Japan Core Inflation At 19-Month High Raises Chances Of Rate Hike

February 20 2025 - 8:54PM

RTTF2

Japan's core inflation accelerated to a 19-month high in

January, bolstering the chances of another interest rate hike by

the Bank of Japan.

Core inflation that excludes fresh food rose more-than-expected

to 3.2 percent from 3.0 percent in December, the Ministry of

Internal Affairs and Communications said Friday. This was the

fastest since June 2023 and was slightly above forecast of 3.1

percent.

Driven by higher food prices, headline CPI inflation increased

to 4.0 percent from 3.6 percent in the previous month. The rate hit

the highest in two years.

There were steep increases in prices of rice, vegetables and

other food items. Rice prices skyrocketed 70.9 percent in

January.

The consumer price index excluding prices of fresh food and

energy, registered an increase of 2.5 percent compared to 2.4

percent in the previous month.

Data showed that services inflation softened to 1.4 percent in

January from 1.6 percent in the previous month.

Capital Economics said services inflation is likely to pick up

over coming months driven by another large pay hike.

Even so, with goods inflation set to come off the boil,

inflation excluding fresh food and energy is set to fall below the

central bank's 2 percent target in the fourth quarter and remain

below that target through to the end of this year, the firm said.

In January, the BoJ had raised its benchmark rate by 25 basis

points to around 0.5 percent, marking the highest rate since the

global financial crisis in 2008.

ING economist Min Joo Kang said the BoJ is expected to deliver a

25 basis point rate hike in May, though a sharp rise in the

Japanese yen complicates the economic outlook.

The economist said the government is likely to introduce

measures to stabilize rice prices, which could tame broader food

costs. However, with Trump's tariff policies intensifying, the BoJ

will remain quite cautious going forward, she added.

Elsewhere, survey data from S&P Global showed that Japan's

private sector logged the fastest growth in five months in

February, underpinned by sustained growth in services activity.

The au Jibun Bank flash composite output index rose to 51.6 in

February from 51.1 in the previous month.

The services activity grew at a faster pace, while the

manufacturing sector continued to contract in February. The

services Purchasing Managers' Index registered 53.1, up from 53.0

in January.

The manufacturing PMI climbed slightly to 48.9 in February from

48.7 in the previous month.

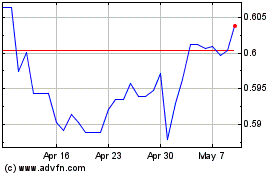

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From Jan 2025 to Feb 2025

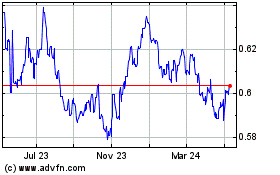

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From Feb 2024 to Feb 2025