Rogue Baron Plc Half Year Report to 30 June 2022

September 30 2022 - 5:00AM

UK Regulatory

TIDMSHNJ

30 September 2022

Rogue Baron Plc.

("Rogue Baron" or the "Company")

Half Year Report

for the six month period ended 30 June 2022

The six month period to June 30, 2022 was one of both great challenge yet

ultimately one of reward. The first quarter was one of very subdued trading

due to an inability to get stock from Tokyo to the USA as a result of repeated

Chinese lockdowns which threw Asian container shipping into chaos. However,

when the company finally was able to get stock into the USA progress was made

in key markets. In the second quarter, the group sold 689 cases globally

resulting in revenue of $87,492, moving 55% higher compared to the same period

in 2021, driven by both the addition of new markets and continuing demand from

existing customers.

In the key strategic US market, the team has been bolstered by an experienced

salesman from Republic National Distributing Company (RNDC), one of the

largest distributors in the US. As per the announcements of April 2022, the

Company has added distribution in a number of European countries (UK, Spain,

Switzerland and Austria). These markets accounted for 14% of total case sales

in the quarter as these markets have just begun to order their initial supply.

The Company has now hired a UK based brand manager to push UK and EU sales with

an initial particular focus on the UK. Progress on expanded USA distribution

has been made and the Company remains very confident of being able to deliver

on this in the near term.

Global consumer trends in the beverage industry continue to shift towards

ultra-premium drinks consumption. The Company has already seen the effect of

this with sales in Europe of its 8-year old Shinju expression. Rogue Baron

intends to capitalise on this trend with the intended future launch of 12 and

15 year old Shinju expressions. Due to strong demand for aged Japanese Whisky

and lack of supply this puts the Company in a strong position not only with

respect to Japanese Whisky but with respect to being able to cross sell other

spirits such as a super-premium tequila. The Company has already had numerous

other approaches from other alcohol brands with respect to being able to

access the Company's USA distribution network We believe this further franks

the value proposition of the Company as the USA liquor market is littered with

failed attempts by overseas brands to enter the country without understanding

the market let alone the regulatory system there.

The Company has also amended its year end to September 30. The Company auditor

PKF has been instructed to undertake a stock take of both Shinju and the

Company's tequila at warehouses in the USA, the Netherlands and Mexico. The

latter should resolve the outstanding matter from the audit opinion at the 31

December 2021 year end.

The Directors of the Company accept responsibility for the contents of this

announcement.

For further information, please contact:

The Company

Ryan

Dolder

rdolder@roguebaron.com

AQSE Corporate Adviser:

Peterhouse Capital Limited

Guy Miller

+44 (0) 20 7469 0936

AQSE Corporate Broker:

Peterhouse Capital Limited

Lucy Williams

+44 (0) 20 7469 0936

ROGUE BARON PLC

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE PERIODED 30 JUNE 2022

Note Unaudited Unaudited

Period ended Period ended

30-Jun-22 30/06/2021

(restated)

US$'000 US$'000

Revenue 90 165

Cost of sales (70) (136)

Gross profit 20 29

IPO costs (4) (185)

Payments made in shares - (440)

Other administrative expenses (317) (378)

Total administrative expenses (321) (1,003)

Share of loss in associated company (24) 0

(Loss)/profit from operations (325) (974)

Finance costs - (15)

Loss before and after taxation from (325) (989)

continuing operations

(Loss)/profit on discontinued operations (3) 28

Exchange differences (50) (18)

Total comprehensive loss for the period/ (378) (979)

year, attributable to the owners of the

company

Total comprehensive loss attributable to

Non-controlling shareholders (1) 13

Equity holders of the parent (377) (992)

(378) (979)

Earnings per share

Total basic and diluted earnings per share 3 (0.36) (1.36)

(cents) from continuing operations

Total basic and diluted earnings per share 0.00 0.04

(cents) from discontinued operations

ROGUE BARON PLC

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2022

Unaudited Audited

30 June 2022 31 December 2021

Assets Note US$'000 US$'000

Non-current

Intangible assets 4 3,826 3,826

Investments in associates 5 40 64

3,866 3,890

Current

Cash and cash equivalents 56 246

Inventories 769 717

Trade and other receivables 260 325

Total current assets 1,085 1,288

Total assets 4,951 5,178

Liabilities

Current

Trade and other payables 203 39

Loans payable 6 140 156

Net liabilities of discontinued operations 192 189

Total current liabilities and total 535 384

liabilities

Equity

Issued share capital 7 119 119

Share premium 6,627 6,627

Exchange reserve (227) (177)

Retained earnings (2,061) (1,734)

Equity attributable to the equity holders 4,458 4,835

of the Company

Non-controlling interest (42) (41)

Total equity 4,416 4,794

Total equity and liabilities

4,951 5,178

ROGUE BARON PLC

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE PERIODED 30 JUNE 2022

Share Share Exchange Retained Total equity Non-controlling Total equity

capital premium reserve earnings attributable interest

account to the owners

of the

company

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

Balance at 1 January 46 3,529 (140) (361) 3,074 (77) 2,997

2021

Share issue 68 2,870 - - 2,938 - 2,938

Share issue costs - (105) - - (105) - (105)

Transactions with 68 2,765 - - 2,833 - 2,833

owners

Loss for the period - - - (974) (974) 13 (961)

Other comprehensive - - (18) (18) (18)

loss for the period - -

Balance at 30 June 114 6,294 (158) (1,335) 4,915 (64) 4,851

2021

Share issue 5 360 - - 365 - 365

Share issue costs - (27) - - (27) - (27)

Transactions with 5 333 - 338 - 338

owners -

Loss for the period - - - (399) (399) 23 (376)

Exchange difference - - (19) - (19) - (19)

on translating

foreign operations

Balance at 31 119 6,627 (177) (1,734) 4,835 (41) 4,794

December 2021

Issue of shares - - - - - - -

Transactions with

owners - - - - - - -

Loss for the period - - - (327) (327) (1) (328)

Other comprehensive - - (50) - (50) - (50)

income for the

period

Balance at 30 June 119 6,627 (227) (2,061) 4,508 (42) 4,416

2022

ROGUE BARON PLC

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE PERIODED 30 JUNE 2022

Unaudited Unaudited

Period ended Period ended

30 June 2022 30 June 2021

(restated)

US$'000 US$'000

Operating activities

Loss/(profit) after tax (325) (989)

Finance cost - 15

Loss on conversion of loans - 176

Loss on associate 24 -

(Increase)/decrease in inventories (52) (112)

(Increase)/decrease in trade and other 65 (198)

receivables

Expenses settled in shares - 440

(Decrease)/increase in trade and other 141 (164)

payables

Net cash (outflow)/inflow from operating (147) (832)

activities

Investing activities

Cash received from discontinued operations - 68

Net cash outflow from investing activities - 68

Financing activities

Proceeds from issue of share capital - 1,147

Share issue costs - (105)

Loans received - 5

Loans repaid - (68)

Net cash inflow from financing activities - 979

Net change in cash and cash equivalents (147) 215

Cash and cash equivalents at beginning of 246 131

period

Exchange difference on cash and cash (43) 32

equivalents

Cash and cash equivalents at end of period 56 378

ROGUE BARON PLC

NOTES TO THE INTERIM REPORT

FOR THE PERIODED 30 JUNE 2022

The financial information set out in this interim report does not constitute

statutory accounts as defined in Section 434 of the Companies Act 2006.The

Company's statutory financial statements for the year ended 31 December 2021

have been completed and filed at Companies House.

1. ACCOUNTING POLICIES

Basis of preparation

The Company's ordinary shares are quoted on the Aquis Stock Exchange and the

Company applies the Companies Act 2006 when preparing its annual financial

statements.

The annual financial statements for the year ending 31 December 2022 will be

prepared under International Financial Reporting Standards as adopted by the

European Union (IFRS) and the principal accounting policies adopted remain

unchanged from those adopted in preparing its financial statements for the year

ended 31 December 2021.

The accounting policies have been applied consistently throughout the Group for

the purposes of preparation of these condensed consolidated interim financial

statements.

Segmental reporting

An operating segment is a distinguishable component of the Group that engages

in business activities from which it may earn revenues and incur expenses,

whose operating results are regularly reviewed by the Group's Chief Executive

Officer to make decisions about the allocation of resources and assessment of

performance and about which discrete financial information is available.

The Chief Executive Officer reviews financial information for and makes

decisions about the Group's performance as a whole, as the Group has recently

been acquired. All revenue is generated in USA,

The Group expects to further review its segmental information during the

forthcoming financial year.

Fees and Loans Settled in Shares

Where shares have been issued as consideration for services provided or loans

outstanding, they are measured at fair value. The difference between the

carrying amount of the financial liability (or part thereof) extinguished, and

the fair value of the shares, is recognised in profit or loss.

2. TAXATION

No tax is due for the period as the Company has made a taxable loss. The

Directors expect these losses to be available to offset against future taxable

trading profits. The Group has not recognised any deferred tax asset at 30

June 2022 (30 June 2021: £nil) in respect of these losses on the grounds that

it is uncertain when taxable profits will be generated by the Group to utilise

any such losses.

3. LOSS per share

The calculation of the basic loss per share is based on the loss attributable

to ordinary shareholders divided by the weighted average number of shares in

issue during the period. The impact of the options and warrants on the loss

per share is anti-dilutive.

Unaudited Unaudited

six months ended six months ended

30 June 2022 30 June 2021

(restated)

US$'000 US$'000

Loss after taxation - continuing (325) (989)

operations ($'000)

Profit/(loss after taxation) - (3) 28

discontinued operations

Loss after taxation - total (328) (961)

Number Number

Weighted average number of shares for

calculating basic earnings per share 90,043,076 70,815,991

Cents Cents

Basic and diluted earnings per share - (0.36) (1.40)

continuing operations

Basic and diluted earnings per share - 0.00 0.04

discontinued operations

Basic and diluted earnings per share - (0.36) (1.36)

total

4. INTANGIBLE ASSETS

Brands & Licences Other Total

US$'000 US$'000 US$'000

Cost

At 1 January 2021, 30 June 2021 and 3,816 10 3,826

31 December 2021

Additions - -

-

At 30 June 2022 3,816 10 3,826

Amortisation and impairment

At 1 January 2021, 30 June 2021 and - -

31 December 2021 -

Impairment

- - -

At 30 June 2022

- - -

Net book value at 30 June 2022 3,816 10 3,826

Net book value at 31 December 2021 3,816 10 3,826

Net book value at 30 June 2021 3,816 10 3,826

The Group owns several licences over liquor brands. The carrying value of

intangible assets have been reviewed for impairment and no impairment was

considered necessary.

5. INVESTMENTS IN ASSOCIATES

On 1 July 2021 the Group acquired a 51% interest in For Mir LLC through Legacy

Retail Group LLC. For Mir LLC operates De Rhum Spot a bar in Washington DC.

Having reviewed the operating agreement, the directors do not consider that the

Group has control of For Mir LLC and has accounted for it as an associate

undertaking. Under the terms of the agreement the Group is liable for the first

$70,000 of losses and thereafter they are apportioned according to

shareholding. The movement in the investment in the associated undertaking was:

30 June 2022 31 December 2021

$'000 $'000

At beginning of period 64 -

Investment - 136

Share of loss for year (24) (72)

At end of period

40 64

6. LOANS

The movement in loans is shown below.

30 June 2022 31 December 2021

Convertible loans $'000 $'000

Balance at beginning of period 151 1,266

Converted into shares - (1,351)

Loss on conversion - 176

Interest charged - 15

Foreign exchange (16) 45

Balance at end of period 135 151

Non-convertible loans

Balance at beginning of period 5 68

Loans received - 5

Repaid in cash - (68)

Balance at end of period 5 5

7. SHARE CAPITAL

The movement in ordinary shares and share premium in the period was as follows:

Number Nominal Share premium

amount (USD (USD $'000)

$'000)

As at 1 January 2021 36,748,500 46 3,529

Shares issued for loan 32,741,450 45 1,306

conversions

Shares issued for cash 12,185,714 17 1,130

Shares issued in payment of 4,510,270 6 434

fees

Share issue costs - - (105)

At 30 June 2021 86,185,934 114 6,294

Shares issued in payment of 1,000,000 1 93

creditors

Shares issued for cash 2,857,142 4 267

Share issue costs - - (27)

At 31 December 2021 90,043,076 119 6,627

Movement in period - - -

At 30 June 2022 90,043,076 119 6,627

8. ULTIMATE CONTROLLING PARTY

The Company has no ultimate controlling party

END

(END) Dow Jones Newswires

September 30, 2022 06:00 ET (10:00 GMT)

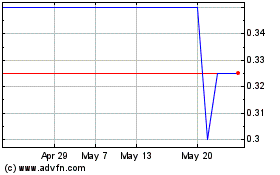

Rogue Baron (AQSE:SHNJ)

Historical Stock Chart

From Dec 2024 to Jan 2025

Rogue Baron (AQSE:SHNJ)

Historical Stock Chart

From Jan 2024 to Jan 2025