U.S. Dollar Advances Amid Higher Treasury Yields

December 26 2024 - 7:36AM

RTTF2

The U.S. dollar climbed against its most major counterparts in

the New York session on Thursday, as treasury yields rose amid

uncertainty about the Federal Reserve's interest rate path and U.S.

President-elect Donald Trump's tariff threats.

Markets focus on the likelihood of fewer rate cuts from the

Fed.

Trump administration's policies stoked concerns about

inflation.

On the U.S. economic front, the Labor Department released a

report showing first-time claims for U.S. unemployment benefits

unexpectedly edged slightly lower in the week ended December

21st.

The report said initial jobless claims slipped to 219,000, a

decrease of 1,000 from the previous week's unrevised level of

220,000. Economists had expected jobless claims to rise to

224,000.

The greenback rose to a 6-day high of 1.2500 against the pound

and more than a 5-month high of 158.08 against the yen, off its

early lows of 1.2547 and 157.29, respectively. The next possible

resistance for the currency is seen around 1.24 against the pound

and 161.00 against the yen.

The greenback touched 0.6215 against the aussie and 0.5621

against the kiwi, setting 6-day highs. The currency is poised to

challenge resistance around 0.61 against the aussie and 0.55

against the kiwi.

The greenback edged up to 0.9010 against the franc. Immediate

resistance for the currency is seen around the 0.92 level.

Against the loonie, the greenback advanced to 1.4416. The

currency is likely to challenge resistance around the 1.47

level.

In contrast, the greenback fell to a 2-day low of 1.0422 against

the euro. The currency is seen finding support around the 1.06

level.

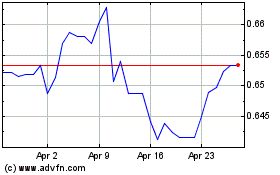

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Nov 2024 to Dec 2024

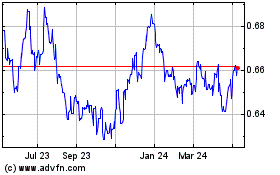

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Dec 2023 to Dec 2024