Stable coins: A hedge against crypto volatility?

August 07 2018 - 7:09AM

ADVFN Crypto NewsWire

A stable coin is also a

cryptocurrency, but its value is pegged to a relatively stable

asset, like gold or a US dollar, and unlike bitcoin or

ethereum

A stable coin is also a

cryptocurrency, but its value is pegged to a relatively stable

asset, like gold or a US dollar, and unlike bitcoin or

ethereum

Banks and other Reserve Bank of India-regulated entities

stopped servicing cryptocurrency

exchanges last month, as per an RBI directive. But within a day

or two, at least two cryptocurrency exchanges in India took the

peer-to-peer trading route to enable crypto-rupee trading. Read

here. P2P transactions, however,

do not hedge you against price fluctuations, which can be

significant in crypto markets, even in a short span.

In a regular transaction, where the exchanges are supported by

the banking system, buying/selling a crypto asset is instant, and

the price gets locked immediately.

However, in a P2P system, when a seller matches with a buyer and

the transaction is initiated, the seller’s crypto asset is locked

in an escrow. The buyer transfers the amount to the seller before

getting the asset after due process. The actual transfer could take

some time.

It is highly likely that the price of the crypto asset in

question changes during that time. If the price depreciates,

the buyer will be at a disadvantage, and vice-versa. Stable coins

resolve this issue.

Stable coin

A stable coin is also a cryptocurrency, but its value is pegged

to a relatively stable asset, like gold or a US dollar, or other

assets easily available globally and does not fluctuate much,

unlike cryptocurrencies like Bitcoin or Etherium that are highly

volatile.

The companies launching stable coin maintain a reserve of the

pegged asset. If a crypto company launches a stable coin pegged to

the US dollar, it is expected to maintain a reserve of dollars in

its publicly auditable accounts that is equal to the volume of the

crypto issued.

In a P2P transaction, the seller can convert the crypto asset to

a stable coin just before locking the value. So if the value is

locked at $1,000, the buyer will transfer the amount and the value

in terms of the stable coin as well as the rupee will remain the

same for both the buyer and the seller. This gives the buyer an

entry and the seller an exit at a known price point. Later, the

buyer can use stable coin for crypto-to-crypto deals.

Indian exchanges offering P2P crypto-to-rupee trading are using

stable coins pegged to the US dollar. Koinex is using a stable coin

called TrueUSD, while WazirX is using USDT or Tether.

All stable coins have advantages and disadvantages, in terms of

transparency of issuance or audits. Consider all the risks before

investing.

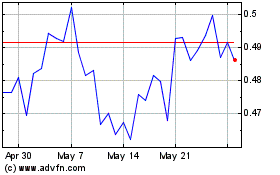

Ripple (COIN:XRPEUR)

Historical Stock Chart

From Apr 2024 to May 2024

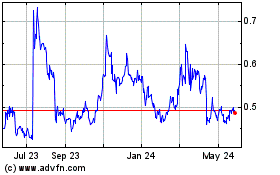

Ripple (COIN:XRPEUR)

Historical Stock Chart

From May 2023 to May 2024