TIDMTRP

RNS Number : 0698X

Tower Resources PLC

18 December 2023

THIS ANNOUNCEMENT IS NOT FOR RELEASE, PUBLICATION OR

DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN, INTO

OR FROM THE UNITED STATES, CANADA, AUSTRALIA, THE REPUBLIC OF SOUTH

AFRICA OR JAPAN OR ANY OTHER JURISDICTION WHERE TO DO SO WOULD

CONSTITUTE A BREACH OF THE RELEVANT SECURITIES LAWS OF SUCH

JURISDICTION.

This announcement does not constitute a prospectus or offering

memorandum or an offer in respect of any securities and is not

intended to provide the basis for any decision in respect of Tower

Resources PLC or other evaluation of any securities of Tower

Resources PLC or any other entity and should not be considered as a

recommendation that any investor should subscribe for or purchase

any such securities.

18 December 2023

Tower Resources plc

("Tower" or the "Company")

Signing of Rig Contract for Cameroon

Proposed Subscription to raise approximately GBP600,000

Tower Resources plc (AIM: TRP), the AIM-listed oil and gas

company focused on Africa, is pleased to announce that it has

executed a contract with Borr Drilling Limited ("Borr") for the

hire of the Norve jack-up rig, one of Borr's fleet of

high-specification drilling units, (the "Rig" or the "Norve") to

drill the NJOM-3 well on Tower's Thali license in Cameroon in

2024.

The Company is also announcing its intention to raise gross

proceeds of approximately GBP600,000 through subscriptions for

approximately 3,000,000,000 ordinary shares of 0.001p each (the

"Subscription Shares") at a price of 0.02p per Subscription Share

(the Subscription Price), representing a discount of approximately

13% to the closing bid price of the shares on 15 December 2023. It

is intended that Jeremy Asher, Chairman & CEO, will subscribe

for GBP80,000 of new ordinary shares as part of the

Subscription.

The Rig Contract

The Rig is currently subject to existing contracts to deliver a

series of wells, whose timing are naturally subject to operational

uncertainty. Following the completion of those wells, the Rig is

expected to be available in Cameroon between April and August 2024.

Subject to the Rig being available during this time period, the

Company therefore anticipates that the NJOM-3 well will be spudded

in Q2 or possibly Q3 of 2024. The expected date range for the Rig's

availability will be narrowed as it draws nearer.

The contract is also subject to conditions precedent concerning

the final documentation of the Company's Thali license extension,

and prepayment of a portion of the expected rig hire. Other terms

of the contract are confidential, but the Company can confirm that

the contracted day rate for the Rig is in line with the Company's

latest cost projections.

The Norve, constructed in 2011 at the PPL shipyard, Singapore,

is capable of operating in water depths of up to 400 ft, and its

specifications may be found via the link here:

https://borrdrilling.com/wp-content/uploads/2020/01/Borr-Drilling-Norve-06-Jan-2020.pdf

Proposed Subscription

The proposed Subscription is being made to fund working capital

and work programme commitments in all three of the Company's

licenses over the coming months, while the documentation of the

Company's license extension in Cameroon and current farm-out

discussions are concluded.

The subscription would raise gross proceeds of approximately

GBP600,000 through the issue of approximately 3,000,000,000

ordinary shares of 0.001p each at a price of 0.02p per Subscription

Share, representing a discount of approximately 13% to the closing

bid price of the shares on 15 December 2023.

It is intended that Jeremy Asher, Chairman & CEO, will

subscribe for GBP80,000 of new ordinary shares as part of the

Subscription, and it is also intended to offer the brokers a

warrant covering 65 million new ordinary shares for a period of

three years at a strike price of 0.04p per share.

A further announcement is expected to be made shortly in respect

of the proposed Subscription.

Tower Resources Chairman & CEO, Jeremy Asher, commented:

"Signing the Rig contract is a significant step forward in the

development of our Cameroon assets and moves us toward spudding the

NJOM-3 well in 2024. The Norve Rig was chosen both for its high

specification and its anticipated window of availability.

"Our next steps will be to finalise the documentation of the

Thali license extension with the Ministry of Mines, Industry and

Technological Development ("MINMIDT"), and to move our farm-out

discussions with multiple parties towards a conclusion, we hope

during the first quarter of 2024. As we have explained in the past,

our plan is to fund the well primarily with asset-level financing,

and we still believe that is realistic.

"While we finalise the farm-out discussions, we have chosen to

raise a small amount of capital of which I am investing GBP80,000.

We envisage that the majority of the remaining well cost will come

from asset-level financing. I have chosen to participate in this

fundraising myself, as I have in several of our previous recent

fundraisings, reflecting my personal commitment to this project and

my confidence in its success."

IMPORTANT NOTICE

This announcement does not constitute or form part of any offer

or invitation to purchase, or otherwise acquire, subscribe for,

sell, otherwise dispose of or issue, or any solicitation of any

offer to sell, otherwise dispose of, issue, purchase, otherwise

acquire or subscribe for, any security in the capital of the

Company in any jurisdiction.

The information contained in this announcement is not to be

released, published, distributed or transmitted by any means or

media, directly or indirectly, in whole or in part, in or into the

United States or to any US Person. This announcement does not

constitute an offer to sell, or a solicitation of an offer to buy,

securities in the United States or to any US Person. Securities may

not be offered or sold in the United States absent: (i)

registration under the Securities Act; or (ii) an available

exemption from registration under the Securities Act. The

securities mentioned herein have not been, and will not be,

registered under the Securities Act and will not be offered to the

public in the United States.

This announcement does not constitute an offer to buy or to

subscribe for, or the solicitation of an offer to buy or subscribe

for, Ordinary Shares in the capital of the Company or any other

security in any jurisdiction in which such offer or solicitation is

unlawful. The securities mentioned herein have not been, and the

Ordinary Shares will not be, qualified for sale under the laws of

any of Canada, Australia, the Republic of South Africa or Japan and

may not be offered or sold in Canada, Australia, the Republic of

South Africa or Japan or to any national, resident or citizen of

Canada, Australia, the Republic of South Africa or Japan. Neither

this announcement nor any copy of it may be sent to or taken into

the United States, Canada, Australia, the Republic of South Africa

or Japan. In addition, the securities to which this announcement

relates must not be marketed into any jurisdiction where to do so

would be unlawful.

Note regarding forward-looking statements

This announcement contains certain forward-looking statements

relating to the Company's future prospects, developments and

business strategies. Forward-looking statements are identified by

their use of terms and phrases such as "targets" "estimates",

"envisages", "believes", "expects", "aims", "intends", "plans",

"will", "may", "anticipates", "would", "could" or similar

expressions or the negative of those, variations or comparable

expressions, including references to assumptions.

The forward-looking statements in this announcement are based on

current expectations and are subject to risks and uncertainties

which could cause actual results to differ materially from those

expressed or implied by those statements. These forward-looking

statements relate only to the position as at the date of this

announcement. Neither the Directors nor the Company undertake any

obligation to update forward looking statements, other than as

required by the AIM Rules for Companies or by the rules of any

other applicable securities regulatory authority, whether as a

result of the information, future events or otherwise. You are

advised to read this announcement and the information incorporated

by reference herein, in its entirety. The events described in the

forward-looking statements made in this announcement may not

occur.

Neither the content of the Company's website (or any other

website) nor any website accessible by hyperlinks on the Company's

website (or any other website) is incorporated in, or forms part

of, this announcement.

Any person receiving this announcement is advised to exercise

caution in relation to the Placing. If in any doubt about any of

the contents of this announcement, independent professional advice

should be obtained.

Market Abuse Regulation (MAR) Disclosure

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as it forms part of

UK domestic law by virtue of the European Union (Withdrawal) Act

2018 ('MAR'). Upon the publication of this announcement via

Regulatory Information Service ('RIS'), this inside information is

now considered to be in the public domain.

Contacts:

Tower Resources plc

Jeremy Asher

Chairman & CEO

Andrew Matharu

VP - Corporate Affairs +44 20 7157 9625

BlytheRay

Financial PR

Tim Blythe

Megan Ray +44 20 7138 3208

SP Angel Corporate Finance

LLP

Nominated Adviser and Joint

Broker

Stuart Gledhill

Kasia Brzozowska +44 20 3470 0470

Axis Capital Markets Limited

Joint Broker

Lewis Jones

Ben Tadd +44 203 026 2689

Novum Securities Ltd

Joint Broker

Jon Bellis

Colin Rowbury +44 20 7399 9400

Panmure Gordon (UK) Limited

Joint Broker

John Prior

Hugh Rich +44 20 7886 2500

About Tower Resources

Tower Resources plc is an AIM listed energy company building a

balanced portfolio of energy opportunities in Africa across the

exploration and production cycle in oil and gas and beyond. The

Company's current focus is on advancing its operations in Cameroon

to deliver cash flow through short-cycle development and rapid

production with long term upside, and de-risking attractive

exploration licenses through acquiring 3D seismic data in the

emerging oil and gas provinces of Namibia and South Africa, where

world-class discoveries have recently been made.

Tower's strategy is centred around stable jurisdictions that the

Company knows well and that offer excellent fiscal terms. Through

its Directors, staff and strategic relationship with EPI Group,

Tower has access to decades of expertise and experience in Cameroon

and Namibia, and its joint venture with New Age builds on years of

experience in South Africa.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEEAEAXFLFDFAA

(END) Dow Jones Newswires

December 18, 2023 02:00 ET (07:00 GMT)

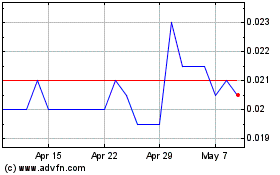

Tower Resources (LSE:TRP)

Historical Stock Chart

From Oct 2024 to Nov 2024

Tower Resources (LSE:TRP)

Historical Stock Chart

From Nov 2023 to Nov 2024