TIDMBZT

RNS Number : 2143E

Bezant Resources PLC

26 October 2022

26 October 2022

Bezant Resources Plc

("Bezant" or the "Company")

Mankayan Project Update

Bezant (AIM: BZT), the copper-gold exploration and development

company, further to its announcement dated 18 March 2022 announces

that on 26 October 2022 it entered into;

-- a conditional share purchase agreement (the "SPA") to

exchange its 27.5% shareholding in IDM Mankayan Pty Ltd ("IDM

Mankayan") for a 27.5% shareholding in IDM International Limited

(ACN 108029198) ("IDM International"). Upon completion of the SPA

and a similar SPA between IDM International and the other

shareholder of IDM Mankayan (the "Other IDM Mankayan Shareholder")

IDM International will own 100% of IDM Mankayan; and

-- a convertible loan note agreement with IDM International to

invest A$137,500 (approx. GBP77K) in IDM International (the

"Convertible Loan Note"). IDM International has also entered into

convertible loan notes with entities associated with two of its

directors to raise A$362,500 (approx. GBP203K) on the same terms as

the Convertible Loan Note (together the "Convertible Notes")

Colin Bird, Executive Chairman of Bezant, commented: " We are

very pleased with the progress made in advancing the Mankayan

Project since IDM International's involvement not least the renewal

of the MPSA for 25 years which is a catalyst for the development of

this world class copper gold porphyry project. We are very

confident that management in the Philippines supported by IDM

International have the experience and expertise to take the project

forward through the next stages of evaluation and development which

will significantly enhance the value of the project."

IDM International, through Crescent Mining Development

Corporation's ("Crescent"), have made very good progress on initial

Pre-Feasibility Studies on the Mankayan copper gold project in the

Philippines since IDM Mankayan acquired its interest in the

Mankayan project in October 2021. This has included:

-- Renewal by the Mines and Geosciences Bureau of the Department

of Environment and Natural Resources of the Philippines government

("MGB") of Crescent's Mineral Production Sharing Agreement No.

057-96-CAR (the "MPSA") for a second 25-year term with effect from

12 November 2021 (the "MPSA Renewal");

-- Meetings with the MGB who have expressed their support and

encouragement for local projects such as the Mankayan Project and

working closely with various Government departments for approvals

required for the development of the Mankayan Project;

-- Working closely with the local communities including direct investment into those areas;

-- The completion of 2 Pre-feasibility holes to depths of 1,000m

each focusing on metallurgy, geotechnical and hydrogeological

studies and the collection and management of all data produced from

the 2 holes for analysis by Crescent's in country team and its

advisors;

-- Commencement of the process of appointing key consultants who

will be undertaking Pre-Feasibility Studies work, including mine

designs and engineering studies, infrastructure and tailings

facilities, environmental studies and indigenous peoples' consent;

and

-- Discussions with private equity and mining finance houses for

the funding of the Pre-Feasibility Studies work program.

Going forward, IDM International and Crescent, along with their

various consultants and advisors, intend to complete a full

Pre-Feasibility Studies during 2023 and 2024 that will present the

Mankayan Project as a globally significant copper-gold project at a

time when the supply-demand gap for copper is expected to be large

as the world transitions to electrification.

Summary of the key terms of the SPA dated 26 October 2022

Parties Bezant Resources Plc and IDM International

Limited

------------------------ ----------------------------------------------------------------------------------

Sale Shares The 44 fully paid ordinary shares in the capital

of IDM Mankayan held by Bezant and representing

27.5% of the shares issued by IDM Mankayan

------------------------ ----------------------------------------------------------------------------------

Consideration Shares 19,381,054 fully paid ordinary shares in the

capital of IDM International representing

27.5% of the shares in issue by IDM International

as enlarged by its acquisition of the Sale

Shares and the 10% of IDM Mankayan that it

is acquiring from the Other IDM Mankayan Shareholder.

------------------------ ----------------------------------------------------------------------------------

Conditions (a) IDM International obtaining the approval

of its shareholders for the issue of the Consideration

Shares to Bezant

(b) completion of the transaction whereby

IDM International will acquire 10% of IDM

Mankayan from the Other IDM Mankayan Shareholder

so that at Completion IDM International will

own 100% of IDM Mankayan; and

(c) the Other IDM Mankayan Shareholder and

Bezant waiving their pre-emption rights in

relation to IDM International acquiring all

the shares of IDM Mankayan which they do not

already own

------------------------ ----------------------------------------------------------------------------------

Deadline for completion 31 March 2023 or such other date as may be

agreed to by the parties in writing

------------------------ ----------------------------------------------------------------------------------

Restrictions on IDM (a) (a) IDM International will not, until

International pending the earlier of Completion or termination of

completion the SPA: (i) (i) subject to (b) below, issue

any securities (including convertible loan

notes or other instruments convertible into

IDM International ordinary shares) other than

for cash consideration and provided that Bezant

has first been given the opportunity, on 14

days written notice, to subscribe for 27.5%

of the securities offered on the same terms

as those offered to participants in the proposed

new issue; (ii) (ii) create any new class

of shares; or (iii) (iii) make any material

changes to the conduct of its Business which

is the supporting and development of the Mankayan

Project, and anything related thereto . (iv)

(b) (b) (a) (i) above does not apply to an

issue by IDM International of: (i) securities

pursuant to a capital raising of at least

A$2 million (before costs) from an investor

(or group of investors); the Convertible Notes

(and their subsequent exercise into IDM International

ordinary shares); (i) (ii) any shares or options

issued in connection with the exercise of

the Convertible Notes; (ii) (iii) securities

in response to the exercise of options or

performance rights on issue (or approved for

issue) as at the date of the SPA; or (iii)

(iv) incentive securities to directors, employees

and/or personnel of IDM International or IDM

Mankayan, or to others engaged in the Mankayan

Project, as approved by the directors of IDM

International.

------------------------ ----------------------------------------------------------------------------------

Warranties The parties have given warranties customary

in an agreement of this nature.

------------------------ ----------------------------------------------------------------------------------

Summary of the Key terms of the Convertible Loan Note dated 26

October 2022

Parties Bezant Resources Plc and IDM International

Limited

---------------------- ----------------------------------------------------------------

Amount being invested A$137,500 (approx. GBP 77K) to acquire 137,500

Notes

---------------------- ----------------------------------------------------------------

Payment Terms & Issue Payment is within 21 Days from date of agreement

Date (the " Issue Date ")

---------------------- ----------------------------------------------------------------

Maturity Date 4 years from Issue Date

---------------------- ----------------------------------------------------------------

Interest 4% per annum which is repayable at the Maturity

Date unless the Notes have been converted

prior to the Maturity Date

---------------------- ----------------------------------------------------------------

Conversion Terms The Company has the right to convert the whole

but not part of the Face Value of each Note

into Shares at A$0.20 at any time (and as

many times) prior to the Maturity Date (the

"Conversion Terms")

---------------------- ----------------------------------------------------------------

Early Conversion Subject to (a) and (b) below the IDM International

by IDM International may elect to redeem the Notes from the Company

before the Maturity Date to the extent they

have not then been converted under the Conversion

Terms by paying to the Company an amount equal

to 110% of the Principal Amount owing under

the Notes ("Early Redemption") provided that

Early Redemption is only permitted;

(a) from 2 years after the Issue Date; and

(b) on IDM International giving 30 days notice

to the Company during which period the Company

can elect to convert the Notes under the Conversion

Terms

---------------------- ----------------------------------------------------------------

Options to be issued For each 2 shares in IDM International issued

to the Company at to the Company under the Conversion Terms

Conversion the Company will also be issued one free new

option to acquire an IDM International share

(an " IDM Option ") with an exercise price

A$0.40 within the 4 years from the date of

issue of the IDM Option.

---------------------- ----------------------------------------------------------------

Warranties The parties have given warranties customary

in an agreement of this nature.

---------------------- ----------------------------------------------------------------

Further information on IDM International

IDM International Limited is incorporated in Australia. For the

year ended 30 June 2021 IDM International made an audited loss of

A$12,319 (approx. GBP6,900) and as at that date had net assets of

A$3,484 (approx. GBP1,956) . Post 30 June 2021 IDM International

established IDM Mankayan Pty Ltd which was incorporated in

Australia on 6 August 2021 as a special purpose vehicle to enter

into the IDM Agreement in relation to the Mankayan Project with

Bezant Resources Plc (see announcement dated 13 September 2021)

which completed in October 2021 . For the period from incorporation

to 31 December 2021 IDM Mankayan Pty Ltd made an unaudited profit

of A$NIL and as at that date had net assets of A$160 (approx.

GBP90). As at the date of this announcement IDM International owns

62.5% of IDM Mankayan Pty Ltd which is its sole subsidiary.

For further information, please contact:

Bezant Resources Plc

Colin Bird, Executive Chairman +44 (0) 20 3416 3695

Beaumont Cornish (Nominated Adviser)

Roland Cornish +44 (0) 20 7628 3396

Novum Securities Limited (Broker)

Jon Belliss +44 (0) 20 7399 9400

or visit http://www.bezantresources.com

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as it forms part of

UK Domestic Law pursuant to the Market Abuse (Amendment) (EU Exit)

regulations (SI 2019/310).

Technical Glossary

"Pre-Feasibility A Preliminary Feasibility Study (Pre-Feasibility

Study" Study) is a comprehensive study of a range of

options for the technical and economic viability

of a mineral project that has advanced to a

stage where a preferred mining method, in the

case of underground mining, or the pit configuration,

in the case of an open pit, is established and

an effective method of mineral processing is

determined. It includes a financial analysis

based on reasonable assumptions on the Modifying

Factors and the evaluation of any other relevant

factors which are sufficient for a Competent

Person, acting reasonably, to determine if all

or part of the Mineral Resources may be converted

to an Ore Reserve at the time of reporting.

A Pre-Feasibility Study is at a lower confidence

level than a Feasibility Study.

----------------- -------------------------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDFEAFFMEESEFS

(END) Dow Jones Newswires

October 26, 2022 07:21 ET (11:21 GMT)

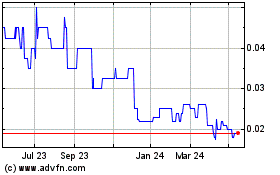

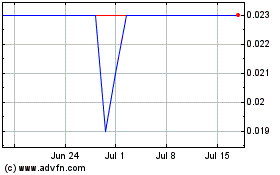

Bezant Resources (AQSE:BZT.GB)

Historical Stock Chart

From Apr 2024 to May 2024

Bezant Resources (AQSE:BZT.GB)

Historical Stock Chart

From May 2023 to May 2024