AC Immune Reports Full Year 2024 Financial Results and Provides a Corporate Update

March 13 2025 - 6:00AM

AC Immune Reports Full Year 2024

Financial Results and Provides a Corporate Update

- Landmark exclusive option and

license deal with Takeda for ACI-24.060 with $100 million upfront

and additional potential milestones of up to about $2.1 billion

plus royalties on sales upon commercialization

- ACI-24.060 ABATE Phase 1b/2 trial

showed encouraging interim safety and tolerability data in Down

syndrome (DS) cohort; further interim results in Alzheimer’s

disease (AD) and DS expected in 2025

- Enrollment progress in JNJ-2056

(ACI-35.030) ReTain Phase 2b trial in preclinical AD patients

triggered second milestone payment of CHF 24.6 million; JNJ-2056

granted U.S. FDA Fast Track Designation in AD

- ACI-7104.056 VacSYn Phase 2 trial

demonstrated positive interim safety and immunogenicity results in

Parkinson’s disease (PD); further interim results in H1 2025

- Cash resources of CHF 165.5 million

at year end provides funding into Q1 2027, assuming no other

milestones

Lausanne, Switzerland, March 13, 2025 – AC

Immune SA (NASDAQ: ACIU), a clinical-stage biopharmaceutical

company pioneering precision therapeutics for neurodegenerative

diseases, today reported results for the full year ended December

31, 2024, and provided a corporate update.

Dr. Andrea Pfeifer, CEO of AC Immune SA,

commented: “We significantly advanced our leading position

in the precision prevention of neurodegenerative diseases in 2024

through strong pipeline progress and the closing of a landmark deal

with Takeda. Achievements across our portfolio of active

immunotherapies, including encouraging clinical data from

ACI-7104.056 and ACI-24.060 and U.S. FDA Fast Track designation for

ACI-35.030, underscore the potential of this modality to treat

patients earlier and to prevent or delay neurodegenerative diseases

and their symptoms. We anticipate additional important evidence

this year from the VacSYn trial of ACI-7104.056 and the ABATE trial

of ACI-24.060, bringing us closer to redefining treatment with more

convenient and better tolerated prevention options for these

devastating conditions.”

“The agreement with Takeda for ACI-24.060 includes potential

milestone payments of up to $2.1 billion and affirms our proven

track record of securing high-value partnerships. In 2024, our

partnership with Takeda included a $100 million upfront payment,

combined with a CHF 24.6 million milestone payment from Janssen,

triggered by rapid prescreening rates in the ReTain trial of

ACI-35.030. These payments ensure funding for currently planned

operations into 2027 and reaffirm the value of our pipeline assets

and differentiated discovery platforms.”

“The ability to innovate is key to our future success. Driven by

our two drug discovery platforms, in 2024, we advanced multiple

early-stage assets, such as small molecule candidates targeting

NLRP3 and Tau further into development.“

2024 and Subsequent Highlights

Active Immunotherapy Programs

ACI-24.060 anti-Abeta active immunotherapy

- AC Immune and Takeda signed an

exclusive option and license agreement for AC Immune’s active

immunotherapies targeting Abeta, including ACI-24.060 for AD. AC

Immune received an upfront payment of $100 million and is eligible

to receive total potential payments of up to approximately $2.1

billion; these include an option exercise fee, development,

commercial and sales milestones. Upon commercialization, AC Immune

also is entitled to receive tiered double-digit royalties on

worldwide net sales.

- Positive interim data from the ABATE

Phase 1b/2 trial in individuals with DS showed that ACI-24.060 was

generally safe and well tolerated with no serious adverse events

related to the study drug and no cases of amyloid-related imaging

abnormalities (ARIA). ABATE will now start to evaluate the high

dose of ACI-24.060 in individuals with DS.

- Treatment of AD patients in the

Phase 1b/2 ABATE trial continues.

ACI-35.030 (JNJ-2056) anti-phospho-Tau (anti-pTau) active

immunotherapy

- AC Immune received the second

ReTain-related milestone payment of CHF 24.6 million under its

agreement with Janssen Pharmaceuticals, Inc. (Janssen), a Johnson

& Johnson company. The payment was triggered by the rapid

prescreening rate in the potentially registrational Phase 2b ReTain

trial investigating JNJ-2056 (ACI-35.030) to treat preclinical

(pre-symptomatic) AD. Phase 1b/2a clinical testing showed that

ACI-35.030 induces an antibody response targeting pathologic

phosphorylated Tau while sparing normal physiological forms of

Tau.

- Johnson & Johnson received Fast

Track designation for JNJ-2056 from the U.S. FDA for AD in July

2024.

- The UK Medicines and Healthcare

products Regulatory Agency (MHRA) has awarded the innovative

medicine designation, the Innovation Passport, for

ACI-35.030/JNJ-2056 in the treatment of AD. This is the entry point

to the Innovative Licensing and Access Pathway (ILAP) which aims to

accelerate time to market and facilitate patient access.

ACI-7104.056 anti-a-syn active immunotherapy

- ACI-7104.056 demonstrated positive

interim safety and immunogenicity in the Phase 2 VacSYn clinical

trial in early PD patients:

- Positive antibody responses were

induced against the target antigen at week 6 after 2 immunizations

and were strongly boostable.

- ACI-7104.056 induced an increase in

anti-a-syn antibodies on average 16-fold higher than the placebo

background level after three immunizations.

- To date, no clinically relevant

safety issues have been reported and the most common adverse events

were transient injection site reactions (49%) and headaches

(18%).

Small Molecule Programs

- ACI-19764 small molecule NLRP3

inhibitor is undergoing in vivo proof of concept with results

expected in 2025 anticipated to enable investigational new drug

(IND) application.

- Our Morphomer Tau and Morphomer

a-syn small molecule aggregation inhibitors have made steady

progress with selection of lead candidates expected in 2025.

Diagnostic Programs

- AC Immune’s partner Life Molecular

Imaging (LMI) received FDA Fast Track Designation for the Tau

positron emission tomography (PET) diagnostic PI-2620 in AD,

progressive supranuclear palsy (PSP), and corticobasal degeneration

(CBD).

- Phase 1 clinical trial of TDP-43-PET

tracer ACI-19626 in genetic frontotemporal dementia (FTD) is

ongoing with initial clinical data expected in 2025.

- Completed IND-enabling studies of

a-syn-PET tracer ACI-15916 for the diagnosis of PD.

Thought and Innovation Leadership

- AC Immune’s therapeutic and

diagnostic programs were featured in multiple presentations at the

International Conference on Alzheimer’s & Parkinson’s disease

(AD/PD™ 2024). In addition, Andrea Pfeifer, Ph.D., CEO of AC

Immune, led an industry symposium exploring the latest clinical

advances in the diagnosis and treatment of alpha-synuclein

pathologies.

- AC Immune unveiled its novel

therapeutic antibody drug conjugate technology morADC for improved

efficacy in neurodegenerative diseases at the Alzheimer's

Association International Conference (AAIC) 2024. morADC combines

proprietary brain-penetrant small molecule Morphomers® with

SupraAntigen® monoclonal antibodies and holds substantial promise

in our fight against neurodegeneration.

Anticipated 2025 Milestones

| Program |

Milestone |

Expected in |

|

ACI-24.060anti-Abeta active immunotherapy |

- ABATE Phase 2 trial interim results

in AD and DS

|

H2 2025 |

|

ACI-7104.056anti-a-syn active immunotherapy |

- Further interim results from Part 1

of Phase 2 VacSYn trial in PD, including pharmacodynamics and

biomarkers

- Initiation of Part 2 of VacSYn

trial

|

H1 2025H2 2025 |

| TDP-43monoclonal

antibody |

- Validated pharmacodynamic assay for

clinical readout

|

H2 2025 |

| ACI-19764Small

molecule NLRP3 inhibitor |

- Lead declaration and initiation of

IND-enabling studies

- IND/CTA filing

|

H1 2025H2 2025 |

| Morphomer-Tau

aggregation inhibitors |

- Lead declaration and initiation of

IND-enabling studies

|

H2 2025 |

| Morphomer a‑syn

aggregation inhibitor |

|

H2 2025 |

| morADC |

- In vivo PoC study of proprietary

brain delivery platform

|

H1 2025 |

| TDP-43-PET

tracer |

- Initial Phase 1 readout in genetic

FTD

|

H2 2025 |

|

ACI-15916 a-syn-PET tracer |

|

H2 2025 |

Analysis of Financial Statements for the Year Ended

December 31, 2024

- Cash Position: The

Company had total cash resources of CHF 165.5 million as of

December 31, 2024, compared to total cash resources of CHF 103.1

million as of December 31, 2023. The Company’s cash balance

provides sufficient capital resources into Q1 2027, assuming no

other milestones.

- Contract Revenues:

The Company recorded CHF 27.3 million in contract revenues for the

year ended December 31, 2024, compared with CHF 14.8 million in

contract revenues in the prior year. For the year ended December

31, 2024, our contract revenues of CHF 27.3 million were related

to:

- The recognition of the second

ReTain-related milestone payment of CHF 24.6 million under the

agreement with Janssen. The milestone payment was triggered by the

rapid rate of prescreening in the potentially registrational Phase

2b ReTain trial investigating active-immunotherapy candidate

JNJ-2056 (ACI-35.030) to treat preclinical AD; and

- The efforts made under the agreement

with Takeda for the development, CMC, and regulatory

activities.

- R&D

Expenditures: R&D expense increased by CHF 8.0 million

for the year ended December 31, 2024 to CHF 62.6 million,

predominantly due to:

- Discovery and preclinical

expenses: Decrease of CHF 1.8 million, primarily due to

the completion of certain pre-clinical studies and our strategic

focus on advancing clinical-stage programs. As a result, a greater

proportion of our resources was allocated to clinical development

activities rather than discovery and pre-clinical activities.

- Clinical expenses:

Increase of CHF 8.8 million, primarily due to an increase of

activities in our Phase 1b/2 ABATE study of ACI-24.060, and our

Phase 2 VacSYn study of ACI-7104.056. This was partially offset by

a decrease of CHF 0.8 million for the clinical development of

ACI-35.030, driven by the completion of the prior Phase 1b/2a trial

and its progression into the Phase 2b ReTain trial, where the costs

are borne by Janssen.

- Salary- and benefit-related

costs: Increase of CHF 1.0 million, primarily due to the

annualization of 2023 hires and additional new hires during the

year, which resulted in an increase in salary- and benefit-related

costs of CHF 0.7 million, and CHF 0.3 million in share-based

compensation expense.

- G&A

Expenditures: G&A expenses increased by CHF 2.0

million for the year ended December 31, 2024, to CHF 17.3 million.

This increase is due to legal fees related to business development

and licensing activities, as well as salaries and related costs,

largely attributable to the higher expenses from equity awards

granted in 2024, which have a higher fair value based on our share

price development.

- IFRS Loss for the

Period: The Company reported a net loss after taxes of CHF

50.9 million for the year ended December 31, 2024, compared with a

net loss of CHF 54.2 million for the prior period.

2025 Financial Guidance

- For the full year 2025, the Company

expects its total cash expenditure to be in the range of CHF

75–85 million. The Company defines total cash expenditure as

operating expenditures adjusted to include capital expenditures and

offset by significant non-cash items (including share-based

compensation and depreciation expense).

About AC Immune SA AC Immune SA

is a clinical-stage biopharmaceutical company and a global leader

in precision prevention for neurodegenerative diseases, including

Alzheimer’s disease, Parkinson’s disease, and NeuroOrphan

indications driven by misfolded proteins. The Company’s two

clinically validated technology platforms, SupraAntigen® and

Morphomer®, fuel its broad and diversified pipeline of first- and

best-in-class assets, which currently features sixteen therapeutic

and diagnostic programs, including five in Phase 2 development and

one in Phase 3. AC Immune has a strong track record of securing

strategic partnerships with leading global pharmaceutical

companies, resulting in substantial non-dilutive funding to advance

its proprietary programs and >$4.5 billion in potential

milestone payments plus royalties.

SupraAntigen® is a registered trademark of AC

Immune SA in the following territories: AU, EU, CH, GB, JP, RU, SG

and USA. Morphomer® is a registered trademark of AC Immune SA in

CN, CH, GB, JP, KR, NO and RU.

The information on our website and any other

websites referenced herein is expressly not incorporated by

reference into, and does not constitute a part of, this press

release.

For further information, please

contact:

| SVP,

Investor Relations & Corporate CommunicationsGary

Waanders, Ph.D., MBAAC ImmunePhone: +41 21 345 91 91Email:

gary.waanders@acimmune.com |

U.S. InvestorsChristina Tartaglia Precision AQ

Phone: +1 332 322 7430Email:

christina.tartaglia@precisionaq.com] |

|

International MediaChris MaggosCohesion

BureauPhone: +41 79 367 6254Email:

chris.maggos@cohesionbureau.com |

|

Forward looking statementsThis

press release contains statements that constitute “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933 and Section 21E of the Securities Exchange Act of 1934.

Forward-looking statements are statements other than historical

fact and may include statements that address future operating,

financial or business performance or AC Immune’s strategies or

expectations. In some cases, you can identify these statements by

forward-looking words such as “may,” “might,” “will,” “should,”

“expects,” “plans,” “anticipates,” “believes,” “estimates,”

“predicts,” “projects,” “potential,” “outlook” or “continue,” and

other comparable terminology. Forward-looking statements are based

on management’s current expectations and beliefs and involve

significant risks and uncertainties that could cause actual

results, developments and business decisions to differ materially

from those contemplated by these statements. These risks and

uncertainties include those described under the captions “Item 3.

Key Information – Risk Factors” and “Item 5. Operating and

Financial Review and Prospects” in AC Immune’s Annual Report on

Form 20-F and other filings with the Securities and Exchange

Commission. Forward-looking statements speak only as of the date

they are made, and AC Immune does not undertake any

obligation to update them in light of new information, future

developments or otherwise, except as may be required under

applicable law. All forward-looking statements are qualified in

their entirety by this cautionary statement.

Consolidated Balance

Sheets(In CHF thousands)

|

|

|

|

|

|

|

As of |

|

|

|

|

|

|

|

December 31, |

|

|

|

|

|

|

|

2024 |

|

2023 |

|

Assets |

|

|

|

|

|

|

|

|

|

Non-current assets |

|

|

|

|

|

|

|

|

|

Property, plant and equipment |

|

|

|

|

|

2,651 |

|

3,376 |

|

Right-of-use assets |

|

|

|

|

|

5,437 |

|

3,508 |

|

Intangible asset |

|

|

|

|

|

50,416 |

|

50,416 |

|

Long-term financial assets |

|

|

|

|

|

415 |

|

361 |

|

Total non-current assets |

|

|

|

|

|

58,919 |

|

57,661 |

|

|

|

|

|

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

|

|

|

Prepaid expenses |

|

|

|

|

|

4,302 |

|

6,437 |

|

Accrued income |

|

|

|

|

|

1,099 |

|

246 |

|

Other current receivables |

|

|

|

|

|

1,104 |

|

622 |

|

Accounts receivable |

|

|

|

|

|

— |

|

14,800 |

|

Short-term financial assets |

|

|

|

|

|

129,214 |

|

24,554 |

|

Cash and cash equivalents |

|

|

|

|

|

36,275 |

|

78,494 |

|

Total current assets |

|

|

|

|

|

171,994 |

|

125,153 |

|

Total assets |

|

|

|

|

|

230,913 |

|

182,814 |

|

|

|

|

|

|

|

|

|

|

|

Shareholders' equity and liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders’ equity |

|

|

|

|

|

|

|

|

|

Share capital |

|

|

|

|

|

2,226 |

|

2,089 |

|

Share premium |

|

|

|

|

|

478,506 |

|

474,907 |

|

Treasury shares |

|

|

|

|

|

(218) |

|

(105) |

|

Currency translation differences |

|

|

|

|

|

(5) |

|

(51) |

|

Accumulated losses |

|

|

|

|

|

(368,239) |

|

(316,197) |

|

Total shareholders’ equity |

|

|

|

|

|

112,270 |

|

160,643 |

|

|

|

|

|

|

|

|

|

|

|

Non-current liabilities |

|

|

|

|

|

|

|

|

|

Long-term deferred contract revenue |

|

|

|

|

|

4,560 |

|

— |

|

Long-term lease liabilities |

|

|

|

|

|

4,401 |

|

2,825 |

|

Net employee defined benefit liabilities |

|

|

|

|

|

8,844 |

|

5,770 |

|

Total non-current liabilities |

|

|

|

|

|

17,805 |

|

8,595 |

|

|

|

|

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

|

|

Trade and other payables |

|

|

|

|

|

2,658 |

|

1,679 |

|

Accrued expenses |

|

|

|

|

|

12,098 |

|

11,087 |

|

Short-term deferred income |

|

|

|

|

|

— |

|

138 |

|

Short-term deferred contract revenue |

|

|

|

|

|

85,056 |

|

— |

|

Short-term lease liabilities |

|

|

|

|

|

1,026 |

|

672 |

|

Total current liabilities |

|

|

|

|

|

100,838 |

|

13,576 |

|

Total liabilities |

|

|

|

|

|

118,643 |

|

22,171 |

|

Total shareholders’ equity and liabilities |

|

|

|

|

|

230,913 |

|

182,814 |

Consolidated Statements of

Income/(Loss)(In CHF thousands, except for

per-share data)

| |

|

|

|

For the Year Ended |

| |

|

|

|

December 31, |

| |

|

|

|

2024 |

|

2023 |

|

2022 |

|

Revenue |

|

|

|

|

|

|

|

|

| Contract

revenue |

|

|

|

27,309 |

|

14,801 |

|

3,935 |

| Total

revenue |

|

|

|

27,309 |

|

14,801 |

|

3,935 |

| |

|

|

|

|

|

|

|

|

|

Operating expenses |

|

|

|

|

|

|

|

|

| Research &

development expenses |

|

|

|

(62,570) |

|

(54,606) |

|

(60,336) |

| General &

administrative expenses |

|

|

|

(17,259) |

|

(15,305) |

|

(15,789) |

| Other operating

income/(expense), net |

|

|

|

142 |

|

1,486 |

|

1,343 |

| Total

operating expenses |

|

|

|

(79,687) |

|

(68,425) |

|

(74,782) |

|

Operating loss |

|

|

|

(52,378) |

|

(53,624) |

|

(70,847) |

| |

|

|

|

|

|

|

|

|

| Financial

income |

|

|

|

3,196 |

|

1,044 |

|

69 |

| Financial

expense |

|

|

|

(133) |

|

(176) |

|

(355) |

| Exchange

differences |

|

|

|

(1,598) |

|

(1,467) |

|

393 |

| Finance

result, net |

|

|

|

1,465 |

|

(599) |

|

107 |

| |

|

|

|

|

|

|

|

|

| Loss

before tax |

|

|

|

(50,913) |

|

(54,223) |

|

(70,740) |

| Income tax

expense |

|

|

|

(3) |

|

(10) |

|

(13) |

| Loss for

the period |

|

|

|

(50,916) |

|

(54,233) |

|

(70,753) |

| |

|

|

|

|

|

|

|

|

| Loss per

share: |

|

|

|

|

|

|

|

|

| Basic and

diluted loss for the period attributable to equity holders |

|

|

|

(0.51) |

|

(0.64) |

|

(0.85) |

Consolidated Statements of Comprehensive

Income/(Loss)(In CHF thousands)

|

|

|

|

|

For the Year Ended |

|

|

|

|

|

December 31, |

|

|

|

|

|

2024 |

|

2023 |

|

2022 |

| Loss

for the period |

|

|

|

(50,916) |

|

(54,233) |

|

(70,753) |

|

Items that may be reclassified to income or loss in subsequent

periods (net of tax): |

|

|

|

|

|

|

|

|

|

Currency translation differences |

|

|

|

46 |

|

(61) |

|

10 |

|

Items that will not to be reclassified to income or loss in

subsequent periods (net of tax): |

|

|

|

|

|

|

|

|

|

Remeasurement gains/(losses) on defined-benefit plans (net of

tax) |

|

|

|

(3,084) |

|

(1,669) |

|

4,426 |

|

Other comprehensive income/(loss) |

|

|

|

(3,038) |

|

(1,730) |

|

4,436 |

|

Total comprehensive loss, net of tax |

|

|

|

(53,954) |

|

(55,963) |

|

(66,317) |

- 20250313__ACIU FY2024 financial results_FINAL

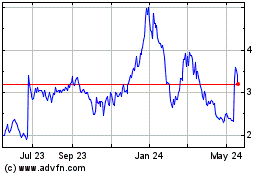

AC Immune (NASDAQ:ACIU)

Historical Stock Chart

From Feb 2025 to Mar 2025

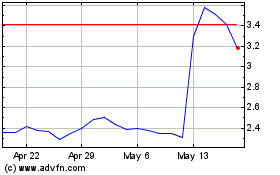

AC Immune (NASDAQ:ACIU)

Historical Stock Chart

From Mar 2024 to Mar 2025