Cardano (ADA) Testing $0.34 Support – On-Chain Data Suggests Price Consolidation

October 09 2024 - 7:30PM

NEWSBTC

Cardano (ADA) is now at a crucial price level after weeks of

intense volatility and uncertainty. Following a dramatic series of

price swings—first a 27% surge, then a 20% retrace, then a 10%

rise, and now a 7% dip to $0.34—Cardano finds itself at one of its

most critical support levels. Holding this level is essential for

bulls to maintain momentum and avoid a deeper decline. Related

Reading: Dogecoin Analyst Expects A ‘Multi-Year Bullish Breakout’ –

200% Surge Potential Market data from Coinglass indicates that ADA

may be entering a consolidation phase, often preceding a

significant price move. Investors and traders closely watch this

level, as it could determine whether Cardano is poised for a

bullish breakout or a deeper correction. With the entire

crypto market in a state of anticipation, ADA’s upcoming price

action will be key in signaling its next trend. As sentiment

remains mixed, this consolidation period will likely set the tone

for Cardano’s direction in the coming weeks. Cardano Funding Rate

Suggests Market Consolidation Cardano (ADA) is showing signs of

entering a potential consolidation phase, a crucial moment for

investors as they evaluate the next move. Recent on-chain data

highlights a surge in large transactions followed by stabilization,

suggesting that the market is cooling off after weeks of

volatility. This stabilization could pave the way for more balanced

price action as ADA hovers around a key support level. Coinglass

data further reinforces the consolidation narrative. The ADA Open

Interest (OI)-Weighted Funding Rate has declined yet remains

positive. A declining but positive funding rate indicates that

demand for ADA is slowing down, but not to a degree where the

market expects heavy short-selling. In crypto, when funding rates

dip but stay in positive territory, the market consolidates rather

than preparing for a sharp downward movement. This suggests that

while ADA’s upward momentum has slowed, there isn’t yet an

overwhelming bearish sentiment. Related Reading: Bitcoin Failed

Attempt To Break $64,000 Could Lead To A Disaster – Analyst If ADA

manages to hold above current levels during this consolidation

phase, it would signal healthy price action. The key is whether

bulls can defend these levels, potentially leading to a more

sustained rally in the weeks ahead. Investors must monitor these

indicators closely as the market tests ADA’s resilience. ADA

Testing Crucial Support Cardano (ADA) is currently trading at $0.34

after failing to reclaim two critical levels: the 4-hour 200 moving

average (MA) at $0.356 and the 200 exponential moving average (EMA)

at $0.359. These indicators are crucial for ADA to regain bullish

momentum, and their rejection signals potential weakness in the

price action. Despite this, ADA is still holding above a key

support level at $0.34. If this level is lost, the price could face

a significant retracement, with lower demand levels around $0.32

and potentially $0.30 being tested. This makes the $0.34 support

critical for maintaining current market sentiment. Conversely, if

ADA can reclaim the 4-hour 200 MA and 200 EMA, breaking above

$0.36, it could set the stage for a rally toward higher resistance

levels. The next significant supply zone to watch would be around

$0.41, where further bullish momentum could face its next

challenge. Related Reading: Ethereum Could Reclaim $2,700 As

Key Data Signals Reduced Selling Pressure The coming days will be

pivotal for ADA as it consolidates and prepares for its next move.

Investors are closely monitoring these key technical levels to

gauge the short-term direction of the price action. Featured image

from Dall-E, chart from TradingView

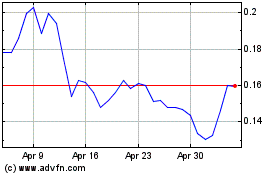

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024