TIDMASTO

RNS Number : 1277Q

AssetCo PLC

16 February 2023

LEI: 213800LFMHKVNTZ7GV45

16 February 2023 Immediate Release

AssetCo plc

Preliminary results for the year ended 30 September 2022

AssetCo plc ("AssetCo" or the "Company"), the agile asset and

wealth management company, today announces its results for the year

ended 30 September 2022.

Highlights

-- Assets under management (AuM) as at 30 September 2022 were

GBP2.7 billion (2021: GBP113m); including SVM Asset Management

which completed post year end AuM was GBP3.1 billion

-- Loss for the year GBP9.2m (2021: profit of GBP14.6m)

-- Interim dividend of 1.3p per share declared and paid

-- Significant cost reduction in listed equities business well

underway with GBP10m of annualised costs cut in River and

Mercantile by 30 September 2022

-- Invested over GBP40m in growth through acquisitions

-- Considerable progress in building out our listed equity

platform through the acquisition of River and Mercantile Group,

Revera Asset Management and SVM Asset Management

Martin Gilbert, Chairman, said:

"We continue to seek out potential opportunities for further

inorganic expansion in relatively difficult trading conditions for

asset management businesses generally. This creates opportunities

for the agile AssetCo in its mission to acquire, improve and grow

otherwise attractive businesses that are experiencing challenges or

whose true value is unrecognised. We are particularly pleased, as

an example, with Parmenion and remain strong advocates of this very

valuable business, the management team and believe that the client

led initiatives as well as industry interest over the past year

will deliver significant value for all its stakeholders.

We are relentlessly focussing on serving our clients, sustaining

investment performance, reducing costs, growing revenues and

getting the group to profitability as soon as possible whilst being

ready to pursue opportunity."

Campbell Fleming, Chief Executive, said:

"Our loss for the year was in part driven by a combination of

acquisition costs and reorganisation costs as we right-size and

integrate our acquired businesses. We are delivering on our

acquisitive growth strategy whilst maintaining a focus on reducing

costs across the business with a GBP10m annualised cost saving in

River and Mercantile achieved. AssetCo has now successfully

invested more than GBP40m in growing the business by completing the

acquisitions of River and Mercantile and Revera, taking revenues

from less than GBP0.5m last year to over GBP8m during the course of

the year, with a forward-looking run rate of GBP17m when the

acquisition of SVM is also factored in.

We are hugely grateful for the efforts of our investment, client

and operations teams as well the continued support from our clients

and our shareholders in what was a volatile, difficult and tough

year for all."

For further information, please contact:

AssetCo plc Numis Securities Limited

Campbell Fleming, CEO Nominated adviser and joint broker

Peter McKellar, Deputy Chairman Giles Rolls / Charles Farquhar

Tel: +44 (0) 785 0464 301 Tel: +44 (0) 20 7260 1000

Panmure Gordon (UK) Limited H/Advisors Maitland

Joint broker Neil Bennett

Atholl Tweedie Rachel Cohen

Tel: +44 (0) 20 7886 2906 Tel: +44 (0) 20 7379 55151

For further details, visit the website, www.assetco.com

Ticker: AIM: ASTO.L

CHAIRMAN'S STATEMENT

The financial year ended 30 September 2022 was an eventful one

for AssetCo, during which we made considerable progress in building

out the Group's listed equity platform, private markets capability

and thematic ETF business. Our objective is to build an agile asset

and wealth management business that is fit for purpose in the

21(st) century.

The acquisition of River and Mercantile Group completed

successfully in June 2022 and of Revera Asset Management in August

2022. The acquisition of SVM Asset Management, announced in June

2022, completed successfully shortly after the financial year end.

Together with established subsidiary Saracen, the combination of

this group of companies provides a complementary product set,

managed by a well respected team of managers based in the UK's two

main investment hubs of London and Edinburgh. We are now focusing

on growing assets under management and on profitability. We are

making good headway towards run rate profitability in our wholly

owned subsidiary businesses, despite difficult trading conditions.

With the support of modest growth in equity stock markets over the

financial year, we are optimistic that we can achieve sales growth

and cost savings that will deliver a positive outcome for the

Group.

Investment markets have had a lot to cope with during the

financial year: the tragedy of war in Ukraine; continuing worldwide

supply chain challenges; energy price rises and continued pandemic

disruption in China. The UK large cap stock market was remarkably

resilient, with the FTSE 100 losing only 2% during the financial

year. This masked a volatile and troubling set of market events

which undermined investor confidence and sparked outflows in assets

under management. The performance of world and mid-cap UK markets

which lost c.20% and c.25% respectively over the financial year are

perhaps more indicative of underlying sentiment and (in the case of

world markets) balance some of the special factors, such as

Brexit-specific discounting, which impacted companies operating

solely or mainly in the UK.

Equity markets generally remained nervous during the year. The

combination of rising energy prices and shortages persisting as the

global economy recovered from Covid led to a sharp rise in

inflation, which had been relatively dormant since the early

1990's. Central banks have increased interest rates to offset this

challenge to economic stability, but this also increases the

chances of an economic slowdown and recession. All of this makes

for a challenging environment for most businesses, not least asset

management businesses which are exposed to the gearing effect of

fluctuating markets.

River and Mercantile has been exposed to the full force of those

challenges. Revenues in the River and Mercantile Group have been

impacted by both market conditions generally and by resulting

client outflows, as clients typically reduced equity exposure.

While wholesale business outflows are lighter than they might have

been when compared to the experience of many of our competitors,

taken together with stock market falls they nonetheless impacted

revenues negatively by approximately GBP2m between acquisition and

the financial year end 2022, on an annualised basis. Stockmarkets

continued to exert downward pressure on revenues going into the new

financial year.

Our mission to improve and grow otherwise attractive asset

management businesses began with tackling an initial cost base of

GBP32m of annualised costs at the point of announcing our

acquisition in January 2022. This was cut aggressively to GBP22.5m

in annualised costs by the financial year end 2022, after adjusting

for pipeline committed savings. Nonetheless, it was the principal

driver of the loss made by the Group of GBP9m after interest and

tax for the year. An aggressive assault on continuing costs is

on-going and remains a key focus of the coming year.

In the financial year under review the Group has invested more

than GBP40m in growing the business through the acquisitions of

River and Mercantile and Revera. Those acquisitions take revenues

from less than GBP0.5m last year to over GBP8m during the course of

the year, with a run rate of GBP17m annualised as at end September

2022 when the acquisition of SVM in October 2022 is also taken into

account. Revenues for the Group for the financial year ended 30

September 2022 include those from River and Mercantile from 15 June

2022 and from Revera from the beginning of August 2022.

Comparisons to the previous year are not particularly

instructive as the Company had little effective revenue during that

year, other than the successful Grant Thornton litigation which

contributed net income of GBP22.4m on a one-off basis. In December

2022 we announced that the four active equity asset management

subsidiaries of the Group will come together under the River and

Mercantile brand during the course of 2023. Much work remains to be

done to realise the significant potential inherent in combining

these businesses, and existing contractual commitments to third

party suppliers, regulatory approvals and client consents are all

hurdles along the way. However, the Group has considerable talent

to draw on and considerable experience in dealing with such

challenges. Rationalisation plans are well advanced.

During the year we have been actively engaged in raising the

profile of the business both in the UK and internationally, seeking

to broaden the shareholder base. We have met with key asset

allocators in the UK and abroad and are exploring growth

opportunities for the business with partners around the world -

both organically and where deeper partnerships might be mutually

attractive.

An interim dividend of 1.3p per share (equivalent to 13p per

share before the August 2022 share split) was declared towards the

end of November 2022, as foreshadowed in the Company's shareholder

circular and AIM admission document in March 2022. This is the

first dividend paid by the Company since its re-admission and sits

alongside a share buy-back programme rolled out in the closing

quarter of the calendar year which, by end January 2023, had bought

back almost GBP6.9m of shares currently held as treasury stock. It

is our intention to pursue a progressive dividend policy where

circumstances permit.

We continue to seek out potential opportunities for further

inorganic expansion. The relatively difficult trading conditions

for asset management businesses generally creates opportunities for

AssetCo in its mission to acquire, improve and grow otherwise

attractive businesses that are experiencing challenges.

Martin Gilbert - Chairman

16 February 2023

BUSINESS REVIEW

As at the end of the financial year to September 2022, the

AssetCo Group encompasses active equities asset management in three

subsidiaries (which became four with the acquisition of SVM asset

management at the end of October 2022) an early stage

infrastructure asset management business, a majority equity

interest in an exchange traded fund provider and a structured 30%

interest in a digital platform business.

Active Equities

The acquisition of the River and Mercantile Group in June 2022

brought useful distribution capability to the Group in the UK as

well as a wide range of funds, taking Active Equities assets under

management to GBP2,291m by September 2022 year end. SVM, acquired

during October 2022, had assets under management of GBP528m as at

30 September 2022.

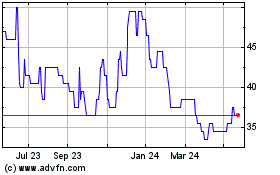

Movement in assets under management from end September 2022 to

end December 2022 may be summarised in the following chart, which

includes SVM on a pro forma basis:

Performance

The three months to end September 2022 have been particularly

active for River and Mercantile with the launch of two funds

compliant with the EU's sustainable finance disclosure Regulations

(SFDR) and its inaugural infrastructure fund. The launch of the two

SFDR funds, European Change for Better Fund (article 9 compliant)

and Global Sustainable Opportunities Fund (article 8 compliant),

has been well received and both are highly rated by independent and

dedicated Sustainable Investment Advisor, Mainstreet Partners. The

funds follow an investment philosophy which incorporates

sustainability into the investment manager's long-established

process, focusing on the characteristics of Potential, Valuation

and Timing. Launched with client seed capital and backing, they

invest in companies which the team believes can make a significant

improvement in their carbon footprint, as well as companies which

enable this improvement for others.

Investment performance of the River and Mercantile equities

funds over the three months to September 2022 has been encouraging

given the prevailing macro-economic headwinds. A number of funds

have responded to the pick-up in demand for a more

'value-orientated' investment approach and investors' requirement

for higher yielding investments. We believe that this trend has

much further to run. Saracen's Global Income and Growth Fund has

also performed well, and the shares are close to all-time

highs.

It is pleasing to note that the acquisition has been achieved

with minimal disruption to clients and that the ongoing River and

Mercantile funds saw less in the way of outflows than many of their

competitors, and no loss of market share. River and Mercantile is

well positioned for future growth.

Fund Performance: active equity funds managed by the Group as at

end December 2022:

Our flagship range of mutual funds, across all of our active

equities subsidiaries, is showing strong investment performance

over 1, 3, and 10 years and since inception.

The information above is disclosed in order to allow

shareholders to assess the current performance of our investment

strategies. While historical investment performance is not an

indicator of future investment performance, the long term track

records of our strategies give shareholders an indication of the

sustainability of our investment performance across different

investment cycles. Performance data is sourced from: FEAnalytics

for IA Sector Peer Group performance. B share class (net of

management fees) performance is used since share class launch for

all funds except Revera UK Dynamic which is Corporate class

performance. For any fund performance prior to the launch of these

share classes, performance is chain linked with the next highest

paying fee share class back to the earliest date.

Costs

In addition to a focus on net new business in its growth plan,

considerable attention is being paid to reducing costs, in line

with comments on right sizing the organisation made at the time of

acquisition. The sale of its UK Solutions offerings, prior to River

and Mercantile's acquisition by AssetCo, followed by the sale of

its US Solutions shortly thereafter, delivered a business with a

larger operating infrastructure than was necessary to run the

remaining active equities asset management business. Shrinking this

operating model to one more appropriate to River and Mercantile's

reduced and simplified business going forward has been a key focus.

Since announcing the deal in January 2022, River and Mercantile's

full time headcount (excluding employees who transferred with the

Solutions sale) has been reduced by 22%, and the annualised

operating costs also by 22% by year end.

A new, lower cost target operating model has been designed with

implementation taking place over the 2023 calendar year to enable a

stronger fit-for-purpose business which is scalable for both

organic growth and the acquisitive nature of the Group. River and

Mercantile's streamlined operating model is intended to be the

backbone of the active equities business for the Group, enabling

further consolidation of operations from other subsidiaries within

the Group. Further cost savings within River and Mercantile have

been identified through a combination of rationalising suppliers

and downsizing operating platforms. A detailed plan covering both

transition and consolidation of the operating model is in place and

being carefully tracked, with cost reduction and efficiency the

clear focus throughout.

SVM Acquisition

In November 2022, the Group completed the acquisition of SVM

Asset Management (SVM) for GBP11.2m. SVM is an active manager of

listed equities and is the Authorised Corporate Director to its own

ICVC fund range, whilst also managing an Investment Trust and

institutional client mandates. SVM is a key component of AssetCo's

plans to have a strong and dynamic asset management hub in

Edinburgh. Completion of the acquisition brought assets managed by

the AssetCo group companies in the Scottish capital to nearly

GBP700m.

The intention is that, over time and subject to appropriate

regulatory approvals and client consents, the majority of

compliance, operational, distribution and marketing resources will

be shared within the broader AssetCo group companies. At the same

time, the unique qualities and strengths for which SVM is well

known will be preserved to form a bedrock of growth for the

future.

Integration

In December 2022, we announced the bringing together of the four

active equity businesses under the River and Mercantile brand

which, given completion of the SVM acquisition only a month before,

was testament to AssetCo's ability to find and augment

complementary businesses. Our Edinburgh-based active equity asset

businesses (Saracen, Revera and SVM) are already working together

effectively using SVM's offices as a single base.

Infrastructure

During the year, the River and Mercantile Infrastructure Income

Fund was launched with a first series of shares to the value of

GBP115m in committed capital (representing GBP0.8m in annualised

revenue when fully drawn) and made its first investments. The first

two investments (in Spring Fibre Limited and Cohiba Communications

Limited) are consistent with the fund's core theme of supporting

the "digital transition" in the UK - through financing the delivery

of full fibre-optic and fixed wireless technology infrastructure in

selected towns, giving residential and commercial customers next

generation access to the internet. Together these investee

companies plan to provide ultra-fast broadband connectivity to more

than 2.5 million homes and, with many of these homes in socially

disadvantaged communities, aim to provide households and businesses

the affordable access to the internet required to fulfil their

potential. These "digital transition" investments, alongside the

fund's focus on supporting the UK's "energy transition",

demonstrate positive tangible Environmental, Social and Governance

(ESG) characteristics for investors and communities alike.

It is expected that this ESG-focused approach to investments

will continue to prove attractive and deliver fundraising success

for the fund during the coming year. The pipeline of interested

investors is strong and, similarly, we see a good supply of

potential investments. We expect good growth potential from this

side of our business, despite recent headwinds in the sector.

Exchange Traded Funds

2022 was a challenging year for European thematic ETF providers,

with the economic headwinds, noted previously, coinciding with an

increase in competition.

Notwithstanding the foregoing, Rize ETF's market recognition as

a leader in thematic and impact thematic funds continues to

flourish, with the firm winning two further awards in 2022,

including the "Best Food Investment Firm / Europe" from

International Investor in relation to the Rize Sustainable Future

of Food UCITS ETF (FOOD) and "Most Innovative Fund Launch -

Passive" from ESG Clarity for the Rize Environmental Impact 100

UCITS ETF (LIFE).

Rize ETF enjoyed net inflows of USD 108 million for the

financial year to 30 September 2022, taking assets under management

to GBP326m with attaching annualised revenues of GBP1.5m pa as at

that date. Rize ETF has been onboarded (approved) by a number of

major clients, including several major private banks across

Europe.

The firm's net flow for the financial year to 30 September 2022

was 1.9% of the thematic market versus a 1% AUM market share,

outpacing the broader thematic ETF market in Europe. Whilst this is

lower than originally projected given the exceptional market

conditions of 2022, Rize has nevertheless outperformed the broader

thematic ETF market and continues the trend of having only had net

inflow in each calendar year since the launch of its first two ETFs

in February 2020. Crucially, much of the net new asset allocations

in 2022 came from new investors that approved the firm in 2022,

illustrating the effectiveness of the firm's distribution strategy

and brand recognition and also the potential for more significant

top-up allocations once positive sentiment returns to equity

markets

Digital Platform

The development of Parmenion's business (30% of which was

acquired by AssetCo in October 2021) continued apace in 2022, with

a number of important initiatives launched to broaden and deepen

its relationship with the UK independent financial advice

community. In response to customer feedback, Parmenion extended its

investment proposition by adding a number of new discretionary fund

managers to the platform, providing greater choice for customers.

It also launched the Advisory Models Pro which provides open

architecture access to advisers who want to build and run their own

advisory portfolios, thereby extending the reach of the firm.

Finally, it completed the acquisition of EBI Portfolios a

Midlands-based business which administers GBP1.9bn for 150 advisory

firms. The EBI suite of 11 Earth model portfolios will be fully

integrated into the Parmenion platform's award-winning investment

proposition. Each of these initiatives should further drive growth

in assets under administration and collectively should contribute

significantly to Parmenion's growing reputation as a provider of

choice for the UK IFA community and their customers.

Parmenion was awarded UK Platform of the Year for 2022 at the

Schroder's UK Platform Awards. In addition, it has 20 Defaqto

ratings covering all aspects of the business from customer service

to platform functionality and investment proposition. This industry

recognition has been driven by strong customer service and this in

turn is reflected in strong financial results for the firm. In the

year to 31 December 2022, revenues increased by over 12% to

GBP40.4m and EBITDA more than doubled to GBP15m. Assets under

management increased to GBP10.3bn, including the EBI Portfolios

assets. We remain strong advocates of the business and the

management team and believe that the client led initiatives over

the past year will deliver significant value for all

stakeholders.

Annualised Revenue Breakdown by Business Type (as at 30

September 2022*)

Business Type AuM (GBPm) Weighted average Gross annualised

fee rate, net revenue net of

of rebates rebates (GBP000s)

(bp)

Wholesale (active equities) 2,074 54 11,228

----------- ----------------- -------------------

Institutional (active

equities) 681 35 2,374

----------- ----------------- -------------------

Investment Trust (active

equities) 64 73 471

----------- ----------------- -------------------

Infrastructure 35 68 237

----------- ----------------- -------------------

ETFs 326 47 1,520

----------- ----------------- -------------------

Total 3,180 15,830

----------- ----------------- -------------------

* Even though SVM was not acquired until after the year end,

this table includes SVM data as at 30 September 2022 as if SVM had

been acquired by this date to illustrate annualised revenue for the

Group on an ongoing basis.

This table excludes the Group's interest in Parmenion which (per

above) had AuM of GBP10.3bn, generating revenues of GBP40.4m as at

31 December 2022 (financial year end of Parmenion).

-- Wholesale refers to the active equity assets which are held

and managed in mutual funds distributed by the Group.

-- Institutional refers to the active equity assets which are

held and managed in separate accounts on behalf of institutional

clients of the Group.

-- Investment Trust refers to the active equity assets which are

held and managed in investment trusts which are clients of the

Group.

Summary Performance Indicators:

The following table includes key performance indicators

referenced in the following Strategic Report and attempts to show

the effect of including SVM at end December 2022, including some

additional alternative performance measures for comparison

purposes.

End Dec 2022 End Sept End Sept Movement

(inc SVM) 2022 2021 Sept 2021

to Sept 2022

(Sept 21

to Dec 22)

Active Equities Assets GBP2,822m GBP2,291m GBP113m +GBP2,178m

under Management (+GBP2,709m)

------------- ---------- --------- ---------------

Total assets GBP96.5m GBP102.1m GBP59.6m +GBP42.5m

(+GBP36.9m)

------------- ---------- --------- ---------------

Annualised revenue(1) GBP17.3m GBP12.9m GBP2.5m +GBP10.4m

(+GBP14.8m)

------------- ---------- --------- ---------------

Profit for the year -GBP9.3m GBP14.7m -GBP24m

(to 30 Sept)

------------- ---------- --------- ---------------

Investment performance(2) -54% points

(1 year) 77% 46% 100%(3) (-23% points)

------------- ---------- --------- ---------------

Investment performance(2) +40% points

(3 year) 53% 53% 13%(3) (+40% points)

------------- ---------- --------- ---------------

(1) Monthly recurring revenue at date shown, annualised (i.e. x

12)

(2) % active equity mutual fund AuM in 1(st) or 2(nd) quartile

when compared to competitor funds in relevant Investment

Association sectors.

(3) Saracen only

Campbell Fleming, Chief Executive Officer

Peter McKellar, Deputy Chairman

16 February 2023

STRATEGIC REPORT

Introduction

The Directors present their Strategic Report on the Group for

the year ended 30 September 2022.

Review of the business

A review of the business is contained in the Chairman's

statement on pages 3 to 4 and in the Business Review on pages 5 to

11 and is incorporated into this report by cross-reference.

Strategy

The Group's strategy is to identify high-quality asset and

wealth management businesses which can be added to the AssetCo

stable and improved by working alongside our experienced management

team to improve their capabilities, distribution and reach.

Our key areas of focus include being a responsible company and

manager, meeting the needs of clients and investors and to expand

through a combination of selective acquisitions and organic

growth.

Key performance indicators (KPIs)

The financial key performance indicators for the year ended 30

September 2022, which has focused on growing the Group's asset

management capabilities, were as follows:

As at end September 2022 2021 Movement

Active Equities Assets GBP2,291m GBP113m +GBP2,178m

under Management

---------- --------- ------------

Total assets GBP102.1m GBP59.6m +GBP42.5m

---------- --------- ------------

Annualised revenue(1) GBP12.9m GBP2.5m +GBP13.3m

---------- --------- ------------

Profit for the year -GBP9.3m GBP14.7m -GBP24m

(to 30 Sept)

---------- --------- ------------

Investment performance(2)

(1 year) 46% 100%(3) -54% points

---------- --------- ------------

Investment performance(2)

(3 year) 53% 13%(3) +40% points

---------- --------- ------------

(1) Monthly revenue at date shown, annualised (i.e. x 12)

(2) % active equity mutual fund AuM in 1(st) or 2(nd) quartile

when compared to competitor funds in relevant Investment

Association sectors.

(3) Saracen only

The key measurements for the asset and wealth management

businesses under our control or influence, include growth (in

assets and revenue) and investment performance.

Alternative Performance Measures

The Group uses non-GAAP APMs as detailed below to provide users

of the annual report and accounts with supplemental financial

information that helps explain its results, recognising the fact

that certain acquired businesses have contributed to the results

for only part of the financial year.

APM Definition Reason for use

Annualised Costs incurred Given that AssetCo has acquired and/or

costs in the month concerned, integrated businesses at different

annualised by multiplying points during the financial year,

by 12 the full year's costs as disclosed

in the statutory accounts do not

give a clear picture of what "business

as usual" might look like. Annualised

costs, as defined, allow us to aggregate

costs across all business units and

present a consolidated picture on

a consistent basis. In practice,

the actual outturn is dependent upon

actual business experience during

the year so this is not a forecast.

--------------------------- -------------------------------------------

Annualised Revenues incurred Given that AssetCo has acquired and/or

revenue in the month concerned, integrated businesses at different

annualised by multiplying points during the financial year,

by 12 the full year's revenues as disclosed

in the statutory accounts do not

give a clear picture of what "business

as usual" might look like. Annualised

revenues, as defined, allow us to

aggregate revenues across all business

units and present a consolidated

picture on a consistent basis. In

practice, the actual outturn is dependent

upon actual business experience during

the year so this is not a forecast.

--------------------------- -------------------------------------------

Risk Management and internal controls

The Board is responsible for the Company's system of internal

control and for reviewing the effectiveness of the Group's risk

management framework.

During the reporting period, the Board has taken steps to

improve the Company's risk management framework through the

appointment of a Head of Risk, Gordon Brough. The Company operates

a risk register which assesses risks facing the Group and sets out

the mitigants to those risks. The Board reviewed the risk register

during the reporting period and obtained assurance from the

Executive Directors as to the effectiveness of the risk management

framework.

The Group has been subject to significant change during the

period and further work will be undertaken to strengthen the risk

management framework in 2023 as part of the integration of the

Group's operating businesses onto a new target operating model.

However, such a system is designed to manage rather than eliminate

the risk of failure to achieve business objectives and can provide

only reasonable and not absolute assurance against material

misstatement or loss.

The Directors review the internal control processes on a regular

basis.

The Company has established procedures for planning and

monitoring the operational and financial performance of all

businesses in the Group, as well as their compliance with

applicable laws and regulations. These procedures include:

-- clear responsibilities for financial controls and the

production of timely financial management information;

-- the control of key financial risks through clearly laid down

authorisation levels and proper segregation of accounting

duties;

-- the review of business updates, cash flows and cash balances by management and the Board.

Principal risks and uncertainties

The Directors continuously monitor the business and markets to

identify and deal with risks and uncertainties as they arise. Set

out below are the principal risks which we believe could materially

affect the Group's ability to achieve its strategy. The risks are

not listed in order of significance.

Risk Responsibility and Principal

Control

Profitability and Dividends Board/Executive Team:

- Profitability remains a key Plans are being actively implemented

focus for the Group. Delays to cut costs and focus distribution

in profitability in the longer efforts thereby increasing new

term could impact the Board's business. The Group is focused

ability to pay a progressive on achieving run-rate profitability

dividend as well as the Group's at the earliest possible date.

ability to fund acquisitions. The Board monitors cash management

carefully.

---------------------------------------

Distribution - Corporate actions Board/Distribution:

such as acquisitions and business The Group continually monitors

re-structuring risk disturbing and develops its product suite

existing clients and discouraging to ensure that it remains competitive

new ones. and attractive.

Distributors and markets are

carefully targeted and the status

of client relationships monitored

to identify risk of loss. Identified

risks are suitably addressed.

---------------------------------------

Loss of Key People - The Group Board/Remuneration Committee:

has managed most departures The Board regularly reviews

on a planned basis but going succession planning for all

forwards will need to ensure senior executives.

continued retention of key staff All senior executives are subject

if it is to manage client, consultant to extended notice periods (between

and regulatory expectations six and twelve months).

. The Group seeks to offer attractive

terms as well as a flexible

working environment.

Consideration is being given

to a replacement for the Company's

cancelled LTIP.

---------------------------------------

Economic Conditions - Adverse Board/Executive Team:

markets were a significant drag The Group seeks to manage an

on performance in the last year. appropriate balance of fixed

As an equity specialist the and variable costs. In the event

business remains vulnerable of sustained economic downturn,

to any material fall in equity the Group would seek to take

markets. early action to cut fixed costs.

---------------------------------------

Systems and Controls - Operating Board/Operations:

multiple systems across multiple The Group has developed a detailed

subsidiary and associate companies controls framework which is

increases the risk of control being rolled out across operating

failure. Managing multiple service subsidiaries to create a consistent,

providers also generates challenges. harmonised approach.

The Group is seeking to consolidate

on to a single operating platform

for compatible businesses as

an early priority, as well as

seeking to rationalise service

providers.

---------------------------------------

ENVIRONMENTAL SOCIAL AND GOVERNANCE

In pursuing its strategy the Company is committed to a

responsible business approach that delivers positive outcomes and

sustainable long term value to its stakeholders. In this regard the

Company has developed an Environmental Social and Governance policy

statement (the "ESG Policy").

This ESG Policy applies to AssetCo plc ("AssetCo"). AssetCo is a

holding company whose mission is to acquire, manage and operate

asset and wealth management activities and interests, together with

other related services (our "Mission").

In pursuing our Mission we are committed to a responsible

business approach that delivers positive outcomes and sustainable

long term value to all our stakeholders and particularly to our

clients. At the heart of this is our ESG Policy which is

incorporated into all our decision-making processes.

In framing our ESG Policy we are, and will continue to be,

focused on our clients concerns and needs. We will endeavour to

engage with our clients to understand and accommodate their ESG

requirements in terms of the services we provide.

Our ESG Policy is not static, it will evolve as our business

evolves and we will continually look to improve our ESG Policy in

the light of best market practice and the expectations of our

stakeholders.

Environmental

We will strive to reduce the impact of our business activities

on the environment. This will include reducing our energy, carbon,

water and waste footprint. In due course we intend to implement

systems to track all our major environmental impacts so that we

might access the effectiveness of our policies and report to our

stakeholders.

Social

We intend to be a responsible member of the community and a

force for positive change. We will endeavour to contribute to the

community through philanthropic partnerships, paid internships and

encouraging employee volunteering.

Governance

Commensurate with the size of the AssetCo business, we embrace

high standards of integrity, transparency and corporate governance.

We foster a culture of inclusion, diversity of thought and

background (including improving our gender balance) and equal

opportunity across our businesses. We treat our staff with

integrity and respect. We are a values led business and will look

to attract, develop and retain the best talent.

Membership and Reporting

Our ESG agenda is supported by the activities of our operating

businesses. This includes the adoption of the United Nations-backed

Principles for Responsible Investment by our subsidiaries and by

becoming signatories to the UK Stewardship Code, to which both

River and Mercantile and SVM Asset Management have been accepted by

the FRC as signatories. A number of the investment products managed

by River and Mercantile and Rize have a clear ESG focussed

investment process. River and Mercantile is the investment manager

of an Article 9 SFDR Fund and an Article 8 SFDR Fund.

We are continuing to evolve our ESG policies across the Group

with the establishment of a Sustainability and Stewardship

Committee under an independent Chair to oversee progress in this

area.

Acquisitions and Service Providers

Our Mission is largely predicated by an acquisition strategy. In

terms of businesses acquired we will look to ensure that they have

or adopt policies and initiatives which are consistent with our ESG

Policy. Likewise we will expect all significant service providers

to AssetCo and its businesses to have in place policies which are

consistent with our ESG Policy.

Our stakeholders: S.172 STATEMENT

Duty to promote the success of the Company

Section 172(1) of the Companies Act 2006 requires Directors to

act in the way they consider, in good faith, would be most likely

to promote the success of the Company for the benefit of its

members as a whole, and in doing so have regard (amongst other

matters) to:

-- the likely consequences of any decision in the long-term;

-- the interests of the Company's employees;

-- the need to foster the Company's business relationships with suppliers, customers and others;

-- the impact of the Company's operations on the community and the environment;

-- the desirability of the Company maintaining a reputation for

high standards of business conduct; and

-- the need to act fairly as between members of the Company.

This Section 172 Statement sets out how the Directors have

discharged this duty.

In order for the Company to succeed in the long-term, the Board

must build and maintain successful relationships with a wide range

of stakeholders. The Board recognises that the long-term success of

the Company is dependent on how it works with a number of important

stakeholders.

The Board's decision-making process considers both risk and

reward in the pursuit of delivering the long-term success of the

Company. As part of the Board's decision-making process, the Board

considers the interests of a broad range of the Company's

stakeholders. The Board considers that its primary stakeholders are

clients, employees, shareholders, suppliers and regulators.

The Board fulfils its duties in collaboration with the senior

management team, to which day-to-day management has been delegated.

The Board seeks to understand stakeholder groups' priorities and

interests. The Board listens to stakeholders through a combination

of information provided by management and also by direct engagement

where appropriate. The following overview provides further insight

into how the Board has had regard to the interests of our primary

stakeholders, while complying with its duty to promote the success

of the Company in accordance with Section 172 of the Companies Act

2006.

Our primary stakeholders How we engage with them

---------------------------------------------------------- ----------------------------------------------------------

Clients Our distribution teams have a busy client engagement

The Company through its subsidiaries aims to provide schedule and maintain contact with our

investment products that meet the needs clients through regular meetings, reporting and written

of clients and put those needs first. communication. This helps us to understand

our clients' needs.

Members of the senior management team meet directly with

key clients to understand the views

of our clients and to ensure that we continue to meet our

clients' expectations.

Client engagement feeds into our regulated subsidiaries

assessment that their products and

services are fit for purpose and offer fair value.

---------------------------------------------------------- ----------------------------------------------------------

Shareholders The Board engages with the Company's shareholders in a

The ongoing support of our shareholders is vital in number of ways which include the AGM

helping us deliver our long-term strategic and one-to-one meetings and telephone conversations. Our

objectives. AGM allows shareholders the opportunity

to engage directly with the Board.

The Chairman, Deputy Chairman and CEO regularly meet (in

person and virtually) the Company's

major shareholders to discuss the financial performance

of the Company.

Matters discussed with shareholders include strategy and

its execution and generating strong

returns. The views of shareholders have been considered

and fed into the implementation of

the cost reduction strategy across the Group.

---------------------------------------------------------- ----------------------------------------------------------

Employees The senior management team engage regularly with

The Company's employees are senior experienced employees through face-to-face meetings where

professionals. It is of the utmost importance open discussion is encouraged. Our subsidiaries have

to the Board that we have a culture that attracts and strong management teams and engage with

retains talented employees. their employees through regular meetings and all employee

calls.

We value our diverse workforce and seek inclusion at all

levels.

The senior management team has focussed on the

integration of newly acquired businesses into

the Group over the past year and the restructuring of

certain group functions to align with

the business needs. During this process, due

consideration has been given to all stakeholders,

including employees, shareholders and our clients.

The Group is proud to support the development our

employees through study loans and paid study

leave. Supported qualifications include the CFA and

accountancy qualifications.

---------------------------------------------------------- ----------------------------------------------------------

Suppliers and service providers The Company is committed to the highest standards of

The Company places reliance on external third party business conduct.

suppliers and service providers for certain The selection process and engagement with these parties

activities and services. is undertaken by senior management.

We ensure that there is an appropriate framework of

oversight of our key third-party suppliers.

Regular meetings are held with key third-party service

providers and issues escalated to senior

management where required. Material supplier selection is

reported to the Board and significant

issues or risks related to suppliers will be escalated to

the Board.

As described above, a key focus has been on the

integration of the newly acquired businesses

into the Group. Suppliers and service providers have been

reviewed by senior management during

this period as part of this project.

---------------------------------------------------------- ----------------------------------------------------------

Regulators

The Group operates in the UK and US and is subject to the

oversight of various regulators. We have a conduct-led culture that

encourages our people to act with integrity at all times.

The Company is AIM listed and complies with the AIM Rules. We

engage with our regulators through the Group's legal and compliance

function by way of regular mandatory reporting as well as any ad

hoc interactions required by our regulators.

Community and the environment

Due regard is given to the impact of the Company's operations on

the community and environment through the activities of its

subsidiaries overseen by the senior management team.

Sustainable investing is a key focus for the Group's businesses.

During the period, River and Mercantile launched an Article 8 SFDR

Fund and Article 9 SFDR Fund. River and Mercantile, Rize, Saracen

and SVM are signatories to UNPRI. Both River and Mercantile and SVM

are signatories to the FRC's Stewardship Code.

The Group aims to make an impact within the communities it

operates in through supporting charitable activities undertaken by

employees through a GAYE payroll scheme and donation matching

(subject to cap), participation in charitable events and offering

paid internships aimed at improving diversity. Examples of specific

activities include a paid internship at River and Mercantile for

two interns through the Girls Are INvestors ('GAIN') investment

internship programme aimed at improving diversity in asset

management and participation in City Hive's Fearless Women campaign

where Campbell Fleming was a panellist.

Pages [ ] to [17] constitute the strategic report which was

approved by the Board on [ ] February 2023 and signed on its behalf

by:

Campbell Fleming

C EO

16 February 2023 Company Registration Number: 04966347

Consolidated Income Statement

for the year ended 30 September Notes 2022 2021

2022 GBP'000 GBP'000

----------------------------------- ----- --------------- ------------------

Revenue 3 8,175 408

Cost of sales - (536)

----------------------------------- ----- --------------- ------------------

Gross profit/(loss) 8,175 (128)

Other income 4 1,977 22,388

Administrative expenses 5 (25,565) (7,967)

Other gains/(losses) 6 (9,732) -

----------------------------------- ----- --------------- ------------------

Operating (loss)/profit 7 (25,145) 14,293

Gain on bargain purchase 8 3,227 -

Finance income 9 12,433 1,844

Finance costs (10) (8)

----------------------------------- ----- --------------- ------------------

Finance income (net) 12,423 1,836

Share of result of associate 181 -

----------------------------------- ----- --------------- ------------------

(Loss)/profit before income tax (9,314) 16,129

----------------------------------- ----- --------------- ------------------

Income tax credit/(expense) 10 59 (1,442)

----------------------------------- ----- --------------- ------------------

(Loss)/profit for the year (9,255) 14,687

----------------------------------- ----- --------------- ------------------

(Loss)/profit attributable to:

Owners of the parent (8,440) 14,796

Non-controlling interest (815) (109)

----------------------------------- ----- --------------- ------------------

(9,255) 14,687

----------------------------------- ----- --------------- ------------------

(Loss)/earnings per Ordinary Share Pence Pence(1)

attributable to the owners of the

parent during the year

----------------------------------- ----- --------------- ------------------

From continuing operations

Basic 11 (8.19) 18.06

Diluted 11 (8.19) 16.10

----------------------------------- ----- --------------- ------------------

(1) Prior year e arnings per share has been re-stated to reflect

the 10-1 share split carried out by AssetCo in August 2022.

Consolidated Statement of Comprehensive 2022 2021

Income GBP'000 GBP'000

for the year ended 30 September 2022

(Loss)/profit for the year (9,255) 14,687

Other comprehensive income:

Currency translation differences - (7)

----------------------------------------- -------------- ------------------

Other comprehensive (loss)/income

(net of tax) - (7)

----------------------------------------- -------------- ------------------

Total comprehensive (loss)/income

for the year (9,255) 14,680

----------------------------------------- -------------- ------------------

Attributable to:

Owners of the parent (8,440) 14,789

Non-controlling interests (815) (109)

----------------------------------------- -------------- ------------------

Total comprehensive income for the

year (9,255) 14,680

----------------------------------------- -------------- ------------------

Group 2022 Group

Consolidated Statement of Financial Position GBP'000 2021

as at 30 September 2022 GBP'000

------------------------------------------------------- ------------ ---------

Assets

Non-current assets

Property, plant and equipment 32 16

Right-of-use assets 224 -

Goodwill and intangible assets 24,600 20,067

Investment in associates 22,052 -

Long-term receivables 1,208 -

-------------------------------------------------------- ------------ ---------

Total non-current assets 48,116 20,083

-------------------------------------------------------- ------------ ---------

Current assets

Trade and other receivables 9,700 607

Financial assets at fair value through profit and loss 37 12,000

Current income tax receivable 1,173 3

Cash and cash equivalents 43,066 26,902

Total current assets 53,976 39,512

-------------------------------------------------------- ------------ ---------

Total assets 102,092 59,595

-------------------------------------------------------- ------------ ---------

Liabilities

Non-current liabilities

Deferred tax liabilities 1,070 49

-------------------------------------------------------- ------------ ---------

Total non-current liabilities 1,070 49

-------------------------------------------------------- ------------ ---------

Current liabilities

Trade and other payables 12,750 1,972

Lease liability 294 -

Current income tax liabilities 1,437 1,437

-------------------------------------------------------- ------------ ---------

Total current liabilities 14,481 3,409

-------------------------------------------------------- ------------ ---------

Total liabilities 15,551 3,458

-------------------------------------------------------- ------------ ---------

Equity attributable to owners of the parent

Share capital 1,493 843

Share Premium - 27,770

Capital redemption reserve 653 653

Merger reserve 43,063 2,762

Other reserves - 5,496

Retained earnings 42,426 18,892

-------------------------------------------------------- ------------ ---------

87,635 56,416

Non-controlling interest (1,094) (279)

-------------------------------------------------------- ------------ ---------

Total equity 86,541 56,137

-------------------------------------------------------- ------------ ---------

Total equity and liabilities 102,092 59,595

-------------------------------------------------------- ------------ ---------

Consolidated Statement of Cash Flows Group Group

for the year ended 30 September 2022 2022 2021

GBP'000 GBP'000

------------------------------------------ ---------- ----------

Cash flows from operating activities

Cash (outflow)/inflow from operations

(note 12) (18,317) 16,755

Cash released in respect of bonds - 1,104

Corporation tax paid (31) -

Finance costs (10) (8)

------------------------------------------- ---------- ----------

Net cash (outflow)/inflow from operating

activities (18,358) 17,851

------------------------------------------- ---------- ----------

Cash flow from investing activities

Net cash received from acquisitions 42,148 (16,460)

Payments for acquisition of associate (21,871) -

Interest on loan notes held in associate 1,977 -

Dividends received from financial assets

held at fair value 11,459 194

Finance income 974 -

Proceeds of disposal of investments at

FV through P and L 1,017 -

Purchase of property, plant and equipment (15) (8)

Purchase of intangibles (12) (1)

------------------------------------------- ---------- ----------

Net cash (outflow)/inflow from investing

activities 35,677 (16,275)

------------------------------------------- ---------- ----------

Cash flow from financing activities

Shares issued for cash - 25,013

Costs of share issue (1,000) (515)

Payments for shares bought back - (26,850)

Buy-back transaction costs - (171)

Lease payments (104) -

Shares bought for treasury (51) -

Net cash used in financing activities (1,155) (2,523)

------------------------------------------- ---------- ----------

Net change in cash and cash equivalents 16,164 (947)

Cash and cash equivalents at beginning

of year 26,902 27,860

Exchange differences on translation - (11)

------------------------------------------- ---------- ----------

Cash and cash equivalents at end of

year 43,066 26,902

------------------------------------------- ---------- ----------

Consolidated

Statement of Share Capita

Changes in Share premium redemption Merger Other Retained Non-controlling Total

Equity capital account reserve reserve reserve earnings Total interest equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------- ------- ---------- --------------- --------- --------- ---------- ------------- ----------------- -----------

At 30 September

2021 1,221 - - - - 31,124 32,345 - 32,345

Comprehensive

income

Profit for the

year - - - - - 14,796 14,796 (109) 14,687

Other

comprehensive

income

Currency

translation

differences - - - - - (7) (7) - (7)

------------------ ------- ---------- --------------- --------- --------- ---------- ------------- ----------------- -----------

Total

comprehensive

income - - - - - 14,789 14,789 (109) 14,680

------------------ ------- ---------- --------------- --------- --------- ---------- ------------- ----------------- -----------

Proceeds from

share issue 173 24,840 - - - - 25,013 - 25,013

Costs of share

issue - (515) - - - - (515) - (515)

Share buy-back (653) - 653 - - (26,850) (26,850) - (26,850)

Costs of share

buy-back - - - - - (171) (171) - (171)

Shares issued on

acquisition 17 - - 2,762 - - 2,779 - 2,779

Share-based

payments

- LTIP - - - - 5,496 - 5,496 - 5,496

- success fee 85 3,445 - - - - 3,530 - 3,530

Non-controlling

interest on

acquisition - - - - - - - (170) (170)

------------------ ------- ---------- --------------- --------- --------- ---------- ------------- ----------------- -----------

At 30 September

2021 843 27,770 653 2,762 5,496 18,892 56,416 (279) 56,137

Comprehensive

income

Loss for the year - - - - - (8,440) (8,440) (815) (9,255)

Other

comprehensive

income/(expense)

Currency

translation

differences - - - - - - - - -

----------------- ------- ---------- --------------- --------- --------- ---------- ------------- ----------------- -----------

Total

comprehensive

expense - - - - - (8,440) (8,440) (815) (9,255)

Shares issued on

acquisition 598 - - 41,301 - - 41,899 - 41,899

Costs of share

issue - - - (1,000) - - (1,000) - (1,000)

Share-based

payments

- LTIP 52 4,255 - - (5,496) - (1,189) - (1,189)

Share premium

cancellation - (32,025) - - - 32,025 - - -

Shares bought for

treasury - - - - - (51) (51) - (51)

------------------ ------- ---------- --------------- --------- --------- ---------- ------------- ----------------- -----------

At 30 September

2022 1,493 - 653 43,063 - 42,426 87,635 (1,094) 86,541

------------------ ------- ---------- --------------- --------- --------- ---------- ------------- ----------------- -----------

NOTES TO THE CONSOLIDATED FINANCIAL INFORMATION

for the year ended 30 September 2022

1. General information and basis of presentation

AssetCo Plc ("AssetCo" or the "Company") is the Parent Company

of a group of companies ("the Group") which offers a range of

investment services to private and institutional investors. The

Company is a public limited company, incorporated and domiciled in

the United Kingdom under the Companies Act 2006 and is listed on

the Alternative Investment Market ("AIM") of the London Stock

Exchange. The address of its registered office is 30 Coleman

Street, London, EC2R 5AL.

The audited preliminary announcement has been prepared in

accordance with the Group's accounting policies as disclosed in the

financial statements for the year ended 30 September 2022 and

international accounting standards ('IFRS'), and the applicable

legal requirements of the Companies Act 2006. This preliminary

announcement was approved by the Board of Directors on 15 February

2023. The preliminary announcement does not constitute statutory

financial statements within the meaning of section 434 of the

Companies Act 2006. Statutory accounts for the year to 30 September

2020 have been delivered to the Registrar of Companies. The audit

report for those accounts was unqualified and did not contain

statements under 498 (2) or (3) of the Companies Act 2006 and did

not contain any emphasis of matter.

Certain statements in this announcement constitute

forward-looking statements. Any statement in this announcement that

is not a statement of historical fact including, without

limitation, those regarding the Company's future expectations,

operations, financial performance, financial condition and business

is a forward-looking statement. Such forward-looking statements are

subject to risks and uncertainties that may cause actual results to

differ materially. These risks and uncertainties include, amongst

other factors, changing economic, financial, business or other

market conditions. These and other factors could adversely affect

the outcome and financial effects of the plans and events described

in this announcement and the Company undertakes no obligation to

update its view of such risks and uncertainties or to update the

forward-looking statements contained herein. Nothing in this

announcement should be construed as a profit forecast.

While the financial information included in this preliminary

announcement has been prepared in accordance with the recognition

and measurement criteria of IFRS, this announcement does not itself

contain sufficient information to comply with IFRSs. The Company

will publish its full financial statements for the year ended 30

September 2022 by 28 February 2023, which will be available on the

Company's website at www.assetco.com and at the Company's

registered office at 30 Coleman Street, London EC2R 5AL . The

Annual General Meeting will be held on Thursday 30 March 2023.

2. Going concern

The directors have considered the going concern assumption of

the company, AssetCo plc, by assessing the operational and funding

requirements of the Group.

The directors have prepared financial projections along with

sensitivity analyses of reasonably plausible alternative outcomes.

The forecasts demonstrate that the directors have a reasonable

expectation that the existing Group has adequate financial

resources to continue in operational existence for the foreseeable

future.

3. Segmental reporting

The core principle of IFRS 8 'Operating segments' is to require

an entity to disclose information that enables users of the

financial statements to evaluate the nature and financial effects

of the business activities in which the entity engages and the

economic environments in which it operates. Segment information is

therefore presented in respect of the company's commercial

competencies, Active Specialists and High-Growth Thematics.

No secondary segmental information has been provided as, in the

view of the Directors, any overseas activities are not material.

The directors consider that the chief operating decision maker is

the Board.

The amounts provided to the Board with respect to net assets are

measured in a manner consistent with that of the financial

statements. The Company is domiciled in the UK.

The segment information provided to the Board for the reportable

segments for the year ended 30 September 2022 is as follows:

Exchange Infra-

Traded Structure Digital

Active specialists Funds investing platforms Head office Total

2022 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

========================== ================== ======== ========== ========== =========== ========

Revenue

Management fees 6,372 - 79 - - 6,451

Marketing fees - 1,724 - - - 1,724

========================== ================== ======== ========== ========== =========== ========

Total revenue to

external customers 6,372 1,724 79 - - 8,175

========================== ================== ======== ========== ========== =========== ========

Operating (loss)/profit (7,124) (2,794) (151) - (15,076) (25,145)

Gain on bargain

purchase - - - - 3,227 3,227

Finance income 974 - - - 11,459 12,433

Finance costs (10) - - - - (10)

Share of result

of associate - - - 181 - 181

-------------------------- ------------------ -------- ---------- ---------- ----------- --------

(Loss)/profit before

tax (6,160) (2,794) (151) 181 (390) (9,314)

Income tax credit/expense 59 - - - - 59

========================== ================== ======== ========== ========== =========== ========

(Loss)/profit for

the year (6,101) (2,794) (151) 181 (390) (9,255)

========================== ================== ======== ========== ========== =========== ========

Segment assets

Total assets 56,826 19,324 1,706 - 24,236 102,092

Total liabilities (12,157) (461) (678) - (2,255) (15,551)

========================== ================== ======== ========== ========== =========== ========

Total net assets 44,669 18,863 1,028 - 21,981 86,541

========================== ================== ======== ========== ========== =========== ========

Depreciation 9 5 - - - 14

Amortisation of

intangible assets 187 40 - - - 227

Amortisation of

right-of-use assets 187 - - - - 187

Total capital expenditure 1 26 - - - 27

========================== ================== ======== ========== ========== =========== ========

Exchange Total

2021 Active specialists Traded Funds Head office GBP'000

--------------------------- ------------------ ------------- ----------- ---------

Revenue

Management fees 135 - - 135

Marketing fees - 273 - 273

=========================== ================== ============= =========== =========

Total revenue to external

customers 135 273 - 408

=========================== ================== ============= =========== =========

Operating profit/(loss) 32 (347) 14,608 14,293

Investment income - - 1,844 1,844

Finance costs - - (8) (8)

--------------------------- ------------------ ------------- ----------- ---------

Profit/(loss) before tax 32 (347) 16,444 16,129

Income tax expense (6) 1 (1,437) (1,442)

=========================== ================== ============= =========== =========

Retained profit/(loss) 26 (346) 15,007 14,687

=========================== ================== ============= =========== =========

Segment assets

Total assets 3,518 21,742 34,335 59,595

Total liabilities (85) (471) (2,902) (3,458)

=========================== ================== ============= =========== =========

Total net assets 3,433 21,271 31,433 56,137

=========================== ================== ============= =========== =========

Depreciation - 2 - 2

Amortisation of intangible

assets 1 7 - 8

Total capital expenditure 3 5 - 8

=========================== ================== ============= =========== =========

4. Other income

2022 2021

GBP'000 GBP'000

-------------------------------- ----------- --------

Interest received on loan notes

held in associate 1,977 -

Grant Thornton litigation - 25,918

Success fee - (3,530)

--------------------------------- ----------- --------

1,977 22,388

-------------------------------- ----------- --------

Interest on loan notes held in associate

The Group has acquired a 30% equity interest in Parmenion

Capital Partners LLP through a corporate entity, Shillay TopCo

Limited. A large part of the Group's total investment is held by

way of loan notes. During the financial year the Group received

GBP1,977,000 of interest on those loan notes and this is reflected

in other income.

Grant Thornton litigation

The case against Grant Thornton was concluded successfully on 2

October 2020. The total award came to GBP30.515 million of which

GBP4.597 million was reflected in the 2020 full year accounts, as

it had been awarded by the Courts irrespective of the outcome of

any appeal. Other income shown in these accounts represents the

balance of the Court's award, less the success fee of 15% of claim

proceeds excluding costs. This item is considered exceptional as it

relates to a very specific issue from the history of the Group when

it was a very different business and the circumstances which gave

rise to the need for litigation are unlikely to occur again.

5. Administrative expenses

2022 2021

GBP'000 GBP'000

------------------------------ ----------- --------

Restructuring costs 3,196 -

Costs of re-admission to AIM 671 360

------------------------------- ----------- --------

Exceptional items 3,867 360

Acquisition costs 1,116 219

Share-based payments 3,250 6,273

Other administrative expenses 17,332 1,651

------------------------------- ----------- --------

Total administrative expenses 25,565 8,503

------------------------------- ----------- --------

Restructuring costs

RMG sold its UK Solutions business for GBP230 million on 25

January 2022, a transaction which left RMG a much smaller business

with overheads out of step with its reduced size. AssetCo has

usually bought businesses where the strategy has mainly involved

growth in revenue but in this instance a significant project to

right-size the acquired business has been needed following

acquisition by AssetCo on 15 June 2022. As part of the process the

Group has incurred one-off exceptional restructuring costs

including termination payments and other charges.

Costs of re-admission to AIM

The Group has in the last two years twice had to apply for

re-admission to AIM; once in April 2021 when shareholders were

asked to approve the change in strategy to asset and wealth

management, and again in June 2022 given the nature and scale of

the acquisition of RMG. These significant costs are in relation to

those exercises and were required because of the unusual nature of

the change in strategy and the relative size of AssetCo compared to

the acquisition target. Our strategy is now settled and, with the

completion of the acquisition of RMG, AssetCo is now at a scale

where re-admission in order to complete an acquisition is unlikely

so the Directors consider that costs such as this are not likely to

recur.

6. Other gains and losses

2022 2021

GBP'000 GBP'000

--------------------------------- ----------- --------

Reduction in fair value of asset

held for resale 9,750 -

Gain on disposal of fair value

investments (18) -

---------------------------------- ----------- --------

Total other gains and losses 9,732 -

---------------------------------- ----------- --------

On 15 June 2022 the Group acquired the entire share capital of

RMG. However the Group had in 2021 bought 5,000,000 shares in RMG

representing 5.85% of the total issued share capital and this

investment was carried on the 2021 balance sheet at a fair value of

GBP12,000,000. When calculating the overall consideration for the

whole of RMG the Group must assess the fair value of the existing

investment at the time of completion of the deal. Given the effect

on the RMG share price of normal market pricing and the significant

return to shareholders arising from the sale of the RMG Solutions

business the fair value was assessed at GBP2,250,000 leading to a

reduction in fair value of GBP9,750,000.

The Group acquired a small number of seed investments with the

acquisition of RMG in June 2022. One of those investments was sold

before 30 September 2022 for sale proceeds of GBP1,017,000

realising a gain on disposal of GBP18,000.

7. Operating (loss)/profit

2022 2021

Operating (loss)/profit is stated after charging GBP000 GBP000

the following:

Depreciation of property plant and equipment 2 2

Depreciation of right-of-use assets 187 -

Amortisation of intangible assets 227 8

Foreign exchange differences 25 89

Fees payable to the Company's auditors:

* For the audit of the parent Company and the

consolidated financial statements 262 132

90 -

* Audit fees re: subsidiaries

10 -

* Audit-related assurance services

86 -

* Tax advisory services

471 -

* Other non-audit services

Employee benefit expense (see below) 15,160 7,014

Expense relating to short-term and low value

leases 66 36

Employee expense includes a share-based charge of GBP2.749

million (2021: GBP5.496 million) in respect of the Company's LTIP

(see note 9) plus a further GBP0.501 million (2021: GBP0.777

million) charge in employers' national insurance on the share

awards to give a total charge included above of GBP3.250 million

(2021: GBP6.273 million).

8. Gain on bargain purchase

2022 2021

GBP'000 GBP'000

------------------------------ ----------- ---------

Arising on acquisition of RMG 3,227 -

------------------------------ ----------- ---------

The calculation of the difference arising on acquisition of

River and Mercantile between the purchase consideration and the

value of net assets acquired gave rise to a negative amount of

goodwill as the value of net assets acquired was larger than the

consideration. In accordance with accounting standards the amount

of GBP3,227,000 is treated as a credit to the income statement.

9. Finance income

2022 2021

GBP'000 GBP'000

--------------------------------- ----------- ---------

Dividend income 11,459 194

Gain on foreign exchange 927 -

Fair value gains on financial

instruments classified as fair

value through profit and loss - 1,650

Interest income 47 -

--------------------------------- ----------- ---------

Total finance income 12,433 1,844

---------------------------------- ----------- ---------

10. Income tax charge

2022 2021

Group GBP'000 GBP'000

Current tax:

Current tax on (loss)/profit for the year (13) 1,437

-------------------------------------------------- --------- ---------

Total current tax (credit)/expenses (13) 1,437

Deferred tax:

Arising from movement in deferred tax assets 16 (307)

Arising from movement in deferred tax liabilities (62) 312

-------------------------------------------------- --------- ---------

Total deferred tax (credit)/expense (46) 5

-------------------------------------------------- --------- ---------

Income tax (credit)/expense (59) 1,442

-------------------------------------------------- --------- ---------

11. (Loss)/earnings per share

(a) Basic

Basic (loss)/earnings per share is calculated by dividing the

(loss)/profit attributable to owners of the parent by the weighted

average number of Ordinary Shares in issue during the year.

2022 2021(1)

GBP'000 GBP'000

=========================================== =========== =============

(Loss)/profit attributable to owners

of the parent (8,440) 14,796

=========================================== =========== =============

Weighted average number of ordinary shares

in issue before share split as reported

- number - 8,194,031

Basic earnings per share as reported

- pence - 180.57

Weighted average number of Ordinary Shares

in issue post share split - number 103,017,624 81,940,310

=========================================== =========== =============

Basic (loss)/earnings per share - pence (8.19) 18.06

=========================================== =========== =============

(b) Diluted

Diluted (loss)/earnings per share is calculated by adjusting the

weighted average number of Ordinary Shares outstanding assuming

conversion of all dilutive potential Ordinary Shares. In the prior

year the Company had one category of dilutive potential ordinary

shares being shares allocated to the LTIP pool. As at 30 September

2022 the LTIP scheme was discontinued therefore there were no

dilutive potential ordinary shares.

2022 2021(1)

GBP'000 GBP'000

========================================== =========== ==========

(Loss)/profit attributable to owners

of the parent (8,440) 14,796

========================================== =========== ==========

Weighted average number of ordinary

shares in issue before share split

as reported - number - 9,877,346

Diluted earnings per share as reported

- pence - 161.05