Azitra, Inc. Announces Closing of Public Offering

July 25 2024 - 1:15PM

Business Wire

Azitra, Inc. (NYSE American: AZTR) (the “Company”), a

clinical-stage biopharmaceutical company focused on developing

innovative therapies for precision dermatology, today announced the

closing of its previously announced public offering of 16,667,000

shares of common stock, at a public offering price of $0.30 per

share. Total gross proceeds from the offering, before deducting

underwriting discounts and other offering expenses, were

approximately $5 million. All of the shares were sold by the

Company. In addition, Azitra has granted the underwriters a 45-day

option to purchase up to an additional 2,500,000 shares of common

stock to cover over-allotments at the public offering price, less

the underwriting discount.

ThinkEquity acted as the sole book-running manager for the

offering.

The Company intends to use the net proceeds for clinical trials

and product development, research and development, clinical

manufacturing as well as for working capital and other general

corporate purposes.

A registration statement on Form S-1 (File No. 333-276598)

relating to the shares was filed with the Securities and Exchange

Commission (“SEC”) and became effective on February 13, 2024. A

prospectus relating to and describing the terms of the offering has

been filed with the SEC and is available on the SEC’s website at

www.sec.gov. The offering was made only by means of a prospectus.

Copies of the final prospectus may be obtained from ThinkEquity, 17

State Street, 41st Floor, New York, New York 10004.

This press release shall not constitute an offer to sell or a

solicitation of an offer to buy, nor shall there be any sale of

these securities in any state or jurisdiction in which such an

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such state or

jurisdiction.

About Azitra, Inc.

Azitra, Inc. is an early-stage clinical biopharmaceutical

company focused on developing innovative therapies for precision

dermatology using engineered proteins and topical live

biotherapeutic products. The Company has built a proprietary

platform that includes a microbial library comprised of

approximately 1,500 unique bacterial strains that can be screened

for unique therapeutic characteristics. The platform is augmented

by artificial intelligence and machine learning technology that

analyzes, predicts and helps screen the Company’s library of

strains for drug like molecules.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, as amended, including statements regarding Azitra’s

expectations on the anticipated use of proceeds from the offering.

Any forward-looking statements in this press release are based on

current expectations, estimates and projections only as of the date

of this release and are subject to a number of risks and

uncertainties that could cause actual results to differ materially

and adversely from those set forth in or implied by such

forward-looking statements. These risks and uncertainties are

described in our final prospectus dated February 13, 2024 filed

with the SEC on February 15, 2024. Azitra explicitly disclaims any

obligation to update any forward-looking statements except to the

extent required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240725675771/en/

Norman Staskey Chief Financial Officer staskey@azitra.com

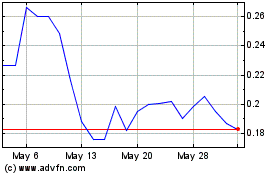

Azitra (AMEX:AZTR)

Historical Stock Chart

From Nov 2024 to Dec 2024

Azitra (AMEX:AZTR)

Historical Stock Chart

From Dec 2023 to Dec 2024