Pound Extends Slide After BoE Rate Cut

August 01 2024 - 9:51PM

RTTF2

The British pound extended its early weakness against other

major currencies in the Asian session on Friday, after the Bank of

England lowered its benchmark rate for the first time since the

onset of the coronavirus pandemic as inflation receded and the

underlying growth momentum remained weaker.

Thursday, the Monetary Policy Committee, led by Governor Andrew

Bailey, decided to cut the bank rate by a quarter-point to 5.00

percent from 5.25 percent, which was the highest since early

2008.

This was the first reduction in U.K. interest rates since March

2020.

The minutes suggested that the UK central bank will move more

cautiously. Governor Bailey said, "We need to be careful not to cut

rates too quickly or by too much."

The BoE said, "Monetary policy will need to continue to remain

restrictive for sufficiently long until the risks to inflation

returning sustainably to the 2 percent target in the medium term

have dissipated further."

Meanwhile, the Asian stock markets traded lower, following the

broadly negative cues from global markets overnight, amid concerns

about the outlook for global economic growth after some

disappointing economic data from the U.S., Europe and China that

offset optimism about a near-term interest rate cut by U.S.

Fed.

Data showed that U.S. manufacturing activity unexpectedly

contracted at an accelerated rate in July and first-time claims for

U.S. unemployment benefits rose to their highest level in almost a

year last week.

Traders now await the U.S. Labor Department's closely watched

report on employment in the month of July.

In the Asian trading today, the pound fell to nearly a 5-month

low of 189.47 against the yen and nearly a 5-1/2-month low of

1.1086 against the Swiss franc, from yesterday's closing quotes of

190.27 and 1.1119, respectively. If the pound extends its

downtrend, it is likely to find support around 188.00 against the

yen and 1.09 against the franc.

Against the U.S. dollar and the euro, the pound dropped to

1-month lows of 1.2713 and 0.8487 from Thursday's closing quotes of

1.2739 and 0.8470, respectively. The pound may test support near

1.25 against the greenback and 0.85 against the euro.

Looking ahead, U.S. jobs data for July, factory orders for June

and U.S. Baker Hughes weekly oil rig count data are due to be

released in the New York session.

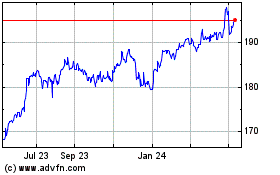

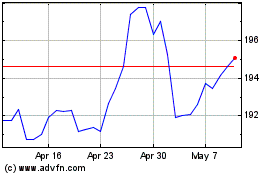

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Oct 2024 to Nov 2024

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Nov 2023 to Nov 2024