TIDMZEG

RNS Number : 8853M

Zegona Communications PLC

14 May 2020

NOT FOR DISTRIBUTION, PUBLICATION OR RELEASE, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN OR INTO OR FROM THE UNITED STATES

OR TO ANY US PERSON, CANADA, AUSTRALIA, JAPAN, THE REPUBLIC OF

SOUTH AFRICA OR ANY MEMBER STATE OF THE EUROPEAN ECONOMIC AREA

(OTHER THAN SPAIN) OR ANY OTHER JURISDICTION IN WHICH THE

DISTRIBUTION, PUBLICATION OR RELEASE WOULD BE UNLAWFUL.

ZEGONA COMMUNICATIONS PLC ("Zegona")

LEI: 213800ASI1VZL2ED4S65

14 MAY 2020

ZEGONA ANNOUNCES 2019 RESULTS

London, England, 14 May, 2020 - Zegona Communications plc (LSE:

ZEG) announces results and publishes its Annual

Report for the year ended 31 December 2019(1) . Highlights include:

PROGRESS AT EUSKALTEL, DIVID POLICY CONFIRMED

-- Positive operational developments at Euskaltel : including a

new five year Business Plan designed to double the customer base,

grow revenues to over EUR1.2bn and EBITDA to over EUR470m by

expanding nationally using the Virgin brand.

-- Q1 growth and limited impact of Covid-19 at Euskaltel :

growth in all financial metrics, national expansion program ready

for launch, full year guidance reconfirmed and expects to pay

EUR0.17 per share dividend in July.

-- Zegona confirms it will pass through 100% of the Euskaltel

dividend: expects to declare an interim dividend of 2.6p per share

in July which equates to an annualised yield of 5.2% 2 .

Enquiries

Tavistock (Public Relations adviser)

Tel: +44 (0)20 7920 3150

Lulu Bridges - lulu.bridges@tavistock.co.uk

Jos Simson - jos.simson@tavistock.co.uk

About Zegona

Zegona was established in 2015 with the objective of investing

in businesses in the European Telecommunications, Media and

Technology sector and improving their performance to deliver

attractive shareholder returns. Zegona is led by former Virgin

Media executives Eamonn O'Hare and Robert Samuelson.

About Euskaltel

Euskaltel S.A. ("Euskaltel") is the leading converged

telecommunications provider in the North of Spain, with its network

covering 2.3 million households. It provides high speed broadband,

data rich mobile, advanced TV and fixed communications services to

residential and business customers under the Euskaltel, R Cable and

Telecable brands. During 2020, Euskaltel intends to expand its

addressable footprint to 18m households through its national

expansion plan using the Virgin brand. Euskaltel is a public

company traded on the stock markets of Bilbao, Madrid, Barcelona

and Valencia.

1. Zegona has also issued, posted, or made available to

shareholders, the Notice of Annual General Meeting and Form of

Proxy for the Annual General Meeting. These documents are also

available on the Zegona's website at www.zegona.com

2. Based on the closing price of Zegona's shares on 13 May 2020 of GBP0.89.

ZEGONA COMMUNICATIONS PLC

Annual Report

For the Year Ended 31 December 2019

STRATEGIC REPORT | CHAIRMAN'S STATEMENT

I am pleased to present Zegona's annual report for 2019. This

year we made significant progress in working constructively with

all stakeholders to put in place the foundations needed for

Euskaltel to return to growth.

Investment in Euskaltel

Early in 2019, we increased our investment in Euskaltel,

eventually becoming the largest shareholder with 21.3%. At the same

time, we continued to engage constructively with the Euskaltel

Board of directors and other major shareholders with the objective

of improving the performance of the business. This resulted in

Euskaltel making a number of changes in the second half of the year

that Zegona believes have been positive. In particular, Euskaltel's

shareholders ratified the appointment of José Miguel García (the

ex-CEO of Jazztel) as CEO and Robert Samuelson and I were appointed

to the Euskaltel Board on 10 July 2019.

Since then, Euskaltel has made a series of encouraging changes.

In addition to José Miguel's arrival, there have been changes to

key leadership positions including a new Chairman, CFO and Company

Secretary and the Board has recently resolved to become more

focused by reducing in size from 13 to 11. A new streamlined

organisation structure has also been put in place with key new

hires and a 25% reduction in the senior executive team. Euskaltel

has also renegotiated its wholesale access agreements with Orange

and Telefonica and signed an agreement to use the Virgin brand to

expand nationally.

In March 2020, Euskaltel published its 2020-2025 Business Plan

setting out its key strategic initiatives and its ambition to

double the size of its customer base and grow revenues to over

EUR1.2bn and EBITDA to over EUR470m by 2025. The plan details the

actions being taken to grow in its existing core regions, to expand

using the Virgin brand to offer high value services to customers

across Spain, and to continue to drive operational efficiencies

through a single integrated organisation.

These changes are already delivering positive results, with

Euskaltel returning to growth in both revenue and profitability in

the fourth quarter of 2019, with the trend continuing in the first

quarter of 2020. Euskaltel has also reported that the early impact

of the Coronavirus pandemic ("Covid-19") has been "limited and

controlled," enabling it to reconfirm its full year guidance for

2020, reconfirm that it still intends to pay a final dividend of

EUR0.17 per share in July and confirm that it is ready to begin its

national expansion program.

We believe that the changes put in place during the second half

of 2019 and Euskaltel's 2020-2025 Business Plan set the business on

an exciting growth trajectory. We think the combination of

increasing its market footprint in its current regions with a

continued focus on operating efficiency will lead to positive

results for the existing business. Additionally, addressing the 85%

of the Spanish market where Euskaltel is not currently present

using the well-recognised Virgin brand creates a major new growth

driver which we expect to transform the financial profile of the

business. Moreover, José Miguel and members of his team have an

excellent track record of building a highly valued national

business from their time at Jazztel, which makes us confident in

their national expansion plans.

Outlook

In our view, the underlying outlook for telecommunications

businesses in Spain continues to be fundamentally sound, which

provides Euskaltel with a solid foundation for growth. The

telecommunications market in Spain continues to be competitive but

rational, with most players seeking to build profitable growth and

we continue to believe Euskaltel can be successful in the national

market with a well-designed and well-targeted offering.

The broader Spanish economy has continued to perform well, with

GDP growth of 2.0% in 2019 and, before the outbreak of Covid-19,

GDP growth of 1.6%(1) was expected in 2020. It is still too early

to tell what the impact of Covid-19 will be, although many

commentators are forecasting significant but relatively short-lived

declines in GDP which could impact Euskaltel. Like many other

telecommunications businesses, Euskaltel has historically proved to

be resilient during a downturn, even growing revenue each year

during the last financial crisis. Encouragingly, Euskaltel has

already announced that it has not seen a significant impact on its

business and financial results during the first quarter of

2020.

Beyond Spain, we continue to see a very healthy environment for

investments across the broader European TMT(2) landscape. There was

an increase in deal activity in 2019 and we have also seen growth

in the availability of assets. We continue to evaluate new

acquisition opportunities and actively pursue those which meet our

rigorous financial and strategic criteria.

Dividends

We remain committed to paying dividends to our shareholders and

we intend, for the foreseeable future, to promptly return all

dividends we receive from Euskaltel to our shareholders. During

2019, we paid EUR9.9 million in dividends, representing a total of

5p per share. Euskaltel has already confirmed that it intends to

pay a dividend of EUR0.17 per share in July 2020 and we intend to

pass through 100% of this dividend once we receive it. We expect to

declare an interim dividend of 2.6p per share in July, which

equates to an annualised yield of 5.2%(3) .

Board Changes

We are reshaping our Board and committees to create a more

independent structure in line with good corporate governance. We

have recently appointed two new independent Non-Executive

Directors, Kjersti Wiklund and Suzi Williams, with very strong

industry and governance credentials. Two Directors are also

stepping down from the Board, Murray Scott and Mark Brangstrup

Watts. This leaves us with a more effective and efficient Board

structure with two Executive Directors and four fully independent

Non-Executives.

In addition, Suzi will become the chair of the Nomination and

Remuneration Committee at the next Annual General Meeting ("AGM")

and we intend to appoint one of our Non-Executives as a Senior

Independent Director. We expect to announce this appointment after

the AGM. With these changes, all Non-Executive Directors and all

Board committees are fully independent. We believe this is the

right Board structure to support Zegona's future development.

Zegona is committed to delivering a high standard of corporate

governance and I am delighted that our governance structure is

continuing to develop alongside our operations. We are already

benefitting from Suzi and Kjersti's wealth of industry knowledge

and governance experience. Mark and Murray have served on the Board

for around five years and in this time have made hugely valuable

contributions to the establishment and development of Zegona. We

greatly appreciate the assistance they have provided to both the

business and the management team and look forward to continuing to

work with Mark in his role as a shareholder.

Annual General Meeting

Zegona's 2020 AGM will be held at 12:00 p.m. on 9 June 2020 at

10 Snow Hill, London EC1A 2AL. Further details on the 2020 AGM and

the business to be conducted on the day can be found on pages 86 to

94. We will ensure that appropriate social distancing measures are

in place and my colleagues and I look forward to meeting you in

June.

Eamonn O'Hare

Chairman and Chief Executive Officer

13 May 2020

1 As published by the European Commission in February 2020.

2 Technology, media and telecommunications.

(3) Based on the closing price of Zegona's shares on 13 May 2020

of 89p.

(4) Pending her re-election at the AGM.

STRATEGIC REPORT | STRATEGY AND BUSINESS MODEL

Vision

* Execute our strategy in the European TMT sector

* Focus on businesses that require active change and

fundamental improvement to realise their full value

* Target significant long-term growth in shareholder

value

Opportunity

Changing market dynamics in the TMT industry create multiple

investment opportunities:

* Demand for data and speed : Data consumption is

growing strongly with customers willing to pay for

speed. Gigabit broadband is now offered in some

markets but network roll-outs and upgrades need to be

efficient.

* Digital convergence : The fixed/mobile divide is

increasingly disappearing for users, meaning

significant growth in more valuable quad play(5)

customers who are combining mobile and fixed

services. This has driven an increase in merger and

acquisition ("M&A") activity and improvements in

economics for converged players since mobile data

delivery is heavily dependent on high capacity fixed

networks.

* Industry consolidation : The sector has seen

heightened M&A activity. Many private equity owners

are looking to sell assets acquired pre-financial

crisis and industry players are focusing on their

core regions, delivering cost reductions and price

repair to rebuild margins. Consolidation has also

created opportunity as businesses are spun out of

corporates to meet regulatory requirements and

strategic objectives, creating opportunity for

Zegona.

* Broad range of attractive assets : Our flexibility in

terms of size, geography and category opens a broad

universe of attractive target assets. We have

identified many businesses of an appropriate scale

across a number of categories, including mobile only

players, mid-sized cable, satellite pay TV, smaller

fixed incumbents, B2B(6) and network infrastructure.

Advantage

A number of factors make Zegona well positioned to access attractive

deals and deliver value:

* Strong, aligned management team : Our management team

has a proven track record of delivering superior

business performance and investor returns and

successfully sold Telecable during 2017. The team has

extensive real world experience in senior operational

roles in large public telecommunications companies.

The team's interests are also strongly aligned with

shareholders as they participate in a long-term

incentive scheme that links management remuneration

directly to growth in shareholder value.

* Entrepreneurial focus : We have considerable freedom

in the projects we pursue and the ways we create

value. Unlike most private equity businesses, Zegona

is free to choose the optimal period to hold assets

and can realise value using a range of approaches, of

which a sale of the asset is only one. This also

permits a focus on fundamental business improvements

that are value accretive rather than relying on high

leverage and multiple expansion. We are also able to

act quickly on acquisition opportunities while still

maintaining financial discipline. This is especially

attractive to potential sellers and a key

differentiator.

* Major global investors : A small number of global

public equity asset managers(7) with a long-term

outlook own more than 81% of Zegona. The successful

placement of equity in February 2019 with gross

proceeds of more than GBP100 million underlines

investor confidence in our strategy, as do recent

significant investments in Zegona, including by

Fidelity Management and Research, Aberforth Partners

LLP and Chelverton Asset Management. Our management

team has an effective investor relations programme

which maintains regular contact with Zegona's major

shareholders and potential shareholders.

Strategy

We seek to provide shareholders with an attractive total return,

primarily through appreciation in the value of Zegona's assets, and

we believe that opportunities exist to create significant value for

shareholders. Our strategy focusses on making investments in

strategically sound businesses within the European TMT sector that

require active change to realise their full value, thereby creating

significant long-term returns through fundamental business

improvements. While the main elements of Zegona's strategy are set

out below, our overall strategic approach is to deal with each

opportunity and situation presented to us individually as it

arises. For example, in the case of Zegona's current investment in

Euskaltel, our strategy has been to increase our ownership position

and seek to work constructively with the Euskaltel Board and

management to improve the performance of the business.

We evaluate potential investments using a disciplined set of

financial and strategic criteria. We focus on:

-- Target businesses with an enterprise value range of GBP1-3

billion, although we may deviate outside of this range if we

believe the returns are sufficiently attractive;

-- TMT, network-based communications and entertainment businesses, primarily in Europe;

-- Strategically sound businesses with established market

positions and limited expected downside risk, but which have scope

for fundamental improvement that is realistically achievable;

-- Moderate leverage (usually 3-4x EBITDA(8) ); and

-- Multiple viable exit options pre-identified.

Many businesses across the TMT sector currently deliver

sub-optimal returns which could be significantly improved. We work

with management to deliver fundamental business improvements, such

as:

-- Changing the businesses' market positions;

-- Being actively involved in the management of the businesses

to drive operational improvements;

-- Instilling strong discipline around cost efficiency;

-- Investing in products, services and other value-accretive

activities to drive top line growth;

-- Focussing on operating profitability and cash generation;

-- Ensuring a balanced and efficient capital structure; and

-- Value enhancing bolt-on acquisitions/divestments.

Buyer interest is stimulated as the performance of each

investment improves, providing Zegona with a range of options to

crystallise the value it has created:

-- We identify the optimal time to crystallise the value we have

created, with flexibility to adapt to market changes and other

opportunities, to maximise shareholder value;

-- Zegona's publicly listed structure allows shareholders to

realise value at any time and provides multiple options for value

delivery; and

-- Following a successful crystallisation, any surplus value

will be reinvested or returned to shareholders.

(5) Quad play: customers with four services (pay TV, fixed

voice, broadband and mobile).

(6) Business to Business

(7) Those with holdings in 3% or more of the issued ordinary

shares of the Company are listed on page 41.

8 O perating profit excluding depreciation of property, plant

and equipment and amortisation of intangible assets.

STRATEGIC REPORT | BUSINESS AND FINANCIAL REVIEW

Zegona is currently organised into two segments:

(i) investment in Euskaltel, which comprises Zegona's share of

the profit of Euskaltel and dividend income (and the movements in

fair value of the investment prior to recognising Euskaltel as an

associate); and

(ii) central costs, which comprises costs incurred in supporting

Zegona's corporate activities, including staff and premises costs

related to the management team, ongoing costs of maintaining the

corporate structure, evaluating new acquisition opportunities and

executing acquisition and disposal activities.

Review of investment in Euskaltel

Strategic developments

During 2019, we sought to increase our existing 15% ownership of

Euskaltel through market purchases or privately regulated

transactions up to a maximum of an additional 12.5% of the

outstanding issued share capital of Euskaltel at a price we

considered attractive for our shareholders based on prevailing

market conditions. To fund this, in February 2019 we received gross

proceeds of GBP100.5 million pursuant to a non pre-emptive

institutional placing (the "Placing") and entered into debt

facilities with Barclays and Virgin in January 2019. To date, we

have drawn down GBP10 million under these facilities. Zegona now

owns the largest shareholding in Euskaltel with 21.3%.

At the same time, we continued to engage constructively with the

Euskaltel Board and other major shareholders with the objective of

improving the performance of the business. This eventually resulted

in Euskaltel making a number of changes in the second half of the

year that Zegona believes have been positive for the business. In

particular, José Miguel García (the ex-CEO of Jazztel) was

appointed as CEO of Euskaltel by its Board with unanimous agreement

on 5 June 2019, and his appointment was overwhelmingly endorsed by

Euskaltel's shareholders at the Extraordinary Shareholder Meeting

on 10 July 2019. At the same shareholder meeting, Eamonn O'Hare and

Robert Samuelson were also confirmed as proprietary(9) directors on

Euskaltel's Board.

Since appointing José Miguel, Euskaltel has made significant

progress in developing and implementing a new plan for the

business. Highlights include:

-- Integrating three operating companies into one business .

This is designed to simplify operations and reduce costs. A new

organisation structure has been implemented, with key hires on

board, including a new Chairman, CFO and Company Secretary and a

significantly streamlined senior executive team. This has created

clearer accountability for results and a stronger and more agile

leadership. Euskaltel is also creating a single technical platform,

whilst integrating the sales strategies of its existing three

brands, taking best practice from each and expanding the more

efficient on-line/direct channels.

-- Improving the customer proposition . Euskaltel is focussed on

reducing churn and enabling ARPU(10) growth. A new mobile offer has

been launched in partnership with Samsung, giving customers a

high-quality handset and large data allowance at highly attractive

rates. In addition, Euskaltel has increased broadband speed for its

customers at no extra cost. A carefully targeted 'more-for-more'

price rise has also been implemented.

-- Expanding nationally . On 12 February 2020, Euskaltel

announced that it had signed a trademark licence agreement to use

the Virgin brand in Spain to drive its expansion into the 85% of

Spain where Euskaltel is not present today and, on 23 March 2020,

Euskaltel confirmed that it is ready to being its national

expansion strategy and already has access to over 13 million homes

in Spain. Pilot tests have successfully been carried out with

customers around Spain who have access to all convergent fixed and

mobile phone services, ultra-fast broadband and 4K TV.

-- Euskaltel believes that expanding nationally will enable it

to offer customers in these regions great value, high quality

quad-play services, leveraging Euskaltel's existing advanced

capabilities. Using the Virgin brand will accelerate growth in this

untapped market for Euskaltel. The national expansion strategy is

also supported by a new wholesale agreement giving Euskaltel

long-term access to Orange's fibre network covering 14 million

households and access to data-rich mobile services across Spain. In

addition, Euskaltel has also announced the renewal of its mobile

access agreement with Telefonica on improved financial terms.

Operational and Financial performance

On 26 February 2020, Euskaltel reported significantly improved

operating KPIs for the year. In 2019, Euskaltel grew its fixed

subscribers by 8,757, with 17,700 broadband net additions and

46,900 postpaid mobile net additions. This is the first year of

customer growth after two years of subscriber losses. The number of

products and services also grew with more convergent customers,

reaching an average of almost 3.7 services per subscriber. In the

B2B market, Euskaltel similarly increased its customer base

materially during 2019, reaching a record high of 15,263 customers

(31 December 2018:14,827).

Euskaltel's financial results were also strong, with revenues

returning to growth in Q4 2019. Actions taken to create a single

unified operational platform serving Euskaltel's multiple regional

brands have already resulted in material cost savings, with

SG&A(11) expenses 11% lower than Q4 2018. These savings, along

with improvements in Euskaltel's main wholesale agreements with

Orange and Telefonica, resulted in EBITDA for Q4 2019 reaching a

record level of EUR92 million, an increase of almost 8%. This

represents the second consecutive quarter of EBITDA growth. For the

full year 2019, EBITDA grew 2.4% to EUR344 million, profit after

tax remained stable at EUR62 million and operating cash flow

increased by 4% to EUR190 million.

Euskaltel continued to report growth in its key operating and

financial results in the first quarter of 2020. Euskaltel recorded

a sixth consecutive quarter of growth in fixed line customers, with

400 new users and 3,000 broadband net additions, driven mainly by

the expansion that has taken place outside the Group's three

traditional regions. Euskaltel saw a second consecutive quarter of

revenue growth with 0.1% in Q1 2020 compared to the same period in

2019. Operating efficiencies also delivered savings that

contributed to EBITDA of EUR88 million, which was an increase of

8.1% compared to the same period in 2019.

Euskaltel also reported that the impact of the Covid-19 pandemic

was limited and controlled. Restrictions on customer portability

imposed due to the State of Emergency have resulted in an

approximately 50% reduction in both daily gross adds and churn from

normal levels, resulting in a stable customer base. There has also

been a limited impact on revenue from unpaid bills and customers

suspending services so far and mitigation measures are already in

place to limit the impact of this in future. The financial position

of the business remains strong with continued operating cash flow

generation. At the end of the first quarter of 2020, Euskaltel had

EUR98 million of cash, which was increased by EUR150 million in

April due to the full drawdown of its revolving credit

facility.

As a result of the strong first quarter results and the limited

impact of Covid-19, Euskaltel also confirmed that, subject to

approval from shareholders, it still intends to pay the final

instalment of the dividend against 2019 results of EUR0.17 on 5

July 2020. Euskaltel also reconfirmed its guidance for 2020 and

indicated that the national expansion plan is ready for full

commercial launch.

Investment performance

Zegona had previously concluded that it did not have significant

influence over Euskaltel and therefore accounted for its investment

in Euskaltel as a financial asset carried at fair value through

profit and loss in accordance with IFRS 9 Financial Instruments. As

more fully discussed in note 3 to the Financial Statements, during

the second half of 2019, Zegona identified certain factors that

indicated that from 10 July 2019 Zegona has the ability to

participate in Euskaltel's financial and operating policy decisions

and therefore accounted for its investment in Euskaltel as an

associate using the equity method.

In the period to 10 July 2019, the investment in Euskaltel

segment generated finance income of EUR38.0 million (2018: EUR12.5

million), being dividend income of EUR10.2 million (2018: EUR7.5

million) and a gain on the fair value of the investment of EUR27.9

million (2018: EUR5.1 million). The gain in fair value reflects the

increase in the Euskaltel share price from EUR6.99 at 31 December

2018 to EUR8.09 at 9 July 2019. The increase in dividend income

reflects an increase in dividend per share paid by Euskaltel from

EUR0.278 per share in 2018 to EUR0.310 per share, together with an

increase in Zegona's ownership since the start of 2019.

During the second half of 2019, Zegona's share of Euskaltel's

profit was EUR9.1 million, which reflects Zegona's 21.3% share of

Euskaltel's adjusted net profit of EUR42.9 million for the period

from 10 July 2019 (2018: EURnil).

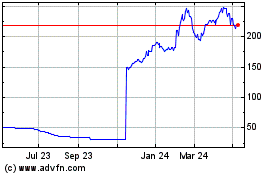

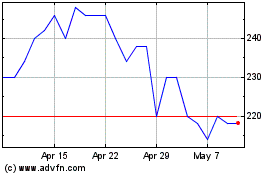

The fair value of Zegona's investment in Euskaltel was EUR341.6

million at 31 December 2019 (2018: EUR187.3 million) with the

increase due to a combination of an increase in the number of

shares owned and a 28.3% increase in Euskaltel's share price during

the year.

Review of Zegona's corporate and other activities

Zegona's corporate and other activities resulted in an operating

loss of EUR6.0 million (2018: EUR4.7 million) plus net finance

income of EUR1.0 million (2018: EUR2.1 million), contributing a

total loss for the year of EUR5.0 million (2018: EUR2.6

million).

Operating loss

Operating costs totalled EUR6.0 million (2018: EUR4.7 million)

and include: (1) EUR5.6 million (2018: EUR3.9 million) related to

Zegona's ongoing corporate operations, with the increase primarily

due to higher bonuses paid to management; and (2) EUR0.3 million

(2018: EUR0.8 million) for significant project costs, which in 2019

were principally advisory and other professional fees incurred on

projects related to increasing Zegona's influence over

Euskaltel.

Net finance income

The net finance income comprises a net foreign exchange gain of

EUR1.4 million (2018: EUR2.4 million) plus a gain on fair value of

the contingent consideration from the sale of Telecable of EUR0.2

million (2018: EUR0.2 million), less interest on bank borrowings of

EUR0.7 million (2018: EURnil). The change in fair value during 2019

reflects a revision to the timing of receipt of the contingent

consideration.

The net gain on foreign exchange principally arises from the

revaluation of the investment in Euskaltel (prior to classification

as an associate), whose shares are quoted in euros, within Zegona

Limited and Zegona Communications plc, a company with a functional

currency of British pounds sterling (" Sterling ").

Key performance indicators and non-GAAP measures

As Zegona does not currently have an operating business, there

are limited material key performance indicators that provide a

useful measure of Zegona's business performance and position other

than financial measures defined by generally accepted accounting

principles (" GAAP ") such as IFRS with the exception of:

Value of Main Assets per share

Zegona's principal asset is its 21.3% ownership of Euskaltel,

where it is the largest shareholder. Zegona believes it is helpful

for its shareholders to be aware of the development in the value of

Euskaltel, and to understand what this represents in terms of value

of the Euskaltel investment and Zegona's net cash position (its "

Main Assets ") per Zegona share, especially since Zegona no longer

accounts for its investment in Euskaltel at fair value, and how

this compares to the market value of Zegona's shares, and also how

this value compares to the Net Invested Capital and Preferred

Return threshold under Zegona's incentive scheme(12) .

The value of Zegona's Main Assets per share is a computation of

the Sterling equivalent of the fair value of Zegona's investment in

Euskaltel, its cash and cash equivalents and its bank borrowings,

divided by the total number of shares outstanding(13) as

follows:

13 May 31 December 31 December

2020 2019 2018

----------- ----------- -----------

Fair value of investment in

Euskaltel (EUR000) 272,277 341,584 187,332

Cash and cash equivalents

(EUR000) 20,844 27,035 3,138

Bank borrowings (EUR000) (11,179) (11,578) -

----------- ----------- -----------

Value of Main Assets (EUR000) 281,942 357,041 190,470

Foreign exchange rate (EUR

/ GBP) 1.1292 1. 17547 1.11258

Value of Main Assets (GBP000) 249,683 303,743 171,196

Shares outstanding 221,492,730 221,935,177 126,219,449

----------- ----------- -----------

Value of Main Assets per share

(GBP) 1.14 1.37 1.36

=========== =========== ===========

(9) Proprietary director means a director of a company who is

the beneficial owner of or is able, either directly or indirectly,

to control more than 15% of the ordinary share capital of the

company.

(10) Average revenue per user.

1 (1) Selling, General and Administrative.

1 (2) As defined on pages 29 and 34.

(13) No value for Zegona Management and Core Investor Incentive

Schemes is included.

STRATEGIC REPORT | RISKS

Principal and emerging risks

We have carried out robust assessments of the principal risks

facing Zegona including those that would threaten our business

model, future performance, solvency or liquidity. Detailed

consideration is given to all of these risk factors by the Audit

and Risk Committee and the board of Directors (the " Board ").

Principal and emerging commercial risks

Risk title Risk rating Change in risk assessment

since the last Annual

Report

-------------------------------- ------------ --------------------------

Risks related to the investment High Increased

in Euskaltel

Acquisition of targets Moderate No change

Key management Moderate No change

Disposal of investments Moderate No change

Brexit Moderate No change

Foreign exchange Low No change

The description, impact and mitigation of these risks are set

out below:

Risks related to the investment in Euskaltel

At 31 December 2019, Zegona's sole investment was its holding of

approximately 21% of Euskaltel. The value of this investment is

dependent on Euskaltel's performance, which could, in turn, be

adversely impacted by risks that Euskaltel is exposed to. Some of

these risks are common to telecommunications operators in Spain and

others that are specific to Euskaltel itself. Whilst not

exhaustive, Zegona believes the most significant of these risks

are:

-- Spanish economy and Covid-19: Deteriorating economic

conditions and rising unemployment rates could have a significant

impact on Euskaltel's performance. The Spanish economy has

experienced healthy growth in recent years following a significant

downturn in 2012 and 2013, which was expected to continue in 2020.

Spain has, however, been severely impacted by Covid-19 and in

mid-March imposed a strict lockdown with restrictions being eased

from the beginning of May 2020. It is still difficult to tell what

the impact will be for the Spanish economy generally and

telecommunication providers in general, although Euskaltel has

already announced that the outbreak has been "limited and

controlled". Despite the relatively limited impact on Euskaltel so

far, there remains a risk that the Spanish economy in general and

Euskaltel's performance and its equity value in particular could be

negatively impacted in the medium and longer term. This impact

could come either directly from the disruption related to

restrictions to address Covid-19 in early 2020, or from a

longer-term economic decline caused indirectly by the outbreak.

-- Competitive environment: Euskaltel faces significant

competition from both established and new competitors that provide

similar services in Spain. This competition includes offers with

aggressive discounts and could negatively impact Euskaltel's

business. To compete effectively, Euskaltel will need to continue

to successfully design and market its services and anticipate and

respond to competitive factors. If it is unable to do this, results

could fall substantially short of current expectations.

-- Delivery of change programme : José Miguel García has

instituted a comprehensive and wide-ranging organisational and

operational change programme across all aspects of Euskaltel's

business, which Zegona fully supports. While this programme has

already delivered significant benefits, there still remains a

considerable amount of work to be done. There is a risk that, if

these improvements are not delivered, this could have an adverse

effect on Euskaltel's business.

-- Success of national expansion : A key part of Euskaltel's

growth strategy is to expand nationally using the Virgin brand to

offer high value services to customers across Spain. While this

provides a significant opportunity, it is a logistically complex

project that requires acquiring customers in a competitive market.

There is a risk that, if the project is not as successful as hoped,

this could have a negative impact on Euskaltel's performance and on

the value of Zegona's investment.

We regularly review the risk-adjusted returns of the Euskaltel

investment and consider whether it is appropriate to retain

ownership or continue increasing our shareholding in Euskaltel.

The appointment of Zegona's Chief Executive Officer Eamonn

O'Hare and Chief Operating Officer Robert Samuelson as proprietary

directors on Euskaltel's Board enables them to take a hands-on role

in delivering tangible improvement actions within the Euskaltel

business, including national expansion in partnership with

Virgin.

Acquisition of targets

The success of Zegona's future investment strategy depends on

our ability to identify and successfully acquire available and

suitable targets. There is a risk that we will not be able to:

-- identify available targets based on competition in the

marketplace;

-- identify suitable targets at a price that allows for

acceptable returns;

-- obtain any consents or authorisations required to carry out

an acquisition;

-- procure the necessary financing, be this from equity, debt or

a combination; or

-- be successful in the acquisition of an identified target

under all or any market conditions.

In making acquisitions, there is also a risk of unforeseen

liabilities being later discovered which were not uncovered or

known at the time of the due diligence process. In pursuit of new

acquisition targets, significant abort costs may be incurred if we

are not able to complete the proposed acquisition (for example,

because Zegona has been outbid by a competitor), which may deplete

Zegona's cash and available liquidity.

We have a disciplined approach to valuation and, ultimately, we

are only prepared to make investments at the right price and after

undertaking a very structured and thorough due diligence process.

When evaluating potential investments, we focus on targets that

have strong fundamentals, high-quality offerings and leading market

positions but which are underperforming their potential and have

scope to generate sustainable performance and cash flow

improvements.

The success of Zegona's acquisitions depend on our ability to

implement the necessary strategic, operational and financial change

programmes in order to refocus the acquired business and improve

its performance. Implementing these change programmes may require

significant modifications, including changes to business assets,

operating and financial processes, business systems, management

techniques and personnel, including senior management. There is a

risk that we will not be able to successfully implement such change

programmes within a reasonable timescale and cost.

As Covid-19 outbreaks continue across Europe, it is possible

that access to significant debt and equity financing may become

more difficult, thus temporarily impacting Zegona's ability to

complete new acquisitions in a reasonable timeframe. Zegona

believes that, as countries begin to ease restrictions in the

coming months and economic activity begins to recover, the

difficulties in accessing debt and equity financing will

reduce.

Key management

Zegona's operations are currently managed by the Chief Executive

Officer, supported by the Chief Operating Officer and Chief

Financial Officer. The absence or loss of key management, due to

Covid-19 or other reasons, could significantly impede our financial

plans and the execution of our planned strategy with respect to the

Euskaltel business, as well as other plans, though there has been

no such absence or loss since Zegona was founded. Zegona will

continue to monitor the Covid-19 situation and do all it can to

ensure the safety of key management and all employees.

We aim to retain our key staff by offering remuneration packages

at market rates, as well as long term incentives through the issue

of management shares and other management incentive plans. The

management team is small which places a natural limit on the volume

of deal flow that can be addressed. The management team itself

along with the Non-Executive Directors continually challenges the

focus of the business and the allocation of resources amongst

projects.

Disposal of investments

Our ability to dispose of Zegona's investment at the optimum

time, and the availability of a suitable buyer who is willing and

able to acquire the investment at an acceptable price or in a deal

with an acceptable structure, is key to the success of our

strategy. There is a risk that such suitable buyers cannot be

identified, thus reducing the returns on investments.

We have proven our ability to execute our strategy since the

formation of Zegona and consideration is given to an exit strategy

as part of the acquisition process.

Brexit

The uncertainty and unpredictability concerning the UK's legal,

political and economic relationship with the EU following the UK's

exit from the EU may continue to be a source of instability in the

international markets, create significant currency fluctuations,

and/or otherwise adversely affect trading agreements or similar

cross-border co-operation arrangements (whether economic, tax,

fiscal, legal, regulatory or otherwise) for the foreseeable future.

Such continued uncertainty could have an adverse impact on the

number or attractiveness of acquisition opportunities available to

Zegona.

The long-term effects of Brexit will depend on any agreements

(or lack thereof) between the UK and the EU and, in particular, any

arrangements for the UK to retain access to EU markets either

during the current transitional period or more permanently.

Additionally, the exchange rate of Sterling vis-a-vis other

currencies may continue to be relatively volatile, which could

result in increasing costs of non-sterling denominated expenses and

other obligations. Furthermore, UK regulatory requirements could be

subject to significant change and could place an additional burden

on Zegona.

Foreign exchange

Foreign currency translation risk exists due to certain Zegona

companies operating, and having equity denominated, in a different

functional currency (Sterling) to that of the investment in

Euskaltel (euro) and of many of our likely acquisition targets.

Transactional foreign currency risk is limited and the principal

ongoing impact is that fluctuations in the Sterling/euro rate could

have a significant impact on the Sterling value of the investment

in Euskaltel, meaning that the Sterling value of the proceeds from

any future sale of Euskaltel shares that Zegona may distribute to

shareholders may be reduced.

The Board and the Chief Financial Officer control and monitor

financial risk management, including foreign currency risk, in

accordance with the internal policy and the strategic plan defined

by the Board.

Longer term viability statement

1. Zegona's prospects

In accordance with provision 31 of the UK Corporate Governance

Code, we have assessed Zegona's prospects over a longer period than

the twelve months required by the "going concern" provision. This

assessment has taken into account Zegona's current position, our

strategy, the risk appetite of the Board and the principal risks

and uncertainties which are described in detail in this Strategic

Report.

Zegona does not control any operating businesses and, currently,

the most significant factor affecting Zegona's prospects is

delivering additional value from the investment in Euskaltel.

2. The assessment period

We continue to believe that three years - in this case the three

years to December 2022 - is the appropriate period over which

Zegona should assess its viability for the following reasons:

-- Three years is considered to be an appropriate period over

which to assess the impact that we have had on Euskaltel; and

-- We have reasonable clarity over a three-year period, which

enables us to make an appropriate assessment of Zegona's principal

risks.

3. The assessment process and key assumptions

The Directors approve a forecast on an annual basis which is

sufficiently detailed to explain all cash inflows and outflows and

includes a description of all reasonably possible risks and

opportunities. Each month, the Board is provided with an analysis

of actual performance against the forecast. Given the

straightforward nature of Zegona's financial operations at this

point, this forecast is considered appropriate to form the base

model for the viability assessment.

The forecast takes into account Zegona's dividend policy to pass

through the Sterling equivalent of all dividends received from

Zegona's investment in Euskaltel to shareholders and factors in the

successful fundraising in early 2019 from both issuing new ordinary

shares and entering into loan facilities.

In preparing the viability assessment, we have deliberately

sought to include a significant element of conservatism into the

base model even before applying further sensitivities. In

particular, the assessment includes the following key

assumptions:

-- Zegona will not acquire another business, or dispose of its

investment in Euskaltel, during the assessment period. This is a

particularly conservative assumption since any new acquisition

would be expected to have a significant positive impact on Zegona's

viability, both through contributing operating cash flows and the

fact that sufficient additional funds could also be raised to

ensure Zegona's viability in the longer term. Despite the fact that

Zegona is hopeful that a successful acquisition will be made during

the assessment period, given the uncertainty over the timing and

size of it, it was not considered appropriate to include it in the

assessment. Similarly, a disposal of the investment in Euskaltel

would be expected to have a significant positive impact on Zegona's

viability, through sale proceeds, therefore it was not considered

appropriate to include it in the assessment;

-- Zegona will incur substantial abort costs on failed

transactions without taking actions; and

-- Zegona has drawn down GBP10 million from its current debt

facility with Barclays, which expires on 14 January 2021. Under the

facility agreement, Zegona can no longer draw the remaining amount.

The GBP10 million credit facility provided by Virgin matured on 30

April 2020. Zegona expects to refinance the current debt facility

during the assessment period in a similar amount and on similar

terms as the existing facility. This is considered to be reasonable

given the small size of the facility compared to the value of the

Euskaltel shares that it is secured on. In the unlikely event that

the facility agreement is not refinanced, the current pledge to

Barclays on Euskaltel shares will cease and therefore Zegona could,

if additional liquidity was needed, sell part of its shareholding

in Euskaltel.

In addition to the already deliberately conservative base model,

we also considered the principal and emerging risks discussed under

section 3 above to determine how far they had already been captured

in the base model and whether any of them needed to be further

considered in assessing viability as shown below. Each of these

principal risks take account of the impact of Covid-19 as an

emerging risk:

Principal and Base model Downside Comment

emerging risks scenario

----------------- ----------- ---------- ----------------------------------------

Investment a r Addressed in the base model through

in Euskaltel the assumptions about dividends

received during the assessment

period and the amount passed through

to Zegona's shareholders. Since

dividends are passed through,

the impact of declining performance,

for example as a result of Covid-19

are limited, therefore no further

downside impacts need to be modelled.

----------------- ----------- ---------- ----------------------------------------

Acquisition a a The most significant risk to viability.

of targets The base model assumes no acquisitions

but includes substantial abort

costs. In the downside scenario,

additional abort costs and other

operating costs are considered.

----------------- ----------- ---------- ----------------------------------------

Key management a r The most significant consequence

of the loss or absence of key

management would likely be on

our ability to execute another

acquisition or exit of Euskaltel

at the desired time. This is already

included in the base case, therefore

no further downside impacts need

to be modelled.

----------------- ----------- ---------- ----------------------------------------

Disposal of r r Not relevant as no disposals are

investments included in the base case.

----------------- ----------- ---------- ----------------------------------------

Brexit a r The most significant consequence

of Brexit would likely be on our

ability to execute another acquisition

or exit of Euskaltel at the desired

time, which is already considered

as part of the 'Acquisition of

targets' and 'Disposal of investments'

risk.

----------------- ----------- ---------- ----------------------------------------

Foreign exchange a a Addressed in the base model through

the assumptions about dividends

received from Euskaltel during

the assessment period and the

amount passed through to Zegona's

shareholders. The base model assumes

constant Sterling:euro rates during

the assessment period. In the

downside scenario, a depreciation

of Sterling against the euro has

been considered.

----------------- ----------- ---------- ----------------------------------------

Based on the evaluation of the principal risks above, combined

with a consideration of a number of other factors (including the

different ways Covid-19 could be expected to impact Zegona) the

Directors identified a severe but plausible downside scenario which

was further used to stress test the base numbers.

The downside scenario includes a number of negative developments

occurring in combination without considering the impact of a number

of achievable mitigating actions. The scenario includes: a

reduction in the amount of debt facility that can be refinanced

from GBP30 million to GBP15 million; a doubling of abort costs; and

a significant increase in operating costs resulting from a range of

sources.

4. Results of the assessment

The assessment showed that in both the base case and the

downside scenario, Zegona would have sufficient cash and liquid

resources to continue in operation throughout the assessment period

without taking any mitigating actions available to it.

Given the small size of the drawn portion of Zegona's existing

facility compared to the value of the Euskaltel shares that it is

secured on, Zegona believes it is probable it will be able to

refinance the facility. However, the assessment also shows that, if

the facility was not refinanced, Zegona would still have sufficient

cash and liquid resources to continue in operation throughout the

assessment period, although this would be after deploying one or

more of a range of the available mitigating actions. These include

reducing discretionary expenditure, selling part of Zegona's

investment in Euskaltel or retaining part of the Euskaltel

dividend.

5. Viability statement

Taking into account Zegona's current position and principal and

emerging risks and uncertainties, the Directors confirm that we

have a reasonable expectation that Zegona will be able to continue

in operation and meet its liabilities as they fall due over the

three years to December 2022.

STRATEGIC REPORT | CORPORATE RESPONSIBILITY

Corporate social responsibility

We recognise our obligations to act responsibly, ethically and

with integrity in its dealings with staff, suppliers and the

environment as a whole. We are committed to being a socially

responsible business.

Our people

We value and respect the unique contributions of each

individual, and we are committed to ensuring that every employee is

treated with dignity and respect, and has a meaningful opportunity

to contribute to Zegona's success.

Zegona's employees are encouraged to actively engage with

charitable activities and are supported in any such efforts.

Zegona recognises that a productive workforce requires a breadth

of experience and perspectives achieved through hiring individuals

with diverse experience. Board Directors and senior managers have

been appointed in order to bring required skills, knowledge and

experience. On 5 February 2020, two female independent

Non-Executive Directors were appointed to the Board, improving

Zegona's diversity. The Nomination and Remuneration Committee will

continue to consider the diversity of the Board for further new

appointments.

The table below shows the breakdown of our workforce at the end

of 2019. As noted above, since then, two female directors have been

appointed to the Board.

Male Female Total

---- ------ -----

Board Directors 6 - 6

Senior management 3 - 3

Other staff - 1 1

==== ====== =====

Total 9 1 10

==== ====== =====

This breakdown excludes directors of companies in liquidation at

31 December 2019. Senior management is per the definition in

section 414C of the UK Companies Act 2006.

Culture

Ethical values and behaviours are embedded in the corporate

culture which the Board upholds. The Directors foster a culture

where transparency, openness, integrity and constructive challenge

are actively encouraged and the Board engages regularly with senior

management to ensure a positive culture.

Human rights

As part of our effort to conduct business in an ethical manner,

Zegona has not engaged in and will not engage in business practices

or activities that compromise fundamental human rights.

Environmental matters

We are committed to minimising Zegona's impact on the

environment and seek to encourage our employees to recycle,

minimise energy wastage, and do their part to ensure that Zegona

acts responsibly.

Since 1 October 2013, the Companies Act 2006 (Strategic Report

and Directors' Report) Regulations 2013 has required all UK quoted

companies to report on their greenhouse gas (GHG) emissions, which

are classified as either direct or indirect and which are divided

further into Scope 1, Scope 2 and Scope 3 emissions. Direct GHG

emissions are emissions from sources that are owned or controlled

by Zegona. Indirect GHG emissions are emissions that are a

consequence of Zegona's activities but that occur at sources owned

or controlled by other entities.

Scope 1 emissions: Direct emissions from sources controlled by

Zegona.

Scope 2 emissions: Indirect emissions attributable to Zegona due

to its consumption of purchased electricity.

Scope 3 emissions: Other indirect emissions associated with

activities that support or supply Zegona's operations.

Zegona is required to report Scope 1 and 2 emissions for its

reporting year to 31 December 2019. Scope 3 is not yet mandatory,

however, we have again chosen to report Scope 3 emissions. Zegona

has no Scope 1 emissions.

Global tonnes of CO(2)

-------------------------

2019 2018

------------ -----------

Scope 2 (electricity) 5.7 3.3

Tonnes of CO 2 per EURm operating

expenses 0.95 0.70

Global tonnes of CO 2

e

-------------------------------

2019 2018

--------------- --------------

Scope 3 (water, business travel) 49.7 52.2

Tonnes of CO 2 e per EURm operating

expenses 8.30 10.99

All emission factors have been selected from the emissions

conversion factors published annually by Defra and the

International Energy Agency. Scope 2 emissions have gone up due to

an increase in Zegona's office space.

Board engagement with our key stakeholders

Section 172 of the Companies Act 2006 requires a Director of a

company to act in the way he or she considers, in good faith, would

be most likely to promote the success of the company for the

benefit of its members as a whole. In doing this, section 172

requires a Director to have regard, among other matters, to: the

likely consequences of any decision in the long term; the interests

of the company's employees; the need to foster the company's

business relationships with suppliers, and others; the impact of

the company's operations on the community and the environment; the

desirability of the company maintaining a reputation for high

standards of business conduct; and the need to act fairly with

members of the company.

The Directors give careful consideration to the factors set out

above in discharging their duties under section 172. More

information about who our key stakeholders are and how we engage

with them is provided on page 24.

The Strategic Report was approved by the Board on 13 May 2020

and is signed on its behalf by:

Eamonn O'Hare

Chairman and Chief Executive Officer

GOVERNANCE | PROFILES OF THE DIRECTORS

Eamonn O'Hare, Chairman and CEO (appointed 19 January 2015)

Eamonn has spent over two decades as a board member and senior

executive of some of the world's fastest growing consumer and

technology businesses. From 2009 to 2013 he was CFO and main board

director of the UK's leading entertainment and communications

business, Virgin Media. Eamonn helped lead the successful

transformation of this business and its strategic sale to Liberty

Global for US$24 billion, crystallising US$14 billion of

incremental shareholder value. From 2005 to 2009, he served as the

CFO for the UK division of one of the world's largest retailers,

Tesco plc. Before joining Tesco, Eamonn was CFO and main board

director of Energis Communications and helped lead the turnaround

of this high profile UK telecommunications company. Prior to this,

he spent 10 years at PepsiCo Inc. in senior executive roles in

Europe, Asia and the Middle East. Eamonn's early career was spent

in the aerospace industry with companies that included Rolls Royce

and British Aerospace.

Eamonn is a proprietary director of Euskaltel. He also serves as

a non-executive director on the main board of Dialog Semiconductor

Plc, a leading edge consumer technology business that provides

critical components for the world's most successful mobile device

brands. The fees for these appointments are disclosed in the

Directors' Remuneration Report on page 38.

Eamonn has a degree in Aerospace Engineering from the Queen's

University Belfast and an MBA from the London Business School.

Robert Samuelson, Executive Director and COO (appointed 19

January 2015)

Robert was Executive Director Group Strategy of Virgin Media

from 2011 to 2014, during which time he was centrally involved in

the sale of the business to Liberty Global and in the post-merger

integration process. Prior to this, Robert was a managing partner

at Virgin Group with global responsibility for developing and

realising returns from Virgin's telecommunications and media

businesses. Before joining Virgin Group, Robert was a director at

Arthur D Little Ltd, where he co-led the European corporate finance

practice, providing strategic advice to major European

telecommunications operators. His early career was spent with

British Aerospace and Royal Ordnance in engineering and production

management roles.

Robert is a proprietary director of Euskaltel and the fees for

this appointment are disclosed in the Directors' Remuneration

Report on page 38.

Robert studied Natural Sciences at Cambridge University and has

an MBA from Cranfield School of Management.

Mark Brangstrup Watts, Non-Executive Director (appointed 19

January 2015 and resigned 12 May 2020)

Mark co-founded the Marwyn asset management group in 2002 and

has many years of experience deploying private equity investment

strategies in the public markets. The Marwyn funds' highly

acquisitive portfolio companies have delivered approximately 100

bolt-on acquisitions with Mark offering significant mergers and

acquisitions, equity capital markets and corporate finance

experience.

Mark brings his background in strategic consultancy to the

management team having been responsible for strategic development

projects for international clients including Ford Motor Company

(US), Cummins (Japan) and 3M (Europe).

Mark is a managing partner in Marwyn Capital LLP and Marwyn

Investment Management LLP. Mark is currently an executive director

of Le Chameau Group Plc, Safe Harbour Holdings Plc and Wilmcote

Holdings Plc. Mark is also a non-executive director of Marwyn Asset

Management Limited (which, as at the date of approval of the Annual

Report, holds 19.16% of the share capital of Zegona in its capacity

as agent for an on behalf of its discretionary managed clients) and

was previously a non-executive director of BCA Marketplace Plc,

Advanced Computer Software Plc, Entertainment One Ltd, Melorio Plc,

Inspicio Plc and Talarius Plc, amongst others.

Mark was a member of the Nomination and Remuneration Committee

but will not stand for re-election at the 2020 AGM and has stepped

down from the Board with effect from 12 May 2020.

Murray Scott, independent Non-Executive Director (appointed 31

July 2015)

Murray has almost 20 years of experience in the international

telecommunications sector, ranging from the then start-ups Equant

and Interoute to BT plc, where he served as CFO for the UK products

sub-division of BT Global Services which had revenues of GBP1.6

billion. After leaving BT, Murray successfully pursued a career as

an interim director and consultant for a number of years before

being appointed as Finance Director of Premia Solutions Limited, an

insurance intermediary, on 1 January 2020.

Murray studied Natural Sciences at Cambridge University and

qualified as a Chartered Accountant with KPMG LLP in London.

Murray is a member of the Audit and Risk Committee and the

Nomination and Remuneration Committee. Murray is not standing for

re-election to the Board at the 2020 AGM.

Richard Williams, independent Non-Executive Director (appointed

9 November 2015)

Richard has spent most of his career in European

telecommunications, most recently as a Director of Investor

Relations at Altice, and prior to that, Virgin Media. Richard is a

qualified Chartered Accountant and has held financial planning

roles at Walt Disney and ITV Digital. He joined Telewest

Communications in 1999 in an investor relations role. Telewest

later merged with NTL and was rebranded to Virgin Media. Richard

led Virgin Media's investor relations activity through to the

acquisition of the company by Liberty Global in 2013. Richard then

joined Altice, where he supported the company's IPO and Altice's

acquisition of SFR and Portugal Telecom, before eventually leaving

the company.

Richard is Chair of the Nomination and Remuneration Committee

and is a member of the Audit and Risk Committee. Richard will step

down as Chair of the Nomination and Remuneration Committee

following the 2020 AGM but will continue to be a member of the

committee.

Ashley Martin, independent Non-Executive Director (appointed 6

February 2017)

Ashley brings a wealth of complementary experience to the Board.

Ashley was Audit Committee Chair at Rightmove plc from 2009 to 2018

and, in that role, gained valuable insight into an entrepreneurial,

high-growth consumer technology business. On 1 September 2018,

Ashley was appointed as a non-executive director of the

international research data and analytics group YouGov plc. Ashley

has also enjoyed a successful executive career spanning 35 years in

larger listed companies, with a particular focus on mergers and

acquisitions. Ashley was Global Chief Financial Officer of private

equity-backed Engine Holding LLC, and was previously the Group

Finance Director of Rok plc, the building services group, and Group

Finance Director of the media services company, Tempus plc.

Ashley qualified as a Chartered Accountant with Armitage &

Norton (now part of KPMG).

Ashley is Chair of the Audit and Risk Committee and a member of

the Nomination and Remuneration Committee.

Kjersti Wiklund, independent Non-Executive Director (appointed 5

February 2020)

Kjersti brings significant experience from a series of senior

global telecommunications roles, including as director of group

technology operations at Vodafone and chief operating officer of

VimpelCom. Kjersti has also held senior executive positions at

Kyivstar, Digi Telecommunications and Telenor.

Kjersti has also gained valuable insight into an

entrepreneurial, high growth consumer technology company as

Remuneration Committee Chair at Trainline plc. She was previously a

non-executive director of Laird plc in the UK, Cxense ASA and Fast

Search & Transfer ASA in Norway and Telescience Inc in the USA

and is currently a non-executive director of Babcock International

Group PLC and Spectris PLC.

Kjersti is a member of the Audit and Risk Committee.

Suzi Williams, independent Non-Executive Director (appointed 5

February 2020)

Suzi brings skills and experience from over 25 years in

telecommunications, media and consumer businesses in the UK and

internationally. As Chief Brand and Marketing Officer at BT, she

was part of the team who transformed the business. Prior to that,

she was Commercial Development Director at Capital Radio Group and

held senior leadership roles at Orange, the BBC, KPMG Consulting,

and Procter & Gamble Europe.

A board member at The AA since 2015, Suzi was Chairman of its

Remuneration Committee until November 2019. She currently sits on

its Risk & Nomination Committees. In January 2020, she joined

the board of WorkSpace Group and sits on all of its board

committees. Suzi also advises a number of early stage technology

and AI businesses.

Suzi is a member of the Nomination and Remuneration Committee

and, subject to her re-appointment at the 2020 AGM, will become the

Chair of this committee.

GOVERNANCE | CORPORATE GOVERNANCE REPORT

Overview

This report is presented separately for the sake of clarity.

Nevertheless, it forms part of the Directors' Report and has been

approved by the Board and signed on its behalf as though it were a

part of the Directors' Report.

We recognise the importance of sound corporate governance

commensurate with the size of Zegona and the interests of

shareholders, and remain committed to developing the corporate

governance arrangements as the business further evolves.

The following sections of this report show how Zegona applies

the main provisions set out in the 2018 UK Corporate Governance

Code (the "Code"), issued by the Financial Reporting Council

("FRC"), as would be required by the Listing Rules of the Financial

Conduct Authority ("FCA") if Zegona were admitted to the Premium

segment of the Official List, and how Zegona meets the relevant

information provisions of the Disclosure and Transparency Rules of

the FCA (the "DTR").

Zegona's principal risks are described on pages 9 to 11. The

Directors' Report on pages 40 to 42 also contains information

required to be included in this statement of corporate

governance.

The Board of Directors

Zegona is led and controlled by an effective Board. The Board at

the date of approval of this report comprises two Executive

Directors and five Non-Executive Directors. The two Executive

Directors are Eamonn O'Hare (Chairman and Chief Executive Officer

("CEO")) and Robert Samuelson (Chief Operating Officer ("COO")).

The Non-Executive Directors are Murray Scott, Richard Williams,

Ashley Martin, Kjersti Wiklund and Suzi Williams. Murray is not

standing for re-election at the 2020 AGM. Mark Brangstrup Watts,

who served as a Director for five years, is also not standing for

re-election at the 2020 AGM and stepped down from the Board with

effect from 12 May 2020.

Biographical details of all Directors and details of their

committee membership at the date of approval of this report appear

on pages 16 to 18. Consideration of the Board size and composition

is kept under regular review by the Nomination and Remuneration

Committee.

Eamonn O'Hare, as the Chairman and CEO, is primarily responsible

for the running of the Board and for the day-to-day running of

Zegona. All Board members have full access to Zegona's advisers for

seeking professional advice at Zegona's expense and our culture is

to openly discuss any important issues and frequently engage with

Board members outside of formal meetings. Operating and financial

responsibility for all subsidiary companies is the responsibility

of the Board.

The Board has adopted a Board Charter, available on Zegona's

website, which sets out:

-- the Board's collective vision on Zegona's strategy and objectives;

-- the Board's approach to the conduct of its business and the

parameters within which it will operate, including the management

of any Board or investor disagreements; and

-- the Board's agreed focus areas for further action.

Board interaction

The Board meets formally at least six times a year but also

frequently meets additionally on an ad hoc basis where necessary.

Meetings are prepared for using a standing agenda which is updated

to incorporate any ad hoc business or matters of interest. The

Board is presented with papers from management to support its

discussions including financial information, information on

investor relations and details of acquisition targets and deal

progress. External advisors are also invited to meetings from time

to time to advise Board members directly where this is felt

necessary.

The Executive Directors actively and constructively encourage

challenge and seek input from the Non-Executive Directors to draw

on their extensive experience and knowledge. They believe that the

role of the Non-Executive Directors in providing independent

challenge is a vital component of an effective Board.

Board committees

The Board has established two principal committees, the Audit

and Risk Committee and the Nomination and Remuneration Committee,

to assist it in the execution of its duties. If the need should

arise, the Board may set up additional committees as appropriate.

The committees' terms of reference are available on Zegona's

website, www.zegona.com, or by request from the Company Secretary.

Each of the committees is authorised, at Zegona's expense, to

obtain legal or other professional advice to assist in carrying out

its duties. No person other than a committee member is entitled to

attend the meetings of these committees, except by invitation of

the chairman of that committee.

Current membership of the committees is shown on pages 16 to 18.

The composition of these committees is reviewed regularly, taking

into consideration the recommendations of the Nomination and

Remuneration Committee.

Independence of the Board

The Code specifies that the Board should identify in the annual

report each Non-Executive Director it considers to be independent.

The Board considers that Ashley Martin, Murray Scott, Richard

Williams, Kjersti Wiklund and Suzi Williams are independent

Non-Executive Directors for the purposes of the Code and have no

relationships or circumstances which are likely to affect, or could

appear to affect, their judgement as Directors.

Similarly, although Mark Brangstrup Watts represents a

significant shareholder, is interested in Core Investor Shares of

Zegona Limited (as detailed in note 21 to the Financial

Statements), and is a beneficial owner of Axio Capital Solutions

Limited ("Axio" or the "Company Secretary"), which provides certain

company secretarial & administration services and financial

& accounting services to Zegona, the Board considers that he

nonetheless, during his term in office, had the characteristics of

an independent Non-Executive Director on the basis that:

-- his extensive experience as a non-executive director means he

was capable of maintaining the independent character and judgement

necessary to fulfil the role; and

-- he was independent of the Executive Directors.

The Board is therefore confident that Mark's ability to fulfil

the role of Non-Executive Director was not fettered.

Board and committee attendance

Attendance at the Board and committee meetings held during 2019

was:

Nomination and

Remuneration Committee Audit and Risk

Board meetings meetings Committee meetings

----------------- -------------------- --------------------------- -----------------------

Held Attended Held Attended Held Attended

----------------- -------- ---------- ---------- --------------- -------- -------------

Eamonn O'Hare 17 16 - - - -

Robert Samuelson 17 16 - - - -

Mark Brangstrup

Watts 17 15 7 5 - -

Murray Scott 17 14 7 6 3 3

Richard Williams 17 17 7 7 3 3

Ashley Martin 17 16 7 7 3 3

The number of Board meetings held reflects the ongoing

assessment of Zegona's options for the investment in Euskaltel over

the year.

Board and Committee changes

During 2019, Korn Ferry, a leading executive search consulting

firm, was engaged to identify a suitable individual to join

Zegona's Board. Other than the engagement to search for an

additional independent non-executive Director, Zegona has no other

connection with Korn Ferry. Following a rigorous series of

interviews with members of the Board and management team, Kjersti

Wiklund and Suzi Williams were identified as outstanding candidates

and, on the recommendation of the Nomination and Remuneration

Committee and taking into account that Murray Scott will not be

standing for re-election at the 2020 AGM, both were appointed with

effect from 5 February 2020. On this date, Kjersti was appointed to

the Audit and Risk Committee and Suzi was appointed to the

Nomination and Remuneration Committee. Biographical details about

Kjersti and Suzi can be found on pages 17 and 18. The Board will