South32 Suspends Share Buyback in Virus Response

March 26 2020 - 6:45PM

Dow Jones News

By David Winning

SYDNEY--South32 Ltd. has suspended its share buyback program and

will cut around US$160 million in spending over the next 15 months

as it responds to the coronavirus pandemic.

South32 said the decision to ice the buyback was taken with

US$121 million remaining. Still, the mining company said there

would be an opportunity to extend the buyback program ahead of its

expiry on September 4.

"Our financial priorities remain unchanged, and today's actions,

including the suspension of our on-market share buyback, are a

prudent response to the current exceptional circumstances and

consistent with our commitment to maintain a strong financial

position," said Chief Executive Graham Kerr.

South32 said US$150 million in planned capital expenditure to

sustain its operations won't now happen, representing a 10% cut in

the year through June and an 18% reduction in the 2021 fiscal year.

It would also seek to cut US$10 million from its budget for

exploring for new deposits of metals and minerals.

Management said it is reviewing activity to find ways to cut

controllable costs meaningfully. "We expect to see the benefit of

this work and lower producer currencies reflected in our FY 2021

operating unit cost guidance," the company said in a regulatory

filing.

Write to David Winning at david.winning@wsj.com

(END) Dow Jones Newswires

March 26, 2020 19:30 ET (23:30 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

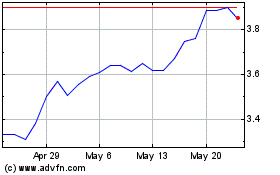

South32 (ASX:S32)

Historical Stock Chart

From Nov 2024 to Dec 2024

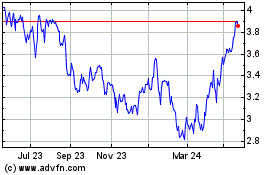

South32 (ASX:S32)

Historical Stock Chart

From Dec 2023 to Dec 2024