TIDMWINV

RNS Number : 7126W

Worsley Investors Limited

14 December 2023

14 December 2023

Worsley Investors Limited

(the "Company")

Half Year Report for the six months ended 30 September 2023

The Company is pleased to announce the release its half year

report and unaudited consolidated financial statements for the six

months ended 30 September 2023 (the "Half Year Report"). A copy of

the Half Year Report will be posted to shareholders and will be

available to view on the Company's website shortly at:

www.worsleyinvestors.com

For further information, please contact:

Worsley Associates LLP (Investment Advisor)

Blake Nixon

Tel: +44 (0) 203 873 2288

Shore Capital (Financial Adviser and Broker)

Robert Finlay / Anita Ghanekar / Rose Ramsden

Tel: +44 (0) 20 74080 4090

Sanne Fund Services (Guernsey) Limited (Administrator and

Secretary)

Chris Bougourd / Matt Falla

Tel: +44 (0) 1481 737600

LEI: 213800AF85VEZMDMF931

Performance Summary

30 September 31 March

2023 2023 % change

-----------------------------

Net Asset Value ("NAV") per

share 42.59p 43.92p -3.03%

-------------- ---------- ---------

Share price(1) 27.40p 28.00p -2.14%

-------------- ---------- ---------

Share price discount to NAV 35.33% 36.25%

-------------- ----------

Six month Six month

period period

ended ended

30 September 30 September

2023 2022

-----------------------

Earnings per share(2) -1.03p -0.62p

-------------- --------------

Total return Six month Six month

period ended period ended

30 September 30 September

2023 2022

NAV Total Return(3) -3.03% 0.83%

-------------- --------------

Share price Total Return(4)

-------------- --------------

- Worsley Investors Limited -2.14% -16.25%

-------------- --------------

- FTSE All Share Index 1.42% -8.31%

-------------- --------------

- FTSE Real Estate Investment

Trust Index -5.28% -33.24%

-------------- --------------

Worsley Associates LLP ('Worsley Associates') was appointed on

31 May 2019 as Investment Advisor (the "Investment Advisor") to

Worsley Investors Limited (the "Company"). At an EGM held on 28

June 2019, an ordinary resolution was passed to adopt new

Investment Objective and Policy. The Company's Investment Objective

and Policy are set out below.

Past performance is not a guide to future performance.

(1) Mid-market share price (source: Shore Capital and Corporate

Limited).

(2) Earnings per share based on the net loss for the period of

GBP0.393 million (30 September 2022: net profit for the period of

GBP0.209 million) and the weighted average number of Ordinary

Shares in issue during the period of 33,740,929 (30 September 2022:

33,740,929).

(3) On a pro forma basis, which includes adjustments as

necessary to take account of the effect of capital alterations

during the period. NAV Total Return is a measure showing how the

NAV per share has performed over a period of time, taking into

account both capital returns and any dividends paid to

shareholders.

(4) A measure showing how the share price has performed over a

period of time, taking into account both capital returns and any

dividends paid to shareholders.

Source : Worsley Associates LLP and Shore Capital and Corporate

Limited.

Chairman's Statement

The Half Year to 30 September 2023 was in some ways rather dull.

The Company over the six months generated a negative NAV net return

of 3.03%, which was broadly in the range between the wider market

in UK smaller companies as represented by the FTSE Small

Capitalisation Index which had a total return of 1.68% and the real

estate sector which continued to struggle under rising interest

rates. The FTSE Real Estate Investment Trust Index, as proxy for

the latter, generated a negative return of 5.28%. Within our

overall figure, the return on the capital invested in our equity

portfolio was negative 3.8% and the other major component was our

Curno cinema which generated a positive cashflow of EUR529,870

before expenses but was marked down by EUR300,000 or 3.9% in local

currency by the independent property valuer. Associated property

management and structural expenses together with an adverse foreign

exchange movement over the six months gave a net positive result in

pounds sterling of 0.7% for Curno. Corporate expenses were

equivalent to 1.4% of opening Net Assets.

Against this backdrop, our share price also drifted sideways

with the period end discount narrowing very marginally to 35.33%

from 36.35% in March.

The Investment Advisor, Worsley Associates LLP, summarises the

market background and outlook together with the developments in

respect of our principal investments succinctly in its report and

there is little that I can usefully add here.

The salient details of the Curno lease are amongst the

information set out in the Investment Advisor's Report. It appears

that there have been few (if any) transactions in Italian cinemas

in recent quarters partly, no doubt, due to the scarcity of finance

and partly due to the operational time lags throughout the cinema

industry as it recovers from the Covid pandemic shutdowns. At least

in that latter regard the availability of interesting new film

releases has continued post the period end with the effect that

attendance volumes are now only very slightly below those

immediately prior to Covid-19. Given the lack of observable and

comparable transactional evidence, the valuer has increased the

capitalisation rate applied to the rental stream to 13.46% which

means that the index-linked passing rental yield is now 14.29% p.a.

on a good quality tenant covenant with 9.5 years to run to the

tenant break option and 16.5 years of full term unexpired. At these

levels, the prospective returns compare very favourably with

expectations of long-term equity market averages even if they are

somewhat below the historical outcomes achieved by the Worsley

strategy over such time periods.

I am also pleased to note the continuing improvements to

operational and financial performance at our largest equity

investment, Smiths News plc, although the market recognition of

that occurred after our reporting period ended on 30 September and

indeed (and frustratingly) its shares underperformed during the

half year.

We are at a juncture where, absent unforeseen extraneous events,

it would appear that we are very close to the peak of this interest

rate cycle and in some sectors such as the UK residential mortgage

market, the cost of medium-term funding is already beginning to

fall. When rates are rising and markets have not formed a consensus

on where they will peak, it is difficult for the equity market as a

whole to make significant sustained progress and, depending upon

the moving balance between optimism and pessimism, prices can be

volatile and subject to downward moves affecting the share prices

even of well-performing companies. In the short term, the capacity

for negative surprises remains but it does seem that the consensus

is building that the peak is not far off both in level and timing

and although market indices could still be described as

range-bound, they would appear to be levelling off, a necessary

precursor to a broader advance in valuations. That said, Worsley

Investments runs a concentrated portfolio of investments each of

which has the capacity either of its own volition or with

encouragement to generate significant shareholder value in absolute

terms. One of the effects of such concentration is that depending

on the timing of events in relation to such investees and

conversely those in relation to the principal constituents of such

indices, performance can diverge from wider market moves from

reporting period to reporting period even when investees'

underlying commercial performance is significantly better than

market averages. A prime example of this is the post period end

re-rating of Smiths News plc's share price.

Once again and on behalf of the Board, I would like to thank our

Investment Advisor, Worsley Associates LLP, for the continued

steady progress they have made in developing our portfolio and to

thank you, our shareholders, for your ongoing support.

William Scott

Chairman

13 December 2023

Investment Advisor's Report

Investment Advisor

The Investment Advisor, Worsley Associates LLP, is regulated by

the FCA and is authorised to provide investment management and

advisory services.

In the period under review, the equities portfolio remained

close to fully invested, and the Investment Advisor has

concentrated on its further development and oversight of the

management of the Curno cinema, investor interest in which has been

adversely affected by European lenders being more cautious in their

approach to lending decisions and substantially higher borrowing

costs.

Curno Cinema Complex

The Group's Italian multiplex cinema complex, located in Curno,

on the outskirts of Bergamo, is let in its entirety to UCI Italia

S.p.A. ("UCI").

The cinema lease documentation remains as amended in June

2020.

The key rental terms of the lease, which has a final termination

date of 31 December 2042, are:

Base Rent

1 January 2023 to 31 December 2023 - EUR1,057,094 per annum.

Base rental is indexed annually to 100% of the Italian ISTAT

Consumer Index on an upwards-only basis. In the ten months to 31

October the index has increased 0.8%.

Variable Rent

Incremental rent is payable at the rate of EUR1.50 per ticket

sold above a minimum threshold of 350,000 tickets per year up to

450,000 tickets per year, rising in 50,000 ticket stages above this

level up to EUR2.50 per extra ticket.

Tenant Guarantee

The lease benefits from a rental guarantee of an initial EUR13

million, reducing over 15 years to EUR4.5 million, given by a U.K.

domiciled intermediate holding company for the UCI group's European

operations, United Cinemas International Acquisitions Limited,

which has latest published shareholders' funds of GBP291.2

million.

Tenant break option

UCI has the right to terminate the lease on 30 June 2035.

Trading

The cinema was open throughout the half.

On the back of a film slate which including a slew of

'blockbuster' movies, and, in particular, the Barbenheimer

phenomenon, Curno ticket sales in the half were 75% up on those for

2022 period, and are continuing their improvement towards pre

COVID-19 levels.

In October, immediately after the period end, there was somewhat

of a gap in openings, but since the beginning of November, with the

release of the Italian smash hit, C' E' Ancora Domani (There's

Still Tomorrow), Italian cinema ticket sales have been extremely

strong, reaching some 92% of November 2019 levels.

The Curno cinema has continued to benefit from substantial

increases in total revenue per customer.

Rentals remained current throughout the period.

Valuation

As at 30 September 2023, the Group's independent asset valuer,

Knight Frank LLP, fair valued the Curno cinema at EUR7.4 million

(31 March 2023: EUR7.7 million), and this figure has been adopted

in these Financial Statements.

Since the June 2020 lease amendment, the Board's expectation has

been that the valuation of the Curno cinema would increase once the

enhanced rental began to be generated by the property from 1 March

2021 onwards. The current rental is some 27% higher than the pre

amendment level.

In response to higher European interest rates, the valuer during

half chose to increase the yield at which it capitalised the rental

stream from 12.97% to 13.46%, which has had the effect of reducing

the valuation by some 3.9%. This particularly cautious approach

reflects the European Central Bank having continued to increase

interest rates in efforts to curb inflation levels and consequent

expectations of further outward pressure on yields.

Given the increasingly strong Italian box office takings seen

since the beginning of April, conditions are now much more

conducive to a return of investor appetite once European banks

revert to more normal levels of property lending. The Group will

retain the Curno cinema until a disposal can be effected at a price

which the board believes properly reflects its medium term

prospects.

Investment Strategy

The Investment Advisor's strategy allies the taking of holdings

in British quoted securities priced at a deep discount to their

intrinsic value, as determined by a comprehensive and robust

research process. Most of these companies will have smaller to

mid-sized equity market capitalisations, which will in general not

exceed GBP600 million. It is intended to secure influential

positions in such British quoted securities, with the employment of

activism as necessary to drive highly favourable outcomes.

Since the publication of the Annual Report in early July, the

U.K. stock market, as measured by the FTSE All-Share Index, has

been range bound between the 3930 and 4200 levels. US monetary

policy developments have become the largest influence on the

British market, eclipsing prospects for the U.K. economy, with the

conflict in Gaza also an important factor.

The US Federal Reserve at its June monetary meeting had

surprised investors with a suggestion that two further rises could

be in the pipeline over the rest of the year, triggering an abrupt

3% drop in the London stock market. However, mid-July first the

U.K. Producer Price Index ('PPI') came in well down and then the US

CPI and PPI were both well below expectations, and the market

retraced most of its fall.

The release of better than expected U.K. June CPI figures then

saw the British market steam ahead, hitting a period high at the

end of July. As it had foreshadowed in June, the US Fed at its July

meeting duly raised its Federal Funds rate to 5.25% - 5.50%, the

highest level for 22 years.

August began with equity markets worldwide in retreat as Fitch

downgraded the US's issuer default rating from AAA to AA+. Strong

U.K. second quarter GDP figures, robust wage growth and sticky core

CPI all signalled further increases in U.K. base rates, and,

exacerbated by rising US and Chinese bond yields, sentiment

weakened with the result that the London market hit a low on the

21st, at which point US 10-year Treasury bond yields were at their

highest since 2007.

Over the following month, however, U.K. equities tested their

high for the period on generally positive U.K. economic news, the

announcement of substantial economic stimulation in China, a view

emanating out of the US Jackson Hole economic symposium that the US

Fed would pause interest rates, and slower inflation in the US and

U.K..

From that point something of a slide ensued, on fears that there

would be one more US Fed rate rise and that rates would remain

higher for longer, the financial distress of the Chinese property

giant, Evergrande, and higher bond yields. However, early in

October a modest recovery commenced on stronger US economic data,

good August U.K. GDP figures and as the US Fed commented that

higher bond yields might aid the fight against inflation, tempered

somewhat by concerns about the conflict in Gaza.

By mid-October, tensions in Gaza had gained the ascendency,

exacerbated by some hawkish signals from the US Fed and bond yields

rising further. The last of these then fed into concerns regarding

the stretched level of US technology stock valuations, with the

result that British market closed on the 27 October at its low

point since our March year end and the lowest level for almost a

year.

Since then, the overall direction of the U.K stock market has

been gradually upward. This was initially on expectations,

subsequently proven correct, that the US Fed and Band of England

would hold interest rates at their respective meetings on 2 and 3

November. Despite further hawkish warnings from the US Fed that

markets should not assume rates had peaked, much lower October

inflation figures in the US and the U.K. saw bond yields fall and

the British market advance, the All-Share Index reaching 4088 on

the 17th. In subsequent weeks, the market has drifted, reflecting

uncertain prospects for the U.K. economy and mixed Chinese economic

data.

The outlook for interest rates in the U.K. and US has improved

since the Annual Report, with a peak level for both of around 5.5%

now foreseen, a reduction in expectations of circa 25 bps since

June.

In the Company's target universe of British smaller companies,

the total return over the six months to 30 September was 1.68 %.

Share prices in this section of the market, after a sharper fall in

the last week of September and most of October than the overall

market, have recovered more strongly, ending up approximately 0.6%

over the last two and a half months.

The Company's portfolio has remained quite fully invested during

the half. This includes a previously undisclosed holding, now

representing some 2.3% of the Group's Net Assets, in LMS Capital

plc ('LMS'). LMS is an English investment company whose shares are

listed on the London Stock Exchange's Main Market. It has a market

capitalisation of GBP19.4 million and as at 30 September its net

cash balance was GBP16.0 million. At that same date LMS owned an

historic portfolio of very predominantly US and U.K. unlisted

investments, valued by its directors at GBP16.65 million, net of

related liabilities. In the past two years, LMS has pursued a new

investment strategy, under which it has made one material

investment, an unquoted Romanian oil and gas production business,

valued by directors at GBP10.1 million. The shares at 24p sell at a

very substantial discount to their stated NAV/share as at 30

September of some 52p.

The largest portfolio position remains our shareholding of in

excess of 4% in Smiths News plc, England's major distributor of

newspapers and magazines. In early November, Smiths News published

its 2023 preliminary results, which were particularly strong, with

increased revenue and operating profit, albeit boosted by the

'Royal Succession' and the 2022 World Cup. Significant inflationary

pressures were substantially mitigated by the ongoing cost

reduction programme. Average net debt for 2023 was GBP25m, down

from GBP50m in 2022. The shares, after early strength, were flat in

the first three months of our reporting period, but for most of the

second quarter underperformed, ending the period down almost 13%.

Post period end the shares have recovered well, being up circa 24%

from their recent low.

The holding in Amedeo Air Four Plus Limited ('AA4') is largely

unchanged. The AA4 group's income stream is underpinned by its

lease of six A380 and two B777-300ER aircraft to the airline,

Emirates. Post the end of the half, AA4, in an update to the

market, noted that Emirates continued to extol the virtues of the

A380 and had recently purchased two out of service A380s for $35m

each. Notwithstanding that, subsequent to going ex the most recent

quarterly dividend the shares have weakened significantly, and at

current levels not only do not reflect the recent uplift in

residual values of A380s but also the considerable equity value

inherent in the group's four A350-900 aircraft leased to Thai

Airways.

The Northamber plc shareholding was increased further in the

half year, after the shares had weakened on the company posting an

increased loss for its 2023 half year, and that in Shepherd Neame

Limited was also topped up. During the half, we also added to

another three holdings and two new positions were initiated.

Preliminary (less than 2% of Net Assets) holdings are held in 9

other companies.

Following a strong recovery since 30 September, the Company's

portfolio as at 30 November 2023 had a total cost of GBP5.30

million, a combined market value of GBP8.27 million, and comprised

17 stocks. The surplus on the portfolio was a little over 56% of

cost, and the annualised return on capital invested since the new

strategy was adopted remains very acceptable, at a little under

27%.

Results for the six months period

Cash revenue from Curno for the period to 30 September 2023 was

EUR529,900 (GBP458,000) (30 September 2022: EUR474,900

(GBP405,000)). The increase reflected the inflationary rental

adjustment, from 1 January 2023, which applied throughout the

current half.

Property expenses, mainly local Curno property taxes, of some

EUR113,000 (GBP98,000) ((30 September 2022: EUR86,000 (GBP73,000)),

were incurred. The increase in the current half was almost entirely

owing to anomalous expenses of circa EUR35,000 in respect of

disputed assessments for Italian registration tax, since resolved

in our favour.

General and administrative expenses of GBP282,000 (30 September

2022: GBP260,000) were above the 2022 run rate, but only slightly

above expectations. Administration expenses were flat period on

period, but Group general expenses were somewhat higher, and

included circa EUR9,000 (GBP8,000) in unbudgeted interest and

penalties on the disputed Italian registration tax. In addition,

registry costs continued to be elevated. As foreshadowed in the

2023 Annual Report, increased Net Assets led to an in crease in

AUM-based fees compared to the corresponding half in 2022.

Transaction charges incurred on equity acquisitions were

GBP2,000 ( 30 September 2022: GBP4,000), reflecting lower activity

than the more usual level in the corresponding half last year.

We continue to believe that the Group's ongoing operating costs

for the full year will be somewhat higher than the 2023 level,

principally the consequence of higher AUM-based costs. Prior to the

ultimate sale of Curno there remains little scope for significant

reduction in the overall cost base.

The equities portfolio recorded a small upturn in the first

quarter before suffering a significant reduction in the second

(since fully recovered), resulting for the half as a whole in a

GBP430,000 net investment mark-to-market reduction (30 September

2022: GBP446,000 reduction). Investment income for the half,

entirely dividends, was GBP229,000 and net investment gains

realised added GBP13,000. In consequence, the total return on

capital invested in the portfolio over the half came out at minus

3.8%.

Taxation is payable on an ongoing basis on Italian income and in

Luxembourg. For the half, an Italian operating tax charge of circa

GBP50,000 ( 30 September 2022: GBP36,000) was incurred. In

addition, irrecoverable VAT in Luxembourg of some GBP3,000 was

paid. Following a review by the Company's auditor, elimination of

deferred taxation, previously posted in respect of lease incentive

balance, resulted in a tax credit of GBP75,000.

In the remainder of the year, the increased Curno rental will be

offset by a return to a more normal tax rate at our Italian

subsidiary, Multiplex, and the incurrence of higher AUM-based fees,

with the expectation remaining that operating cash flow (that is

prior to allowance for equity income and net purchases) will be

modestly positive.

Financial Position

Net Assets at 30 September 2023 were GBP14.369 million, which

compares with the GBP14.819 million contained in the 31 March 2023

Annual Report. The decrease arose from the loss in the half of

GBP348,000, of which GBP260,000 (EUR300,000) related to the

reduction in the Euro valuation of the Curno property, further

exacerbated by a GBP102,000 decrease in the pounds sterling fair

value of Euro-denominated assets, principally the property.

The Group's liquidity reduced slightly in the period, reflecting

net portfolio purchases of GBP328,000, with GBP400,000 in cash held

at 30 September 2023 and no debt. However, given the ample

secondary liquidity of the equity portfolio and positive ongoing

cash flows, the Group's financial position continues to be

strong.

In due course, the sale of the Curno cinema will provide

considerable additional resources for equity investment.

Euro

As at 31 September 2023, some 45% of Total Assets were

denominated in Euros, of which the Curno property was circa 44% of

Total Assets, similar to the 44% as at 31 March 2023. The pound

sterling Euro cross rate moved some 1.5% during the period from

1.137 as at 31 March 2023 to 1.154 as at 30 September 2023. This

cross rate will remain a potentially significant influence on the

level of Group Net Assets until Curno's disposal.

Outlook

After the first two months of 2023 had been buoyant, U.K. stock

market prices, whilst variable, as a result of a strong dichotomy

between investor hopes for lowered interest rates and central

banks' determination to drive inflation down to target levels, now

stand at just above their opening level.

This is in line with the view expressed in the Annual Report

that economic uncertainty appeared set to continue for at least the

remainder of 2023. Given the inherent delays in the impact of

tighter U.K. monetary policy, and in particular higher borrowing

costs, the prospects for U.K. company earnings in the first half of

2024 remain subdued.

It is pleasing to note that 2023's much more normal slate of

movie releases, including most recently new Italian titles, has

continued to drive greatly improved Italian cinema attendances.

Even so, there remains a dearth of Italian medium term debt

finance available, undermining investor demand, the consequence

being that retention of our Curno cinema is the most likely

scenario in the immediate future. While that is not our preferred

course, the multiplex will remain the source of substantial,

inflation protected, cash flow for the Group.

We have previously stressed that the Worsley investment strategy

is relatively insensitive to the near term economic outlook, being

focussed on the medium term prospects of individual companies.

The interim profit figures for British companies released in the

period came in broadly in line with previously diminished

expectations. Against that, once again a multitude of stocks with

capitalisations below GBP150 million have seen their prices drop

abruptly.

In the preponderance of instances these falls are the

consequence of a substantial worsening in the outlook for the

relevant sector, natural resources being a familiar example.

Nevertheless, a proportion of the prices of well-founded companies

also tend to fall prey to such sentiments and, inevitably, some

come to be gravely mispriced and as such prospective investees.

The Worsley equity portfolio is well established and, in spite

of a somewhat gloomy prognosis for the U.K. economy, the Company

remains well placed to continue to deliver respectable returns.

Worsley Associates LLP

12 December 2023

Interim Management Report

A description of the important events which have occurred during

the first six months of the financial year and their impact on the

performance of the Company as shown in the Financial Statements is

given in the Chairman's Statement, the Investment Advisor's Report

and the Notes to the Financial Statements and are incorporated here

by reference.

Statement of principal risks and uncertainties

The Board is responsible for the Company's system of internal

controls and for reviewing its effectiveness. The Board, through

its Risk Committee, has carried out a robust assessment of the

principal risks and uncertainties facing the Company, using a

comprehensive risk matrix as the basis for analysing the Company's

system of internal controls while monitoring the investment limits

and restrictions set out in the Company's investment objective and

policy.

The principal risks assessed by the Board relating to the

Company were disclosed in the Annual Financial Report for the year

ended 31 March 2023. The principal risks disclosed include

investment risk, operational risk, accounting, legal and regulatory

risk, financial risks and foreign exchange risk. A detailed

explanation of these can be found in the Annual Financial Report.

The Board and Investment Advisor do not consider these risks to

have materially changed during the six months ended 30 September

2023 and they are not expected to change in the remainder of the

financial year.

Going concern

The Directors, at the time of approving the Financial

Statements, have a reasonable expectation that the Group has

adequate resources to continue in operational existence for the

next 12 months. The lease income generates enough cash flows to pay

on-going expenses. The Directors have considered the cash position

and performance of the current capital invested of the Group and

concluded that it is appropriate to adopt the going concern basis

in the preparation of these Financial Statements.

Going concern is assessed over the period until 12 months from

the approval of these Consolidated Financial Statements. Owing to

the fact that the Group currently has no borrowing, has a

significant cash holding and that the Company's equity investments

predominantly comprise readily realisable securities, the Board

considers there to be no material uncertainty.

Interim Report is Unaudited

This Interim Report has not been audited, nor reviewed by

auditors pursuant to the Auditing Practices Board guidance on

Review of Interim Financial Information.

Responsibility Statement

We confirm to the best of our knowledge that:

-- the Condensed Unaudited Interim Financial Statements have

been prepared in accordance with International Accounting Standard

34 'Interim Financial Reporting'; as required by Disclosure

Guidance & Transparency Rule ("DTR") 4.2.4R of the UK's

Financial Conduct Agency ("FCA"); and

-- the Interim Management report includes a fair review of the information required by:

(a) DTR 4.2.7R of the Disclosure and Transparency Rules, being

an indication of important events which have occurred during the

first six months of the financial year and their impact on the

condensed set of Financial Statements; and a description of the

principal risks and uncertainties for the remaining six months of

the year; and

(b) DTR 4.2.8R of the Disclosure and Transparency Rules, being

related party transactions which have taken place in the first six

months of the current financial year and which have materially

affected the financial position or performance of the entity during

that period; and any changes in the related party transactions

described in the last Annual Report which could do so.

The Directors are responsible for the maintenance and integrity

of the corporate and financial information included on the

Company's website, and for the preparation and dissemination of

financial statements. Legislation in Guernsey governing the

preparation and dissemination of financial statement may differ

from legislation in other jurisdictions.

On behalf of the Board

W. Scott

Chairman

13 December 2023

Condensed Unaudited Consolidated Statement of Comprehensive

Income

For the six months ended 30 September 2023

For the six For the six

month period month period

to to

30 September 30 September

2023 2022

(Unaudited) (Unaudited)

Notes GBP000s GBP000s

---- ------ --------------------------------------- ------ -------------- --------------

3 &

Gross property income 6 394 380

3 &

Property operating expenses 6 (98) (73)

Net property income 296 307

----------------------------------------------------- ------ -------------- --------------

Net loss on investments at fair

value through profit or loss 7 (188) (75)

Unrealised valuation loss on investment

property (260) (170)

Lease incentive movement 3 64 25

General and administrative expenses 4 (282) (260)

---- ----------------------------------------------- ------ -------------- --------------

Operating loss (370) (173)

----------------------------------------------------- ------ -------------- --------------

Loss before tax (370) (173)

----------------------------------------------------- ------ -------------- --------------

Income tax expense (53) (36)

Tax credit 75 -

Loss for the period (348) (209)

----------------------------------------------------- ------ -------------- --------------

Other comprehensive income

Foreign exchange translation (loss)/gain (102) 320

------------------------------------------------ ------ -------------- --------------

Total items which are or may be reclassified

to profit or loss (450) 111

----------------------------------------------------- ------ -------------- --------------

Total comprehensive (loss)/profit

for the period (450) 111

----------------------------------------------------- ------ -------------- --------------

Basic and diluted loss per ordinary

share (pence) 5 (1.03) (0.62)

----------------------------------------------------- ------ -------------- --------------

Condensed Unaudited Consolidated Statement of Changes in

Equity

For the six months ended 30 September 2023

Foreign

Distributable currency Total

Revenue reserve reserve reserve equity

(Unaudited) (Unaudited) (Unaudited) (Unaudited)

GBP000s GBP000s GBP000s GBP000s

-------------------------- ---------------- -------------- ------------ ------------

Balance at 1 April 2023 (44,446) 47,263 12,002 14,819

Loss for the period (348) - - (348)

Other comprehensive loss - - (102) (102)

Balance at 30 September

2023 (44,794) 47,263 11,900 14,369

--------------------------- ---------------- -------------- ------------ ------------

For the six months ended 30 September 2022

Foreign

Distributable currency Total

Revenue reserve reserve reserve equity

(Unaudited) (Unaudited) (Unaudited) (Unaudited)

GBP000s GBP000s GBP000s GBP000s

---------------------------- ---------------- -------------- ------------ ------------

Balance at 1 April 2022 (45,477) 47,263 11,680 13,466

Loss for the period (209) - - (209)

Other comprehensive income - - 320 320

Balance at 30 September

2022 (45,686) 47,263 12,000 13,577

----------------------------- ---------------- -------------- ------------ ------------

Condensed Unaudited Consolidated Statement of Financial

Position

As at 30 September 2023

30 September

2023 31 March 2023

(Unaudited) (Audited)

Notes GBP000s GBP000s

--------- -------------------------------- ------ ------------- --------------

Non-current assets

Investment property 6 5,750 6,033

Lease incentive 6 663 737

------------------------------------------ ------ ------------- --------------

Total non-current assets 6,413 6,770

Current assets

Cash and cash equivalents 400 541

Investments held at fair value

through profit or loss 7 7,750 7,839

Trade and other receivables 8 31 54

Tax receivable 23 29

------------------------------------------ ------ ------------- --------------

Total current assets 8,204 8,463

Total assets 14,617 15,233

------------------------------------------- ------ ------------- --------------

Non-current liabilities

Deferred tax payable - 75

------------------------------------------ ------ ------------- --------------

Total non-current liabilities - 75

Current liabilities

Trade and other payables 9 153 178

Tax payable 95 161

------------------------------------------ ------ ------------- --------------

Total current liabilities 248 339

Total liabilities 248 414

------------------------------------------- ------ ------------- --------------

Total net assets 14,369 14,819

------------------------------------------- ------ ------------- --------------

Equity

Revenue reserve (44,794) (44,446)

Distributable reserve 47,263 47,263

Foreign currency reserve 11,900 12,002

Total equity 14,369 14,819

------------------------------------------- ------ ------------- --------------

Number of ordinary shares 33,740,929 33,740,929

Net asset value per ordinary share

(pence) 11 42.59 43.92

------------------------------------------- ------ ------------- --------------

The Financial Statements were approved by the Board of Directors

and authorised for issue on 13 December 2023. They were signed on

its behalf by:

W. Scott

Chairman

Condensed Unaudited Consolidated Statement of Cash Flows

For the sixth months ended 30 September 2023

For the six For the six

month period month period

to to

30 September 30 September

2023 2022

(Unaudited) (Unaudited)

Notes GBP000s GBP000s

----------------------------------------- ------ -------------- --------------

Operating activities

Loss before tax (370) (173)

Adjustments for:

Net loss on investments held at

fair value through profit or loss 7 188 75

Investment income 229 203

Unrealised valuation loss on investment

property 196 170

Decrease/(increase) in trade and

other receivables 97 (32)

Decrease in trade and other payables (25) (42)

Purchase of investments held at

fair value through profit or loss 7 (352) (533)

Sale of investments held at fair

value through profit or loss 7 24 412

Net cash from operations (13) 80

-------------------------------------------------- -------------- --------------

Tax paid (125) (27)

Net cash (outflow)/inflow from operating

activities (138) 53

-------------------------------------------------- -------------- --------------

Effects of exchange rate fluctuations (3) 47

(Decrease)/increase in cash and cash

equivalents (141) 100

-------------------------------------------------- -------------- --------------

Cash and cash equivalents at start

of the period 541 576

Cash and cash equivalents at the period

end 400 676

-------------------------------------------------- -------------- --------------

1. Operations

Worsley Investors Limited (the "Company") is a limited

liability, closed-ended investment company incorporated in

Guernsey. The Company historically invested in commercial property

in Europe which was held through subsidiaries. The Company's

current investment objective is to provide Shareholders with an

attractive level of absolute long-term return, principally through

the capital appreciation and exit of undervalued securities. The

existing real estate asset of the Company will be realised in an

orderly manner, that is with a view to optimising the disposal

value of such asset.

The Condensed Unaudited Consolidated Financial Statements (the

"Financial Statements") of the Company for the period ended 30

September 2023 comprise the Financial Statements of the Company and

its Subsidiaries (together referred to as the "Group").

Worsley Associates LLP was appointed on 31 May 2019 as

Investment Advisor to the Company.

2. Significant accounting policies

Basis of preparation

These Financial Statements have been prepared in accordance with

International Accounting Standard ("IAS") 34 'Interim Financial

Reporting' as required by DTR 4.2.4R, the Listing Rules of the

London Stock Exchange and applicable legal and regulatory

requirements. They do not include all the information and

disclosures required in Annual Financial Statements and should be

read in conjunction with the Company's last Annual Report and

Audited Consolidated Financial Statements for the year ended 31

March 2023.

The same accounting policies and methods of computation are

followed in the Interim Financial Report as compared with the most

recent Annual Financial Statements for the year ended 31 March

2023.

Going concern

The Directors, at the time of approving the Financial

Statements, have a reasonable expectation that the Group has

adequate resources to continue in operational existence for the

next 12 months.

The Group maintains a significant cash balance and an extensive

portfolio of securities, and the property lease generates

sufficient cash flows to pay on-going expenses and other

obligations. The Directors have considered the cash position and

performance of the current capital invested by the Group, the

potential impact on markets and supply chains of geo-political

risks such as the crisis in Ukraine and continuing macro-economic

factors and inflation and concluded that it is appropriate to adopt

the going concern basis in the preparation of these Financial

Statements.

Going concern is assessed over a minimum period of 12 months

from the approval of these Financial Statements. The Board consider

there to be no material uncertainty owing to the fact that the

Group currently has no borrowing, retains a significant cash

balance and that the Company's equity investments comprise

predominantly readily realisable securities.

3. Gross property income

Gross property income for the period ended 30 September 2023

amounted to GBP0.394 million (30 September 2022: GBP0.380 million).

The Group leases out its investment property under an operating

lease which is structured in accordance with local practices in

Italy. The Group's lease agreement in place as at 30 September 2023

was unchanged from that disclosed in the Company's Audited Annual

Financial Statements for the year ended 31 March 2023.

Property income

30 September 30 September

2023 2022

GBP000s GBP000s

(Unaudited) (Unaudited)

---------------------------------------------------- ------------- -------------

Property income received (net of lease incentives) 458 405

Straight-lining of lease incentives (64) (25)

Property income 394 380

---------------------------------------------------- ------------- -------------

Expense from services to tenants, other property operating and

administrative expenses

30 September 30 September

2023 2022

GBP000s GBP000s

(Unaudited) (Unaudited)

------------------------------------------- ------------- -------------

Property expenses arising from investment

property which generates income 98 73

------------------------------------------- ------------- -------------

Total property operating expenses 98 73

------------------------------------------- ------------- -------------

There were no p roperty expenses arising from investment

property which did not generate income.

4. General and administrative expenses

30 September 30 September

2023 2022

GBP000s GBP000s

(Unaudited) (Unaudited)

------------------------ ---------------------------- ------------- -------------

Administration fees 54 54

General expenses 48 37

Audit fees 27 25

Legal and professional fees 10 9

Directors' fees

(note 13) 25 23

Insurance costs 13 14

Corporate broker fees 12 13

Investment Advisor fees (note 13) 93 85

Total 282 260

---------------------------------------------------------- ------------- -------------

5. Basic and diluted earnings per ordinary share (pence)

The basic and diluted earnings per share for the Group is based

on the net loss for the period of GBP0.393 million (30 September

2022: net loss of GBP0.209 million) and the weighted average number

of Ordinary Shares in issue during the period of 33,740,929 (30

September 2022: 33,740,929). There are no instruments in issue

which could potentially dilute earnings or loss per Ordinary

Share.

6. Investment property

6 months

ended Year ended

30 September

2023 31 March 2023

(Unaudited) (Audited)

GBP000s GBP000s

------------------------------------------------- ------------- --------------

Valuation of investment property before lease

incentive adjustment

at beginning of period/year 6,770 7,328

Fair value adjustment (260) (862)

Foreign exchange translation (97) 304

Independent external valuation 6,413 6,770

Adjusted for: Lease incentive* (663) (737)

Fair value of investment property at the

end of the period/year 5,750 6,033

--------------------------------------------------- ------------- --------------

* The Lease incentive is separately classified as a non-current

asset within the Consolidated Statement of Financial Position and

to avoid double counting is hence deducted from the independent

property valuation to arrive at fair value for accounting

purposes.

The property is carried at fair value. The lease incentive

granted to the tenant is amortised over the term of the lease. In

accordance with IFRS, the external independent valuation is reduced

by the carrying amount of the lease incentive as at the valuation

date.

Quarterly valuations are carried out at 31 March, 30 June, 30

September and 31 December by Knight Frank LLP, external independent

valuers. The valuation of the investment property is recorded in

Euros and converted into Pounds Sterling at the end of each

reporting period. The rates used were as follows:

30 September 2023 31 March 2023

(Unaudited) (Audited)

------------ ------------------ --------------

Euro / GBP 1.1538 1.1374

The resultant fair value of investment property is analysed

below by valuation method, according to the levels of the fair

value hierarchy. The different levels have been defined as

follows:

Level 1: quoted (unadjusted) prices in active markets for

identical assets or liabilities;

Level 2: inputs other than quoted prices included within Level 1

which are observable for asset or liability, either directly (i.e.

as prices) or indirectly (i.e. derived from prices);

Level 3: inputs for the asset or liability which are not based

on observable market data (unobservable inputs).

The investment property (Curno) is classified as Level 3.

The significant assumptions made relating to its independent

valuation are set out below:

Significant assumptions 30 September 2023 31 March 2023

(Unaudited) (Audited)

---------------------------------------------------- ------------------ --------------

Gross estimated rental value per square metre p.a. EUR114.00 EUR114.00

Equivalent yield 13.46% 12.97%

The external valuer has carried out its valuation using the

comparative and investment methods. The external valuer has made

the assessment on the basis of a collation and analysis of

appropriate comparable investment and rental transactions. The

market analysis has been undertaken using market knowledge,

enquiries of other agents, searches of property databases, as

appropriate and any information provided to them. The external

valuer has adhered to the RICS Valuation - Professional

Standards.

An increase/decrease in ERV (Estimated Rental Value) will

increase/decrease valuations, while an increase/decrease to yield

decreases/increases valuations. The information below sets out the

sensitivity of the independent property valuation to changes in

Fair Value.

If market rental increases by 10% then property value increases

by 1.88%, being EUR139,120 (31 March 2023: 1.85%, being

EUR142,817).

If market rental decreases by 10% then property value decreases

by 1.88% being EUR139,120 (31 March 2023: 1.85%, being

EUR142,817).

If yield increases by 1% then property value decreases by 5.74%,

being EUR424,760 (31 March 2023: 5.91%, being EUR456,044).

If yield decreases by 1% then property value increases by 6.66%,

being EUR492,840 (31 March 2023: 6.89%, being EUR532,021).

Property assets are inherently difficult to value owing to the

individual nature of each property. As a result, valuations are

subject to uncertainty. There is no assurance that estimates

resulting from the valuation process will reflect the actual sales

price even where a sale occurs shortly after the valuation date.

Rental income and the market value for properties are generally

affected by overall conditions in the local economy, such as growth

in Gross Domestic Product ("GDP"), employment trends, inflation and

changes in interest rates. Changes in GDP may also impact

employment levels, which in turn may impact the demand for

premises. Furthermore, movements in interest rates may affect the

cost of financing for real estate companies.

Both rental income and property values may be affected by other

factors specific to the real estate market, such as competition

from other property owners, the perceptions of prospective tenants

of the attractiveness, convenience and safety of properties, the

inability to collect rents because of the bankruptcy or the

insolvency of tenants, the periodic need to renovate, repair and

release space and the costs thereof, the costs of maintenance and

insurance, and increased operating costs. The Investment Advisor

addresses market risk through a selective investment process,

credit evaluations of tenants, ongoing monitoring of tenants and

through effective management of the property.

7. Investments at fair value through profit or loss

("FVTPL")

6 months ended Year ended

30 September 2023 31 March 2023

GBP000s GBP000s

(Unaudited) (Audited)

Opening book cost 4,908 3,983

Total unrealised gains at beginning of period 2,931 1,990

---------------------------------------------------------------- ------------------ --------------

Fair value of investments at FVTPL at beginning of period 7,839 5,973

Purchases 352 1,223

Sales (24) (563)

Realised gains 13 264

Unrealised (losses)/gains (430) 942

---------------------------------------------------------------- ------------------ --------------

Total investments at FVTPL 7,750 7,839

---------------------------------------------------------------- ------------------ --------------

Closing book cost 5,249 4,908

Total unrealised gains at end of period 2,501 2,931

Total investments at FVTPL 7,750 7,839

----------------------------------------------- ------- ------

30 September 2023 30 September 2022

GBP000s GBP000s

(Unaudited) (Unaudited)

Realised gains 13 168

Unrealised losses (430) (446)

------------------------------------------------- ------------------ ------------------

Total losses on investments at FVTPL (417) (278)

------------------------------------------------- ------------------ ------------------

Investment income 229 203

------------------------------------------------- ------------------ ------------------

Total losses on financial assets at FVTPL (188) (75)

------------------------------------------------- ------------------ ------------------

The fair value of investments at FVTPL are analysed below by

valuation method, according to the levels of the fair value

hierarchy. The different levels have been defined as follows:

Level 1: quoted (unadjusted) prices in active markets for

identical assets or liabilities;

Level 2: inputs other than quoted prices included within Level 1

which are observable for asset or liability, either directly (i.e.

as prices) or indirectly (i.e. derived from prices);

Level 3: inputs for the asset or liability which are not based

on observable market data (unobservable inputs).

The following table analyses within the fair value hierarchy the

Company's financial assets at fair value through profit or

loss:

30 September 2023 Level 1 Level 2 Level 3 Total

GBP000s GBP000s GBP000s GBP000s

Fair value through profit or loss

----------- -------- -------- --------

- Investments 5,244 2,506 - 7,750

----------- -------- -------- --------

As at 30 September 2023, within the Company's financial assets

classified as Level 2, securities totalling GBP1,424,323 are traded

on the London Stock Exchange or AIM, with securities of

GBP1,081,500 being traded on the Aquis Exchange. The Level 2

securities are valued at the traded price as at the period end and

no adjustment has been deemed necessary to these prices. However,

although these are traded, they are not regularly traded in

significant volumes and hence have been classified as level 2.

31 March 2023 Level 1 Level 2 Level 3 Total

GBP000s GBP000s GBP000s GBP000s

Fair value through profit or loss

----------- -------- -------- --------

- Investments 5,847 1,992 - 7,839

----------- -------- -------- --------

As at 31 March 2023, within the Company's financial assets

classified as Level 2, securities totalling GBP1,162,559 were

traded on the London Stock Exchange or AIM Market and securities of

GBP829,100 were traded on the Aquis Exchange. The Level 2

securities were valued at the traded price as at the year end and

no adjustment were deemed necessary to these prices. However,

although these were traded, they were not regularly traded in

significant volumes and hence were classified as level 2.

The valuation and classification of the investments are reviewed

on a regular basis. The Board determines whether or not transfers

have occurred between levels in the hierarchy by re-assessing

categorisation (based on the lowest level input which is

significant to the fair value measurement as a whole) at the end of

each reporting period.

8. Trade and other receivables

30 September

2023 31 March 2023

GBP000s GBP000s

(Unaudited) (Audited)

------------- ------------- --------------

Prepayments 31 54

Total 31 54

--------------- ------------- --------------

The carrying values of trade and other receivables are

considered to be approximately equal to their fair value.

9. Trade and other payables

30 September

2023 31 March 2023

GBP000s GBP000s

(Unaudited) (Audited)

-------------------------------------- ------------- --------------

Investment Advisor's fee (note 13) 16 15

Administration fees 38 18

Audit fee 24 42

Directors' fees payable (note 13) - 2

Other 75 101

Total 153 178

-------------------------------------- ------------- --------------

Trade and other payables are non-interest bearing and are

normally settled on 30-day terms. The carrying values of trade and

other payables are considered to be approximately equal to their

fair value.

10. Share capital

6 months ended Year ended

30 September 2023 31 March 2023

Number of shares Number of shares

(Unaudited) (Audited)

Shares of no par value issued and fully paid

Balance at the start of the period/year 33,740,929 33,740,929

Balance at the end of the period/year 33,740,929 33,740,929

---------------------------------------------- ------------------ -----------------

6 months ended Year ended

30 September 2023 31 March 2023

GBP000s GBP000s

(Unaudited) (Audited)

-------------------------------------------------------------------------- ------------------ --------------

Balance at the start of the period/year 14,819 13,466

(Loss)/profit for the period/year and other comprehensive (loss)/ income (450) 1,353

Balance at the end of the period/year 14,369 14,819

-------------------------------------------------------------------------- ------------------ --------------

No shares were issued by the Company during the period (31 March

2023: none).

11. Net asset value per ordinary share

The Net Asset Value per Ordinary Share at 30 September 2023 is

based on the net assets attributable to the ordinary shareholders

of GBP14.369 million (31 March 2023: GBP14.819 million) and on

33,740,929 (31 March 2023: 33,740,929) ordinary shares in issue at

the Consolidated Statement of Financial Position date.

12. Financial risk management

The Company's financial risk management objectives and policies

are consistent with those disclosed in the Company's Audited Annual

Financial Statements for the year ended 31 March 2023.

13. Related party transactions

The Directors are responsible for the determination of the

Company's investment objective and policy and have overall

responsibility for the Group's activities including the review of

investment activity and performance.

Mr Nixon, a Director of the Company, is also Founding Partner

and a Designated Member of Worsley Associates LLP ("Worsley"). The

total charge to the Consolidated Income Statement during the period

in respect of Investment Advisor fees to Worsley was GBP92,722 (30

September 2022: GBP85,450) of which GBP15,657 (31 March 2023:

GBP15,277) remained payable at the period end.

Upon appointment of Worsley as Investment Advisor (31 May 2019),

Mr Nixon waived his future Director's fee for so long as he is a

member of the Investment Advisor.

The Directors who served on the Board during the period,

together with their beneficial interests at 30 September 2023 and

at 31 March 2023, were as follows:

30 September 2023 31 March 2023

Ordinary Ordinary

shares % of shareholdings shares % of shareholdings

Blake Nixon 10,083,126 29.88% 10,083,126 29.88%

William Scott 718,811 2.13% 678,811 2.01%

Robert Burke - - - -

The aggregate remuneration and benefits in kind of the Directors

and directors of its subsidiaries in respect of the Company's

period ended 30 September 2023 amounted to GBP24,690 (30 September

2022: GBP22,975) in respect of the Group of which GBP17,500 (30

September 2022: GBP17,500) was in respect of the Company. No mounts

were payable at the period end (31 March 2023: GBP1,912).

All the above transactions were undertaken at arm's length.

14. Capital commitments and contingent liability

As at 30 September 2023 the Company has no capital commitments

(31 March 2023: no commitments).

15. Segmental analysis

As at 30 September 2023, the Group has two segments (31 March

2023: two).

The following summary describes the operations in each of the

Group's reportable segments for the current period:

Property Group Management of the Group's property asset.

Parent Company Parent Company, which holds listed equity investments

Information regarding the results of each reportable segment is

shown below. Performance is measured based on segment profit/(loss)

for the period, as included in the internal management reports that

are reviewed by the Board, which is the Chief Operating Decision

Maker ("CODM"). Segment profit is used to measure performance as

management believes that such information is the most relevant in

evaluating the results of certain segments relative to other

entities that operate within these industries.

The accounting policies of the reportable segments are the same

as the Group's accounting policies.

(a) Group's reportable segments

Continuing Operations

30 September 2023 Property Group Parent Company Total

GBP000 GBP000 GBP000

External revenue

Gross property income 394 - 394

Property operating expenses (98) - (98)

Net loss on investments at fair value through profit or loss - (188) (188)

Unrealised valuation loss on investment property (260) - (260)

Lease incentive movement 64 - 64

--------------- --------------- -------

Total segment revenue 100 (188) (88)

Expenses

General and administrative expenses (72) (210) (282)

--------------- --------------- -------

Total operating expenses (72) (210) (282)

Profit/(loss) before tax 28 (398) (370)

Income tax charge (53) - (53)

Tax credit 75 - 75

--------------- --------------- -------

Profit/(loss) after tax 50 (398) (348)

Profit/(loss) for the period 50 (398) (348)

--------------- --------------- -------

Total assets 6,525 8,092 14,617

--------------- --------------- -------

Total liabilities 153 95 248

--------------- --------------- -------

Continuing Operations

30 September 2022 Property Group Parent Company Total

GBP000 GBP000 GBP000

External revenue

Gross property income 380 - 380

Property operating expenses (73) - (73)

Net loss on investments at fair value through profit or loss - (75) (75)

Unrealised valuation loss on investment property (170) - (170)

Lease incentive movement 25 - 25

--------------- --------------- -------

Total segment revenue 162 (75) 87

Expenses

General and administrative expenses (63) (197) (260)

--------------- --------------- -------

Total operating expenses (63) (197) (260)

Profit/(loss) before tax 99 (272) (173)

Income tax charge (36) - (36)

--------------- --------------- -------

Profit/(loss) after tax 63 (272) (209)

Profit/(loss) for the period 63 (272) (209)

--------------- --------------- -------

Total assets 7,789 6,216 14,005

--------------- --------------- -------

Total liabilities 269 159 428

--------------- --------------- -------

(b) Geographical information

The Company is domiciled in Guernsey. The Group has subsidiaries

incorporated in Europe.

The Group's revenue from external customers from continuing

operations and information about its segment non-current assets by

geographical location (of the country of incorporation of the

entity earning revenue or holding the asset) are detailed

below:

Revenue from External Customers Non-Current Assets

For the six months ended

30 September 2023 30 September 2023

GBP000 GBP000

-------- -------------------------------- -------------------

Europe 394 6,413

394 6,413

-------------------------------- -------------------

Revenue from External Customers Non-Current Assets

For the six months ended

30 September 2022 31 March 2023

GBP000 GBP000

-------- ---------------------------------------- -------------------

Europe 380 6,770

380 6,770

---------------------------------------- -------------------

16. Net asset value reconciliation

The following is a reconciliation of the net asset value per

share attributable to ordinary shareholders as presented in these

Financial Statements to the net asset value per share reported to

the London Stock Exchange:

NAV per Ordinary Share

30 September 2023 (pence)

------------------------------------------------------------------------------ -----------------------

Net Asset Value reported to London Stock Exchange (unaudited) 42.37

Increase in current assets 0.22

------------------------------------------------------------------------------ -----------------------

Net Assets Attributable to Shareholders per Financial Statements (unaudited) 42.59

------------------------------------------------------------------------------ -----------------------

17. Subsequent events

There were no post period end events which require disclosure in

these Financial Statements.

Portfolio statement (unaudited)

as at 30 September 2023

Fair value % of Group

Currency GBP'000 Net Assets

------------------------------------- ---------- ----------- ------------

Property

UCI Curno EUR 6,413 44.63%

Less: lease incentive EUR (663) (4.61%)

----------- ------------

Total 5,750 40.02%

----------- ------------

Securities

Smiths News Plc GBP 4,299 29.92%

Northamber Plc GBP 667 4.64%

Amedeo Air Four Plus Limited GBP 637 4.43%

Shepherd Neame Limited GBP 580 4.04%

Daniel Thwaites PLC GBP 502 3.49%

J. Smart & Co (Contractors) PLC GBP 256 1.78%

LMS Capital plc GBP 151 1.05%

7,092 49.35%

Total disclosed securities

Other securities (none greater than

2% of Net Assets) GBP 658 4.58%

Total securities 7,750 53.93%

----------- ------------

Total investments 13,500 93.95%

----------- ------------

Investment Policy

Investment Objective and Policy Change

Investment Objective

The Company's investment objective is to provide shareholders

with an attractive level of absolute long-term return, principally

through the capital appreciation and exit of undervalued

securities. The existing real estate asset of the Company will be

realised in an orderly manner, that is with a view to optimising

the disposal value of such asset.

Investment Policy

The Company aims to meet its objectives through investment

primarily, although not exclusively, in a diversified portfolio of

securities and related instruments of companies listed or admitted

to trading on a stock market in the British Isles (defined as (i)

the United Kingdom of Great Britain and Northern Ireland; (ii) the

Republic of Ireland; (iii) the Bailiwicks of Guernsey and Jersey;

and (iv) the Isle of Man). The majority of such companies will also

be domiciled in the British Isles. Most of these companies will

have smaller to mid-sized equity market capitalisations (the

definition of which may vary from market to market, but will in

general not exceed GBP600 million). It is intended to secure

influential positions in such British quoted securities with the

deployment of activism as required to achieve the desired

results.

The Company, Property Trust Luxembourg 2 SARL and Multiplex 1

SRL ("the Group") may make investments in listed and unlisted

equity and equity-related securities such as convertible bonds,

options and warrants. The Group may also use derivatives, which may

be exchange traded or over-the-counter.

The Group may also invest in cash or other instruments including

but not limited to: short, medium or long term bank deposits in

Pound sterling and other currencies, certificates of deposit and

the full range of money market instruments; fixed and floating rate

debt securities issued by any corporate entity, national

government, government agency, central bank, supranational entity

or mutual society; futures and forward contracts in relation to any

other security or instrument in which the Group may invest; put and

call options (however, the Group will not write uncovered call

options); covered short sales of securities and other contracts

which have the effect of giving the Group exposure to a covered

short position in a security; and securities on a when-issued basis

or a forward commitment basis.

The Group pursues a policy of diversifying its risk. Save for

the Curno Asset until such time as it is realised, the Group

intends to adhere to the following investment restrictions:

-- not more than 30 per cent. of the Gross Asset Value at the

time of investment will be invested in the securities of a single

issuer (such restriction does not, however, apply to investment of

cash held for working capital purposes and pending investment or

distribution in near cash equivalent instruments including

securities issued or guaranteed by a government, government agency

or instrumentality of any EU or OECD Member State or by any

supranational authority of which one or more EU or OECD Member

States are members);

-- the value of the four largest investments at the time of

investment will not constitute more than 75 per cent of Gross Asset

Value;

-- the value of the Group's exposure to securities not listed or

admitted to trading on any stock market will not exceed in

aggregate 35 per cent. of the Net Asset Value;

-- the Group may make further direct investments in real estate

but only to the extent such investments will preserve and/or

enhance the disposal value of its existing real estate asset. Such

investments are not expected to be material in relation to the

portfolio as a whole but in any event will be less than 25 per

cent. of the Gross Asset Value at the time of investment. This

shall not preclude Property Trust Luxembourg 2 SARL and Multiplex 1

SRL (the "Subsidiaries") from making such investments for

operational purposes;

-- the Company will not invest directly in physical commodities,

but this shall not preclude its Subsidiaries from making such

investments for operational purposes;

-- investment in the securities, units and/or interests of other

collective investment vehicles will be permitted up to 40 per cent.

of the Gross Asset Value, including collective investment schemes

managed or advised by the Investment Advisor or any company within

the Group; and

-- the Company must not invest more than 10 per cent. of its

Gross Asset Value in other listed investment companies or listed

investment trusts, save where such investment companies or

investment trusts have stated investment policies to invest no more

than 15 per cent. of their gross assets in other listed investment

companies or listed investment trusts.

The percentage limits above apply to an investment at the time

it is made. Where, owing to appreciation or depreciation, changes

in exchange rates or by reason of the receipt of rights, bonuses,

benefits in the nature of capital or by reason of any other action

affecting every holder of that investment, any limit is breached by

more than 10 per cent., the Investment Advisor will, unless

otherwise directed by the Board, ensure that corrective action is

taken as soon as practicable.

Borrowing and Leverage

The Group may engage in borrowing (including stock borrowing),

use of financial derivative instruments or other forms of leverage

provided that the aggregate principal amount of all borrowings

shall at no point exceed 50 per cent. of Net Asset Value. Where the

Group borrows, it may, in order to secure such borrowing, provide

collateral or security over its assets, or pledge or charge such

assets.

Corporate Information

Directors (All non-executive) Registered Office

W. Scott (Chairman) 1 Royal Plaza

R. H. Burke Royal Avenue

B. A. Nixon St Peter Port

Guernsey, GY1 2HL

Investment Advisor Administrator and Secretary

Worsley Associates LLP Sanne Fund Services (Guernsey) Limited

First Floor 1 Royal Plaza

Barry House Royal Avenue

20 - 22 Worple Road St Peter Port

Wimbledon, SW19 4DH Guernsey, GY1 2HL

United Kingdom

Financial Adviser Corporate Broker

Shore Capital and Corporate Limited Shore Capital Stockbrokers Limited

Cassini House Cassini House

57 St James's Street 57 St James's Street

London, SW1A 1LD London SW1A 1LD

United Kingdom United Kingdom

Independent Auditor Registrar

BDO Limited Computershare Investor Services (Guernsey)

Place du Pré Limited

Rue du Pré 1(st) Floor

St Peter Port Tudor House

Guernsey, GY1 3LL Le Bordage

St Peter Port

Guernsey, GY1 1DB

Registration Number

43007

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BIBDDCSBDGXX

(END) Dow Jones Newswires

December 14, 2023 02:00 ET (07:00 GMT)

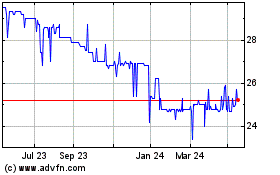

Worsley Investors (LSE:WINV)

Historical Stock Chart

From Dec 2024 to Jan 2025

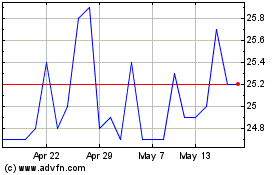

Worsley Investors (LSE:WINV)

Historical Stock Chart

From Jan 2024 to Jan 2025