0001001614FALSE00010016142024-12-312024-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 31, 2024

Riley Exploration Permian, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 1-15555 | 87-0267438 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

29 E. Reno Avenue, Suite 500

Oklahoma City, Oklahoma 73104

Address of Principal Executive Offices, Including Zip Code)

405-415-8699

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | | REPX | | NYSE American |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

SPECIAL NOTE ABOUT FORWARD-LOOKING STATEMENTS

This Form 8-K contains certain statements that are, or may be deemed to be, “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical facts, included herein or incorporated herein by reference are “forward-looking statements.” Included among “forward-looking statements” are, among other things:

•statements that we expect to commence or complete construction of each phase of our midstream buildout plan by certain dates, or at all due to the uncertainties involved in projects of this nature;

•statements regarding future levels of natural gas production or our ability to successfully execute our development plan for the New Mexico Assets;

•statements relating to the anticipated costs related to our midstream buildout plan, which are subject to change due to cost overruns, change orders, necessity to acquire rights-of-way, delays or costs necessitated by regulatory requirements and/or approvals, adverse weather events and increases in prices of construction materials or labor;

•statements that the systems and facilities that we intend to build will have certain characteristics, including volume capacity or the feasibility and cost of pipeline interconnections;

•statements regarding our midstream business strategy, our midstream business plans (including strategic opportunities) or any other plans, forecasts or objectives any or all of which are subject to change;

•statements about our access to sufficient capital to fund the midstream buildout plan, our development plan or any related matters; and

•any other statements that relate to non-historical or future information.

These forward-looking statements are often identified by the use of terms and phrases such as “achieve,” “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “plan,” “project,” “propose,” “strategy” and similar terms and phrases. Although we believe that the expectations reflected in these forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect.

These statements relate to future events or our future financial performance or condition and involve known and unknown risks, uncertainties and other factors that could cause our actual results, levels of activity, performance or achievement to differ materially from those expressed or implied by these forward-looking statements. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this Form 8-K.

You should read this Form 8-K and the documents that we reference herein as well as the Company’s public filings completely and with the understanding that our actual results may differ materially from what we expect as expressed or implied by our forward-looking statements. We discuss many of these risks and uncertainties in greater detail in our Annual Report on Form 10-K, particularly in Part I. Item 1A. “Risk Factors” and our subsequent filings under the Securities Exchange Act of 1934. These forward-looking statements represent our estimates and assumptions only as of the date of this Form 8-K regardless of the time of delivery of this Form 8-K. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise after the date of this Form 8-K.

Item 8.01 Other Events.

Gas Purchase Agreement and Midstream Buildout for New Mexico Assets

Riley Exploration – Permian, LLC (“REP, LLC”), a wholly-owned subsidiary of Riley Exploration Permian, Inc. (“REPX” together with REP, LLC, hereinafter referred to as the “Company”), entered into a 15-year gas purchase agreement, dated December 31, 2024, with a leading third-party midstream service provider (the “Midstream Counterparty”).

Under this gas purchase agreement, the Midstream Counterparty is obligated to process, treat and purchase from the Company, and the Company is obligated to sell to the Midstream Counterparty, all of the committed gas and natural

gas liquids conforming to certain quality specifications produced from the dedicated acreage. The gas purchase agreement contains the following terms and conditions: (i) an acreage dedication for a significant portion of the Company’s oil and gas assets in the Yeso trend of the Permian Basin (the “New Mexico Assets”) commencing on the in-service date which we currently anticipate will be on or before the end of the third quarter in 2026, (ii) customary representations, warranties and agreements by the Company, (iii) customary indemnification obligations of the Company and the Midstream Counterparty against certain liabilities, (iv) reimbursement by the Company of construction costs incurred by the Midstream Counterparty to connect to the Company’s pipeline, subject to a monetary cap, and (v) an initial 15-year term from the in-service date followed by a year-to-year continuation until terminated by either party upon 180 days written notice.

To interconnect to the receipt points for processing and treating by the Midstream Counterparty per the gas purchase agreement, the Company intends to construct, own and operate low and high-pressure gathering lines and compression facilities that will connect to its new high capacity 20-inch natural gas pipeline to be constructed by the Company and designed to handle gas volumes of up to 150MMcf per day. The Company anticipates the first compressor station will be in-service in the first quarter of 2025, which will connect to our existing processing and treating counterparty. Subsequently, the Company plans to begin the construction of additional gathering systems and the pipeline, with an estimated completion before the end of 2026. The Board of Directors approved an aggregate of approximately $130 million in capital expenditures to complete these initial projects of our midstream buildout plan.

Following completion of the initial buildout, we expect to continue to invest in our midstream infrastructure and development, as we believe it will allow us to meet our expected production growth from the New Mexico Assets and provide for additional takeaway capacity, which we believe affords us more control over the direction and planning of our drilling pace.

Additionally, the Company may pursue opportunities in New Mexico as part of a longer-term midstream business strategy. These activities may include pursuing strategic transactions as well as pursuing additional revenue streams by leveraging our midstream infrastructure to aggregate third-party volumes.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | |

| Exhibit No. | Description |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | RILEY EXPLORATION PERMIAN, INC. |

| | | |

| Date: | January 6, 2025 | By: | /s/ Bobby Riley |

| | | Bobby Riley |

| | | Chief Executive Officer |

Cover

|

Dec. 31, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Dec. 31, 2024

|

| Entity Registrant Name |

Riley Exploration Permian, Inc.

|

| Entity Incorporation, Date of Incorporation |

DE

|

| Entity File Number |

1-15555

|

| Entity Tax Identification Number |

87-0267438

|

| Entity Address, Address Line One |

29 E. Reno Avenue

|

| Entity Address, Address Line Two |

Suite 500

|

| Entity Address, City or Town |

Oklahoma City

|

| Entity Address, State or Province |

OK

|

| Entity Address, Postal Zip Code |

73104

|

| City Area Code |

405

|

| Local Phone Number |

415-8699

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

REPX

|

| Security Exchange Name |

NYSEAMER

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001001614

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

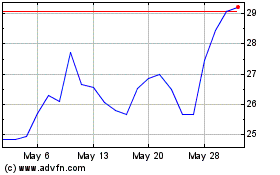

Riley Exploration Permian (AMEX:REPX)

Historical Stock Chart

From Dec 2024 to Jan 2025

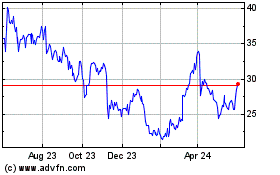

Riley Exploration Permian (AMEX:REPX)

Historical Stock Chart

From Jan 2024 to Jan 2025