KBC Group: KBC’s capital remains well above the minimum capital requirements

December 13 2024 - 11:00AM

UK Regulatory

KBC Group: KBC’s capital remains well above the minimum capital

requirements

KBC’s capital remains well above the

minimum capital requirements

KBC has been informed by the European Central

Bank (ECB) of its new minimum capital requirements. Following the

Supervisory Review and Evaluation Process (SREP) performed for

2024, the ECB has formally notified KBC of its decision to

maintain both the Pillar 2 Requirement (P2R) at 1.86% and Pillar

2 Guidance (P2G) at 1.25% of RWA.

The decision leads to a fully loaded overall

CET1 requirement for KBC Group (under the Danish Compromise) of

10.88%1. This consists of a

Pillar 1 Requirement of 4.50%, a P2R of 1.09%2, a

capital conservation buffer of 2.50%, the O-SII (other systemically

important institutions) capital buffer of 1.50% and includes all

announced decisions by local competent authorities on future

changes of countercyclical capital buffers (1.15%) and the

sectorial systemic risk buffer (0.14%).

At the end of the third quarter of 2024, KBC

Group’s fully loaded CET1 ratio amounted to 15.2%, well above the

new CET1 requirement.

For more information, please contact:

Kurt De Baenst, General Manager, Investor Relations, KBC

Group

Tel.: +32 2 429 35 73 – E-mail: kurt.debaenst@kbc.be

Viviane Huybrecht, General Manager of Corporate

Communication/KBC Group Spokesperson

Tel.: + 32 2 429 85 45 – E-mail: pressofficekbc@kbc.be

|

* This news item contains information that is subject to the

transparency regulations for listed companies. |

KBC Group NV

Havenlaan 2 – 1080 Brussels

Viviane Huybrecht

General Manager of Corporate Communication/

KBC Group Spokesperson

Tel.: + 32 2 429 85 45 |

Press Office

Tel. + 32 2 429 29 15 Ilse De Muyer

Tel. + 32 2 429 32 88 Pieter Kussé

Tel. + 32 2 429 29 49 Tomas Meyers

pressofficekbc@kbc.be |

KBC press releases are available at www.kbc.com or

can be obtained by sending an e-mail to

pressofficekbc@kbc.be

Follow us on www.twitter.com/kbc_group |

1 Including P2R split according to Article 104a of

Capital Requirement Directive V

2 The CET1 requirement related to P2R now includes

100% of the 11bps add-on related to back-stop shortfall for old

non-performing loans (exposures defaulted before 01-04-2018), while

the other part (1.75%) of P2R may be partially filled by AT1 and T2

instruments

- 20241213_PB_ECB_SREP2024_ENG

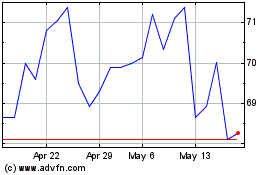

KBC Groep NV (EU:KBC)

Historical Stock Chart

From Feb 2025 to Mar 2025

KBC Groep NV (EU:KBC)

Historical Stock Chart

From Mar 2024 to Mar 2025