Real Estate Credit Investments Ltd Investment Manager's Q2 Investor Presentation (2538S)

November 03 2023 - 2:05AM

UK Regulatory

TIDMRECI

RNS Number : 2538S

Real Estate Credit Investments Ltd

03 November 2023

03 November 2023

Real Estate Credit Investments Limited

Investment Manager's Q2 Investor Presentation

Real Estate Credit Investments Limited ("RECI" or "the Company")

is pleased to announce that the Investment Manager's Q2 Investor

Presentation is now available on the Company's website at:

https://realestatecreditinvestments.com/investors/results-reports-and-presentations/#currentPage=1

An extract from the Summary section of the presentation is set

out for investors in the Appendix to this announcement.

For further information, please contact:

Richard Crawley / Edward Mansfield +44 (0)20 3100

Broker: (Liberum Capital) 2222

+44 (0)20 7968

Investment Manager Richard Lang (Cheyne) 7328

Appendix: Q2 Investor Presentation Extract

Key Quarter Updates

* Portfolio

- Total NAV Return for the quarter: +0.5% / Total NAV Return

for H1 2023: +3.8%

- No defaults in the portfolio

- During the quarter, one French loan fully repaid, realising

net proceeds of GBP2.4m, and providing headroom to invest in

new deals at enhanced IRRs

- Rotation of market bond portfolio into strong senior loans

with attractive returns

* Cash

- Cash reserves remain targeted at between 5% to 10% of NAV

- As at 30 September 2023, cash was GBP14.9m / 4.3% of NAV

* Dividend

- Dividends maintained at 3p per quarter, annualised 9.1% yield,

based on share price, as at 30 September 2023

- Dividends predominantly covered by net interest income generated

from RECI's assets. The aim is for dividend cover from net

interest income

* Opportunities

- The present macroeconomic backdrop is set to continue through

2023/2024, resulting in further constraints in bank lending

and alternative sources of capital. The opportunity to provide

senior loans at low risk points, for higher margins, is increasingly

evident

- The Company expects to deploy its currently available cash

resources to its near term commitments and towards a compelling

emerging opportunity set in senior loans

* Post Quarter Update - Market Bonds

- RECI has exited 8 market bond positions since 30 September

2023, realising proceeds (net of repo financing) of GBP5.9m.

The fund now only has 7 market bond positions, with a notional

value of GBP11.9m / 3.5% of NAV

* Citywire Investment Trust Awards 2023

- RECI won the Best Performance award for Specialist Debt at

Citywire's London-listed Investment Companies awards held on

01 November 2023. The performance awards are given to investment

companies judged to have delivered the best underlying return

in terms of growth in NAV in the three years to 31 August 2023

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDDLLFBXFLXFBV

(END) Dow Jones Newswires

November 03, 2023 03:05 ET (07:05 GMT)

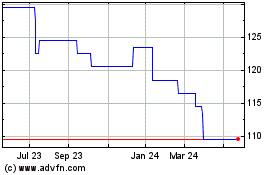

Real Estate Credit Inves... (AQSE:RECI.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

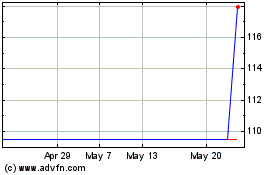

Real Estate Credit Inves... (AQSE:RECI.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024