Indian economy appears to have turned the corner. Recent HSBC

survey--which maps manufacturing and services sectors—showed

that India expanded at a faster rate than China during the month of

February. (Read: 3 Red Hot Dividend ETFs)

Further, trade data for the month of February showed that the

exports rose for the second month in a row, pushing the trade

deficit to its lowest level in 10 months. Better trade data

resulting from pickup in exports to Europe, is likely to result in

an improvement in current account deficit this year.

The budget presented by the Indian government recently had many

investor and business friendly measures—which could put the economy

back on the higher growth path, even though the budget did not do

much to alleviate concerns regarding widening fiscal and current

account deficits.

As the inflation seems to be coming under control, there are

hopes for another rate cut by the central bank (after a cut in

January this year), which would further support growth.

According the government, the economy will grow between

6.1% and 6.7% in the fiscal year starting April 1, after an

estimated 5.5% growth for the current year—its slowest growth rate

in a decade. A recent report by the Moody’s projects the economy to

grow at ~7% from 2014 onwards.

As a result of the recent optimism, the stock market is at its

highest level in about two years and the currency has been

strengthening. (Read: Buy these ETFs for higher returns and lower

risk)

Earlier last year, S&P and Fitch had downgraded the outlook

on the country and warned of a sovereign credit downgrade. If

downgraded, India would be the first country in the BRICs block to

lose its investment grade rating.

It appears that the downgrade threats were a wake-up call for

the Indian policy makers. Later last year, the government announced

many significant reforms. While the reforms were a welcome change

after many years of policy paralysis in the country since they

indicated the government’s willingness to take political risks even

in the face of looming elections, it is important that the reforms

are implemented at the earliest.

Further, even with the recent optimism, it is quite unlikely

that the economic growth will revert to 8-9% growth recorded during

2004-2011 anytime soon. India suffers from some structural problems

like high fiscal deficit, massive corruption, chronic inflation and

very bad infrastructure.

Indian stock market exhibits high volatility since its

performance is largely driven by foreign institutional inflows. The

currency also remains vulnerable to major capital flows, even

though the country has foreign exchange reserves of approximately

$300 billion, as the currency market is much less liquid than major

currency markets. (Read: 3 Excellent ETFs for Income Investors)

At the same time, despite several constraints, the growth in

India is still one of the highest in the world. Positive factors

like a rising middle class and a younger population with growing

spending power which results in soaring domestic consumption will

continue to fuel growth.

For investors seeking broad exposure to Indian equities,

following ETF choices are available:

Wisdom Tree India Earning Fund (EPI)

EPI is the most popular ETF in this space, with about $1.1

billion in AUM. It tracks the Wisdom Tree India Earning Index,

which weights the Indian companies based on their earnings. It

charges the investors 83 basis points for annual expenses.

In terms of sector weightings, the fund has highest exposure to

financials (26%), followed by energy (21%), information technology

(14%) and materials (10%).Top 10 holdings account for more than 40%

of total holdings. EPI is currently Zacks #1 Rank (Strong Buy)

ETF.

PowerShares India Portfolio (PIN)

PIN which tracks the Indus India Index, has assigned highest

weighting to the Energy sector (26%), followed by information

technology (19%) and financials (18%).

The expense ratio of the ETF is 81 basis points. Top ten

holdings constitute 58% of the holdings. PIN is currently

Zacks #2 Rank (Strong Buy) ETF.

S&P India Nifty 50 Index

Fund (INDY)

INDY follows S&P CNX Nifty Index, a free float market cap

weighted index of 50 largest and most liquid Indian companies. It

charges the investors 92 basis points for annual expenses.

Top 10 companies in the fund account for 59% of the fund. Sector

weighting are: financials (28%), Information Technology (14%) and

power (13%). INDY is currently Zacks #1 Rank (Strong Buy) ETF.

iShares MSCI India Index Fund (INDA)

This is the newest ETF in the space, launched in February last

year. The fund follows MSCI India Index, which is float adjusted

market cap weighted index. With the expense ratio at 0.67%, this is

the cheapest option now.

Financials enjoy highest weighting (31%), followed by

information technology (17%) and energy (12%). Top ten companies

account for more than half of the total holdings. INDA is currently

Zacks #2 Rank (Strong Buy) ETF.

Want the latest recommendations from Zacks Investment Research?

Today, you can download7

Best Stocks for the Next 30 Days.Click

to get this free report >>

WISDMTR-IN EARN (EPI): ETF Research Reports

ISHARS-M INDIA (INDA): ETF Research Reports

ISHARS-SP INDIA (INDY): ETF Research Reports

PWRSH-INDIA POR (PIN): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

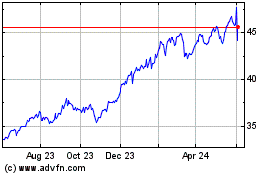

WisdomTree India Earnings (AMEX:EPI)

Historical Stock Chart

From Nov 2024 to Dec 2024

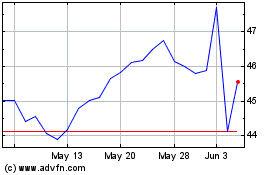

WisdomTree India Earnings (AMEX:EPI)

Historical Stock Chart

From Dec 2023 to Dec 2024