Pound Slides Amid BoE Rate Cut Speculation

July 31 2024 - 10:30PM

RTTF2

The British pound weakened against other major currencies in the

pre-European session on Thursday, as traders speculate that the

Bank of England is likely to lower its interest rate from a 16-year

high at the monetary policy meeting today.

The Bank of England will announce its decision on monetary

policy at 7.00 am ET. The Monetary Policy Committee is expected to

trim the bank rate by 25 basis points to 5.00 percent. This will be

the first reduction since the onset of the pandemic.

However, markets are divided over the chance of a rate cut today

as wage growth and services inflation remain high.

In economic news, data from Nationwide Building Society showed

that U.K. house prices increased for the third straight month in

July. House prices posted a monthly growth of 0.3 percent after

rising 0.2 percent in June. This was the third consecutive increase

and faster than forecast of 0.1 percent.

On a yearly basis, house price growth accelerated to 2.1 percent

from 1.5 percent in June. The latest pace of growth was the fastest

since December 2022. Economists had forecast prices to climb 1.8

percent.

In the pre-European session today, the pound fell to nearly a

1-1/2-month low of 1.1231 against the Swiss franc, more than a

3-week low of 1.2803 against the U.S. dollar and nearly a

3-1/2-month low of 190.97 against the yen, from early highs of

1.1288, 1.2861 and 193.25, respectively. If the pound extends its

downtrend, it is likely to find support around 1.11 against the

franc, 1.27 against the greenback and 188.00 against the yen.

Against the euro, the pound edged down to 0.8442 from an early

high of 0.8421. The EUR/GBP may test support near the 0.85

region.

Looking ahead, manufacturing PMI reports for July from various

European economies and U.K., and Eurozone unemployment data for

June are due to be released in the European session.

At 7.00 am ET, The Bank of England will release its monetary

policy summary and the minutes.

In the New York session, U,S, weekly jobless claims,

manufacturing PMI reports for July from U.S. and Canada and U.S.

construction spending for June are slated for release.

At 9:35 am ET, Bank of England Governor Andrew Bailey will

deliver a speech on the monetary policy decision.

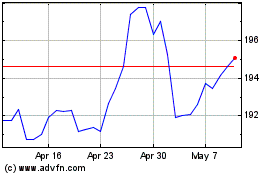

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Oct 2024 to Nov 2024

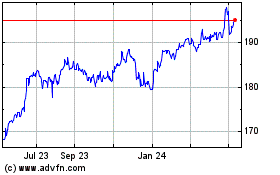

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Nov 2023 to Nov 2024