Tabcorp Bid for Tatts Sent Back to Australian Competition Tribunal

September 20 2017 - 3:26AM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--A US$9 billion tie-up between two of

Australia's biggest betting companies has been put on hold after an

Australian court called for further regulatory scrutiny of Tabcorp

Holdings Ltd.'s (TAH.AU) offer for rival Tatts Group Ltd.

(TTS.AU).

Without disclosing their reasoning, three federal court judges,

in a written decision Wednesday, referred the proposed deal back to

the Australian Competition Tribunal for further consideration.

The ruling, in response to appeals by the country's antitrust

regulator and Crown Resorts Ltd's (CWN.AU) CrownBet unit, set aside

the tribunal's decision in June to allow the merger to go

ahead.

Tabcorp and Tatts agreed to a tie-up last October in a deal they

estimated would create a betting and lottery company with an

enterprise value of 11.3 billion Australian dollars (US$9.05

billion) and annual revenue of more than A$5 billion. At the time,

they expected the deal would be done by the middle of the year.

The Australian Competition and Consumer Commission welcomed the

court decision to support its appeal, which was based on a view

that a takeover would substantially lessen competition. Rod Sims,

chairman of the regulator, said the ACCC also argued the

competition tribunal made an error when it failed to compare the

likely future state of competition both with and without a

merger.

Tabcorp approached the ACCC for approval of its planned offer in

November, but pulled its application and turned to the competition

tribunal in March after the ACCC released a statement containing

concerns it had with the deal.

The tribunal is a court-affiliated body that balances public

benefits of proposed transactions against likely detriments, which

differs from the ACCC test, which looks more narrowly at whether a

merger or acquisition would reduce competition.

Tabcorp has offered 0.8 of a share plus 42.5 cents cash for each

Tatts share, which when it was made, valued Tatts at about A$6.4

billion.

Australia's gambling industry has attracted attention from

overseas in recent years and betting activity in Tabcorp's retail

locations has fallen because of the heightened competition.

Companies such as Ladbrokes Coral Group PLC and William Hill PLC

have opened online betting platforms in the country.

Tabcorp's approach for Tatts attracted a rival offer from a

group of investors that included private equity firm KKR & Co.

and Australian bank Macquarie Group Ltd., but it was rejected by

Tatts.

Shares in Tabcorp and Tatts were placed on trading halts ahead

of the court decision.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

September 20, 2017 04:11 ET (08:11 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

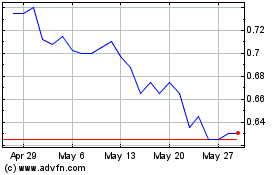

Tabcorp (ASX:TAH)

Historical Stock Chart

From Jan 2025 to Feb 2025

Tabcorp (ASX:TAH)

Historical Stock Chart

From Feb 2024 to Feb 2025