FRIEDMAN INDUSTRIES, INCORPORATED ANNOUNCES SHARE REPURCHASE AND AUTHORIZATION OF ADDITIONAL SHARE REPURCHASE PROGRAM

December 18 2023 - 12:38PM

On December 13, 2023, Friedman Industries, Incorporated (the

“Company”) repurchased 400,041 shares of the Company’s common stock

from Metal One Corporation for an aggregate repurchase price of

approximately $5.1 million. After the repurchase, the Company had

6,971,824 shares of common stock outstanding.

In addition, the Board of Directors authorized a

share repurchase program on December 13, 2023 under which the

Company may repurchase up to 1,045,774 shares of the Company’s

outstanding common stock through December 13, 2026, which equates

to 15% of the Company’s outstanding shares of common stock after

the repurchase of shares from Metal One.

Repurchases under the program may be made from

time to time at the Company’s discretion and may be made in open

market transactions, through block trades, in privately negotiated

transactions and pursuant to any trading plan that may be adopted

by the Company’s management in accordance with Rule 10b5-1 of the

Securities Exchange Act of 1934, as amended, or otherwise. The

timing and actual number of shares repurchased pursuant to the

program will depend on a variety of factors including price,

corporate and regulatory requirements, market conditions and other

corporate liquidity requirements and priorities. The repurchase

program does not obligate the Company to acquire a specific dollar

amount or number of shares and may be modified, suspended or

discontinued at any time.

Michael Taylor, Chairman of the Board and

President and CEO of the Company, remarked, “The Board’s approval

of this program and the repurchase of Metal One’s shares reflects

our confidence in the Company’s future. Repurchasing stock is one

means of underscoring our commitment to enhancing stockholder

value. We are optimistic about the future value creation potential

of our business. We have achieved significant growth over the last

two years. We have completed a series of strategic investments that

have transformed our business by expanding our steel processing

capabilities, broadening our geographical reach and improving our

earnings. Building on this positive momentum, we are looking to

deliver our most profitable year for a third year in a row and have

our sights set on capturing even greater earnings potential on our

existing fixed assets as we execute our strategy.”

ABOUT FRIEDMAN INDUSTRIES

Friedman Industries, Incorporated (“Company”),

headquartered in Longview, Texas, is a manufacturer and processor

of steel products with operating plants in Hickman, Arkansas;

Decatur, Alabama; East Chicago, Indiana; Granite City, Illinois;

Sinton, Texas and Lone Star, Texas. The Company has two reportable

segments: flat-roll products and tubular products. The flat-roll

product segment consists of the operations in Hickman, Decatur,

East Chicago, Granite City and Sinton where the Company processes

hot-rolled steel coils. The Hickman, East Chicago and Granite City

facilities operate temper mills and corrective leveling cut-to

length lines. The Sinton and Decatur facilities operate stretcher

leveler cut-to-length lines. The Sinton facility is a newly

constructed facility with operations commencing in October 2022.

The East Chicago and Granite City facilities were acquired from

Plateplus, Inc. on April 30, 2022. The tubular product segment

consists of the operations in Lone Star where the Company

manufactures electric resistance welded pipe and distributes pipe

through its Texas Tubular Products division.

For further information, you may contact Alex

LaRue, Chief Financial Officer – Secretary and Treasurer, at

(903)758-3431.

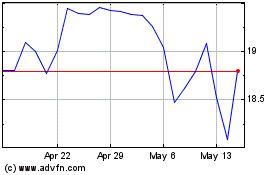

Friedman Industries (AMEX:FRD)

Historical Stock Chart

From Dec 2024 to Jan 2025

Friedman Industries (AMEX:FRD)

Historical Stock Chart

From Jan 2024 to Jan 2025