Rio Tinto Rebuffs Glencore Again in Bidding for Australian Coal Assets--Update

June 26 2017 - 9:00AM

Dow Jones News

By Tapan Panchal and Razak Musah Baba

LONDON-- Glencore PLC suffered another setback Monday in a

bidding war for Australian coal mines, after the commodity giant's

rival Rio Tinto PLC said it would rather take a sweetened offer

from a Chinese company.

Rio Tinto restated its preference for Yancoal Australia Ltd.'s

offer after the company improved its bid to $2.69 billion. Rio

Tinto had agreed to sell its Australian coal business, Coal &

Allied Industries Ltd., to Yancoal in January for $2.45 billion,

but Glencore swooped in earlier this month with its own offers,

pushing the price up.

The bidding demonstrates renewed appetite for deal-making by

Glencore Chief Executive Ivan Glasenberg almost two years after the

Switzerland-based commodity giant experienced a downward spiral in

share price. Glencore has since cut its debt almost in half after

selling assets, eliminating its dividend and issuing new

shares.

Mr. Glasenberg has long wanted to buy Rio's coal business

because the assets sit near Glencore's Australian coal operations,

offering opportunities for synergies. Mr. Glasenberg rose through

Glencore as a coal trader, and the company is among the biggest

traders of the commodity in the world.,

Glencore has now twice unsuccessfully tried to outbid Yancoal

for Rio's Coal & Allied business.

The Switzerland-based company first bid $2.55 billion earlier

this month, after Yancoal revised its offer to make its $2.45

billion payable upfront. Escalating the bidding on Friday, Glencore

submitted an all-cash offer of $2.68 billion, saying its bid was

fully funded and worth at least $225 million more than

Yancoal's.

Yancoal countered with a bid Rio says is worth around $2.69

billion, comprising $2.45 billion in cash payable in full on

completion, as well as $240 million via unconditional guaranteed

royalty payments of which $200 million will be received before the

end of 2018.

Rio Tinto on Monday confirmed its recommendation that

shareholders vote in favor of the sale of C&A to Yancoal on the

grounds that the sweetened China-backed offer had a strong chance

of completing. Rio has highlighted Yancoal's approval from

regulators in China, a voracious consumer of coal.

Write to Tapan Panchal at Tapan.Panchal@wsj.com and Razak Musah

Baba at Razak.Baba@wsj.com

(END) Dow Jones Newswires

June 26, 2017 09:45 ET (13:45 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

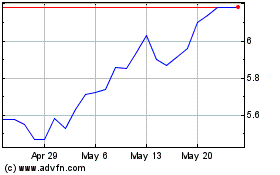

Yancoal Australia (ASX:YAL)

Historical Stock Chart

From Nov 2024 to Dec 2024

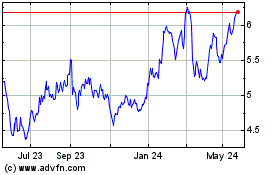

Yancoal Australia (ASX:YAL)

Historical Stock Chart

From Dec 2023 to Dec 2024