Bitcoin Price Dip Could Be Linked To On-Chain Activity

May 13 2023 - 6:58AM

NEWSBTC

Bitcoin (BTC) has experienced downward price pressure in May, with

the token failing to surpass the $30,000 resistance mark. This

development could be linked to on-chain activities that indicate an

increase in the number of Bitcoins sold on exchanges during this

period. 300,000 Bitcoin Sold On Exchanges In May According to

CryptoQuant, a data explorer, over 300,000 bitcoins purchased

between one to six months ago have been sold this month. It is

worth noting that the majority of these sales were made by

individuals who acquired the cryptocurrency between November of

last year and January of this year. According to the data explorer,

266,000 bitcoins were purchased between November and January, while

78,000 bitcoins purchased between January and March were sold in

May. The motivation behind these sales could be to take profits due

to the significant price increase that Bitcoin has experienced

since the investors purchased it. From November to April, the price

of Bitcoin rose from $16,000 to $31,000. However, since April, the

cryptocurrency has been making lower highs, possibly due to the

selling activity of these investors in May. Related Reading: PEPE

Attempts Market Rebound, Surges By 28% In 24 Hours Bitcoin Shows

Strength At Around $27,000 Bitcoin’s price action in recent days

was significant as it demonstrated the resilience of the

cryptocurrency in the face of market volatility. As mentioned,

Bitcoin had fallen to as low as $26,800 before quickly rebounding

and testing support at its low of $27,000. This successful retest

of support once again confirmed the strength of Bitcoin in this

price zone. The market’s high volatility yesterday can be

attributed to the United States’ inflation report, which revealed a

higher-than-expected increase in prices. Additionally, false rumors

that the US government was selling Bitcoin caused bearish pressure

on the market. Despite these events, Bitcoin held strong and was

able to retest support. Related Reading: Polkadot (DOT) Price: The

Bear Vs. Bull Battle Continues – Who’ll Take The Beating? Bitcoin

has tested the support around $27,000 several times in the past two

months and has formed a solid bottom. In addition, the Fear

& Greed Index has declined, putting the market back into

neutral territory. While this level is not necessarily bad when

taken at face value, the fact that the index has declined from

greed back to neutral is concerning. Nevertheless, despite some

analysts predicting that the cryptocurrency could fall to lower

levels, it has not dropped below this price zone. This is a

positive sign for investors as it shows that there is a strong

demand for Bitcoin at this level. Bitcoin price has

consolidated as the market seeks a new equilibrium after the recent

price correction. Bitcoin Price At the time of writing,

Bitcoin is trading at $26,804 with a 24-hour price rise of 2%. It

remains to be seen whether the token will make a renewed push

toward the $30,000 resistance mark in the coming days. -Featured

image from iStock, charts from TradingView.

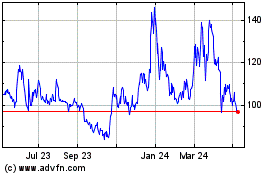

Quant (COIN:QNTUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

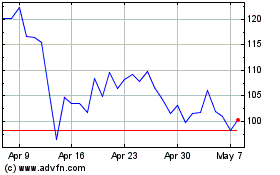

Quant (COIN:QNTUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024