UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934 (Amendment No. 1)

Filed

by the Registrant [X]

Filed

by a Party other than the Registrant [ ]

Check

the appropriate box:

|

[ ]

|

Preliminary

Proxy Statement

|

|

[ ]

|

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

[ ]

|

Definitive

Proxy Statement

|

|

[X]

|

Definitive

Additional Materials

|

|

[ ]

|

Soliciting

Material Pursuant to §240.14a-12

|

DGSE

COMPANIES, INC.

(Name

of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

|

[X]

|

No

fee required.

|

|

|

|

|

|

[ ]

|

Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

|

(1)

|

Title

of each class of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

(2)

|

Aggregate

number of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

(3)

|

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which

the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

|

|

(4)

|

Proposed

maximum aggregate value of transaction:

|

|

|

|

|

|

|

|

|

(5)

|

Total

fee paid:

|

|

|

|

|

|

|

[ ]

|

Fee

paid previously with preliminary materials.

|

|

|

|

|

|

[ ]

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date

of its filing.

|

|

|

|

|

|

|

|

|

(1)

|

Amount

Previously Paid:

|

|

|

|

|

|

|

|

|

(2)

|

Form,

Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

|

(3)

|

Filing

Party:

|

|

|

|

|

|

|

|

|

(4)

|

Date

Filed:

|

EXPLANATORY

NOTE

On

September 20, 2019, DGSE Companies, Inc. (the “Company”) filed its Definitive Proxy Statement on Schedule 14A (the

“Proxy Statement”) for the Company’s 2019 Annual Meeting of Stockholders with the Securities and Exchange Commission.

The Proxy Statement was filed in connection with the Company’s 2019 Annual Meeting of Stockholders to be held on October

11, 2019 (the “Annual Meeting”). This supplement to the Proxy Statement and a revised proxy card are being filed on

this Amendment 1 to Schedule 14A to add new Proposals 4 and 5. Proposal 4 solicits a non-binding, advisory vote, from the Company’s

stockholders to approve the compensation of the Company’s named executive officers as disclosed in the Proxy Statement (“Proposal

4” or the “Say on Pay Vote”). Proposal 5 solicits a non-binding, advisory vote from the Company’s stockholders

on the frequency in which the Company’s stockholders shall have an advisory vote on compensation paid to our named executive

officers (“Proposal 5” or the “Say When on Pay Vote). Other than the changes described in this supplement, which

adds Proposal 4 and Proposal 5, makes other conforming changes to the Proxy Statement and updates the notice of the Annual Meeting,

no other changes have been made to the Proxy Statement, and the Proxy Statement continues to be in full force and effect as originally

prepared and continues to seek the vote of Company’s stockholders for the proposals to be voted on at the Annual Meeting.

A form of the revised proxy card has also been included in this filing.

Capitalized

terms used but not otherwise defined in this supplement have the meanings ascribed to them in the Proxy Statement. This supplement

should be read together with the Proxy Statement, which should be read in its entirety.

DGSE

COMPANIES, INC.

13022

Preston Road

Dallas,

TX 75240

SUPPLEMENT

TO PROXY STATEMENT

FOR

2019

ANNUAL MEETING OF STOCKHOLDERS

TO

BE HELD ON FRIDAY, OCTOBER 11, 2019

This

Proxy Statement Supplement (this “Supplement”) supplements and amends the original definitive proxy statement of DGSE

Companies, Inc. (the “Company”, “we”, or “our”), dated September 20, 2019 (the “Proxy

Statement”) for the Company’s 2019 Annual Meeting of Stockholders (the “Annual Meeting”) to (i) add a

new Proposal 4 to the Proxy Statement that provides for a non-binding, advisory vote approving the compensation of our named executive

officers (“Proposal 4” or “Say on Pay Vote”), (ii) add a new Proposal 5 to the Proxy Statement that provides

for a non-binding, advisory vote approving the frequency of future advisory votes on the compensation of our named executive officers

(“Proposal 5” or the “Say When on Pay Vote”), (iii) update the Notice of Annual Meeting to add Proposal

4 and Proposal 5, and (iv) make additional changes to the Proxy Statement resulting from the addition of Proposal 4 and Proposal

5. As previously disclosed in the Proxy Statement, the Annual Meeting will be held on October 11, 2019 at 2:00 p.m., local time,

or any adjournment thereof, in the Texas Learning Center at the Omni Dallas Hotel at Park West located at 1590 LBJ Freeway, Dallas,

TX 75234.

This

Supplement relates to Proposal 4 and Proposal 5 to be considered by stockholders at the Annual Meeting and does not provide all

of the information that is important to your decisions with respect to voting on all of the proposals that are being presented

to stockholders for their vote at the Annual Meeting. Additional information is contained in the Proxy Statement. To the extent

that the information in this Supplement differs from, updates or conflicts with the information contained in the Proxy Statement,

the information in this Supplement shall amend and supersede the information in the Proxy Statement. Except as so amended or superseded,

all information set forth in the Proxy Statement remains unchanged and important for you to review. Accordingly, we urge you to

read this Supplement carefully and in its entirety together with the Proxy Statement. If you would like to receive another copy

of the Proxy Statement, please contact the Company with a written request to: 13022 Preston Road, Dallas, TX 75240, Attention:

Corporate Secretary.

This

Supplement relates to the solicitation of proxies by our Board of Directors (the “Board”) for use at the Annual Meeting.

This Proxy Statement Supplement, the Updated Notice of Annual Meeting attached hereto as Appendix A, and a revised proxy card

(the “Revised Proxy Card”) are being made available on or about September 27, 2019 to all stockholders entitled to

vote at the Annual Meeting.

We

urge stockholders of record to vote on Proposals 1 through 6 by submitting a Revised Proxy Card. If you return an executed Revised

Proxy Card without marking your instructions with regard to the matters to be acted upon, the proxy holders will vote “FOR”

the election of director nominees set forth in the Proxy Statement, “FOR” the approval of Proposals 2, 3, 4 and 6,

and “3 Years” on Proposal 5.

If

you have already voted and do not submit a Revised Proxy Card, your previously submitted proxy will be voted at the Annual Meeting

with respect to Proposals 1, 2, 3 and 6, but will not be counted in determining the outcome of Proposal 4 and Proposal 5.

PLEASE

NOTE THAT IF YOU SUBMIT A REVISED PROXY CARD IT WILL REVOKE ALL

PROXY

CARDS PREVIOUSLY SUBMITTED, SO IT IS IMPORTANT TO INDICATE YOUR VOTE

ON

EACH PROPOSAL ON THE REVISED PROXY CARD.

PROPOSALS

TO BE VOTED UPON BY STOCKHOLDERS

Information

contained in this Supplement relates to Proposals 4 and 5 that will be presented to stockholders at the Annual Meeting. Information

regarding Proposals 1, 2, 3 and 6 that will be presented to stockholders at the Annual Meeting can be found in the Proxy Statement

as originally filed with the SEC on September 20, 2019.

Please

note that we strongly encourage you to read this Supplement and to vote on Proposals 4and 5.

Vote

Required; Effect of Abstentions and Broker Non-Votes.

A

plurality of votes cast will be used to determine the results of the non-binding advisory vote on Proposals 4 and 5. Brokers cannot

vote on their customers’ behalf on “non-routine” proposals such as Proposals 4 and 5. Because brokers require

their customers’ direction to vote on such non-routine matters, it is critical that stockholders provide their brokers with

voting instructions. If you hold your shares in street name and do not provide voting instructions to your bank, broker or other

custodian, your shares will not be voted on Proposals 4 and 5 (a “broker non-vote”). A broker non-vote on Proposals

4 and 5 presented at the Annual Meeting will have no effect on the outcome of the proposal. Because a plurality of votes cast

will be used to determine the results of the non-binding advisory vote, abstentions will have no effect on the outcome of the

vote on Proposals 4 and 5. These abstentions, however, are counted towards establishing a quorum for the Annual Meeting.

Revocation

of Proxies/Voting of Shares.

Any

stockholder giving a proxy may revoke it at any time before the votes are counted at the Annual Meeting by (i) delivering a later-dated

proxy to the address of our principal executive offices, (ii) delivering a written notice of revocation to the Company’s

Corporate Secretary at the address of our principal executive offices, prior to your shares being voted, or (iii) attending the

Annual Meeting and voting in person. Unless so revoked, the shares represented by such proxies or voting instructions will be

voted at the Annual Meeting and all adjournments or postponements of the Annual Meeting. Proxies solicited on behalf of the Board

will be voted in accordance with the directions given.

PROPOSAL

4 - ADVISORY VOTE TO APPROVE THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

Pursuant

to Section 14A of the Securities Exchange Act of 1934, as amended (“Exchange Act”), our stockholders are allowed to

cast an advisory vote to approve the compensation of our named executive officers, as disclosed in the Proxy Statement. Although

the stockholder vote is an advisory vote only and is not binding on the Company or our Board, our Board and our Compensation Committee

will consider the voting results when making future compensation decisions.

As

described in the “Executive Compensation” section of the Proxy Statement beginning on page 17, we believe that our

Executive Compensation Program (1) provides a competitive total compensation program that enables us to attract, retain and motivate

our executive officers, and (2) aligns the interests of our named executive officers with the interests of our stockholders by

focusing on both short-term and long-term performance goals, by promoting ownership of our company, and by rewarding individual

performance. For these reasons, we recommend that stockholders vote in favor of the following resolution:

“RESOLVED,

that the stockholders hereby approve the compensation of DGSE Companies, Inc.’s named executive officers, as disclosed in

the Proxy Statement pursuant to the compensation disclosure rules of the U.S. Securities and Exchange Commission, including the

Summary Compensation Table and the other related tables and disclosures.”

The

Board of Directors unanimously recommends voting “FOR” the approval of the advisory vote to approve the compensation

of our named executive officers.

PROPOSAL

5—ADVISORY VOTE TO DETERMINE THE FREQUENCY OF FUTURE ADVISORY VOTES ON EXECUTIVE COMPENSATION

Pursuant

to Section 14A of the Exchange Act, our stockholders are allowed to vote, on a non-binding, advisory basis, for their preference

as to how frequently we should seek future advisory votes on the compensation of our named executive officers as disclosed in

accordance with the compensation disclosure rules of the Securities and Exchange Commission, which we refer to as an advisory

vote to approve executive compensation. By voting with respect to this proposal, stockholders may indicate whether they would

prefer that we conduct future advisory votes on executive compensation every one, two, or three years. Stockholders also may,

if they wish, abstain from casting a vote on this proposal.

After

careful consideration, the Board believes that submitting the advisory vote to approve executive compensation every three years

is appropriate for the Company and its stockholders at this time. The Board believes that an advisory vote at this frequency will

provide stockholders with sufficient time to evaluate the effectiveness of our overall compensation philosophy, policies and practices

in the context of our long-term business results for the corresponding period. An advisory vote that occurs every three years

will also permit the Company’s stockholders to observe and evaluate the impact of any changes to executive compensation

policies and practices that have occurred since the last advisory vote to approve executive compensation. The Board is therefore

recommending that stockholders vote for holding the advisory vote to approve executive compensation every three years.

This

vote is advisory and not binding on the Company or our Board in any way. The Board will take into account the outcome of the vote,

however, when considering the frequency of future advisory votes to approve executive compensation. The Board may decide that

it is in the best interests of our stockholders and the Company to hold an advisory vote to approve executive compensation more

or less frequently than the frequency selected by our stockholders.

The

Revised Proxy Card provides stockholders with the opportunity to choose among four options (holding the vote every one, two or

three years, or abstaining) and, therefore, stockholders will not be voting to approve or disapprove the recommendation of the

Board. We have determined to view the alternative receiving the greatest number of votes cast as the advisory vote of the stockholders,

although such vote will not be binding on us or our Board. Abstentions and broker non-votes will not affect the outcome of the

vote on this proposal.

The

Board recommends that you vote “3 Years” as the frequency for future advisory votes to approve executive compensation.

IF

YOU HAVE ALREADY VOTED, YOUR VOTES WILL BE COUNTED WITH RESPECT TO THE ELECTION OF DIRECTORS IN PROPOSAL 1, AND PROPOSALS 2, 3

AND 6. HOWEVER, WE URGE YOU TO CAST YOUR VOTE ON ALL SIX PROPOSALS USING THE REVISED PROXY CARD EVEN IF YOU HAVE PREVIOUSLY CAST

YOUR VOTE ON PROPOSALS 1, 2, 3 AND 6 AS DESCRIBED IN OUR PROXY STATEMENT DATED SEPTEMBER 20, 2019.

Appendix

A

DGSE

COMPANIES, INC.

13022

Preston Road

Dallas,

TX 75240

UPDATED

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO

BE HELD ON OCTOBER 11, 2019

The

2019 Annual Meeting of Stockholders (“Annual Meeting”) of DGSE Companies, Inc. (the “Company,” “we,”

“us” or “our”) will be held on Friday, October 11, 2019 at 2:00 p.m., Local Time, in the Texas Learning

Center at the Omni Dallas Hotel at Park West located at 1590 LBJ Freeway, Dallas, TX 75234, for the following purposes, which

now include a new Proposal 4 and Proposal 5, as more fully described in our Proxy Statement dated September 20, 2019 (the “Proxy

Statement”) and the supplement to the Proxy Statement (the “Supplement”);

1.

To

elect five directors to our Board of Directors, each to serve until our 2020 annual meeting of stockholders and until his successor

is duly elected or appointed and qualified or until his earlier resignation or removal;

2.

To

approve to amend and restate the Company’s articles of incorporation, including the name change to Envela Corporation;

3.

To

ratify the appointment of Whitley Penn, LLP as our independent registered public accounting firm for our fiscal year ending December

31, 2019;

4.

To

approve, on an advisory basis, the compensation of our named executive officers;

5.

To

approve, on an advisory basis, the frequency of future advisory votes on the compensation of our named executive officers; and

6.

To

transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof.

The

Proxy Statement includes information related to Proposals 1,2,3 and 6. The Supplement contains additional information related

to the new Proposals 4 and 5. Neither the Proxy Statement nor the Supplement individually include all of the information provided

in connection with the Annual Meeting. Accordingly, we urge you to carefully read both the Proxy Statement and the Supplement

together in their entirety.

Only

stockholders of record at the close of business on September 18, 2019 are entitled to receive notice of and to vote at the Annual

Meeting. A list of stockholders entitled to vote at the Annual Meeting will be available for inspection by any stockholder for

any purpose germane to the Annual Meeting at our principal executive offices during normal business hours for the 10 days before

the Annual Meeting, as well as at the Annual Meeting.

Please

note that if you have already voted your shares, we strongly encourage you to also vote on Proposals 4 and 5 which have been added

for stockholders to consider and vote on at the Annual Meeting.

Important

Notice of Availability of Proxy Materials for the Annual Meeting of Stockholders to be held October 11, 2019; Our proxy materials,

including the Proxy Statement, the Supplement, our 2018 Annual Report on Form 10-K for the year ended December 31, 2018 and Proxy

Card, as revised, are available on the internet at www.DGSECompanies.com.

|

By Order of the Board of

Directors,

|

|

|

|

|

|

/s/

Bret A. Pedersen

|

|

|

Bret A. Pedersen

|

|

|

Chief Financial Officer

|

|

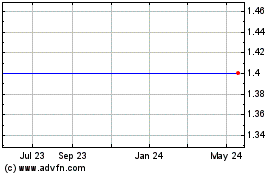

DGSE Companies (AMEX:DGSE)

Historical Stock Chart

From Dec 2024 to Jan 2025

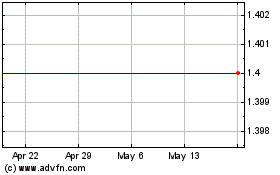

DGSE Companies (AMEX:DGSE)

Historical Stock Chart

From Jan 2024 to Jan 2025