Duke Royalty Limited Refinance and Upsize of Credit Facility (2929J)

December 12 2022 - 1:00AM

UK Regulatory

TIDMDUKE

RNS Number : 2929J

Duke Royalty Limited

12 December 2022

12 December 2022

Duke Royalty Limited

("Duke Royalty", "Duke" or the "Company")

Refinance and Upsize of Credit Facility to GBP100 million on

Improved Terms with Fairfax Financial

Duke Royalty, a provider of alternative capital solutions to a

diversified range of profitable and long-established businesses in

Europe and North America , is pleased to announce that it has

entered into a new GBP100 million credit facility agreement (the

"New Credit Facility") with Fairfax Financial Holdings Limited and

certain of its subsidiaries ("Fairfax").

The material terms of the New Credit Facility are as

follows:

-- Term facility of up to GBP100 million to replace Duke's

existing GBP55 million term and revolving facilities

-- Five-year term, expiring in January 2028 with a bullet

repayment on expiry and no amortisation payments during the

five-year term

-- Interest rate equal to SONIA plus 5.00% per annum, which

represents an improvement of 225bps on Duke's existing rate of

SONIA plus 7.25%

-- As part of the deal, Duke will issue 41,615,134 warrants to

Fairfax with a five-year maturity and strike price of 45 pence

reflecting the strategic nature of the deal

-- Initial drawdown of the New Credit Facility expected to occur

in mid/late January 2023 coinciding with the expiry of the non-call

period enshrined in Duke's existing credit facilities

The New Credit Facility will provide Duke with a significant

amount of additional liquidity and will push out the Company's

requirement for additional equity capital. Furthermore, the New

Credit Facility comes at a lower cost to the Company's existing

credit facility thereby having an immediate and material impact on

the free cash flow of the Company.

Neil Johnson, CEO of Duke Royalty, said:

"I am delighted to announce this upsized credit facility with

Fairfax on improved terms for Duke shareholders. Fairfax is an

internationally recognised and well respected company. Both Duke

and Fairfax have similar philosophies of investing in a supportive

way over the long term and I believe that this is the start of a

long standing and mutually beneficial relationship.

"The upsizing of the New Credit Facility will allow Duke to

accelerate its growth and deployment schedule without any near-term

equity dilution. More strategically, Fairfax and Duke believe our

partnership can benefit more businesses looking for long-term,

flexible capital solutions by increasing Duke's capital base and

diversification, as well as benefit Duke's shareholders through

higher free cash flow per share."

Prem Watsa, Chairman and CEO of Fairfax, said:

"We are impressed with the degree to which Duke's investing

philosophy aligns with our own - focusing on lending to

established, profitable, cash-generating, well-managed companies,

with incentivised management teams. We are delighted to be

partnering with Duke and believe that there is a large group of

companies that can benefit from Duke's long-term flexible

support."

About Fairfax Financial Holdings Limited

Fairfax Financial Holdings Limited is a holding company which,

through its subsidiaries, is primarily engaged in property and

casualty insurance and reinsurance and the associated investment

management. Fairfax is headquartered in Toronto, Canada and its

common shares are listed on the Toronto Stock Exchange under the

symbol FFH and in U.S. dollars under the symbol FFH.U.

***ENDS***

For further information, please visit www.dukeroyalty.com or

contact:

Neil Johnson / Charles

Cannon Brookes / Hugo

Duke Royalty Limited Evans +44 (0) 1481 730 613

Cenkos Securities

plc

(Nominated Adviser Stephen Keys / Callum

and Joint Broker) Davidson / Michael Johnson +44 (0) 207 397 8900

Canaccord Genuity

(Joint Broker) Adam James / Harry Rees +44 (0) 207 523 8000

SEC Newgate (PR) Elisabeth Cowell / Axaule +44 (0) 20 3757 6882

Shukanayeva dukeroyalty@secnewgate.co.uk

About Duke Royalty

Duke Royalty Limited provides alternative capital solutions to a

diversified range of profitable and long-established businesses in

Europe and abroad. Duke Royalty's experienced team provide

financing solutions to private companies that are in need of

capital but whose owners wish to maintain equity control of their

business. Duke Royalty's royalty investments are intended to

provide robust, stable, long term returns to its shareholders. Duke

Royalty is listed on the AIM market under the ticker DUKE and is

headquartered in Guernsey.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEAKAFFLXAFFA

(END) Dow Jones Newswires

December 12, 2022 02:00 ET (07:00 GMT)

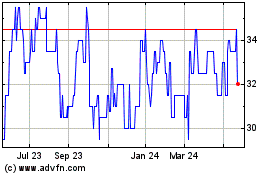

Duke Capital (AQSE:DUKE.GB)

Historical Stock Chart

From Dec 2024 to Jan 2025

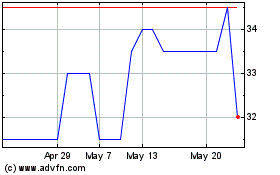

Duke Capital (AQSE:DUKE.GB)

Historical Stock Chart

From Jan 2024 to Jan 2025