UniCredit Considers Capital Increase to Meet ECB Rules

July 14 2016 - 4:00AM

Dow Jones News

UniCredit Chairman Giuseppe Vita said Italy's biggest lender

will have to consider a capital increase to satisfy European

Central Bank requirements, as the sale of assets carried out in

recent days wouldn't be enough.

"I don't believe that the European Central Bank will be

satisfied with what we've done," said Mr. Vita on the sidelines of

an event in Rome.

The bank—Italy's largest by assets—launched the sale of two

minority stakes in the past few days in an effort to reinforce its

capital position. On Wednesday, it completed the sale a 10% stake

in Polish subsidiary Bank Pekao SA for roughly €749 million ($830

million). On Tuesday, it said it sold a 10% in online bank

Finecobank.

UniCredit said that the sale of the stake in Pekao would improve

its capital-adequacy ratio by about 12 percentage points, while the

FinecoBank transaction has improved its capital ratio by 8

percentage points.

Write to Manuela Mesco at manuela.mesco@wsj.com

(END) Dow Jones Newswires

July 14, 2016 04:45 ET (08:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

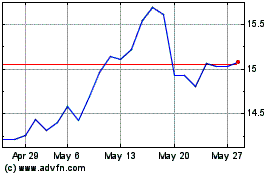

Finecobank (BIT:FBK)

Historical Stock Chart

From Nov 2024 to Dec 2024

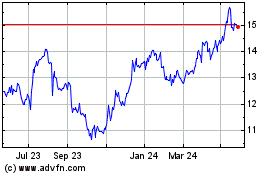

Finecobank (BIT:FBK)

Historical Stock Chart

From Dec 2023 to Dec 2024

Real-Time news about Finecobank SpA (Italian Stock Exchange): 0 recent articles

More Finecobank News Articles