TIDMHYG TIDMSVCT

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS STIPULATED UNDER THE UK

VERSION OF THE MARKET ABUSE REGULATION NO 596/2014 WHICH IS PART OF

ENGLISH LAW BY VIRTUE OF THE EUROPEAN (WITHDRAWAL) ACT 2018, AS AMED.

ON PUBLICATION OF THIS ANNOUNCEMENT VIA A REGULATORY INFORMATION SERVICE,

THIS INFORMATION IS CONSIDERED TO BE IN THE PUBLIC DOMAIN.

23 February 2021

Seneca Growth Capital VCT plc

Annual Report and Financial Statements

for the year ended 31 December 2020

NAV Update

and

Notice of Annual General Meeting

The Directors are pleased to announce the audited results of the Company

for the year ended 31 December 2020. A copy of the Annual Report and

Financial Statements will be made available to shareholders shortly, and

extracts are now set out below.

The Company's AGM will be a closed meeting as a result of the Covid-19

("C-19") pandemic and will be held at 14:00 on Monday, 29 March 2021 at

9 The Parks, Haydock, WA12 0JQ. A copy of the Notice of AGM and Annual

Report and Accounts will be available on the Company's website:

https://www.globenewswire.com/Tracker?data=u-Ewvi184t6K0JFXrr-S0qFSC58dXS5-8hJ7iY6c6HNmsVxQnnTTZ1A-K6uDO5pI8zZUAJWuLcu9a54IJwBpoEVcS-m73t_NihkTL5zFaew=

www.senecavct.co.uk

Financial Headlines

Ordinary Shares

95.5p Ordinary share NAV plus cumulative dividends paid at 31 December

2020 ("Total Return")

30.2p Ordinary share NAV at 31 December 2020

13.0p Interim capital dividends paid per Ordinary share during year

B Shares

GBP2.4m Amount raised during the year from the issue of B shares

GBP1.36m Amount invested during the year into six new investee companies

by B share pool

97.8p B share NAV plus cumulative dividends paid at 31 December 2020

("Total Return")

91.8p B share NAV at 31 December 2020

3.0p Interim dividends paid per B share during year

Financial SummarySHYSHYSHY

Year to Year to Year to Year to

31 December 31 December 31 December 31 December

2020 2020 2019 2019

Ordinary B share Ordinary B share

share pool pool share pool pool

Net assets (GBP'000s) 2,453 8,317 2,463 5,921

Return on ordinary activities

after tax (GBP'000s) 1,045 252 (547) (168)

Earnings per share (p) 12.8 3.5 (6.7) (3.2)

Net asset value per share (p) 30.2 91.8 30.4 93.1

Dividends paid since inception

(p) 65.25 6.00 52.25 3.0

Total return (NAV plus cumulative

dividends paid) (p) 95.45 97.8 82.65 96.1

Financial Calendar

The Company's financial calendar is as follows:

29 March 2021 Annual General Meeting ("AGM") will be a

closed meeting as a result of the Covid-19 ("C-19") pandemic and will be

held at 14:00 at 9 The Parks, Haydock, WA12 0JQ

July 2021 Half-yearly results to 30 June 2021

published

February 2022 Annual results for the year to 31 December

2021 announced and Annual Report and Financial Statements published

For further information, please contact:

John Hustler, Seneca Growth Capital VCT Plc at

https://www.globenewswire.com/Tracker?data=VUTZAyI2tOsXQnI3wTnXggIiOIr6VRqO7HFMCwy3vlnB0qO5v1YqRqw07FBZwrZDS1jtIJamSGMjlURnvzwDK9ogyLqBCuQHvIG0au8r4JwtuTsmapqUXkJaJHwGjBxy-JZ7S4AEiu49Es0HFSJjpXwv5AJCMVbDdRQfIjKCBppKIbFPV1yKxuwxIf7GMGwlH40x_kPwAkiyWLl2bLnaNyj_1OB2nBMSV1nGFI_sRVlLPY54uqgmmkFMarStKhO3EqV_T4f5UzwTA7ah0K3wzLQ7WelZwOPsBQE8oqHErHc=

john.hustler@btconnect.com

Richard Manley, Seneca Growth Capital VCT Plc at

https://www.globenewswire.com/Tracker?data=NZU5LUhFeIfLtyWtEnEBBQlBx2wYpHal4PUH3dO5fxtywTrzqkofEDb_IKTlm650eaQPbvXFQcNQyrkh8iOIkShgtP3GP90fnLQrDeo5jp3GM8ZV9fGUzNkiUX-ijWHO9-srrvC0cJhaELLsW74vPK5aISV8a_JMz62bcam4ko0xV7N_juF4ofdrQqHg4M87FlWupe57Np3Swdmyz18sZVzE6__qaao4hgCpMpqgaF_KMS4HnBpGQbg8BGlhZL3r52xU5ru-8qYt3hMhQfZpy0D5-2zZw71ZPl2YCBFrDKQ2oacZW3ffG9qH71jZfZXIzUF7xhfUVeTGQJeee4lnig==

Richard.Manley@senecapartners.co.uk

Please note: page references and defined terms included in the extracts

below refer to the page numbers and definitions in the Annual Report and

Financial Statements.

Chairman's Statement

I am pleased to present the 2020 Annual Report on behalf of the Board to

shareholders.

Overview

As shareholders will recall, Seneca have assumed the investment and

accounting responsibilities of the Company with effect from August 2018,

following which GBP8.7 million has been raised for the B share pool to

31 December 2020. Since this represents the active investment portfolio,

I am reporting on the B share portfolio first and then will give the

results of the legacy Ordinary share portfolio.

I am pleased to say that, despite the unprecedented circumstances which

we are all facing due to the C-19 global pandemic, I am able to report

that both the B share and Ordinary share investment portfolios have

stood up well to the challenges that they have faced. The Total Return

(NAV per share plus cumulative dividends per share) for each share class

increased during the year with the B share increasing by 1.8% to 97.8p

and the Ordinary share increasing by 15.5% to 95.5p.

I am also pleased to be able to report that Seneca continued the

development of the B share pool during the year both in terms of

fundraising and investment activity. In October 2020, the Company

launched its third offer for B shares and allotted an additional GBP1.5

million of shares in December 2020 taking to GBP8.7 million the total

raised by the B share pool from launch in May 2018 to 31 December 2020.

I would like to welcome all new shareholders and thank both existing and

new shareholders for their support. The share offer will remain open

until 28 May 2021 unless it reaches the target of GBP10 million with an

over-allotment facility of GBP10 million before then.

The Company made six new B share pool investments in the year in

addition to achieving one full exit and one partial exit and as a result

the Company's B share pool closed the year with ten investments, an

increase of five on the prior year.

There were two full, and one partial disposal from the Ordinary share

pool. The Ordinary share pool now has just seven investments remaining

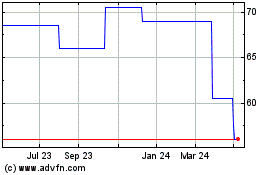

with AIM quoted Scancell Holdings Plc ("Scancell") (which encouragingly

secured GBP48 million of new investment in the year) accounting for 66%

of the Ordinary share pool's NAV at the year end. Recent press coverage

regarding Scancell's involvement in a potential C-19 vaccine has led to

a significant rise in its share price, which stood at 24.5p at 19

February 2021 compared to our year end value of 13.5p. Further details

and an updated unaudited NAV per Ordinary share and B share are included

below.

With 54% of the B share pool's NAV as at 31 December 2020 represented by

cash and more than 20% of the Ordinary share pool's NAV, the Company has

ended the year well placed to face the challenges and opportunities

presented by the ongoing C-19 pandemic and to deliver on the key

objectives of continuing to build an attractive portfolio of growth

capital investments in the Company's B share pool whilst also continuing

to realise investments in the Ordinary share pool when the opportunity

arises.

I have set out below the progress made by each of the Company's share

classes during the year.

B Share Pool

B Shares - Results

The key items to impact the NAV of the B share pool during the year were

as follows:

-- Two dividends paid during the year totalling 3.0p per B share.

-- The full realisation of one B share pool AIM quoted investment generating

a 2.1x return.

-- The partial exit of one B share pool AIM quoted investment generating a

1.6x return.

-- An increase in the valuation of two of the B share pool's remaining three

AIM quoted holdings.

-- A reduction in fair value of one of the B share pool's seven unquoted

company investments as a result of the impact of C-19.

-- The Company's running costs.

The net result of the above was an overall increase in the Total Return

per B share to 97.8p as at 31 December 2020 (2019: 96.1p), consisting of

a modest reduction in the NAV per B share to 91.8p as at 31 December

2020 (2019: 93.1p), a positive capital return of 5.7p per B share (2019:

negative 0.7p) and a negative revenue return of 2.2p per B share (2019:

negative 2.5p).

Whilst the negative revenue return of 2.2p per B share is principally a

result of the impact of the Company's running costs on the B share pool,

shareholders will recall that the Company's running expenses are capped

at 3% of the B share NAV until July 2021 (thereafter the total running

costs will continue to be capped at 3% with general expenses being

allocated to the Ordinary share pool and the B share pool pro-rata to

their respective NAVs). As a result, Seneca reduced their annual

management fee for 2020 from GBP127k to GBP41k to ensure the Company's

annual running expenses stayed within this 3% limit.

The positive capital return of 5.7p per B share noted above was

principally due to increases in the share prices of the B share pool's

AIM quoted investments during the year and some harvesting of profit via

partial sales of these AIM quoted investments offset by a reduction in

the carrying value of one of the B share pool's unquoted company

investments. Full details are disclosed in the Investment Manager's

Report on pages 14 to 27.

B Shares - Investment Portfolio Review

As at 31 December 2020, the B share portfolio comprised ten companies,

three of which are quoted on AIM, at a total net investment cost of

GBP3,794k. As at 31 December 2020 this portfolio was valued at

GBP3,982k.

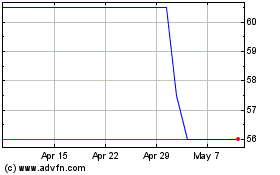

In January 2021, the Company sold 1,750,000 shares in

SkinBioTherapeutics Plc ("SkinBio") which represented 37% of the

original holding of 4,677,107 shares, reducing the remaining holding to

2,752,107 shares. These were sold at a net average price of 35.5p per

share providing a return in the region of 2.2x on original cost.

B Shares -- Update and Outlook

Taking into account further proceeds realised since 31 December 2020 as

detailed above and in note 17 on page 97 and an overall increase in AIM

quoted investment bid prices, the Company is pleased to announce an

updated unaudited NAV per B share of 99.4p per B share at 19 February

2021, an increase of 7.6p per B share from the audited NAV of 91.8p per

B share as at 31 December 2020 and an overall increase in the Total

Return per B share to 105.4p as at 19 February 2021.

Shareholders will be pleased to know the Board declared an interim B

share dividend of 1.5p per B share on 18 February 2021 to be paid on 14

May 2021 to shareholders on the B share register on 30 April 2021, with

an ex-dividend date of 29 April 2021.

Seneca continue to work closely with the investee companies in the B

share portfolio with the aim of ensuring that the potential impact of

C-19 is mitigated and that each investee company has sufficient funds to

support their working capital requirements until normal trading and

economic conditions return. Seneca remain confident that the portfolio

retains its potential to provide attractive returns for B shareholders

over the medium term.

The Board is pleased with the progress that Seneca have made since their

appointment as Investment Manager in 2018, in terms of funds raised, new

investments made and relationships with brokers offering new quoted

securities and now, exits achieved.

Seneca expect to increase the funds raised under the current B share

Offer and add new growth capital investments to the B share portfolio

during the course of 2021 from, inter alia, the investments they

currently have in the later stages of due diligence.

Ordinary Share Pool

Ordinary Shares - Results

Whilst the NAV per Ordinary share decreased by 0.2p from 30.4p to 30.2p

during the year, this was after the payment of dividends per Ordinary

share totalling 13.0p. A better understanding of the underlying

performance of the Company's Ordinary share portfolio during the year is

therefore provided by considering the NAV movement per Ordinary share

during the year before dividends which shows an increase of some 12.8p

(a 42% increase compared to 31 December 2019).

This increase was principally driven by the increase in value of the

Ordinary share portfolio's two AIM quoted investments during the year.

The quoted bid price of Scancell shares increased from 7.0p to 13.5p

from the start of the financial year to the financial year end. During

this period, it was decided to harvest a modest portion of our

shareholding and we now hold 12 million shares. Omega benefited from its

involvement in a partnership to develop a C-19 antibody test and the

share price rose significantly; the Board, therefore, decided it was

appropriate to take advantage of this and we sold our entire holding for

GBP987k, generating a profit over original cost of GBP659k and over our

holding value at 31 December 2019 of GBP666k.

As a result of the realisations noted above, your Board were very

pleased to be able to pay dividends totalling 13p per Ordinary share

during the year with no material adverse impact on the Ordinary pool's

NAV. The Total Return in relation to the Ordinary shares is now 95.5p

comprising cumulative distributions of 65.25p per Ordinary share and a

residual NAV per Ordinary share of 30.2p as at 31 December 2020.

As previously reported, the Board remains focused on identifying exit

opportunities for the remainder of the Ordinary share pool investment

portfolio, and it was particularly pleasing to have been able to

distribute 13p per Ordinary share to shareholders this year with no

material adverse impact on the Ordinary share pool's NAV. Realisations

in the last three years have enabled the payment of a total of 41p per

Ordinary share in dividends to Ordinary shareholders, representing 64.3%

of the NAV per Ordinary share as at 31 December 2017 and we still retain

net assets of 30.2p per Ordinary share as at 31 December 2020.

Notwithstanding this success, we remain confident that, overall, there

remains the opportunity to realise further value for Ordinary

shareholders in due course (particularly in relation to our Scancell

holding): indeed as noted below, earlier this month we realised a

further portion of our Scancell holding. For the time being, we do not

currently consider it appropriate to liquidate any further Scancell

shares and do not see any other immediate opportunities for realisations,

but we continue to monitor the situation closely.

Ordinary Shares - Investment Portfolio

The remaining Ordinary share portfolio now comprises one AIM quoted

holding, Scancell, as referred to above, which has a carrying value of

GBP1,620k as at 31 December 2020, and six unquoted holdings -- the

carrying value of three of which have been reduced to zero with the

combined carrying value of the other three being GBP521k as at 31

December 2020.

Shareholders will note therefore that Scancell represented more than 75%

of the value of the Ordinary share portfolio as at 31 December 2020 and

as a result the NAV per Ordinary share now fluctuates largely in line

with the movement in the Scancell share price. Whilst the Scancell share

price showed volatility during 2020, it is not our policy to update the

market following each of these fluctuations unless there are considered

to be abnormal events (e.g. sale of a significant holding -- see below).

Your Board therefore recommends that shareholders or prospective

shareholders keep the Scancell share price under review and consider its

impact on the Ordinary share NAV per share before taking any action in

relation to an existing or prospective holding in the Company's Ordinary

shares.

Further details in relation to the Ordinary share pool's investment

portfolio are included in the Investment Manager's Report on pages 28 to

35.

Ordinary Shares -- Update and Outlook

As referred to above, and following recent press coverage, the share

price of Scancell has risen significantly from 13.5p at 31 December 2020

and was 24.5p at 19 February 2021. We are pleased that the market is

recognising the continuing developments at Scancell and have taken the

opportunity to realise a further modest part of our holding by selling 1

million shares at 21.7p per Scancell share. Our current holding is 11

million shares and we continue to believe that there is further upside

in this holding.

This increase in the share price has given rise to a significant rise in

the NAV per Ordinary share. Based on the NAV at 31 December 2020,

adjusted solely for the uplift in valuation of our Scancell shares , the

Ordinary share unaudited NAV per share was 44.0p at 19 February 2021.

The Ordinary share pool retained a cash balance of GBP527k as at 31

December 2020 in order to make follow-on investments into existing

Ordinary share portfolio companies where the Board believes this will

protect the Ordinary share pool's existing investment and/or improve the

overall prospects of a timely exit from the investee company. This has

been increased to GBP744k following the recent sale of Scancell shares.

Despite several of the Ordinary share pool portfolio companies seeking

further funds during the year, we did not consider the terms attractive

nor likely to improve the overall prospects for a timely realisation

from the investee company and therefore no further Ordinary share pool

investments were made.

Ordinary shareholders will recall that, following the appointment of

Seneca as Investment Manager in August 2018, the Ordinary share pool

incurs no running costs until July 2021.

Fund Raising

During the year the Company has allotted 2,701,500 B shares raising

gross proceeds of GBP2,403k in the process. The current B share Offer

will remain open until May 2021.

Annual General Meeting

The Company's AGM will be held as a closed meeting at 14.00 on Monday,

29 March 2021 at the Company's registered address 9 The Parks, Haydock,

WA12 0JQ in accordance with the provisions of the Corporate Insolvency

and Governance Act 2020. In light of the unprecedented restrictions on

movement and gatherings due to the C-19 pandemic, shareholders will not

be permitted to attend this year's AGM and the meeting will take place

with either two Directors who hold shares in the Company or one Director

and an investment manager from Seneca Partners, who is also a

shareholder, present only, to constitute the minimum quorum for the AGM

to take place under the Company's articles of association and company

law requirements. Shareholders should note that only the formal business

set out in the Notice of AGM will be considered at the AGM.

Although shareholders will not be permitted to attend the AGM this year

there will be a shareholder update presentation by the Investment

Manager and a question and answer ("Q&A") session at 10:00 on 8 March

2021, further details of which are included below and on

https://senecavct.co.uk/march-2021-shareholder-presentation/.

Shareholders wishing to vote on any of the matters of business are urged

to do so through completion of a proxy form appointing the Chairman of

the AGM, which can be submitted to the Company's Registrar. Proxy forms

should be completed and returned in accordance with the instructions

thereon and the latest time for the receipt of proxy forms is 14.00 on

Saturday, 27 March 2021. Proxy votes can be also be submitted by CREST.

All resolutions will be decided by a poll and therefore it is essential

that shareholders wishing to vote submit their proxy forms by 14.00 on

Saturday, 27 March 2021.

Shareholders will have the opportunity to ask questions prior to

submitting their proxy votes at the shareholder update presentation on 8

March 2021 as detailed below.

The Board has reviewed my performance and has asked me to continue as

Chairman. A resolution for my re-election is included in the AGM Notice.

Resolutions for the re-election of Alex Clarkson, Richard Manley and

Richard Roth are also included in the AGM Notice.

The Notice of the AGM includes resolutions empowering the Directors to

issue further B shares following the date of the AGM, which will

primarily be used for the issue of B shares under a further Offer which

we intend to launch for the 2021/2022 tax year. This requires

authorisation for the Directors to be able to allot up to a further

35,000,000 B shares. Including these resolutions in the AGM business

will avoid the Company having to produce and send out a separate

circular to convene a separate general meeting.

The Notice of the AGM also includes a resolution to adopt amended

Articles of Association which are substantially in the same form as the

Company's current Articles of Association but will allow, inter alia,

the holding of partially virtual AGMs and to increase the total

remuneration of the Directors to allow for the recruitment of a new

non-executive Director. Further details of the differences between the

two sets of Articles are set out in the Directors' Report on pages 48 to

49.

A summary of the resolutions to be proposed by the Company at the AGM is

included on pages 48 to 49.

Shareholder Update Presentation

Due to government restrictions impacting shareholders' ability to attend

the 2021 AGM as a result of the C-19 pandemic, a virtual shareholder

update presentation will take place at 10:00 on Monday, 8 March 2021.

Shareholders can register to attend the presentation by visiting:

--https://zoom.us/webinar/register/WN_UyGALLGCQCusM0gYuvud0A.

Further details about the shareholder event can be found on

https://senecavct.co.uk/march-2021-shareholder-presentation/.

A Q&A session will take place where shareholders will have the

opportunity to submit questions directly which we will seek to answer

during the presentation. Questions can be submitted by emailing them to

enquiries@senecavct.co.uk

https://www.globenewswire.com/Tracker?data=gguV8Z2GkYFeSOeY2jAjOS-vx8JD9886O4U7tyg9hcAEqI_WVOudWOtySOdPOwWI_HI1PETCbQr_NsLmbouvY6YeAe_zaJDGomOF8FzKEQ5_8jV4-qXHPZDz2y_koLym

. Both the questions and answers will be published on the Company's

website following the presentation.

VCT Qualifying Status

Philip Hare & Associates LLP provides the Board with advice on the

ongoing compliance with HMRC rules and regulations concerning VCTs; they

have confirmed that the Company remains within all the appropriate VCT

qualifying regulations as at 31 December 2020. In respect of the 80%

Qualifying Holdings test, as at the end of December 2020 the percentage

is 100% by virtue of a disregard of disposal proceeds, of which there

have been GBP1.1m of relevant share sales (exit proceeds that occurred

in the prevailing 12-month period are deducted from the total

investments balance). Note, these exit proceeds are only deducted to the

point that the test reaches 100% but without these the Company was still

well above the 80% qualifying requirement. As at 31 December 2020 39% of

funds raised in the year to 31 December 2019 had been invested in

qualifying investments for the 30% minimum requirement.

Fund Administration

Our administration is conducted by Seneca at the Company's registered

address. Neville Registrars Limited ("Neville") continue to maintain the

shareholder register. All information in respect of both share classes

including Annual Reports and notices of meetings can be found on our

website www.senecavct.co.uk. We would remind shareholders who have not

opted for electronic communications that this is more efficient and

ecologically friendly than receiving paper copies by post and therefore

encourage you to contact Neville, whose details are on page 101, to

advise them of your wish to switch to electronic communication.

Auditor

UHY Hacker Young LLP have audited the Company's annual results for the

year ending 31 December 2020, and shareholders will be asked to

reappoint them at the AGM for the audit of the accounts for the year

ending 31 December 2021.

Future Prospects

We are pleased that Seneca have continued to develop the portfolio of B

share pool investee companies during the year. The B share portfolio

includes a mix of both unquoted and AIM quoted investments and whilst

progress of these investments to date has been generally positive, the

Board and Seneca remain acutely aware of the need to continue to work at

close quarters with all B share portfolio companies as they navigate the

challenges ahead resulting from the C-19 pandemic.

We also note that Seneca expect to see an increase in the number of

businesses seeking investment to support their growth plans over the

next 12 months as a result of the C-19 pandemic. With over GBP4.5

million of cash on the B share pool balance sheet at 31 December 2020.

Seneca believe they are very well placed to continue to support the

existing B share investment portfolio as well as adding attractive new

growth capital investments to the B share portfolio from the strong

pipeline of opportunities presented to them. We therefore look forward

to the continued development of the B share portfolio in due course.

Your Board continues to view the future of our Company with confidence.

John Hustler

Chairman

22 February 2021

Investment Manager's Report

We are pleased to set out in this section further details in relation to

the development of both the B and Ordinary share pools and their

respective investee companies during 2020.

The B Share Pool

Fundraising

Our second B share offer was concluded in July 2020, bringing total

funds raised to GBP7.2 million and our fund-raising efforts have since

continued under our third B share Offer that was launched in October

2020, with GBP1.5 million being raised under this third Offer as at 31

December 2020. We were encouraged by the funds raised in the two months

immediately following launch and remain focused on increasing the size

of the B share pool, which will in turn allow us to increase the number

and diversity of new investments that we make.

Performance and Dividends

Despite the unprecedented economic climate and general turmoil of

financial markets occasioned by the C-19 pandemic, we are pleased with

the development of the B share portfolio, with six additional

investments being made in the year. We are also pleased to report an

increase in the NAV Total Return per B share, from 96.1p at 31 December

2019 to 97.8p as at 31 December 2020.

This increase in NAV Total Return per B share was the result of a slight

reduction in the B share NAV as at 31 December 2020 (which fell to 91.8p

per B share (2019: 93.1p)) which was more than explained by the payment

of two B share dividends totalling 3.0p during the year.

These two B share dividends paid during the year were in line with the

Company's ambition to continue to pay dividends on the B shares and it

should be noted that the Company has sufficient distributable reserves

to enable the continued declaration of B share dividends over the medium

term subject to Board approval, the B share pool investment pipeline and

liquidity levels.

AIM Quoted Investments

With the AIM market demonstrating a heightened level of volatility

during the year as a result of the impact of C-19, we took the

opportunity to realise just over half of the B share pool's shareholding

in OptiBiotix plc ("OptiBiotix") (an investment made during the year),

selling 400,000 shares and realising a gain of GBP92k on the disposal

(1.6x cash return in just 2 months following the original investment).

We also sold our full holding in Genedrive (another investment made in

the year) which is the B share pool's first full exit and generated a

profit of GBP136k versus original cost (2.1x cash return).

We were also encouraged that the during the year we saw an increase in

the bid price of the two largest B share pool AIM quoted investments:

the SkinBio share price increased to 22.0p as at 31 December 2020 (a 57%

increase from 14p as at 31 December 2019) and the OptiBiotix share price

increased to 57.0p as at 31 December 2020 (a 42.5% increase from the

cost price of 40p per share).

Co-investing With Seneca EIS Funds

More generally we continue to develop Seneca's position in the market as

an active growth capital investor and as at 31 December 2020, we have

raised and deployed c.GBP100 million of EIS and VCT investment funds

into over 50 SME companies, through over 100 funding rounds, since we

undertook our first EIS investment in 2012. This includes GBP8.7 million

raised to date by the B share pool.

The ten investments in the B share portfolio had a value of GBP3,982k as

at 31 December 2020 and are co-investments with EIS funds also managed

by Seneca. We believe that the opportunity for the Company's B share

pool to co-invest with EIS funds that are also managed by Seneca

provides the B share pool with a number of advantages including being

able to participate in a higher number of investments, of a larger scale,

into more established businesses than would be possible for the B share

pool on a standalone basis.

Further, as a result of our position in the UK market as an active

growth capital investor we maintain a strong pipeline of investment

opportunities, particularly in the North of England, with a focus on

well managed businesses with strong leadership teams that can

demonstrate established and proven concepts in addition to growth

potential. We aim to invest in both unquoted and AIM quoted companies

and are pleased to have completed three additional AIM quoted

investments in the year.

Investee Company Updates

We are very happy with the development of the B share investment

portfolio. As noted above, we are delighted to have been able to include

some AIM quoted investments in these early investments and are also very

happy that by 31 December 2020 we had already been able to exit some of

these at a profit so early in the development of those businesses (1

full exit and 2 partial exits). These early profits have supported the

performance of the B share pool NAV at the same time as we continue to

develop the unquoted company investment portfolio.

We are excited about the potential that lies with the B share investment

portfolio and have included updates in relation to all of the B share

pool investee companies later in this Investment Manager's Report but

wanted to highlight in particular the progress being made by B share

pool investee companies SilkFred Limited ("SilkFred") and SkinBio below

and also comment on the reduction in fair value introduced against the

carrying value of Qudini.

SilkFred

SilkFred is an online marketplace which specialises in independent

ladies' fashion brands. The B share pool invested GBP500k in SilkFred in

December 2018 and the business made strong progress throughout the first

year of our investment building a strong reputation and brand in the

"event driven" fashion space.

As you would expect however, this left the business exposed to the

impact of the C-19 pandemic in 2020 which brought about a fall in sales

levels as a result of the reduction in the number of celebrations and

events which previously drove the company's growth.

Notwithstanding this, SilkFred's recovery from the UK's first lockdown

was swift and Gross Marketplace Value (total sales value sold through

the SilkFred platform) during the summer months of 2020 actually

exceeded that of 2019. The business traded well for the rest of the year,

remaining profitable throughout, buoyed by the loyalty shown by the

customer base. The management team continue to view their market

position positively and are looking to the future with confidence,

particularly in anticipation of the return of their core markets as the

UK emerges from lockdown. We too, are excited about SilkFred's future.

SkinBio

SkinBio is an AIM quoted life science company focused on skin health and

the B share pool invested GBP750k in February 2019 at 16p per share. The

business made excellent progress during 2020 including raising cGBP4.45m

of funds from new and existing investors, successfully accelerating the

project timeline for its food supplement programme and gaining

commercial interest for its MediBiotix(TM) and CleanBiotix(TM)

programmes. The SkinBio share price closed on 31 December 2020 at 22p

per share.

Having initially invested in SkinBio in February 2019, we sold 175,000

shares in early June 2019 at a profit of c1.5x original cost reducing

the remaining holding to 4,502,107 shares. We did not sell any shares in

2020; however following the 31 December 2020 year end, the positive

progress being made by SkinBio translated into further increases in the

share price and we are pleased to report that we have taken the

opportunity to take some profit from this investment. We sold 1,750,000

shares in January 2021 (37% of the B share pool's original holding of

4,677,107 shares) reducing the remaining holding to 2,752,107 shares.

These were sold at a net average price of 35.5p per share providing a

return in the region of 2.2x on original cost.

The business is well funded, is targeting a valuable market with unmet

cosmetic and clinical needs and we remain confident of SkinBio's

long-term prospects of success.

Qudini

Qudini is a UK based market leading provider of queue management

software for enterprise brands. It generates the vast majority of its

revenue from bricks and mortar retailers. Given the level of uncertainty

caused in this core market by C-19, we took the prudent decision to

reduce the carrying value of the B share pool's investment in Qudini by

40% as at 30 June 2020. Whilst there has been some improvement in the

trading performance of Qudini in H2 2020, some uncertainty remains over

the future of its core bricks and mortar retail market. Therefore, we

have maintained the 40% reduction in fair value and this investment was

held at 60% of cost as at 31 December 2020.

Investments made after the Year End and outlook

Following the year end we also completed an additional unquoted company

investment into Solascure Ltd ("Solascure") for GBP500k. Solascure is an

early stage wound care specialist which was originally spun out of (and

continues to work alongside) world leading German biotech company BRAIN

engaged in the development of a new-to-market wound care product.

Solascure is also backed by strategic investor Eva Pharma and the

business will commence their first clinical trial in 2021. Solascure's

Aurase product is a gel-based product that efficiently and gently cleans

wounds, making the healing process much more straightforward.

We look forward to continuing to increase the funds raised for the B

share pool under the current Offer and with several new investment

opportunities in the later stages of due diligence, we expect to add to

the portfolio of B share investee companies in the coming months.

Investment Portfolio -- B shares

Movement

Carrying in the year

value at to

Equity Unrealised 31 December 31 December

held Investment profit/(loss) 2020 2020

Unquoted Investments % at cost GBP'000 GBP'000 GBP'000 GBP'000

Fabacus Holdings

Limited 2.0 500 63 563 -

-------------------- --------- ---------------- -------------- ------------- ------------

Silkfred Limited <1.0 500 - 500 -

Old St Labs Limited 3.8 500 - 500 -

Ten80 Ltd 7.5 400 - 400 -

Qudini Limited 2.4 500 (200) 300 (200)

Bright Network Ltd 1.7 234 - 234 -

ADC Biotechnology

Ltd <1.0 150 - 150 -

Total unquoted

investments 2,784 (137) 2,647 (200)

Movement

in the year

Carrying to

Unrealised value at 31 December

Shares Investment profit/(loss) 31 December 2020

Quoted Investments held at cost GBP'000 GBP'000 2020 GBP'000 GBP'000

SkinBioTherapeutics

Plc 4,502,107 720 270 990 360

OptiBiotix plc 350,000 140 60 200 60

Abingdon Health plc 156,250 150 (5) 145 (5)

Total quoted

investments 1,010 325 1,335 415

Total investments 3,794 188 3,982 215

No. of Investment Sale Realised

Exits for Investment Shares at cost Proceeds profit/(loss) Exit

the period Date sold GBP'000 GBP'000 GBP'000 Multiple

OptiBiotix

Health

Plc(*) April 2020 400,000 160 252 92 1.6

----------- ----------- ------- ---------- -------- ------------- --------

Genedrive

Plc May 2020 157,437 126 262 136 2.1

Total 286 514 228 1.8

(*) Partial exit

B Share Pool -- Investment Portfolio -- Top Six Unquoted Investments by

value as at 31 December 2020

1. Fabacus Holdings Limited

Fabacus is an independent software company

that has developed a complete product

lifecycle solution: Xelacore, aimed at

bringing transparency to supply chain

networks, with an initial focus on resolving

the interaction and information flow between

global licensors and their licensees.

Currently, there is a fundamentally flawed

data capture process between licensors

and licensees; and a disconnection from

the framework of retail standards that

have underpinned and continue to enable

the retail value chain. This has resulted

in an inability to correctly address known

shortcomings in respect to data management

and hinder the needed digital transformation

of licensors in the digitally evolving

retail landscape.

Fabacus's solution, Xelacore, is a modular,

Software as a Service solution with an

intuitive interface and proprietary data

aggregation and management engine that

allows all stakeholders to operate on

a single unified and collaborative platform.

It bridges the gaps in an inefficient

process within the current retail ecosystem

by creating authenticated, enriched universal

records that unlock opportunities, reduce

risk and drive performance for both licensors

and licensees.

Progress made by the company in 2020 includes:

--Continuing to make excellent progress

with a number of customers, most notably

through its promising relationship with

Amazon.

--Onboarding fee-paying licensees to their

market leading data platform and starting

to generate revenue from their relationship

with IMG (#1 global licensing agency).

--Successfully raising c.GBP1m to fund

the working capital requirements of the

company and to onboard the growing customer

pipeline.

--Collaborating with Amazon to provide

a version of the company's technology

which has the ability to identify and

remove any counterfeit products from online

marketplaces. In turn this has driven

a significant increase in interest in

and demand for Fabacus' platform and ancillary

services which has translated into increased

Initial investment commercial activity and revenue in recent

date: February 2019 months.

-----------------------------------------------

Cost: GBP500,000

-----------------------------------------------

Valuation: GBP563,000

Equity held: 2.0%

Last statutory 31 August

accounts: 2019

Turnover: Not disclosed

Loss before tax: Not disclosed

Net assets: GBP7.6

million

Valuation method: Price of last

fundraise

------------- -----------------------------------------------

2. SilkFred Limited

Initial investment December 2018 SilkFred is an online marketplace for

date: independent ladies' fashion brands. The

business was founded in 2011 with the

aim of creating an efficient marketplace

for emerging fashion designers to bring

products to market and establish their

brand in the sector. The business now

works with c.600 independent brands, selling

to over 500k customers.

SilkFred acts as a central marketing and

sales platform for these brands, charging

commission in exchange for these services,

and as a result the business itself takes

minimal inventory / working capital risk

on new brands, lines or products.

The business model revolves around a market

leading and scalable customer service

platform, and as such SilkFred are continually

investing in core infrastructure and constantly

seeking innovative methods to enhance

the customer experience.

Progress made by the company in 2020 includes:

-- Bouncing back extremely well from the impact of the

first C-19 lockdown which saw the company's primary

market of event driven fashion being adversely

impacted by the C-19 pandemic. Product mix has

changed dramatically in the short term, meaning

SilkFred is well positioned for future growth with a

more diverse customer base and impacted less by

seasonal trends.

-- Continued expansion of SilkFred's international

presence. It is clear that the international

potential of the brand is a key driver of value in

the business and it is therefore encouraging to see

international sales growing by more than 60% in 2020.

-- Despite the C-19 impact being felt to some extent

throughout 2020, SilkFred saw continued growth in its

portfolio of brands, increasing to more than 900 and

once again selling over 1m units for the year. The

company also saw continued improvement in its key

performance metrics with average order value, orders

to repeat customers and return on marketing spend all

increasing during the year.

------------------------------------------------------------

Cost: GBP500,000

------------------------------------------------------------

Valuation: GBP500,000

Equity held: <1%

Last statutory 31 December

accounts: 2019

Turnover: GBP20 million

Loss before tax: GBP3.1 million

Net assets: GBP4.4 million

Valuation method: Cost and price

of recent investment

(reviewed for

any fair value

adjustment)

--------------------- ------------------------------------------------------------

3. Old St Labs Limited

Old St Labs is a provider of cloud based,

supplier collaboration tools for large,

blue chip customers, enabling them to

manage key supplier relationships and

strategic project work. The core product,

Vizibl, seeks to make supplier collaboration

much more straight forward, with key focus

on compliance, savings / efficiency and

driving growth across the business.

Vizibl is the only SaaS workspace that

supports collaborative supplier relationships,

bringing all points of contact together

in one place, providing visibility across

the company and eliminating duplication

of efforts. Vizibl's real-time reporting

speeds up decision making, drawing on

and sharing the expertise of the community

in the process. The offering taps into

a growing trend in supplier collaboration,

having moved on from the initial focus

on compliance, to an increased emphasis

on savings / efficiency, and recent developments

highlighting the benefits in terms of

wider growth strategy for large customers.

Vizibl provides the infrastructure, governance

and reporting capabilities to optimise

present supplier performance and acts

as a springboard for those collaborative

supplier relationships. The product is

CRM / ERP agnostic, working alongside

all major software providers to ensure

the collaboration software is insightful

and informative.

Progress made by the company in 2020 includes:

-- Engaging with global leaders across a wide range of

sectors with keeping annual recurring revenue

consistent at just over GBP1m. In what was initially

a slow period for the business with large corporate

customers slowing down decision making and pausing

project spend upon the onset of C-19, Old St Labs

have worked closely with existing customers and have

returned to growth in the second half of the year

with multiple impressive customer wins.

-- Continuing to expand the Vizibl platform and

enhancing its capabilities and usability. In the

current year, in response to the global pandemic, the

team have pushed more of a sustainability angle into

the platform, adding features and enhancements to

assist both new and existing customers with ensuring

that their projects and organisations remain

resilient.

-- Building on an already impressive customer base by

onboarding Unilever and Sanofi. Not only do these

types of customers improve the financial profile of

the business, but they also further validate the

proposition and serve to demonstrate the viability of

the Vizibl platform across a wider range of sectors.

-- Securing a GBP2.5m funding from the UK

Initial investment Government-backed Future Fund, providing sufficient

date: March 2019 headroom to progress through to profitability.

------------------------------------------------------------

Cost: GBP500,000

------------------------------------------------------------

Valuation: GBP500,000

Equity held: 3.8%

Last statutory 31 March 2020

accounts:

Turnover: Not disclosed

Loss before tax: Not disclosed

Net assets: GBP260,000

Valuation method: Cost and price

of recent investment

(reviewed for

any fair value

adjustment)

--------------------- ------------------------------------------------------------

4. Ten80 Group Limited

Based in Hammersmith, Ten80 Group Limited

("Ten80") was established in early 2019.

The company is a SAP focussed on-demand

outcome-based delivery solution. SAP is

best known for producing enterprise resource

planning software which allows organisations

to manage business operations across procurement,

manufacturing, service, sales, finance,

and HR.

Ten80's aim is to connect every SAP customer

with every SAP consultant globally, delivering

outcome-based projects rather than time-driven

costs through the contractor or freelancer

marketplace.

The SAP global consultancy market is estimated

to be worth in excess of GBP300bn.

Progress since our investment:

-- Securing its first paying customers, providing

further validation that the proposition is of value

to large corporations with significant IT project

spend. Whilst the global pandemic has slowed down

large enterprise decision making, it has also

fast-tracked the shift to remote working and flexible

resource, something which plays into the hands of the

Ten80 proposition.

-- Successfully adding the required skills to the team

scaling it from 5 people at the time of investment to

19 at present. This has added valuable resource

across the business, with key focus on the

development team, sales personnel and customer

success roles.

-- Further, in January 2021 the business secured a GBP1m

funding round under the UK Government-backed Future

Fund. This will in turn provide the business with

additional cash headroom as they focus on converting

an exciting customer pipeline and expanding the

Initial investment customer base, as well as ramping up usage of the

date: March 2020 Ten80 platform within existing customers.

------------------------------------------------------------

Cost: GBP400,000

------------------------------------------------------------

Valuation: GBP400,000

Equity held: 7.5%

Last statutory 31 December

accounts: 2019

Turnover: Not disclosed

Loss before tax: Not disclosed

Net assets: GBP30,000

Valuation method: At cost (reviewed

for any fair

value adjustment)

------------------ ------------------------------------------------------------

5. Qudini Limited

Founded in 2012, Qudini is a B2B software

company that provides customer experience

SaaS solutions to organisations in retail,

hospitality, the public sector and healthcare.

Qudini provides a software solution for

appointment bookings, queue management,

event management and task management --

enabling businesses to improve shop floor

operations by managing staff activity,

breaks and performance, and by assigning

tasks at store or head office level.

Qudini is aiming to revolutionise digital

queue and appointment management. It achieves

this through deployment of its data-centric,

cloud-based (Amazon Web Services), cross-platform

service, which improves a business' ability

to manage the flow of customers awaiting

service, using algorithms to provide accurate,

live data, such as estimated wait times.

Through integration with various software

platforms and compatible with wide variety

of hardware, Qudini enables detailed analytics

focused on customer trends, and provides

a unique insight into areas such as customer

footfall, peak demand times, and wait

times.

2020 update:

-- Given that the company's main source of income is

through the provision of queuing technology for

bricks and mortar retailers, the effect of C-19

during the first UK lockdown was expected to be

significant. As such, the company took the

opportunity to restructure its cost base and reduce

FTE's by c.50% to 19 and put a stop to any

unnecessary spend in order to preserve cash.

Consequently, we applied a 40% reduction in fair

value (in March 2020) against the carrying value of

the B share pool's investment in Qudini to reflect

this uncertainty and have maintained this at 31

December 2020.

-- Although a level of uncertainty remains given the

company's retail market exposure, the outlook has

improved somewhat given the increasing demand for

queuing/customer management technologies as retailers

look to re-open and trade safely.

-- Whilst the environment for new business during the

first lockdown had not been ideal, Qudini now has a

short window of opportunity to continue to gain

market share in H1 2021.

-- The demand noted above has driven an increase in

Annual Recurring Revenue ("ARR") as at December 2020

to c.GBP2.5m (December 2019: GBP1.8m); however, it

will be a key focus of the management team over the

next 12 months to upsell Qudini's other services in

order to help retain the company's new customers

Initial investment post-covid and transition those new customers on to

date: April 2019 longer term contracts.

------------------------------------------------------------

Cost: GBP500,000

------------------------------------------------------------

Valuation: GBP300,000

Equity held: 2.4%

Last statutory 31 December

accounts: 2019

Turnover: Not disclosed

Loss before tax: Not disclosed

Net assets: GBP3.1 million

Valuation method: At cost, less

a 40% reduction

in fair value

to reflect potential

impact of C-19

on the company's

core UK markets

--------------------- ------------------------------------------------------------

6. Bright Network (UK) Limited

Bright Network (UK) Limited ("Bright")

is a Human Resources technology platform

designed to enable leading employers to

reach, identify and recruit high quality

graduates and young professionals. At

the time of our investment, the platform

supported a network of over 255,000 high

calibre candidates and has 300+ leading

employers within its customer base, including

multiple high-quality blue-chip clients.

These employers utilise Bright's services

to fill annual intern and graduate recruitment

scheme places, as well as any bespoke

recruitment requirements.

Data analytics and machine learning is

utilised to support and continuously improve

identification of the best-suited talent

to each employer. Bright provides a free

service to undergraduates, personalising

careers advice and job matches to support

their career journey. The database is

therefore a growing data-rich asset, processing

30 million pieces of data on a new generation

of young professionals.

In March 2020, the VCT invested GBP234,000,

as part of a larger GBP3.5m fundraise

to allow the company to increase the size

of its digital and talent solutions' sales

and marketing resources, together with

improvements to the technical platform

to drive additional service revenues.

Progress since our investment:

--Limiting the potential impact of C-19

by cutting its cost base and through the

launch of online internships which were

extremely well received over the summer.

This has resulted in an increase in registered

users to over 350,000.

--Trading ahead of expectations. Due to

the pandemic the sales season (which typically

ends at the end of August) has been extended,

and the company continues to be on track

to surpass the GBP2.5M revenue target

for the financial year ending 31 March

2021 (FY21).

--Delivering strong top line performance

coupled with tight cost control has resulted

in the company outperforming FY21 planned

gross profit and EBITDA.

--Delivering an improved cash position

which is GBP900k ahead of budget. This

outperformance alongside business agility

puts the company in a strong position

as the UK recovers from the C-19 pandemic.

However, whilst more macro-economic uncertainty

Initial investment remains, this investment will continue

date: March 2020 to be held at cost.

------------------------------------------------

Cost: GBP234,000

------------------------------------------------

Valuation: GBP234,000

Equity held: 1.7%

Last statutory 31 March 2020

accounts:

Turnover: Not disclosed

Loss before tax: Not disclosed

Net assets: GBP4.9 million

Valuation method: At cost (reviewed

for any fair

value adjustment)

------------------ ------------------------------------------------

B Share Pool - Investment Portfolio -- AIM Quoted Investments as at 31

December 2020

1. SkinBioTherapeutics Plc

SkinBioTherapeutics is a life science

company focused on skin health. The company's

proprietary platform technology, SkinBiotix(TM)

, is based upon discoveries made by Dr.

Cath O'Neill and Professor Andrew McBain.

SkinBioTherapeutics' platform applies

research discoveries made on the activities

of lysates derived from probiotic bacteria

when applied to the skin. The company

has shown that the SkinBiotix(TM) platform

can improve the barrier effect of skin

models, protect skin models from infection

and repair skin models. Proof of principle

studies have shown that the SkinBiotix(TM)

platform has beneficial attributes applicable

to each of these areas.

The aim of the company is to develop its

SkinBiotix(TM) technology into commercially

successful products supported by a strong

scientific evidence base. SkinBioTherapeutics'

commercial strategy is to engage health

and wellbeing and/or pharmaceutical companies

in early dialogue to build up relationships

and maintain communication on technical

progress until one or more commercial

deals can be secured.

Progress made by the company in 2020 includes:

-- Announcing a 3 year agreement with Winclove to focus

on the development of a blend of probiotic bacteria

which have been identified as having a positive

impact on the psoriasis disease pathway. Under the

agreement, SkinBio will identify the specific

probiotic strains which Winclove will formulate and

manufacture into a consumable product to be branded

AxisBiotix. Later in the year the company announced

that Winclove had been able to successfully combine

and formulate the blend as a probiotic food

supplement, to be known as AxisBiotix Ps, several

months ahead of schedule. A study is due to commence

in February 2021.

-- Announcing in July 2020 that the SkinBiotix cosmetic

programme had achieved a number of key scientific

milestones with its partner Croda. Croda has

successfully replicated the lysate manufacturing

process and achieved the same performance from the

SkinBiotixTM technology as established by the

company. Croda is now working to validate scale up of

the manufacturing process at different volume levels.

The project is progressing in line with the original

plan and has not been adversely impacted by C-19.

-- Continued progress with live opportunities across its

MediBiotix, CleanBiotix and PharmaBiotix divisions,

including the development of eczema treatments as

well as additional opportunities designed to reduce

hospital acquired infections.

-- Completion of a GBP4.5m funding round in October

2020, providing the business with sufficient cash

headroom to progress with its exciting pipeline of

commercial opportunities, as well as continuing with

Initial investment the development of a number of early stage,

date: February 2019 pre-clinical opportunities.

------------------------------------------------------------

Cost (of the

portion of the

original investment

still held as

at 31 December

2020): GBP720,000

------------------------------------------------------------

Valuation: GBP990,000

Equity held: 2.9%

Last statutory 30 June 2020

accounts:

Turnover: GBPnil

Loss before tax: GBP1.6 million

Net assets: GBP2.5 million

Valuation method: Bid price of

22p per share

-------------- ------------------------------------------------------------

2. OptiBiotix Health Plc

Initial investment April 2020 OptiBiotix Health PLC is a Life Sciences

date: business operating in one of the most

progressive areas of biotechnological

research, developing technologies that

modulate the human microbiome -- the collective

genome of the microbes in the body. The

business identifies and develops microbial

strains, compounds and formulations for

use in food ingredients, supplements and

active compounds that can impact on human

physiology, deriving potential health

benefits.

With an established pipeline of microbiome

modulators, the OptiBiotix team works

today in the prevention and management

of chronic lifestyle diseases including

obesity, hypercholesterolemia and lipid

profiles, and diabetes.

To date, the company has signed in excess

of 50 commercial deals globally to supply

or licence its suite of products/supplements

to manufacturers and retailers and has

launched a number of its own brand products.

The VCT invested GBP300,000 into a GBP1m

fundraise in April 2020, with funds being

used to launch its award-winning products

across Asia and the US, through partners

who have an international reputation and

significant retail network, as well as

further expanding the portfolio of products.

Between investment and 31 December 2020

53% of the shares originally acquired

have been realised at a 60% profit.

Progress since our investment:

--Announcing positive half year results

for the 6 month period to 30 June 2020

including:

o H1 revenue growth of GBP745k.

o a 5x increase in revenues from H1 2019.

o a 15.5% reduction in other administration

costs.

a 50% reduction in loss compared to the

same period in the prior year.

The company is now at a commercial turning

point with the business model now proven

through growing sales from proven products,

established partners in multiple international

territories, and reduced administration

and R&D costs. We believe the company

is therefore well placed to attack the

various attractive markets in which they

are gaining traction.

Optibiotix's first generation products,

SlimBiome(TM) , and LPLDL(TM) , are now

established scientifically, clinically,

and commercially with products being sold

in over 120 countries around the world

and a growing brand presence.

As sales and profitability in first generation

products continues to improve, there is

an expectation this should enhance the

company's reach into new application areas

and territories, and commercialise next

generation products -- all of which have

the ability to further enhance the scale

and growth prospects of the company.

------------------------------------------------

Cost (of the GBP140,000

portion of the

original investment

still held as

at 31 December

2020):

------------------------------------------------

Valuation: GBP200,000

Equity held: <1.0%

Last statutory 31 December

accounts: 2019

Turnover: GBP745,000

Loss before tax: GBP2.2 million

Net assets: GBP5.2 million

Valuation method: Bid price of

57p per share

-------------- ------------------------------------------------

3. Abingdon Health plc

Initial investment December 2020 Abingdon Health is a specialist outsourced

date: Contract Development and Manufacturing

Organisation (CDMO) providing a full suite

of services to the lateral flow diagnostic

market. It is the lead member of the UK's

Rapid Test Consortium (UK-RTC) for a point-of-need

C-19 antibody test (AbC-19) and is investing

in automated manufacturing to significantly

increase capacity and attract new customers

across a range of sectors.

As the lead member of UK-RTC, the company

co-ordinated a consortium of four companies

(including former Ordinary share portfolio

company Omega) and, in under four months,

successfully developed and validated a

rapid lateral flow test ("AbC-19") for

detecting SARS-CoV-2 IgG antibodies. The

UK Government has ordered the first 1m

devices and provided funding for the components

for a further 9m to be delivered in the

coming months. There is a mechanism by

which Abingdon Health can sell any excess

supply externally and it has already had

significant interest from a number of

third parties. It is also working with

a number of partners on rapid antigen

tests, leveraging its key lateral flow

competencies and offering broad exposure

in C-19 diagnostics. The pandemic has

driven a material step change in demand

for lateral flow tests generally and has

catalysed a number of other C-19 and non-C-19

contract development and manufacturing

opportunities.

Abingdon Health has established relationships

with blue chip partners and a strong pipeline

of potential new business, including a

number of signed and qualified opportunities.

It also has an innovative and proprietary

mHealth solution, AppDx, a customisable

smartphone reader that is capable of quantitative

analysis of lateral flow tests and the

transfer of real-time data.

The investment was completed just before

the end of the financial year, so there

is no further progress to report from

2020.

---------------------------------------------------

Cost: GBP150,000

---------------------------------------------------

Valuation: GBP145,000

Equity held: <1.0%

Last statutory 30 June 2019

accounts:

Turnover: GBP2.3 million

Loss before tax: GBP1.5 million

Net assets: GBP6.2 million

Valuation method: Bid price of

93p per share

-------------- ---------------------------------------------------

B Share Pool -- Investment Portfolio -- Post-balance sheet Investments

as at 22 February 2021

1. Solascure Ltd

Solascure is an early stage wound care

specialist, originally spun out of and

working alongside BRAIN (world leading

German biotech company), to develop a

new-to-market wound care product. In 2019,

the company deconsolidated from BRAIN

and brought in additional strategic investment

from Eva Pharma (c.GBP2m) and is now set

to commence clinical trials of its wound

care product Aurase. Solscure's Aurase

is a gel-based product that efficiently

and gently cleans wounds, making the healing

process much more straightforward. Pre-clinical

work has been extremely positive and the

clinical trial planning process is now

well progressed.

Chronic wounds are a growing global problem,

and alternative methods of treatment for

hard to heal wounds are extremely expensive,

impractical and slow. Solascure's proprietary

technology utilises the key mechanism

of maggot debridement without the cost

or labour input of live maggots. In simple

terms, it uses maggot elements to facilitate

and promote the body's own wound cleansing

processes. Core benefits of the product

are the clear practical elements, as well

as the reduced time scale to full debridement

without delaying wound healing.

SolasCure have an approved protocol for

a clinical study in order to reach market

authorisation, which is anticipated to

commence in early 2021 (with phase 1 anticipated

to conclude by the end of the year). Crucially,

the product permits the use of the main

maggot-derived wound debriding enzyme

without the cost or labour input involved

with the use of live maggots, but also

augments and synergises the body's own

wound cleansing processes. The product

is expected to demonstrate 3 key benefits:

1) Speci c swift destabilisation of brin

debris; 2) No irritation or damage to

healthy tissue; 3) Reducing the time to

full debridement without delaying wound

healing.

In January 2021, the VCT invested GBP500,000,

alongside GBP733,000 of Seneca EIS funds

as part of a GBP2.9m fundraise to allow

the company to progress and complete the

Initial investment January full trial (Phase 1 and 2) by the end

date: 2021 of 2022.

-------------------------------------------------

Cost: GBP500,000

-------------------------------------------------

Valuation: GBP500,000

Equity held: 2.8%

Last statutory 30 June

accounts: 2019

Turnover: Not

disclosed

Loss before tax: Not

disclosed

Net assets: GBP 6.7

million

Valuation method: At cost

---------- -------------------------------------------------

The Ordinary Share Pool

Shareholders will recall that whilst Seneca is the Company's Investment

Manager, responsibility for the management of the Ordinary share pool

investments continues to rest with those remaining members of the Board

of Directors who were serving at the point of Seneca's appointment on 23

August 2018, which now includes John Hustler and Richard Roth.

AIM Quoted Investments

The Ordinary share pool's largest investment is AIM quoted Scancell and

this represented 37% of the Ordinary share pool's NAV as at 31 December

2019 when the Scancell share price was 7.0p. During the year, the

Scancell share price almost doubled and ended the year at 13.5p. In view

of this increasing share price, the Company took the opportunity to

realise some profit and sold a small portion of our Scancell shares

during the year (1,049,730 shares (8%) were sold from a holding at the

start of the year of 13,049,730 shares) realising GBP127k and generating

a profit versus original cost of GBP64k (a 2x return on the original

investment) and a profit versus the 31 December 2019 carrying value of

GBP54k. The Ordinary share pool's remaining stake in Scancell of

12,000,000 shares increased by GBP780k during the year to stand at a

value of GBP1,620k as at 31 December 2020.

The Ordinary share pool's investment in AIM quoted Omega gained

significant traction in the year following its involvement in a

partnership to develop a C-19 antibody test. The share price rose

substantially from its 31 December 2019 price when it was 14p and this

allowed the Company to sell the Ordinary share pool's entire holding of

2,293,868 Omega shares in the year for a total of GBP987k. This

generated a profit versus original cost of GBP659k (a 3x return on the

original investment) and similarly a profit of GBP666k versus its 31

December 2019 value.

Unquoted Investments

With regard to the Ordinary share pool's unquoted investments, the

carrying value of OR Productivity Limited ("ORP") and Fuel 3D

Technologies Limited ("Fuel 3D") were both reduced as a result of

fundraises by these companies in 2020. In the case of ORP, the dilutive

impact of the funds raised are such that the Company reduced the

carrying value to GBPnil for the Ordinary share pool's investment in ORP

as at 31 December 2020 (31 December 2019 carrying value: GBP233k) and in

the case of Fuel 3D the carrying value has been reduced to bring it in

line with the price of their 2020 fundraise. Although the Ordinary share

pool has maintained the value of Arecor Ltd at the price of the last

fundraising in 2018, it continues to make excellent technical and

commercial progress.

Performance and Dividends

As a result of the above AIM quoted investee company realisations, the

Ordinary share pool was able to pay dividends totalling 13p per Ordinary

share during the period.

The Total Return in relation to the Ordinary shares is now 95.5p

comprising cumulative distributions of 65.25p per Ordinary share and a

residual NAV per Ordinary share of 30.2p as at 31 December 2020.

As noted in the Chairman's statement, the Company is focussed on

realising assets in the Ordinary share pool at the appropriate time with

the proceeds then being distributed to Ordinary shareholders as

dividends -- it is therefore noteworthy that in the 3 years to 31

December 2020 the Company has paid out dividends totalling 41p per

Ordinary share (equivalent to 64.3% of the NAV per Ordinary share of

63.8p as at 31 December 2017) and the Ordinary share pool also retains

NAV per Ordinary share of 30.2p as at 31 December 2020.

Investment Portfolio -- Ordinary shares

Movement

Carrying in the year

value at to

Equity Investment Unrealised 31 December 31 December

held at cost profit/(loss) 2020 2020

Unquoted Investments % GBP'000 GBP'000 GBP'000 GBP'000

Arecor Limited 1.1 142 63 205 -

--------------------- ---------- -------------- -------------- ------------- -------------------------

Fuel 3D Technologies

Limited <1.0 299 (104) 195 (81)

Insense Limited 4.6 509 (388) 121 -

OR Productivity

Limited 3.7 765 (765) - (232)

Microarray Limited 3.0 132 (132) - -

ImmunoBiology Limited 1.2 868 (868) - -

Total unquoted

investments 2,715 (2,194) 521 (313)

Movement

in the year

Carrying to

Investment Unrealised value at 31 December

Shares at cost profit/(loss) 31 December 2020

Quoted Investments held GBP'000 GBP'000 2020 GBP'000 GBP'000

Scancell plc 12,000,000 726 894 1,620 780

Total quoted

investments 726 894 1,620 780

Total investments 3,441 (1,300) 2,141 467

No. of Investment Sale Realised

Exits for Investment Shares at cost Proceeds profit/(loss) Exit

the period Date sold GBP'000 GBP'000 GBP'000 Multiple

Scancell plc December

(*) 2003 1,049,730 63 127 64 2.0

------------ ----------- --------- ---------- -------- ------------- --------

Omega

Diagnostics

plc August 2007 2,293,868 328 987 659 3.0

Exosect

Limited January

(**) 2010 8,575 270 - (270) -

Total 661 1,114 453 1.7

(*) Partial exit

(**) Dissolved 24 January 2020

Ordinary Share Pool -- Investment Portfolio -- All Six Unquoted

Investments by value as at 31 December 2020

1. Arecor Limited

Arecor was a spin-out from Insense (a

Seneca Growth Capital Ordinary share investee

company -- see below) to commercialise

technology developed by Insense for enabling

biologics to maintain their integrity

without the need for refrigeration - this

both reduces cost and also helps supply

chain logistics in developing countries

where temperature monitored cold storage

facilities are in short supply.

Progress made by the company in 2020 includes:

-- Announcing in March 2020 that Arecor had extended its

multi-product collaboration with a US-based clinical

stage biotechnology company.

-- Announcing in June 2020 positive results of their

phase 1 trial on AT247.

-- Expanding their partnership with Hikma announced 20

October 2020.

-- Commencing in December 2020 dosing patients in the

AT278 clinical study (ultra-concentrated insulin,

first in man study) following a GBP1.9m fund raise:

this is a very significant milestone as they continue

to build momentum with their differentiated portfolio

of superior products.

-- Announcing in late December 2020 that Arecor's

partner, Inhibrx, exercised their option to license a

novel formulation of the investigational clinical

stage product, INH-101, developed by Arecor. This is

the first license under a multi-product collaboration

with Inhibrx and further validates the value of the

Initial investment ArestatTM technology platform in developing superior

date: January 2008 versions of existing therapeutic products.

------------------------------------------------------------

Cost: GBP142,000

------------------------------------------------------------

Valuation: GBP205,000

Equity held: 1.1%

Last statutory 31 December

accounts: 2019

Turnover: GBP748,000

Loss before GBP2.7

tax: million

Net assets: GBP4.2

million

Valuation method: Price of last

fundraise

------------- ------------------------------------------------------------

2. Fuel 3D Technologies Limited

Initial investment March 2010 In 2014 Fuel 3D was formed to acquire

date: the computer 3D imaging IP of Seneca Growth

Capital Ordinary share investee company,

Eykona. The initial application for this

IP targeted by Eykona was measuring the

volume of chronic wounds; however this

has since developed and the current application

focus is on a) measuring tumours in animals

used in drug development via a product

called BioVolume and b) enabling the manufacture

of products to fit a particular individual

e.g. masks used to treat certain medical