UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE

13A-16 OR 15D-16 UNDER THE SECURITIES

EXCHANGE

ACT OF 1934

For

the month of August, 2024

Commission

File Number: 001-41353

Genius

Group Limited

(Translation

of registrant’s name into English)

8

Amoy Street, #01-01

Singapore

049950

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ________.

Note:

Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report

to security holders.

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ________.

Note:

Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that

the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated,

domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on

which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to

be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the

subject of a Form 6-K submission or other Commission filing on EDGAR.

Exhibit

Index

Exhibit

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

GENIUS

GROUP LIMITED |

| |

|

|

| Date:

August 16, 2024 |

|

|

| |

By: |

/s/

Adrian Reese |

| |

Name: |

Adrian

Reese |

| |

Title: |

Chief

Financial Officer |

| |

|

(Principal

Financial Officer) |

Exhibit

99.1

GENIUS

GROUP LIMITED

(Company

Registration No. 201541844C)

(Incorporated

in the Republic of Singapore)

Registered

Office:

8

Amoy Street #01-01

Singapore

049950

NOTICE

OF EXTRAORDINARY GENERAL MEETING

NOTICE

IS HEREBY GIVEN THAT an Extraordinary General Meeting (“EGM”) of the Genius Group Limited (the “Company”)

will be held at Genius Central Singapore Pte Ltd, 7 Amoy Street #01-01 Far East Square Singapore 049949 on 18 September 2024 at 4:00

PM (Singapore time), for the purpose of considering and, if thought fit, passing with or without modifications, the special resolution

as set out below:

SPECIAL

RESOLUTION: THE PROPOSED SHARE CONSOLIDATION

THAT:

| (a) |

approval

be and is hereby given for the board of directors of the Company (the “Board”) to proceed with, at its sole discretion,

the proposed share consolidation (the “Proposed Share Consolidation”) of every 3 - 100 ordinary shares in

the capital of the Company (“Shares”) held by shareholders of the Company (“Shareholders”)

as at the Share Consolidation Record Date into one (1) Consolidated Share, (“Share Consolidation Ratio Range”)

fractional entitlements to be disregarded, and the number of Consolidated Shares which Shareholders will be entitled to pursuant

to the Proposed Share Consolidation, based on their holdings of the existing Shares as at the Share Consolidation Record Date, will

be rounded down to the nearest whole Consolidated Share; |

| |

|

| (b) |

approval

be and is hereby given for fractions of a Consolidated Share arising from the Proposed Share Consolidation to be aggregated and dealt

with in such manner as the directors of the Company (“Directors”) may, in their absolute discretion, deem fit

in the interests of the Company, including (i) aggregating and cancelling the same, or (ii) aggregating and selling the same and

retaining the net proceeds for the benefit of the Company; |

| |

|

| (c) |

approval

be and is hereby given for the Directors, in their absolute discretion, to decide whether to implement the Proposed Share Consolidation

in 1 step or in 2 separate steps, provided that the overall proportion by which the Company reduces the number of its Shares (the

“Share Consolidation Ratio”), whether implemented in 1 or 2 separate steps, shall fall within the Share Consolidation

Ratio Range set out in special resolution (a) above, being 3 -100 existing Shares into one (1) Consolidated Share; |

| |

|

| (d) |

the

Directors and each of them be and are hereby authorised, in their absolute discretion, to fix: |

| |

(i) |

the

Share Consolidation Ratio; and |

| |

|

|

| |

(ii)

|

the

Share Consolidation Record Date(s) and the Share Consolidation Effective Trading Date(s) at such time and on such date as they may

deem fit in the interests of the Company, such dates being any time up to 18 months from the date of the EGM; and |

| (e) |

the

Directors and each of them be and are hereby authorised to do all such acts and things (including, without limitation, executing

all such documents as may be required) as they or each of them may consider expedient or necessary or in the interests of the Company

to give effect to this Special Resolution. |

GENIUS

GROUP LIMITED

(Company

Registration No. 201541844C)

(Incorporated

in the Republic of Singapore)

Registered

Office:

8

Amoy Street #01-01

Singapore

049950

Explanatory

Notes relating to the Proposed Share Consolidation:

Background

The

Directors are seeking Shareholder’ approval to consolidate its share capital through the consolidation of every 3 - 100 Shares

into one (1) Consolidated Share. Pursuant to the Shareholders’ approval granted on 16 February 2023, the Company carried

out a share consolidation exercise where every 10 Shares was consolidated into one (1) Share (the “First Share Consolidation”).

The First Share Consolidation was completed on 16 August 2024. After completion of the First Share Consolidation, the Company

will have an issued and paid-up share capital of US$146,884,770, comprising of approximately 21,708,970 Shares1.

Purpose

The

Directors believe that the Proposed Share Consolidation will result in a more appropriate and effective capital structure for the Company

and a resultant trading price for the Consolidated Shares that would be more appealing to a wider range of investors, particularly institutional

investors, globally.

After

completion of the First Share Consolidation, the Company will have approximately 21,708,970 Shares2 on issue, which for a

company of its size, is a very large number and subjects Shareholders to several disadvantages, including:

| |

● |

poor

market perception as investors equate the low share price with the perception of a troubled or poorly performing company; |

| |

|

|

| |

● |

vulnerability

to speculative day-trading and short selling, which generates share price volatility; |

| |

|

|

| |

● |

the

large number of Shares on issue is disproportionate to that of comparable companies; and |

| |

|

|

| |

● |

discouraging

quality, long term institutional investors, equity funds and lending institutions seeking stability and long-term growth. |

The

Board believes these factors can be minimised by the Proposed Share Consolidation.

Effect

of the Proposed Share Consolidation

On

the assumption that there will be no new Shares issued by the Company up to the Share Consolidation Record Date and no fractions of Consolidated

Shares arising from the Proposed Share Consolidation, and subject to Shareholders’ approval being obtained for the Proposed Share

Consolidation at the EGM, the issued and paid-up share capital of the Company will be approximately US$146,884,770, comprising of the

following number of Consolidated Shares after completion of the Proposed Share Consolidation:

| Share

Consolidation Ratio |

|

Number

of Consolidated Shares* |

| If

every 3 Shares is consolidated into 1 Consolidated Share |

|

7,236,323 |

| If

every 10 Shares is consolidated into 1 Consolidated Share |

|

2,170,897 |

| If

every 20 Shares is consolidated into 1 Consolidated Share |

|

1,085,449 |

1 Subject

to rounding differences from the First Share Consolidation.

2 Subject

to rounding differences from the First Share Consolidation.

GENIUS

GROUP LIMITED

(Company

Registration No. 201541844C)

(Incorporated

in the Republic of Singapore)

Registered

Office:

8

Amoy Street #01-01

Singapore

049950

| If

every 30 Shares is consolidated into 1 Consolidated Share |

|

723,632 |

| If

every 40 Shares is consolidated into 1 Consolidated Share |

|

542,724 |

| If

every 50 Shares is consolidated into 1 Consolidated Share |

|

434,179 |

| If

every 60 Shares is consolidated into 1 Consolidated Share |

|

361,816 |

| If

every 70 Shares is consolidated into 1 Consolidated Share |

|

310,128 |

| If

every 80 Shares is consolidated into 1 Consolidated Share |

|

271,362 |

| If

every 90 Shares is consolidated into 1 Consolidated Share |

|

241,211 |

| If

every 100 Shares is consolidated into 1 Consolidated Share |

|

217,090 |

*fractional

entitlements to be disregarded

The

Number of Consolidated Shares set out in the table above are presented purely for illustrative purposes only and does not purport to

be indicative or a projection of the actual number of Consolidated Shares immediately after completion of the Proposed Share Consolidation.

As

the Share Consolidation applies equally to all Shareholders, individual Shareholdings will be reduced in the same ratio as the total

number of Shares (fractional entitlements being disregarded). Accordingly, subject to disregarding of fractional entitlements, the Proposed

Share Consolidation will have no material effect on the percentage interest in the Company of each Shareholder.

Options,

Warrants, Restricted Stock Units and Convertible Loans

As

at the date of this Notice of EGM, the Company has options, warrants, restricted stock units and convertible loans. If the Proposed Share

Consolidation is approved, the options, warrants, restricted stock units and convertible loans will also be re-organised in accordance

with the terms and conditions of the applicable Listing Rules of the New York Stock Exchange. The number of options, warrants,

restricted stock units and convertible loans will be consolidated in the same ratio as the Shares and the exercise price of options and

convertible loans or restricted stock units will be amended in inverse proportion to that ratio.

Rounding

and Fractional entitlements

Shareholders

should note that the number of Consolidated Shares which they will be entitled to pursuant to the Proposed Share Consolidation, based

on their holdings of existing Shares as at the Share Consolidation Record Date, will be rounded down to the nearest whole Consolidated

Share and any fractions of Consolidated Shares arising from the Proposed Share Consolidation will be disregarded. All fractional entitlements

arising from the implementation of the Proposed Share Consolidation will be aggregated and/or dealt with in such manner as the Directors

may, in their absolute discretion, deem appropriate in the interests of the Company, including (i) disregarding the fractional

entitlements, or (ii) aggregating and selling the same and retaining the net proceeds for the benefit of the Company. Affected

Shareholders will not be paid for any fractions of a Consolidated Share which are disregarded or any of the proceeds arising from any

aggregation and sale of such fractions. Where a Shareholder’s holding would be less than one (1) Share as a result of the

Share Consolidation, no Shares will be held by that Shareholder after the Share Consolidation.

GENIUS

GROUP LIMITED

(Company

Registration No. 201541844C)

(Incorporated

in the Republic of Singapore)

Registered

Office:

8

Amoy Street #01-01

Singapore

049950

Definitions

For

the purposes of this Notice (including the Proxy Form), the following definitions are used:

“Beneficial

Shareholders” means persons or entities holding their interests in the Company’s shares as, or through, a participant

in The Depository Trust Company (“DTC”), or its nominee, Cede & Co. in book entry form at VStock Transfer, LLC

(“VStock”) or such other entity that may be engaged as registrar of members or transfer agent on behalf of the Company,

a broker, dealer, securities depository or other intermediary and who are reflected in the books of such intermediary; also commonly

referred to in the United States as “street name holders”.

“Consolidated

Share” means the consolidated shares in the issued share capital of the Company held by Shareholders pursuant to the completion

of the Proposed Share Consolidation.

“Share

Consolidation Effective Trading Date” means the date(s) to be determined by the Directors as being the date when the Proposed

Share Consolidation will become effective and the date on which the Consolidated Shares will trade on the New York Stock Exchange. For

the avoidance of doubt, in the event the Proposed Share Consolidation is implemented in 2 separate steps, each step shall have a different

Share Consolidation Effective Trading Date.

“Share

Consolidation Record Date” means the time and date(s) (to be announced by the Board at and on which, subject to the approval

of the Shareholders for the Proposed Share Consolidation being obtained at the EGM and compliance with the Rules and Regulations for

the U.S. Securities and Exchange Commission and other regulatory requirements, the Register of Members of the Company and Share Transfer

Books of the Company shall be used to determine the entitlements of Consolidated Shares of Shareholders under the Proposed Share Consolidation.

For the avoidance of doubt, in the event the Proposed Share Consolidation is implemented in 2 separate steps, each step shall have a

different Share Consolidation Record Date.

“Shareholder

on Record” means a person or entity whose name is reflected in the Company’s register of members, and who is not necessarily

a Beneficial Shareholder.

“NYSE

American Shareholders” means Beneficial Shareholders.

General

Matters relating to the EGM:

| 1. |

The

Company’s EGM will be held in a wholly physical format at Genius Central Singapore Pte Ltd, 7 Amoy Street #01-01 Far East Square

Singapore 049949 on 18 September 2024 at 4:00 PM (Singapore time), for considering and, if thought fit, passing the Special Resolution

set out in this Notice of EGM. There will be no option for shareholders to participate virtually. |

| |

|

| 2. |

Quorum:

The quorum required to transact business at the EGM is for at least two Shareholders to be present. Shares represented at the

meeting for which an abstention from voting has been recorded are counted towards the quorum. |

| |

|

| 3. |

Basis

of voting: Votes shall be taken on a poll with one vote for each share. In order for the Special Resolution to be passed, more

than 75% of the eligible votes cast on the Resolution must be in favour of the Resolution. Whilst shares for which an abstention

from voting has been recorded are counted toward the quorum of the meeting, the calculation of the percentage of votes cast in favour

of the Resolution disregards abstained votes. A person entitled to more than one vote need not use all his votes or cast all the

votes he uses in the same way. |

| |

|

| 4. |

Identification

of Beneficial Shareholders and Shareholders on Records and their corporate representatives: Before any person may participate

in the EGM, the Chairman of the EGM (“Chairman”) must be reasonably satisfied that the right of the person to

participate at the EGM has been reasonably verified. |

| |

|

| 5. |

Record

Date for determining Beneficial Shareholders’ eligibility to vote: Only those Beneficial Shareholders recorded in the records

of the relevant securities depository on 12 August 2024 are eligible to vote. |

GENIUS

GROUP LIMITED

(Company

Registration No. 201541844C)

(Incorporated

in the Republic of Singapore)

Registered

Office:

8

Amoy Street #01-01

Singapore

049950

Participation

in the EGM

| 1. |

Notice

and Proxy Form: Printed copies of this Notice and accompanying proxy form will be sent to Shareholders and published on the Company’s

corporate website at the URL https://ir.geniusgroup.net/. |

| |

|

| 2. |

Submission

of questions: Shareholders may submit questions related to the resolution to be tabled no later than 04:00 p.m., 15 September

2024 (Singapore time) via email to investors@geniusgroup.net. For verification purpose, when submitting any questions, Shareholders

MUST provide the Company with their particulars (comprising full name (for individuals) / company name (for corporates), email address,

contact number, NRIC / passport number / company registration number, shareholding type and number of shares held). The Company will

endeavour to address the substantial and relevant queries from Shareholders no later than 48 hours prior to the closing date and

time for the lodgement of the proxy forms through an announcement to be released on the Company’s corporate website at the

URL https://ir.geniusgroup.net/. If questions or follow-up questions are submitted after the 15 September 2024 deadline,

the Company will endeavour to address these questions at the EGM itself. Where substantially similar questions are received, the

Company will consolidate such questions and consequently not all questions may be individually addressed. |

| 3. |

Appointment

of Proxies: |

| |

(a) |

Shareholders

may exercise their voting rights at the EGM via proxy voting. A proxy need not be a Shareholder. |

| |

|

|

| |

(b) |

Shareholders

who wish to appoint proxies (including appointing the Chairman as their proxy) to attend the EGM and vote at the EGM on their behalf

must complete and submit the Proxy Form in accordance with the instructions below or on the proxy card; by 4:00 PM on 15 September

2024 (Singapore time). |

| |

|

|

| |

(c) |

A

Shareholder who wishes to submit an instrument of proxy must first complete and sign the proxy form mailed to them with the Notice

(or downloaded from the Company’s corporate website), before delivering or scanning and sending a clear copy of it: |

| |

(i) |

in

the case of NYSE American Shareholders, by following the instruction on the proxy form by 04:00 PM on 15 September 2024 (Singapore

time); and |

| |

|

|

| |

(ii) |

in

the case of Shareholders on Record, to VStock Transfer, LLC, 18 Lafayette Place or by email to vote@vstocktransfer.com or

by following the instruction on the proxy form by 04:00 PM on 15 September 2024 (Singapore time). |

| |

(d) |

In

the Proxy Form, a Shareholder should specifically direct the proxy on how he/she is to vote for or vote against (or abstain from

voting on) the resolution to be tabled at the EGM. If no specific direction as to voting is given, the proxy (including the Chairman

if he is appointed as proxy) will vote or abstain from voting at his/her discretion. All valid votes cast via proxy on each resolution

will be counted. |

GENIUS

GROUP LIMITED

(Company

Registration No. 201541844C)

(Incorporated

in the Republic of Singapore)

Registered

Office:

8

Amoy Street #01-01

Singapore

049950

| 4. |

Personal

Data Privacy: |

By

participating in the EGM (through pre-registration, attendance or the submission of any questions to be raised at the EGM) and/or any

adjournment thereof, submitting an instrument appointing a proxy to attend, speak and vote at the EGM and/or any adjournment thereof,

or submitting any details of the Shareholder’s corporate representatives in connection with the EGM, a Shareholder (whether a Beneficial

Shareholder or a Shareholder of Record) (a) consents to the collection, use and disclosure of the Shareholder’s personal data by

the Company (or its agents or service providers) for the purpose of the processing, administration and analysis by the Company (or its

agents or service providers) of proxies appointed for the EGM (including any adjournment thereof) and the preparation and compilation

of the attendance lists, minutes and other documents relating to the EGM (including any adjournment thereof), and in order for the Company

(or its agents or service providers) to comply with any applicable laws, take-over rules, listing rules, regulations and/or guidelines

(collectively, the “Purposes”); (b) warrants that where the Shareholder discloses the personal data of the Shareholder’s

proxy or corporate representative to the Company (or its agents or service providers), the Shareholder has obtained the prior consent

of such proxy or corporate representative for the collection, use and disclosure by the Company (or its agents or service providers)

of the personal data of such proxy or corporate representative for the Purposes; and (c) agrees that the Shareholder will indemnify the

Company in respect of any penalties, liabilities, claims, demands, losses and damages as a result of the Shareholder’s breach of

warranty.

By

Order of the Board

Roger

James Hamilton

Director

Date: 16 August 2024

Attachments:

Proxy Form

GENIUS

GROUP LIMITED

(Company

Registration No. 201541844C)

(Incorporated

in the Republic of Singapore)

Registered

Office:

8

Amoy Street #01-01

Singapore

049950

PROXY

FORM

EXTRAORDINARY

GENERAL MEETING

| IMPORTANT |

| |

| 1. |

By

submitting an instrument appointing a proxy, the Shareholder accepts and agrees to the personal data privacy terms set out in the Notice

of Extraordinary General Meeting (“EGM”) dated 16 August 2024. |

| 2. |

Alternative

arrangements relating to submission of questions in advance of the EGM and voting during the EGM or by appointing a proxy or proxies

(including the Chairman of the Meeting as proxy) at the EGM, are set out in the Notice of EGM dated 16 August 2024. |

| 3. |

Please

read the notes to the Proxy Form. |

I/We*,_____________________________(Name)

_________________________________ (NRIC/Passport/Registration No.) of______________________________________ (Address) being the Shareholder

of Record / Beneficial Shareholder* of__________________ ordinary shares in Genius Group Limited (the “Company”) hereby

appoint:

| Name |

|

Address |

|

NRIC

/ Passport Number / Registration Number |

|

Email

Address |

|

Number

of Shares |

|

|

|

|

|

|

|

|

|

*and/or

(delete as appropriate)

| Name |

|

Address |

|

NRIC

/ Passport Number / Registration Number |

|

Email

Address |

|

Number

of Shares |

|

|

|

|

|

|

|

|

|

or

failing the person / both of the persons* above, the Chairman of the EGM as my/our* proxy to attend, speak and vote for me/us on my/our

behalf at the EGM of the Company to be held at Genius Central Singapore Pte Ltd, 7 Amoy Street #01-01 Far East Square Singapore 049949

on 18 September 2024 at 04:00 PM Singapore time and at any adjournment thereof.

I/We

direct the proxy(ies) of the EGM, to vote “For” or “Against”, or “Abstain” from voting on the Resolution

proposed at the EGM as indicated hereunder. If no specific directions as to voting is given or in the event of any other matter arising

at the EGM and at any adjournment thereof, the proxy will vote or abstain from voting at his/her discretion.

GENIUS

GROUP LIMITED

(Company

Registration No. 201541844C)

(Incorporated

in the Republic of Singapore)

Registered

Office:

8

Amoy Street #01-01

Singapore

049950

| No |

|

Special

Resolution |

|

Number

of votes FOR |

|

Number

of votes AGAINST |

|

Number

of votes ABSTAIN |

| 1 |

|

Proposed

Share Consolidation

|

|

|

|

|

|

|

Notes:

(Please

indicate with a tick [“√”] in the space provided whether you wish to cast all your votes for or against or to

abstain from voting on each resolution as set out in the Notice of EGM. Alternatively, if you wish to exercise your votes both for and

against any resolution and/or to abstain from voting on any resolution, please indicate the number of shares in the respective spaces

provided.)

Dated

this ________ day of ______________________ 2024

| Signature(s)

of member(s) or common seal |

|

| IMPORTANT:

PLEASE READ NOTES OVERLEAF |

|

GENIUS

GROUP LIMITED

(Company

Registration No. 201541844C)

(Incorporated

in the Republic of Singapore)

Registered

Office:

8

Amoy Street #01-01

Singapore

049950

NOTES

TO PROXY FORM:

| 1. |

An

instrument appointing a proxy shall be in writing and: |

| |

(a) |

in

the case of an individual shall be signed by the appointor or by his attorney; and |

| |

|

|

| |

(b) |

in

the case of a corporation shall be either under the common seal or signed by its attorney or by a duly authorised officer on behalf

of the corporation. |

| 2. |

A

proxy need not be a member of the Company. A Shareholder may choose to appoint the Chairman of the EGM as his/her/its proxy. |

| |

|

| 3. |

Shareholders

who wish to submit an instrument of proxy must first complete and sign the proxy form mailed to them with the Notice (or downloaded

from the Company’s corporate website), before delivering it (or scanning and sending a clear copy of it): |

| |

(i) |

in

the case of NYSE American Shareholders by following the instruction on the proxy form by 4:00 PM on 15 September 2024 (Singapore

time); and |

| |

|

|

| |

(ii) |

in

the case of Shareholders on Record to VStock Transfer, LLC,18 Lafayette Place or by email to vote@vstocktransfer.com or by following

the instruction on the proxy form by 4:00 PM on 15 September 2024 (Singapore time). |

| 4. |

The

power of attorney (if applicable) or other authority, if any, appointing a person to attend and vote at the Extraordinary General

Meeting must be submitted to the Company via email to investors@geniusgroup.net, not less than 72 hours before the time appointed

for holding the EGM i.e. by 4:00 PM on 15 September 2024 (Singapore time). |

| |

|

| 5. |

A

corporation which is a Shareholder of the Company may authorise by resolution of its directors or other governing body, such person

as it thinks fit to act as its representative at the EGM in accordance with Section 179 of the Companies Act 1967 of Singapore. |

| |

|

| 6. |

Shareholders

shall insert the relevant number of those shares owned by them that is to be represented in this Proxy Form. Shareholders are not

obliged to vote all their shares or to vote all their shares in the same manner. |

| |

|

| 7. |

Shareholders

shall insert the relevant number of shares in respect of which they wish to vote in the relevant space under the columns headed “For”,

“Against”, “Abstain”, as appropriate if they wish to split their votes across the voting options or to cast

their votes in respect of a lesser number of shares than they own in the Company. Shareholders are not obliged to use all the votes

exercisable by them, but the total of the votes cast and in respect of which abstention is recorded may not exceed the total of the

votes exercisable by them. If Shareholders wishes to cast all of the votes of those shares owned by them that are represented in

this Proxy Form in the same way in respect of a particular resolution, such Shareholders need not fill in such number of shares,

and shall indicate their vote as either “For”, “Against” or “Abstain” by placing a “√”

within the box provided. |

| |

|

| 8. |

Any

deletions, alterations or corrections made to this Proxy Form must be initialled by the Shareholder. |

| |

|

| 9. |

In

the case of joint Shareholders, all holders must sign this Proxy Form. |

GENIUS

GROUP LIMITED

(Company

Registration No. 201541844C)

(Incorporated

in the Republic of Singapore)

Registered

Office:

8

Amoy Street #01-01

Singapore

049950

| 10. |

The

Chairman of the EGM may accept any voting instruction submitted other than in accordance with these notes if he is satisfied as to

the manner in which the Shareholder wishes to vote. |

| |

|

| 11. |

Any

form that is incomplete, improperly completed or illegible or where the true intentions of the person executing the Proxy Form are

not ascertainable may be rejected. |

| |

|

| 12. |

In

any case where a Shareholder on Record is a securities depository whose name or whose nominee’s name is entered as a member

in the register of members of the Company in respect of book-entry securities in the Company (“Depository”), the

Company shall be entitled and bound: |

| |

(a) |

to

reject any instrument of proxy lodged if a person who has an account directly with the Depository, which account is credited with

book-entry securities in the Company, (“Depositor”) is not shown to have any shares entered against his name in

the register maintained by the Depository in respect of book-entry securities in the Company (“Depository Register”)

as at 72 hours before the time of the EGM as certified by the Depository to the Company; and |

| |

|

|

| |

(b) |

to

accept as the maximum number of votes which in aggregate the proxy appointed by the Depositor is or are able to cast on a poll a

number which is the number of shares entered against the name of that Depositor in the Depository Register as at 72 hours before

the time of the EGM as certified by the Depository to the Company, whether that number is greater or smaller than the number specified

in any instrument of proxy executed by or on behalf of that Depositor. If that number is smaller than the number specified in the

instrument of proxy, the maximum number of votes “For”, “Against” or “Abstain” shall be accepted

in (as nearly as may be) the respective proportions set out in the instrument of proxy. |

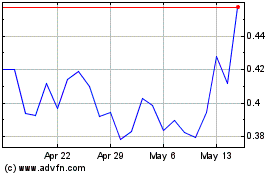

Genius (AMEX:GNS)

Historical Stock Chart

From Feb 2025 to Mar 2025

Genius (AMEX:GNS)

Historical Stock Chart

From Mar 2024 to Mar 2025