was waived by the lender, they remain fully supportive with

approval obtained to waive the next two debt service covenant tests

dated 30 September 2023 and 31 December 2023.

Market outlook

The UK continues to demonstrate strong growth underpinned by the

sustainability messaging, highlighted by the growth in SI-branded

products, and has opened opportunities in both the NHS and private

sectors where the drive to 'Net Zero' is gaining momentum. Whilst

industrial action by clinical staff has impacted both the volume of

surgery and pace of evaluations, the UK business has proved to be

resilient and continues to show growth into Q3. The UK sales team

is at full strength and has benefited from a new enhanced training

programme, which will also be rolled out to support all of our

international partners over the coming months.

Sustainability messaging initiatives continue to drive sales in

many key markets and the ongoing investment in sales support,

marketing, training and development of the financial &

environmental calculator have proved to be powerful tools in

driving growth. APAC has continued to demonstrate growth and the

delayed launch of Elite 5mm and Optical, now expected in late Q4,

provides further opportunity before the year-end. Progress in

Europe has quickened, with sales in H1 above pre-Covid levels for

the first time, with sustainability a key driver and continuing to

provide opportunities in H2.

Revised targeting and incentive plans for the US sales team have

already seen an increase in the number of active evaluations with

the potential to drive sales from Q4 and beyond. Long-term partner,

Adler Instruments, continues to have a strong business

opportunities, however outside of the Southeast the consortium of

distributors has proven to be disappointing. The Company continues

to review the most effective routes to market for its scissor

sales.

Investment in new product development has continued and a number

of projects remain close to fruition. The YelloPort Elite family

was enhanced with the launch of the 5mm Optical and, whilst some

registration delays have slowed the launch in key markets, it is

expected these registrations will be completed to allow a Q4 launch

in the majority of key markets feedback from important markets has

identified the opportunity for a further line extension in the form

of a shielded cutting trocar specifically in Gynaecology. Under the

new MDR approved quality management system we have been able to

accelerate the development of this device and anticipate a launch

in late Q4. Some supply chain delays have slowed progress on the

Logi Dissect and Grasp instruments for which launch is now planned

in the earlier part of 2024. Investment in new product development

continues to build on the sustainability message.

Underlying revenues in the OEM segment continued throughout H1

to be suppressed, not by demand, but due to supply chain

constraints. Alternate suppliers of some key components to address

delays have taken substantially longer to come online. These

challenges slowed sales in the first half of the year, but a

significant improvement has been seen since the end of the first

half. Collaborations with CMR have moved to a new phase, and take

sales out of the OEM segment, leveraging the relationship with CMR

to open opportunity for SI's global partners to introduce YelloPort

Elite for both robotic and conventional laparoscopic cases. This

has substantially sped up the number and volume of evaluations in

two new markets, India and Germany.

Operational and Regulatory activities

The reduction in the Supply chain disruptions has not been as

fast as anticipated, leading to a delay to some sales orders into

the second half as a result. This has also led to higher levels of

inventory being held, though this is now reducing and is expected

to return to more normalised volumes over the coming months,

returning cash into the business.

The regulatory pathway continues to be on track for the EU

Medical Device Regulation (MDR), although the delay in implementing

the transition to MDR has seen the focus of the notified body move

to other, more current priorities. The Company's Quality Management

System, technical files and microbiology data have been made

compliant with MDR, audited by BSI and fully approved. Progress on

the product technical files continues with 2 out of 3 approved for

MDR, and the final file has clinical review in progress. UKCA mark

has been achieved and a further Medical Device Single Audit Program

(MDSAP) audit successfully completed.

Current trading and outlook

Group revenues have continued to grow in H2 in line with the

Board's expectations, with key markets and OEM in particular

performing strongly. Manufacturing challenges continue to be

addressed, to manage the impact of increased supply chain lead

times and the increasing cost base. An operational plan to improve

productivity and margins continues to be implemented with the help

of an industry operational expert.

The momentum in sales has continued into H2 and the order book

remains positive, leaving management confident of the H2 revenue

forecast. A robust operational plan will begin to drive

efficiencies and margins, the majority of the impact of which will

be seen from 2024 onwards.

Jonathan Glenn

Chairman

19 September 2023

Unaudited consolidated income statement for the six months ended

30 June 2023

Unaudited Unaudited Audited

six months six months Year ended

ended 30 ended 30 31 December

June June 2022

2023 2022

Notes GBP'000 GBP'000 GBP'000

---------------------------- ----- ------------------- ---------------------- ---------------------------

Revenue 3 5,650 5,413 11,340

Cost of sales (3,786) (3,540) (7,418)

---------------------------- ----- ------------------- ---------------------- ---------------------------

Gross profit 2 1,864 1,873 3,922

Other operating expenses (2,170) (1,933) (3,881)

Other income - - -

---------------------------- ----- ------------------- ---------------------- ---------------------------

Adjusted EBITDA profit

* 95 287 695

Amortisation of intangible

assets (140) (129) (232)

Impairment of intangible - - -

assets

Depreciation of tangible

assets (231) (164) (355)

Exceptional items (8) (32) (32)

Share based payments (22) (22) (35)

---------------------------- ----- ------------------- ---------------------- ---------------------------

Operating (loss)/profit (306) (60) 41

Finance costs 4 (68) (51) (98)

Finance income - - -

---------------------------- ----- ------------------- ---------------------- ---------------------------

Loss before taxation (374) (111) (57)

Taxation credit/(charge) 5 - 97 321

---------------------------- ----- ------------------- ---------------------- ---------------------------

(Loss)/profit and total

comprehensive income (374) (14) 264

---------------------------- ----- ------------------- ---------------------- ---------------------------

Earnings per share

Basic 6 (0.040p) (0.002p) (0.028p)

Diluted 6 (0.040p) (0.002p) (0.028p)

---------------------------- ----- ------------------- ---------------------- ---------------------------

* Adjusted EBITDA is earnings before interest, depreciation,

amortisation (including impairment) and exceptional items.

Unaudited consolidated statement of changes in equity for the

six months ended 30 June 2023

Notes Share capital Share premium Capital Merger Retained Total

reserve reserve earnings

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------- ------------- ------------- ------------ ----------- ------------- -------

Balance as at 1 January 2023 9,328 6,587 329 1,250 (6,531) 10,963

Employee share-based payment charge - - - - 22 22

------------------------------------- ------------- ------------- ------------ ----------- ------------- -------

Total - Transaction with owners 9,328 6,587 329 1,250 (6,509) 10,985

------------------------------------- ------------- ------------- ------------ ----------- ------------- -------

Loss and total comprehensive income

for the period - - - - (374) (374)

------------------------------------- ------------- ------------- ------------ ----------- ------------- -------

Unaudited balance as at 30 June

2023 9,328 6,587 329 1,250 (6,883) 10,611

------------------------------------- ------------- ------------- ------------ ----------- ------------- -------

Unaudited consolidated balance sheet as at 30 June 2023

Unaudited Unaudited Audited

30 June 30 June 31 December

2023 2022 2022

Notes GBP'000 GBP'000 GBP'000

------------------------------- ----- --------- --------- -----------

Assets

Non-current assets

Property, plant and equipment 925 471 858

Right of Use Assets 903 947 918

Intangible assets 6,387 6,255 6,403

------------------------------- ----- --------- --------- -----------

8,215 7,673 8,179

------------------------------- ----- --------- --------- -----------

Current assets

Inventories 3,566 3,040 3,162

Trade and other receivables 9 2,137 2,054 2,055

Cash at bank and in hand 1,412 3,040 2,199

------------------------------- ----- --------- --------- -----------

7,115 8,134 7,416

------------------------------- ----- --------- --------- -----------

Total assets 15,330 15,807 15,595

------------------------------- ----- --------- --------- -----------

Equity and liabilities

Equity attributable to equity holders of the parent company

Share capital 9,328 9,328 9,328

Share premium account 6,587 6,587 6,587

Capital reserve 329 329 329

Merger reserve 1,250 1,250 1,250

Retained earnings (6,883) (6,822) (6,531)

------------------------------- ----- --------- --------- -----------

Total equity 10,611 10,662 10,963

------------------------------- ----- --------- --------- -----------

Non-current liabilities

Dilapidation provision 165 165 165

Lease liability 670 790 722

Borrowings 8 679 1,031 825

------------------------------- ----- --------- --------- -----------

1,514 1,986 1,712

------------------------------- ----- --------- --------- -----------

Current liabilities

Trade and other payables 9 2,188 1,945 1,886

Accruals 411 653 420

Lease liability 254 209 232

Borrowings 8 352 352 382

------------------------------- ----- --------- --------- -----------

3,205 3,159 2,920

------------------------------- ----- --------- --------- -----------

Total liabilities 4,719 5,145 4,632

------------------------------- ----- --------- --------- -----------

Total equity and liabilities 15,330 15,807 15,595

------------------------------- ----- --------- --------- -----------

Unaudited consolidated cash flow statement for the six months

ended 30 June 2023

Unaudited Unaudited Audited

six months six months year

ended ended ended

30 June 30 June 31 December

Notes 2023 2022 2022

GBP'000 GBP'000 GBP'000

-------------------------------------- ----- --------------- ---------- -----------

Cash flows from operating activities

Loss after tax for the year (374) (14) 264

Adjustments for:

Taxation - (97) (321)

Finance Income - - -

Finance Costs 4 68 51 98

Depreciation of property, plant

and equipment 115 73 167

Amortisation and impairment of

intangible assets 140 129 232

Depreciation of right of use

assets 116 91 188

Share-based payment charge 22 22 35

Foreign Exchange (loss)/gain 32 (87) (82)

Increase in inventories (404) (75) (197)

Increase in current receivables (82) (360) (360)

Increase in trade and other payables 292 487 204

-------------------------------------- ----- --------------- ---------- -----------

Cash (used in)/ generated from

operations (73) 220 228

Taxation received 5 - 97 321

Interest received - - -

Interest paid (39) (25) (63)

-------------------------------------- ----- --------------- ---------- -----------

Net cash (used in)/generated

from operating activities (112) 292 486

-------------------------------------- ----- --------------- ---------- -----------

Payments to acquire property,

plant and equipment (181) (189) (659)

Acquisition of intangible assets (124) (168) (419)

-------------------------------------- ----- --------------- ---------- -----------

Net cash used in investment

activities (305) (357) (1,078)

-------------------------------------- ----- --------------- ---------- -----------

Repayment of bank loan 8 - (375) (375)

Repayment of CBILS 8 (176) (118) (294)

Repayment of lease liabilities 7(162) (133) (266)

--------------------------------------- ----- ----- -------

Net cash used in financing activities (338) (626) (935)

--------------------------------------- ----- ----- -------

Net decrease in cash and cash

equivalents (755) (691) (1,527)

Cash and cash equivalents at

beginning of period 2,199 3,644 3,644

Effective exchange rate fluctuations

on cash held (32) 87 82

--------------------------------------- ----- ----- -------

Net cash and cash equivalents

at end of period 1,412 3,040 2,199

--------------------------------------- ----- ----- -------

Notes to the Interim Financial Information

1. Basis of preparation of interim financial information

The interim financial information was approved by the Board of

Directors on 18 September 2023. The financial information set out

in the interim report is unaudited.

The interim financial information has been prepared in

accordance with the AIM Rules for Companies and on a basis

consistent with the accounting policies and methods of computation

as published by the Group in its annual report for the year ended

31 December 2022, which is available on the Group's website.

The Group has chosen not to adopt IAS 34 Interim Financial

Statements in preparing these interim financial statements and

therefore the interim financial information is not in full

compliance with International Financial Reporting Standards as

adopted for use in the European Union.

The financial information set out in this interim report does

not constitute statutory financial statements as de- fined in

section 434 of the Companies Act 2006. The figures for the year

ended 31 December 2022 have been extracted from the statutory

financial statements which have been filed with the Registrar of

Companies. The auditor's report on those financial statements was

unqualified and did not contain a statement under sections 498(2)

and 498(3) of the Companies Act 2006.

Going concern and funding

The Directors have considered the available cash resources of

the Group, with the additional secured funding in September 2023

and the current internal anticipated forecasts the Directors have a

reasonable expectation that the Group have adequate resources. The

Group is expected to continue to generate cash from operations over

the next 12 months as inventory levels reduce and operational

efficiencies improve, therefore providing ample support and

continue in operational existence for the foreseeable future,

considered to be at least 12 months for the date of approval from

the financial statements.

2. Disaggregation of gross margin

The Group has disaggregated margins in Six months Six months 12 months

the following table:

ending 30 ending 30 ending

June 31

June 2023 2022 Dec 2022

(unaudited)

(unaudited) (audited)

GBP'000 GBP'000 GBP'000

---------------------------------------- ------------------- ------------ ----------

Revenue 5,650 5,413 11,340

Cost of Sales (3,360) (2,959) (6,525)

Underlying Gross Margin 2,290 2,454 4,815

Underlying Gross Margin % 40.5% 45.3% 42.6%

Net Cost of Manufacturing (426) (581) (893)

---------------------------------------- ------------------- ------------ ----------

Contribution Margin 1,864 1,873 3,922

---------------------------------------- ------------------- ------------ ----------

Contribution Margin % 33.0% 34.6% 34.6%

---------------------------------------- ------------------- ------------ ----------

Underlying gross margin (excluding net costs of manufacturing)

is an adjusted KPI measure. Nets costs of Manufacturing are

overheads that have not been effectively absorbed due to reduced

productivity.

Adjusted KPIs are used by the Board to understand underlying

performance and exclude items which distort comparability. The

method of adjustments are consistently applied but are not defined

in International Financial Reporting

Standards (IFRS) and, therefore, are considered to be non-GAAP

(Generally Accepted Accounting Principles) measures. Accordingly,

the relevant IFRS measures are also presented where

appropriate.

3. Disaggregation of revenue

The Group has disaggregated revenues in SI Brand Distribution OEM Total

the following table:

Six months ended 30 June 2023 (unaudited) GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------------------- -------------- -------------- ------------- --------------

United Kingdom 920 2,105 614 3,639

Europe 694 - - 694

US 479 - 69 548

APAC 541 - - 541

Rest of World 228 - - 228

--------------------------------------------- -------------- -------------- ------------- --------------

2,862 2,105 683 5,650

--------------------------------------------- -------------- -------------- ------------- --------------

SI Brand Distribution OEM Total

Six months ended 30 June 2022 (unaudited) GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------------------- --------- -------------- ------------- --------------

United Kingdom 679 2,006 676 3,361

Europe 587 - - 587

US 596 - 240 836

APAC 484 - - 484

Rest of World 145 - - 145

--------------------------------------------- --------- -------------- ------------- --------------

2,491 2,006 916 5,413

--------------------------------------------- --------- -------------- ------------- --------------

SI Brand Distribution OEM Total

Year ended 31 December 2022 (audited) GBP'000 GBP'000 GBP'000 GBP'000

----------------------------------------- --------- ------------ --------- ---------------

United Kingdom 1,683 4,044 1,315 7,042

Europe 1,377 - - 1,377

US 1,240 - 424 1,664

APAC 926 - - 926

Rest of World 331 - - 331

----------------------------------------- --------- ------------ --------- ---------------

5,557 4,044 1,739 11,340

----------------------------------------- --------- ------------ --------- ---------------

Revenues are allocated geographically on the basis of where

revenues were received from and not from the ultimate final

destination of use.

4. Finance Costs

Finance costs: Six month Six month 12 months

ended ended 30 ended 31

30 June Dec

June 2022 2022

2023

GBP'000 GBP'000 GBP'000

------------------------------------------ ------------------ ---------------- ---------

On bank borrowings 40 24 43

On right-of-use assets lease liabilities 28 27 55

------------------------------------------ ------------------ ---------------- ---------

68 51 98

------------------------------------------ ------------------ ---------------- ---------

5. Tax

Current taxation

During 2023 the Group submitted an enhanced Research and

development claim in respect of 2022 amounting to GBP0.22m, which

was paid in August of the current year.

Deferred taxation

Overall, the Group continues to hold substantial tax losses on

which it holds a cautious view and consequently the Group has

chosen not to recognise those losses fully.

6. Earnings per share

Unaudited Unaudited Audited

six months six months year

ended ended ended

30 June 30 June 31 December

2023 2022 2022

-------------------- ---------- ---------- -----------

Earnings per share

Basic (0.040p) (0.002p) (0.028p)

Diluted (0.040p) (0.002p) (0.028p)

Adjusted (0.037p) 0.004p (0.036p)

-------------------- ---------- ---------- -----------

Basic earnings per share is calculated by dividing the earnings

attributable to ordinary shareholders by the weighted average

number of shares in issue. Diluted earnings per share is calculated

by dividing the earnings attributable to ordinary shareholders by

the diluted weighted average number of shares in issue. Adjusted

Earnings per share is calculated by dividing the adjusted earnings

attributable to ordinary shareholders (profit before non-recurring

costs, amortisation, impairment costs and share based payments) by

the weighted average number of shares in issue.

The anti-dilutive effect of unexercised share options has not

been taken into account and therefore the diluted

earnings per share is equal to the basic earnings per share.

The Group has one category of dilutive potential ordinary shares

being share options issued to Directors and

employees. The impact of dilutive potential ordinary shares on

the calculation of weighted average number of shares is set out

below.

Unaudited Unaudited Audited

six months six months year

ended ended ended

30 June 30 June 31 December

2023 2022 2022

'000s '000s '000s

-------------------------------------- ---------- ---------- -----------

Basic earnings per share 932,816 932,816 932,816

Dilutive effect of unexercised share

options 1,240 5,049 3,129

-------------------------------------- ---------- ---------- -----------

Diluted earnings per share 934,056 937,865 935,945

-------------------------------------- ---------- ---------- -----------

7. Leases

Impact on the statement of financial position

30 June 2023 30 June 2022 31 December

2022

Assets Liabilities Assets Liabilities Assets Liabilities

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Right of use assets and lease

liabilities 903 924 947 999 918 954

Of which are:

Current lease liabilities 254 209 232

Non-Current lease liabilities 670 790 722

Impact on Equity (21) (52) (36)

------------------------------- ------- ----------- ------- ----------- ------- -----------

Total impact on statement

of financial position 903 903 947 947 918 918

------------------------------- ------- ----------- ------- ----------- ------- -----------

During 2022, the Group financed a new CNC Lathe through HP

finance totalling GBP158,000, the cost of the right-of-use asset

has been reflected into the period ending 30 June 2022.

8. Net borrowings

At amortised cost Six month ended Six month months ended

30 June 2023 ended 31

30 June Dec 2022

2022

GBP'000 GBP'000 GBP'000

Cash & cash equivalents 1,412 3,040 2,199

Current bank borrowings (352) (352) (382)

Non-current bank borrowings (679) (1,031) (825)

Adjusted Net Cash 381 1,657 992

Current lease liabilities (254) (209) (232)

Non-current lease liabilities (670) (790) (722)

-------------------------------- --------------- --------- ----------------------------

Net Cash (543) 658 38

-------------------------------- --------------- --------- ----------------------------

In March 2022, the Group refinanced the existing debt with

Yorkshire bank consisting of the following:

-- Extension to the CBILS of GBP1.5m repayable in May 2026,

Interest rate of 2.94% repayable monthly over the Bank of England

(BoE) base rate. Monthly instalments are GBP0.029m.

-- Covenants attached to the CBILS comprise of EBITDA to debt

servicing costs minimum 1.25x on a 12-month rolling basis.

-- The covenant test for the period ending 30 June 2023 was

waived by the lender, with approval obtained to waive the next two

debt service covenant tests dated 30 September 2023 and 31 December

2023.

-- Additional headroom is provided by an Invoice Discounting

facility of GBP1.0m, at 2.5% margin on receivables drawn with a

maximum administration fee of GBP0.018m if not utilised. As at the

date of this announcement, this facility remains undrawn.

9. Financial Instruments

The financial assets of the Group are categorised as

follows:

At amortised cost Six months Six months 12 months

ended ended ended

30 June 30 June 31 Dec

2023 2022 2022

GBP'000 GBP'000 GBP'000

--------------------------- ------------------- ----------------- ---------

Trade receivables 1,566 1,681 1,762

Cash and cash equivalents 1,412 3,040 2,199

--------------------------- ------------------- ----------------- ---------

2,978 4,721 3,961

--------------------------- ------------------- ----------------- ---------

The financial liabilities of the Group are categorised as

follows:

At amortised cost Six months Six months 12 months

ended ended ended

30 June 30 June 31 Dec

2023 2022 2022

GBP'000 GBP'000 GBP'000

--------------------------------- ----------- ----------- -----------

Trade payables 1,756 1,427 1,420

Other payables 268 280 294

Current lease liabilities 254 209 232

Non-current lease liabilities * 670 790 722

Current bank borrowings 352 352 382

Non-current bank borrowings * 679 1,031 825

--------------------------------- ----------- ----------- -----------

3,979 4,089 3,875

--------------------------------- ----------- ----------- -----------

*Amortised costs are considered to the equivalent amount of fair

value

Trade and other payables Six months Six months 12 months

ended ended ended

30 June 30 June 31 Dec

2023 2022 2022

GBP'000 GBP'000 GBP'000

------------------------------- ------------------- ----------------- ---------

Trade payables 1,756 1,427 1,420

Other tax and social security 164 238 172

Corporation tax - - -

Other payables 268 280 294

------------------------------- ------------------- ----------------- ---------

2,188 1,945 1,886

------------------------------- ------------------- ----------------- ---------

10. Interim Report

This interim report is available at

www.sigroupplc.com/annual-interim-reports.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BIGDCRUBDGXI

(END) Dow Jones Newswires

September 19, 2023 02:00 ET (06:00 GMT)

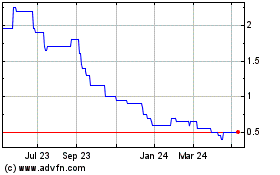

Surgical Innovations (LSE:SUN)

Historical Stock Chart

From Dec 2024 to Jan 2025

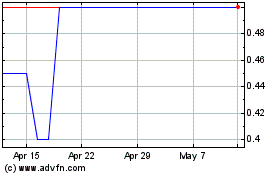

Surgical Innovations (LSE:SUN)

Historical Stock Chart

From Jan 2024 to Jan 2025