LVMH shows good resilience in the current context

Paris, October 15, 2024

LVMH Moët Hennessy Louis Vuitton, the world’s

leading high-quality products group, recorded revenue of

€60.8 billion in the first nine months of 2024, stable on a

constant consolidation scope and currency basis despite the current

context and a high basis of comparison, following several years of

exceptional post-Covid growth. Europe and the United States posted

slight growth on a constant consolidation scope and currency basis;

Japan continued to achieve double-digit revenue growth; the rest of

Asia reflected in particular the strong growth in spending by

Chinese customers in Europe and Japan.

In the third quarter, the slight decline in revenue mainly arose

from lower growth seen in Japan, essentially due to the stronger

yen.

Revenue by business group changed as

follows:

|

In millions of euros |

9 months 2023 |

9 months 2024 |

Change:

First 9 months

2024/2023

Reported

Organic* |

|

Wines & Spirits |

4 689 |

4 193 |

-11% |

-8% |

|

Fashion & Leather Goods |

30 912 |

29 922 |

-3% |

-1% |

|

Perfumes & Cosmetics |

6 021 |

6 148 |

+2% |

+5% |

|

Watches & Jewelry |

7 951 |

7 536 |

-5% |

-3% |

|

Selective Retailing |

12 431 |

12 559 |

+1% |

+6% |

|

Other activities and eliminations |

201 |

395 |

- |

- |

|

Total LVMH |

62 205 |

60 753 |

-2% |

+0% |

* On a constant consolidation scope and currency basis. For

the Group, the impact of changes in scope with respect to the first

nine months of 2023 was -1%; the impact of exchange rate

fluctuations was -2%.

The Wines & Spirits

business group saw a revenue decline (-8% organic) in the first

nine months of 2024. Champagne was down, reflecting the ongoing

normalization of post-Covid demand, but remained significantly

higher than in 2019. Hennessy cognac was held back by weak local

demand in the Chinese market, while the United States saw a return

to growth in the second quarter, in a market that remained

cautious. In Provence rosé wines, Château d’Esclans stepped up its

international expansion. The joint venture with Beyoncé

Knowles-Carter gave rise to a new American whisky, SirDavis. A

strategic partnership with French Bloom, the market leader in

premium alcohol-free sparkling wine, was also announced.

The Fashion & Leather Goods

business group, which was broadly stable on an organic basis over

the first nine months of 2024, showed good resilience and gained

market share. Louis Vuitton and Christian Dior both enjoyed high

visibility over the summer with the Paris 2024 Olympic and

Paralympic Games. Louis Vuitton was once again driven by its

remarkable capacity for innovation in the world of travel. Many new

products were unveiled in leather goods. Victory travels in Louis

Vuitton: bespoke trunks, handcrafted in its historic Asnières

workshops, held the world’s most prestigious sports trophies, such

as those of the Louis Vuitton Cup and the 37th America’s Cup in

Barcelona, as well as the torches and medals of the Paris 2024

Olympic and Paralympic Games. Christian Dior maintained its

creative momentum, fusing heritage and modernity, as seen in its

new Miss Dior line. The L’Or de Dior exhibition

at the Guardian Art Center in Beijing honored the Maison’s strong

ties with China through the prism of art. New My Dior

designs featuring Dior’s iconic cannage stitching

celebrated and reinterpreted traditional jewelry-making

craftsmanship. Loro Piana, Loewe and Rimowa confirmed their solid

momentum. The Group welcomed two new creative directors: Michael

Rider at Celine and Sarah Burton at Givenchy.

The Perfumes & Cosmetics

business group achieved organic revenue growth of 5% in the first

nine months of 2024, driven by its powerful innovation strategy and

highly selective distribution policy. Christian Dior achieved an

excellent performance. Sauvage continued to achieve solid

growth, consolidating its position as the world’s leading

fragrance, while Rihanna became the new face of iconic women’s

perfume J’adore. The new Miss Dior Parfum edition

was a major success. Makeup and premium skincare also contributed

to the Maison’s strong performance. Guerlain enjoyed solid momentum

in fragrances, driven in particular by its exceptional L’Art

& La Matière collection and the addition of its new

Florabloom scent to the Aqua Allegoria line.

Givenchy continued to see growth, driven by its new L’Interdit

Absolu fragrance. Fenty Beauty launched a new range of

haircare products and expanded its retail presence in China.

The Watches & Jewelry

business group saw a slight decline on an organic basis in the

first nine months of 2024. Tiffany & Co. continued to showcase

its iconic lines through its global “With Love, Since 1837”

campaign. The new Tiffany Titan by Pharrell Williams

collection was exceptionally well received, while the Maison

celebrated the 50th anniversary of the first pieces designed by

Elsa Peretti. It continued to successfully roll out its new store

concept in its main markets. Bulgari celebrated its

140th anniversary with Zendaya, Anne Hathaway and Yifei, who

starred in the “Eternally Reborn” brand campaign. This celebration

included the launch of a new jewelry collection, Bulgari

Tubogas, inspired by the 1940s icon, reinterpreted in a bold,

timeless yellow gold edition. Chaumet enjoyed high visibility

during the summer with the awarding of the medals for the Paris

2024 Olympic and Paralympic Games, created by its design

studio.

The announcement of LVMH’s 10-year global partnership with

Formula 1 was a major highlight, in which several of LVMH’s

iconic Maisons – in particular Louis Vuitton, Moët Hennessy and TAG

Heuer – will be involved starting in 2025.

In Selective Retailing, organic

revenue growth was 6% in the first nine months of 2024. Sephora

performed remarkably well and continued to gain market share in

North America, Europe and the Middle East. DFS saw business

activity remain below its 2019 pre-Covid level, with marked

differences in tourist traffic between its various destinations. Le

Bon Marché continued to achieve growth, driven by the department

store’s differentiation strategy, with its continuously renewed

selection of products and services and unique slate of events.

OUTLOOK

In an uncertain economic and geopolitical

environment, the Group remains confident and will maintain a

strategy focused on continuously enhancing the desirability of its

brands, drawing on the authenticity and quality of its products,

excellence in distribution and agile organization.

LVMH will draw on its powerful brands and the talent of its teams

to reinforce its global leadership position in luxury goods once

again in 2024.

Apart from the information mentioned in this

press release, during the quarter and to date, no events or changes

have occurred that could significantly modify the Group’s financial

structure.

Regulated information related to this press release and

presentation is available at www.lvmh.com.

Details from the webcast on the publication

of revenue for the third quarter of 2024 are available at

www.lvmh.com.

APPENDIX

LVMH – Revenue by business group and by quarter

|

Revenue for 2024 (in millions of euros) |

2024

|

Wines & Spirits |

Fashion & Leather Goods |

Perfumes & Cosmetics |

Watches & Jewelry |

Selective Retailing |

Other activities and eliminations |

Total

|

|

First quarter |

1 417 |

10 490 |

2 182 |

2 466 |

4 175 |

(36) |

20 694 |

|

Second quarter |

1 391 |

10 281 |

1 953 |

2 685 |

4 457 |

216 |

20 983 |

|

First half |

2 807 |

20 771 |

4 136 |

5 150 |

8 632 |

181 |

41 677 |

|

Third quarter |

1 386 |

9 151 |

2 012 |

2 386 |

3 927 |

214 |

19 076 |

|

First nine months |

4 193 |

29 922 |

6 148 |

7 536 |

12 559 |

395 |

60 753 |

|

Revenue for 2024 (organic growth versus same period in

2023) |

2024

|

Wines & Spirits |

Fashion & Leather Goods |

Perfumes & Cosmetics |

Watches & Jewelry |

Selective Retailing |

Other activities and eliminations |

Total

|

|

First quarter |

-12% |

+2% |

+7% |

-2% |

+11% |

- |

+3% |

|

Second quarter |

-5% |

+1% |

+4% |

-4% |

+5% |

- |

+1% |

|

First half |

-9% |

+1% |

+6% |

-3% |

+8% |

- |

+2% |

|

Third quarter |

-7% |

-5% |

+3% |

-4% |

+2% |

- |

-3% |

|

First nine months |

-8% |

-1% |

+5% |

-3% |

+6% |

- |

+0% |

|

Revenue for 2023 (in millions of euros) |

2023

|

Wines & Spirits |

Fashion & Leather Goods |

Perfumes & Cosmetics |

Watches & Jewelry |

Selective Retailing |

Other activities and eliminations |

Total

|

|

First quarter |

1 694 |

10 728 |

2 115 |

2 589 |

3 961 |

(52) |

21 035 |

|

Second quarter |

1 486 |

10 434 |

1 913 |

2 839 |

4 394 |

140 |

21 206 |

|

First half |

3 181 |

21 162 |

4 028 |

5 427 |

8 355 |

87 |

42 240 |

|

Third quarter |

1 509 |

9 750 |

1 993 |

2 524 |

4 076 |

113 |

19 964 |

|

First nine months |

4 689 |

30 912 |

6 021 |

7 951 |

12 431 |

201 |

62 205 |

As table totals are calculated based on unrounded figures,

there may be slight discrepancies between these totals and the sum

of their component figures.

LVMH

LVMH Moët Hennessy Louis Vuitton is

represented in Wines and Spirits by a portfolio of brands that

includes Moët & Chandon, Dom Pérignon, Veuve Clicquot, Krug,

Ruinart, Mercier, Château d’Yquem, Domaine du Clos des Lambrays,

Château Cheval Blanc, Colgin Cellars, Hennessy, Glenmorangie,

Ardbeg, Belvedere, Woodinville, Volcán de Mi Tierra, Chandon,

Cloudy Bay, Terrazas de los Andes, Cheval des Andes, Newton, Bodega

Numanthia, Ao Yun, Château d’Esclans, Château Galoupet, Joseph

Phelps and Château Minuty. Its Fashion and Leather Goods division

includes Louis Vuitton, Christian Dior, Celine, Loewe, Kenzo,

Givenchy, Fendi, Emilio Pucci, Marc Jacobs, Berluti, Loro Piana,

RIMOWA, Patou, Barton Perreira and Vuarnet. LVMH is present in the

Perfumes and Cosmetics sector with Parfums Christian Dior,

Guerlain, Parfums Givenchy, Kenzo Parfums, Perfumes Loewe, Benefit

Cosmetics, Make Up For Ever, Acqua di Parma, Fresh, Fenty Beauty by

Rihanna, Maison Francis Kurkdjian and Officine Universelle Buly.

LVMH's Watches and Jewelry division comprises Bulgari, Tiffany

& Co., TAG Heuer, Chaumet, Zenith, Fred and Hublot. LVMH is

also active in selective retailing as well as in other activities

through DFS, Sephora, Le Bon Marché, La Samaritaine, Groupe Les

Echos-Le Parisien, Paris Match, Cova, Le Jardin d’Acclimatation,

Royal Van Lent, Belmond and Cheval Blanc hotels.

“This document may contain certain forward

looking statements which are based on estimations and forecasts. By

their nature, these forward looking statements are subject to

important risks and uncertainties and factors beyond our control or

ability to predict, in particular those described in LVMH’s

Universal Registration Document which is available on the website

(www.lvmh.com). These forward looking statements should

not be considered as a guarantee of future performance, the actual

results could differ materially from those expressed or implied by

them. The forward looking statements only reflect LVMH’s views as

of the date of this document, and LVMH does not undertake to revise

or update these forward looking statements. The forward looking

statements should be used with caution and circumspection and in no

event can LVMH and its Management be held responsible for any

investment or other decision based upon such statements. The

information in this document does not constitute an offer to sell

or an invitation to buy shares in LVMH or an invitation or

inducement to engage in any other investment activities.”

LVMH CONTACTS

Analysts and investors

Rodolphe Ozun

LVMH

+ 33 1 44 13 27 21 |

Media

Jean-Charles Tréhan

LVMH

+ 33 1 44 13 26 20 |

MEDIA CONTACTS |

|

France

Charlotte Mariné / +33 6 75 30 43 91

Axelle Gadala / +33 6 89 01 07 60

Publicis Consultants

+33 1 44 82 46 05 |

France

Michel Calzaroni / + 33 6 07 34 20 14

Olivier Labesse / Hugues Schmitt / Thomas Roborel de

Climens / + 33 6 79 11 49 71 |

Italy

Michele Calcaterra / Matteo Steinbach

SEC and Partners

+ 39 02 6249991 |

UK

Hugh Morrison / Charlotte McMullen

Montfort Communications

+ 44 7921 881 800 |

US

Nik Deogun / Blake Sonnenshein

Brunswick Group

+ 1 212 333 3810

|

China

Daniel Jeffreys

Deluxewords

+ 44 772 212 6562

+ 86 21 80 36 04 48 |

- LVMH 2024 Third Quarter Revenue

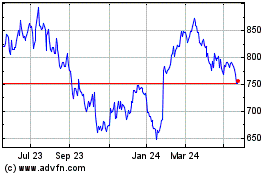

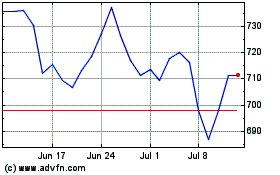

Lvmh Moet Hennessy Louis... (BIT:1MC)

Historical Stock Chart

From Oct 2024 to Nov 2024

Lvmh Moet Hennessy Louis... (BIT:1MC)

Historical Stock Chart

From Nov 2023 to Nov 2024