TIDMWPHO

RNS Number : 4423N

Windar Photonics PLC

25 September 2023

25 September 2023

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

Windar Photonics plc

("Windar", the "Company" or the "Group")

Unaudited interim report for the six months ended 30 June

2023

Windar Photonics plc (AIM:WPHO), the technology group that has

developed a cost efficient and innovative LiDAR wind sensor for use

on electricity generating wind turbines, announces its unaudited

interim results for the six months ended 30 June 2023.

Financial highlights

-- revenue increased by 220% to EUR1.3 million (H1 2022: EUR0.4 million)

-- gross profit increased by 290% to EUR0.74 million (H1 2022: EUR0.19 million)

-- EBITDA loss reduced to EUR0.27 million (H1 2022: EUR0.74 million)

Operational highlights

-- overall production capacity increased to 80-100 systems per

month, despite supply chain challenges

-- new COO appointed in March to further strengthen the

Company's production and logistics functions

-- relocated its China operations to a new facility in Shanghai

-- completed the test project on a GE 1.6MW platform in North

America, demonstrating a potential increase of 3.2% in its annual

energy production

For further information, please contact:

Windar Photonics plc Tel: +45 24234930

Jørgen Korsgaard Jensen, CEO

WH Ireland Limited Tel: +44 20 7220 1666

Chris Fielding / James Bavister /

Isaac Hooper

Notes to Editors:

Windar Photonics is a technology group that develops

cost-efficient and innovative Light Detection and Ranging ("LiDAR")

optimisation systems for use on electricity generating wind

turbines. LiDAR wind sensors in general are designed to remotely

measure wind speed and direction.

http://investor.windarphotonics.com

The person responsible for arranging the release of this

announcement on behalf of the Company is Jørgen Korsgaard Jensen,

Chief Executive of the Company.

CHAIRMAN'S STATEMENT

The Board is delighted to report that revenue for the first half

year of 2023 increased by 220% to EUR1.3 million (H1 2022: EUR0.4

million).

This was achieved despite revenue in the first 3 months of the

year being negatively impacted by component shortages following the

COVID pandemic and subsequent supply chain issues.

Besides navigating these component shortages during the first

half year, the Company has been focused on increasing the overall

production capacity, both internally and within our supply chain,

and is pleased to announce that overall production capacity when

entering the second half of 2023 has been doubled, since 2022, to

approximately 80-100 systems per month.

The Gross profit for the period amounted to EUR0.74 million (H1

2022: EUR0.19 million), representing a Gross margin of 54.9%

compared to a gross margin in the first half of 2022 of 46.3%. The

increase was predominantly due to a more favorable product and

customer mix, which are expected to continue going forward.

Due to the increased activity level, operational expenses,

excluding amortisation, depreciation and warrant costs, increased

by 7.2% to EUR1.02 million (H1 2022: EUR.96 million), as a result

of which the Company reported a reduced EBITDA loss of EUR0.27

million (H1 2022: EUR0.74 million).

During the first half of 2023 the Board made some strategic

decisions affecting the operational expenses. Firstly, it hired in

March a new COO to further strengthen the performance of the

Company's production and logistics functions. Secondly, in February

the Company relocated its China operations to a new facility in

Shanghai, as a result of which, the Company is better positioned to

serve the growing demand from Chinese customers and in due course

to have the flexibility to establish local assembly facilities.

Project wise the Company completed the previously announced test

project on a GE 1.6MW platform in North America. Overall the test

demonstrated a potential increase of 3.2% in Annual Energy

Production (AEP). Part of the improvement was due to identification

of non-optimal turbine settings. This is an important result for

the Company since it demonstrates the efficacy of our product in

respect of an additional operating platform. The Board estimates

that approximately 15,000 turbines of this type are currently

installed globally.

The Company is currently discussing with this particular client

a roll-out of our Lidar as a Service (LaaS) concept, whereby the

revenue stream from this project will be more consultancy oriented.

This consultancy service does require accurate Lidar-based data, as

the existing wind turbine data was insufficiently accurate.

Financial Overview

Overall, the Group reported increased revenues of EUR1.3 million

(H1 2022: EUR0.4 million) and a reduced net loss of EUR0.37 million

for the period (H1 2022: loss of EUR0.76 million) after

depreciation, amortisation and warrant costs of EUR0.13 million (H1

2022: EUR0.09 million).

Due to primarily the depreciation of the Chinese currency of 6%

against the euro during the first half of 2023, other comprehensive

income amounted to EUR0.09 million (H1 2022: (EUR0.04 million)).

Net equity at the end of the period amounted to EUR0.06 million (H1

2022: ((EUR1.54 million)).

Cash flow from operations produced a net outflow of EUR1.1

million for the period, compared to a net inflow of EUR0.1 million

in H1 2022. Movements in working capital items amounted to a net

outflow of EUR0.6 million for the period compared to a net inflow

of EUR1.2 million in H1 2022.

Outlook

At the start of the second half, the Company had an order

backlog of EUR3.8 million for delivery during the year. However,

current customer delivery schedules for the second half now amount

to approximately EUR5.2 million, of which EUR2.2 million has

already been delivered .

In addition, at the end of August the Company had outstanding

quotations with customers amounting to approximately EUR6.0

million, the vast majority of which are expected to be rolled over

into 2024 in light of the timing of the final order and assembly

capacity.

Regarding the above-mentioned US GE 1.6MW project, this project

was initially planned for a full roll-out in 2023. However, this is

now expected to be transformed into a consultancy contract with

revenue in the order of EUR0.8-1.0 million primarily spread over

2024.

Given the above the Company expects to meet the current market

expectations for 2023 including net revenue of approximately EUR6.5

million - an increase of approximately 260% compared to 2022 (2022:

EUR1.8 million), and an EBITDA result of approximately EUR1.5-1.6

million compared to an EBITDA loss of EUR1.1 million realised in

2022. This would represent a record-breaking revenue for the

Company and its maiden profit.

As the Company expects to see continued growth in China in 2024

a main focus for the second half of 2023 is to increase production

capacity further to approximately 150 systems per month by the end

of the year.

CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE

INCOME

FOR THE SIX MONTHSED 30 JUNE 2023

Six months Six months Year ended

ended 30 June ended 30 31 December

2023 June 2022 2022

(unaudited) (unaudited) (audited)

Note EUR EUR EUR

Revenue 1,347,072 420,555 1,853,249

Cost of goods sold (607,584) (225,853) (906,638)

--------------------------- --------------- -----------------

Gross profit 739,488 194,702 946,611

Administrative expenses (1,155,834) (1,047,542) (1,953,607)

Other operating income 16,115 16,129 32,260

Exceptional (expenses)/income - - (89,038)

--------------------------- --------------- -----------------

Loss from operations (400,231) (836,711) (1,063,774)

Finance expenses (87,658) (43,606) (230,734)

--------------------------- --------------- -----------------

Loss before taxation (487,889) (880,317) (1,294,508)

Taxation 117,818 124,997 218,837

--------------------------- --------------- -----------------

Loss for the period (370,071) (755,320) (1,075,671)

Other comprehensive income

Items that will or maybe reclassified

to profit or loss:

Exchange losses arising on translation

of foreign operations 90,240 (37,554) 22,817

--------------------------- --------------- -----------------

Total comprehensive loss for

the period (279,831) (792,874) (1,052,854)

=========================== =============== =================

Loss per share for loss attributable

to the ordinary equity holders

of Windar Photonics plc

Basic and diluted, cents per

share 2 (0,6) (1.4) (1,9)

--------------------------- --------------- -----------------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION AS AT 30 JUNE

2023

As at 31

As at 30 As at December

June 2023 30 2022

June

2022

(unaudited) (unaudited) (audited)

Notes EUR EUR EUR

Assets

Non-current assets

Intangible assets 1,182,304 1,215,454 1,196,996

Property, plant & equipment 191,371 1,815 106,983

Right of use asset 74,260 - -

Deposits 38,837 26,601 28,994

------------------------------- --------------- --------------------- --------------------- ----------------------

Total non-current assets 1,486,772 1,243,870 1,332,973

------------------------------- --------------- --------------------- --------------------- ----------------------

Current assets

Inventory 3 885,751 858,407 699,236

Trade receivables 4 482,310 482,310 389,652

Other receivables 4 217,998 16,717 197,496

Tax credit receivables 4 337,722 373,853 218,928

Prepayments 93,911 24,785 47,860

Cash and cash equivalents 284,830 109,533 1,404,073

------------------------------- --------------- --------------------- --------------------- ----------------------

Total current assets 2,302,522 1,671,727 2,957,245

------------------------------- --------------- --------------------- --------------------- ----------------------

Total assets 3,789,294 2,915,597 4,290,218

------------------------------- --------------- --------------------- --------------------- ----------------------

Equity

Share capital 5 834,771 675,664 834,771

Share premium 16,479,150 14,502,837 16,479,150

Merger reserve 2,910,866 2,910,866 2,910,866

Foreign currency reserve 24,663 (126,248) (65,577)

Accumulated loss (20,188,163) (19,505,475) (19,818,092)

------------------------------- --------------- --------------------- --------------------- ----------------------

Total equity 61,287 (1,542,356) 341,118

------------------------------- --------------- --------------------- --------------------- ----------------------

Non-current liabilities

Warranty provisions 45,696 42,858 45,774

Holiday Allowance provision 6 135,987 131,829 134,734

Right of use liability 41,134 - -

Loans 6 1,500,663 1,318,842 1,690,462

------------------------------- --------------- --------------------- --------------------- ----------------------

Total non-current liabilities 1,723,480 1,361,700 1,870,970

------------------------------- --------------- --------------------- --------------------- ----------------------

Current liabilities

Trade payables 7 358,130 754,981 264,083

Other payables and accruals 7 347,620 758,713 451,402

Contract liabilities 7 940,956 1,048,039 1,205,531

Right of use liability 7 27,422 - -

Loans 7 330,399 534,520 157,114

------------------------------- --------------- --------------------- --------------------- ----------------------

Total current liabilities 2,004,527 3,096,252 2,078,130

------------------------------- --------------- --------------------- --------------------- ----------------------

Total liabilities 3,728,007 4,457,953 3,949,100

------------------------------- --------------- --------------------- --------------------- ----------------------

Total equity and liabilities 3,789,294 2,915,597 4,290,218

------------------------------- --------------- --------------------- --------------------- ----------------------

CONSOLIDATED CASH FLOW STATEMENT FOR THE SIX MONTHSED

30 JUNE 2023

Six months Six months

ended 30 ended 30 Year ended

June 2023 June 2022 31 December

2022

(unaudited) (unaudited) (audited)

EUR EUR EUR

Loss for the period before tax (487,889) (880,317) (1,294,508)

Adjustments for:

Finance expenses 87,658 43,606 230,734

Amortisation 89,622 83,752 174,792

Depreciation 10,736 - 2,992

Received tax credit - - 265,510

Foreign exchange difference 90,240 (37,554) 22,817

Warrants expense 30,794 8,193 15,927

----------------------------------------- ---------------------- -------------------- ----------------------

(178,839) (782,320) (581,736)

Movements in working capital

Changes in inventory (186,515) (163,439) (4,268)

Changes in receivables (113,160) 844,503 562,504

Changes in prepayments (46,051) 9,170 (13,906)

Changes in deposits (9,843) (203) (2,596)

Changes in trade payables 94,047 81,799 (280,247)

Changes in contract liabilities (264,575) 96,433 253,926

Changes in warranty provision (82) 6,708 9,620

Changes in other payables and provision (103,781) 290,916 (306,832)

----------------------------------------- ---------------------- -------------------- ----------------------

Cash flow (used in) operations (808,799) 383,567 (363,535)

----------------------------------------- ---------------------- -------------------- ----------------------

Investing activities

Payments for intangible assets (192,953) (221,298) (297,540)

Grants received 115,971 130,078 121,019

Payments for tangible assets (97,541) - (107,456)

----------------------------------------- ---------------------- -------------------- ----------------------

Cash flow (used in) investing

activities (174,523) (91,220) (283,977)

----------------------------------------- ---------------------- -------------------- ----------------------

Financing activities

Proceeds from issue of share capital - - 2,393,686

Costs associated with the issue

of share capital - - (258,266)

Proceeds from new long-term loans - 373,055

Repayment of loans (15,260) (184,111) (372,934)

Interest (paid)/received (87,658) (43,605) (124,630)

----------------------------------------- ---------------------- -------------------- ----------------------

Cash flow from financing activities (102,918) (227,716) 2,010,911

----------------------------------------- ---------------------- -------------------- ----------------------

Net (decrease)/increase in cash

and cash equivalents (1,086,240) 64,631 1,363,399

Exchange differences (33,003) 4,354 126

Cash and cash equivalents at the

beginning of the period 1,404,073 40,548 40,548

----------------------------------------- ---------------------- -------------------- ----------------------

Cash and cash equivalents at the

end of the period 284,830 109,533 1,404,073

----------------------------------------- ---------------------- -------------------- ----------------------

INTERIM CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THE SIX

MONTHSED 30 JUNE 2023

Share Share Merger Foreign Accumulated

Capital Premium reserve currency Losses Total

reserve

EUR EUR EUR EUR EUR EUR

------------------ ----------------- --------------- ------------ ------------ --------------- ---------------

At 1 January 2022

675,664 14,502,837 2,910,866 (88,394) (18,758,348) (757,375)

New shares

issued - - - - - -

Share option and

warrant costs - - - - 8,193 8,193

----------------- --------------- ------------ ------------ --------------- ---------------

Transaction with

owners - - - - 8,193 8,193

----------------- --------------- ------------ ------------ --------------- ---------------

Comprehensive

loss

for the period - - - - (755,320) (755,320)

Other

comprehensive

loss - - - (37,854) - (37,854)

------------------ ----------------- --------------- ------------ ------------ --------------- ---------------

Total

comprehensive

income - - - (37,854) (755,320) (793,174)

------------------ ----------------- --------------- ------------ ------------ --------------- ---------------

At 30 June 2022 675,664 14,502,837 2,910,866 (126,248) (19,505,475) (1,542,356)

------------------ ----------------- --------------- ------------ ------------ --------------- ---------------

New shares

issued 159,107 2,234,579 - - - 2,393,686

Costs associated

with capital

raise - (258,266) - - - (258,266)

Share option and

warrant costs - - - - 7,734 7,734

----------------- --------------- ------------ ------------ --------------- ---------------

Transaction with

owners 159,107 1,976,313 - - 7,734 2,143,154

----------------- --------------- ------------ ------------ --------------- ---------------

Comprehensive

loss

for the period - - - - (320,351) (320,351)

Other

comprehensive

income - - - 60,671 - 60,671

------------------ ----------------- --------------- ------------ ------------ --------------- ---------------

Total

comprehensive

income - - - 60,671 (320,351) (259,680)

------------------ ----------------- --------------- ------------ ------------ --------------- ---------------

At 31 December

2022 834,771 16,479,150 2,910,866 (65,577) (19,818,092) 341,118

New shares issued - - - - - -

Share option and - - - - - -

warrant costs

----------------- --------------- ------------ ------------ --------------- ---------------

Transaction with - - - - - -

owners

----------------- --------------- ------------ ------------ --------------- ---------------

Comprehensive

loss

for the period - - - - (370,071) (370,071)

Other

comprehensive

Income - - - 90,240 - 90,240

------------------ ----------------- --------------- ------------ ------------ --------------- ---------------

Total

comprehensive

income - - - 90,240 (370,071) (344,831)

------------------ ----------------- --------------- ------------ ------------ --------------- ---------------

At 30 June 2023 834,771 16,479,150 2,910,866 24,663 (20,188,163) 61,287

------------------ ----------------- --------------- ------------ ------------ --------------- ---------------

1. BASIS OF PREPARATION

The financial information for the six months ended 30 June 2023

and 30 June 2022 does not constitute the Groups statutory financial

statements for those periods with the meaning of Section 434(3) of

the Companies Act 2006 and has neither been audited or reviewed

pursuant to guidance issued by the Auditing Practices Board. The

annual financial statements of Windar Photonics plc are prepared in

accordance with International Financial Reporting Standards. The

principal accounting policies used in preparing the Interim

financial statements are those that the Group expects to apply in

its financial statements for the year ended 31 December 2023 and

are unchanged from those disclosed in the Group's Annual Report for

the year ended 31 December 2022. The comparative financial

information for the year ended 31 December 2022 included within

this report does not constitute the full statutory accounts for

that period. The statutory Annual Report and Financial Statements

for 2022 have been filed with the Registrar of Companies. The

Independent Auditor's Report on the Annual Report and Financial

Statements for 2022 was unqualified but included a reference to the

material uncertainty related to going concern in respect of the

timing of future revenues without qualifying their report and did

not contain a statement under section 498(2)-498(3) of the

Companies Act 2006. After making enquiries, the directors have a

reasonable expectation that the Group has adequate resources to

continue operating for the next 12 months. Accordingly, they

continue to adopt the going concern basis in preparing the half

yearly condensed consolidated financial statements. This interim

report was approved by the directors.

2. Loss per share

The loss and weighted average number of ordinary shares used in

the calculation of basic loss per share are as follows:

Six months Six months Year ended

ended 30 ended 30 31 December

June 2023 June 2022 2022

EUR EUR EUR

Loss for the period (370,071) (755,320) (1,075,671)

Weighted average number of ordinary

shares for the purpose of basic

earnings per share 55,963,110 54,595,522 55,963,110

------------------------ -------------------- ----------------

Basic loss and diluted, cents per

share (0,6) (1.4) (1.9)

There is no dilutive effect of the warrants as the dilution

would reduce the loss per share.

3. Inventory

As at 31

As at 30 As at 30 December

June 2023 June 2022 2022

EUR EUR EUR

Raw materials 705,287 489,292 382,027

Work in progress 115,464 71,677 294,852

Finished goods - 297,438 22,357

------------------ -------------------------------------------------- ----------------------- ---------------------

Inventory 820,751 858,407 699,236

------------------ -------------------------------------------------- ----------------------- ---------------------

4. Trade and other receivables

As at 31

As at As at 30 December

30 June June 2022 2022

2023

EUR EUR EUR

---------------------------------------- ------------------- ----------------------- ---------------------

Trade receivables 482,310 1,161,721 389,652

Less; provision for impairment of

trade receivables - (873,289) -

---------------------------------------- ------------------- ----------------------- ---------------------

Trade receivables - net 482,310 288,432 389,652

---------------------------------------- ------------------- ----------------------- ---------------------

Total financial assets other than

cash and cash equivalents classified

at amortised costs 482,310 288,432 389,652

---------------------------------------- ------------------- ----------------------- ---------------------

Tax receivables 337,722 373,853 218,928

Other receivables 205,631 16,717 197,496

---------------------------------------- ------------------- ----------------------- ---------------------

Total other receivables 543,353 390,570 416,424

---------------------------------------- ------------------- ----------------------- ---------------------

Total trade and other receivables 1,025,663 679,002 806,076

---------------------------------------- ------------------- ----------------------- ---------------------

Classified as follows: Current Portion 1,025,663 679,002 806,076

---------------------------------------- ------------------- ----------------------- ---------------------

5. Share capital

Number of

shares EUR

Shares as 30 June 2022 54,595,524 675,664

Issue of shares for cash 1,367,586 159,107

------------------------------ ------------ ---------

Shares at 31 December 2022 55,963,110 834,771

------------------------------ ------------ ---------

Issue of shares for cash - -

------------------------------ ------------ ---------

Shares at 30 June 2023 55,963,110 834,771

------------------------------ ------------ ---------

At 30 June 2023, the share capital comprises 55,963,110 shares

of 1 pence each.

6. Borrowings

The carrying value and fair value of Group's borrowings are as

follows:

Six months Six months Year ended

ended ended 30 31 December

30 June June 2022 2022

2023

EUR EUR EUR

Growth Fund Loans (including accrued interest) 1,831,062 1,721,533 1,847,576

Current portion of Growth Fund Loans (330,399) (534,520) (157,114)

Holiday Accruals 135,987 131,829 134,734

Total non-current financial liabilities

measured at amortised cost 1,636,650 1,318,842 1,825,196

-------------------------------------------------- ----------- -------------------- ----------------

The Growth Fund Loans include two separate loans. All conditions

for the loans are unchanged to the position at the end of year

2022.

All loans are denominated in Danish Kroner.

7. Trade and other payables

As at 31

As at 30 As at 30 December

June June 2022 2022

2023

EUR EUR EUR

Trade payables 358,130 754,981 264,083

Other payables and accruals 347,620 758,713 410,600

Payables to Directors - - 40,802

Right of use liability 27,422 - -

Current portion of loans 330,399 534,520 157,114

---------------------------------- ---------------------------------- ----------------------- ---------------------

Total financial liabilities,

excluding 'non-

current' loans and borrowings

classified as financial

liabilities

measured at amortised cost 1,063,571 2,048,214 872,599

---------------------------------- ---------------------------------- ----------------------- ---------------------

Contract liabilities 940,956 1,048,039 1,205,531

---------------------------------- ---------------------------------- ----------------------- ---------------------

Total trade and other payables 2,004,527 3,096,253 2,078,130

---------------------------------- ---------------------------------- ----------------------- ---------------------

Classified as follows: Current

Portion 2,004,527 3,096,253 2,078,130

---------------------------------- ---------------------------------- ----------------------- ---------------------

There is no material difference between the net book value and

the fair values of current trade and other payables due to their

short-term nature.

8. Availability of Interim Report

Copies of the Interim Report will not be sent to shareholders

but will be available from the Group's website

www.investor.windarphotonics.com.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BZLLLXKLZBBX

(END) Dow Jones Newswires

September 25, 2023 02:00 ET (06:00 GMT)

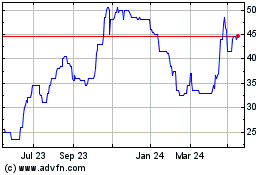

Windar Photonics (LSE:WPHO)

Historical Stock Chart

From Jan 2025 to Feb 2025

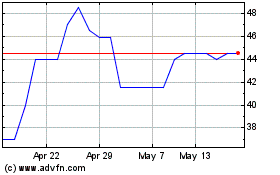

Windar Photonics (LSE:WPHO)

Historical Stock Chart

From Feb 2024 to Feb 2025