Pyxis Debuts Senior Loan ETF - ETF News And Commentary

November 07 2012 - 7:55AM

Zacks

Pyxis, a Dallas-based money manager that already has a lineup of

mutual funds, is making its first foray into the ETF world with the

Pyxis/iBoxx Senior Loan ETF (SNLN). This new

product was initially supposed to launch in late October but the

devastating ‘superstorm’ Sandy delayed the launch for the firm.

Now that the storm has passed, Pyxis has released its new SNLN

on to the market, offering up a new choice for investors seeking

exposure in the senior loan world. Still, with the Sandy related

delays and some entrenched competition, the fund could have some

trouble building up some assets although the product could be an

interesting alternative to what is already on the market (see HYEM:

The Best Choice in Junk Bond ETFs?).

That is because this new fund looks to charge investors a

relatively low 55 basis points a year in fees, beating out the

competition on this front. The product will also be following a

different benchmark, the Markit iBoxx Liquid Leveraged Loan Index,

so exposure for this fund looks to have a focus on liquidity, only

holding the 100 most liquid loans.

This will likely result in some interesting competition against

the PowerShares Senior Loan ETF (BKLN) the only

other ETF to focus on senior loan universe. This product charges

investors 76 basis points a year in fees, but has seen incredible

interest, amassing over $1.2 billion and seeing volume in excess of

half a million shares a day (read Should You Buy The Senior Loan

ETF?).

Clearly BKLN has found quite the niche among investors, as the

product is basically 18 months old, suggesting a pretty rapid

buildup of assets for the fund. Yet due to the higher expense ratio

and more spread out nature, the new SNLN could find a way to make

its way into the market and steal a considerable amount of assets

in this market segment.

Senior/ Leveraged Loan ETFs in focus

For those who are unfamiliar with the asset type, senior loans,

also known as leveraged loans, are private debt instruments that

provide capital to a company. Usually, these go to below-investment

grade firms, and are issued by a bank and syndicated by a group of

banks or institutional investors.

According to PowerShares, these loans are typically issued along

with leveraged buyouts or other M&A activity, while the

securities are (unsurprisingly) senior to other forms of debt or

equity. This provides investors with some protection should there

be a credit event, especially if the loans are secured by property,

equipment, or other company items (read Three Excellent Dividend

ETFs for Safety and Income).

Investors should also note that the rates for these notes float

at a pre determined level over LIBOR, so there are minimal interest

rate risks involved. Still, due to the lower credit quality and the

relatively illiquid nature, the segment can be a decent yielder, as

BKLN currently has a 30-Day SEC payout of 4.4%, despite an average

years to maturity of less than five years.

The space has already proven to be a solid, and overlooked,

segment for yield without taking on too much interest rate risk, or

really credit risk either (thanks to the secured nature of these

loans). Due to this, BKLN has been a solid performer, crushing

broad bond benchmarks in the YTD and trailing one year time frame,

and accumulating more than $1 billion in AUM along the way (read

The ETF Winners and Losers of October).

Pyxis must have seen this incredible success, and the relatively

low competition levels in the market, and decided to jump in as

well. SNLN acts as a nice complement to the rest of the firm’s

mutual fund lineup and it could be a good acid test for the Texas

firm to see if it can find success in the ETF world as well.

However, with the huge lead of BKLN, the competition will be tough

to beat, although a much lower expense ratio for Pyxis’ fund

certainly won’t hurt in their quest to develop a solid lineup of

ETFs.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

Follow @Eric Dutram on Twitter

PWRSH-SNR LN PR (BKLN): ETF Research Reports

(SNLN): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

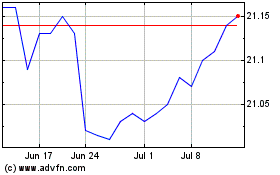

Invesco Senior Loan ETF (AMEX:BKLN)

Historical Stock Chart

From Dec 2024 to Jan 2025

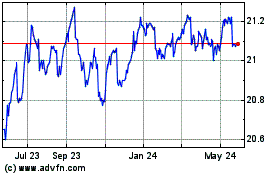

Invesco Senior Loan ETF (AMEX:BKLN)

Historical Stock Chart

From Jan 2024 to Jan 2025