Bitcoin Dominance Fuels $585 Million Crypto ETP Inflows In 2025

January 08 2025 - 7:30AM

NEWSBTC

Bitcoin and crypto ETPs continue their impressive performance just

a week into the new year. According to a CoinShares report filed by

James Butterfill, crypto ETPs saw massive $585 million inflows in

the first few days of the year. Analysts say this early strong

performance of the crypto ETPs continues the impressive run of the

assets from last year. Related Reading: SUI Skyrockets: Bullish

Momentum Drives Push Toward $6 In the same CoinShares report,

crypto ETPs achieved over $44 billion outflows in 2024, with

Bitcoin as the most-traded digital asset. Bitcoin saw $38 billion

in inflows, representing nearly 30% of all Assets in Management

(AUM), while Ethereum picked up pace in the latter half of the

year, with net inflows of more than $4.8 billion. Bitcoin ETPs Lead

The Pack CoinShare’s James Butterfill shared these findings on the

performance of crypto ETPs on the company’s official site and

social media pages. The report explained that Bitcoin ETPs were the

preferred digital investment product, cornering $38 billion of all

Bitcoin AUMs of global ETPs. 2024 saw US$44bn inflows in to crypto

ETPs, 2025 off to a good start with US$585m inflows so

farhttps://t.co/OczGDBUdph — James Butterfill (@jbutterfill)

January 6, 2025 Ethereum ETPs ranked second, receiving roughly $4.8

billion in inflows in 2024, representing 26% of all ETH AUMs of

global ETPs. The ETP’s inflows this past year are 2.4 times bigger

than what was recorded in 2021 and 60 times bigger than in 2023.

Ethereum beats Solana regarding inflows in 2024, with just $69

million, representing only 4% of all assets under management. While

Solana’s numbers are small relative to Bitcoin and Ethereum, it

still leads all other altcoins. Approval Of Spot ETFs Helps

Increase Inflows The industry saw record-breaking inflows in 2024,

which is better than what the bull market experienced in 2021. In

2021, cryptocurrency investment products recorded more than $10

billion in net inflows. In short, last year’s inflows were 4x

bigger than the recorded amount in 2021. According to Bufferfill,

the surge in global crypto investment products benefited from the

US’ approval of spot ETFs for Bitcoin in January 2024. In January

2024, the US Securities and Exchange Commission approved 11

applications for spot Bitcoin ETFs, which were followed by eight

spot ETFs for Ether on May 22nd. According to recent data, these

spot Bitcoin ETFs are the main reasons for the inflows in

Bitcoin-related investments. Butterfill also explained that these

ETFs will redefine the inflows for crypto investments in the

future. Related Reading: Dogecoin To Hit $1? Expert Calls It A

Realistic Goal For 2025 – Here’s Why Better Days Ahead For US

Bitcoin Spot ETPs Aside from CoinShares, Galaxy Digital also

offered a rosy picture of the future of the crypto investments

industry. In a report shared last December 31st, 2024, the company

boldly predicted that the US spot ETPs market will continue to soar

in 2025. The report indicated that this niche will reach $250

billion in AUMs this year. Meanwhile, Alex Thorne of Firmwide

Research said Bitcoin ETPs are closing in on US gold ETPs in total

value of assets under management. Thorne added that Bitcoin will

continue to become one of the top-performing assets on its

risk-adjusted basis. Other analysts shared that Ether’s spot ETPs

will also surge this year. The Ethereum blockchain will benefit

from a Trump presidency and favorable regulatory changes. Featured

image from OneSafe, chart from TradingView

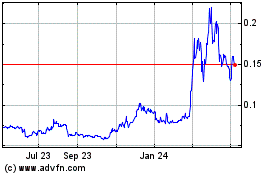

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From Dec 2024 to Jan 2025

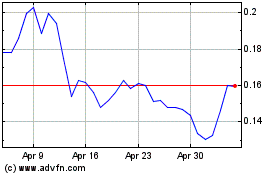

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From Jan 2024 to Jan 2025