false

0001750106

0001750106

2024-05-21

2024-05-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): May 21, 2024

ALSET

INC.

(Exact

name of registrant as specified in its charter)

| Texas |

|

001-39732 |

|

83-1079861 |

(State

or other

jurisdiction

of incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

| 4800

Montgomery Lane |

|

|

| Suite

210 |

|

|

| Bethesda,

Maryland 20814 |

|

20814 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (301) 971-3940

Not

Applicable

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Ticker

symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.001 par value per share |

|

AEI |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01 Entry into a Material Definitive Agreement

On

May 21, 2024, Alset Inc. (the “Company”) entered into a Securities Purchase Agreement (the “Securities Purchase Agreement”)

with the Company’s Chairman and Chief Executive Officer, Chan Heng Fai, and Heng Fai Holdings Limited, a company wholly owned by

Mr. Chan. Pursuant to the Securities Purchase Agreement, the Company will purchase 982,303 shares of DSS Inc., a NYSE-listed company

(“DSS”). These shares include 979,325 shares of DSS common stock to be acquired from Mr. Chan and 2,978 shares

to be acquired from Heng Fai Holdings Limited (collectively, the “Shares”). The Shares represent approximately

13.9% of the total issued and outstanding shares of DSS as of the date hereof. As consideration for the Shares, the Company will issue

a total of 3,316,488 shares of its common stock to Mr. Chan and Heng Fai Holdings Limited. The consideration to be paid

for the Shares is based on the relevant market closing price of DSS common stock and the Company’s common stock as

of May 3, 2024.

Approval

of the transactions described herein was granted by the Board of Directors of the Company (“the Board”) during a meeting

of the Board held on May 6, 2024. Mr. Chan and Chan Tung Moe, another member of the Board and the son of Mr. Chan, recused themselves

from discussion and voting on the approval of the approval of such transaction and the acquisition of the DSS Shares.

The

closing of the transactions contemplated by the Securities Purchase Agreement remain subject to the approval of the Company’s stockholders

and no objection from the Nasdaq.

The

foregoing description of the Securities Purchase Agreement does not purport to be complete and is qualified in its entirety by reference

to the complete text of the Securities Purchase Agreement, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Form 8-K to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

ALSET

INC. |

| |

|

|

| Dated:

May 22, 2024 |

By: |

/s/

Rongguo Wei |

| |

Name: |

Rongguo

Wei |

| |

Title: |

Co-Chief

Financial Officer |

Exhibit 10.1

SECURITIES

PURCHASE AGREEMENT

This

SECURITIES PURCHASE AGREEMENT (this “Agreement”) is made as of May 21, 2024 by and between Alset Inc.,

a Texas corporation (referred to herein as “AEI” or the “Buyer”), and Chan

Heng Fai, an individual with an address listed on Section 4.1 hereto who currently serves as AEI’s Chairman of the Board and Chief

Executive officer, and Heng Fai Holdings Limited (“Heng Fai Holdings”), a company wholly owned by Chan Heng

Fai (Chan Heng Fai and Heng Fai Holdings Limited are referred to collectively herein as the “Seller”).

RECITALS

WHEREAS,

Seller wishes to sell 982,303 shares (the “DSS Shares”) of the common stock of DSS, Inc., a New York company

listed on the New York Stock Exchange (NYSE: DSS) of which Seller currently serves as Chairman of the Board (“DSS”),

which includes 979,325 shares of common stock held by Chan Heng Fai directly and 2,978 shares of common stock held by Heng

Fai Holdings Limited, representing approximately 13.9% of the total issued and outstanding shares of DSS as of the date hereof, to Buyer

in exchange for 3,316,488 newly issued shares of the common stock, $0.001 par value per share, of AEI (the “AEI Shares”),

upon the terms and conditions set forth in this Agreement; and

WHEREAS,

Buyer wishes to purchase the DSS Shares from Seller in exchange for the 3,316,488 newly issued AEI Shares, upon the terms and conditions

set forth in this Agreement.

NOW,

THEREFORE, in consideration of the mutual covenants contained in this Agreement, and for other good and valuable consideration,

the receipt and adequacy of which are hereby acknowledged, Seller and Buyer hereby agree as follows:

1.

SALE AND PURCHASE OF SHARES.

On

the terms and subject to the conditions set forth in this Agreement, at the Closing Seller will sell, convey, transfer and assign to

Buyer, free and clear of all liens, pledges, encumbrances, changes, restrictions or known claims of any kind, nature or description,

and Buyer will purchase and accept from Seller, the DSS Shares. In consideration therefor, Buyer will issue to Seller, and Seller will

accept from Buyer, the AEI Shares, free and clear of all liens, pledges, encumbrances or known claims of any kind, nature or description.

Chan Heng Fai and Heng Fai Holdings shall allocate the AEI Shares in proportion to their respective ownership of the DSS

Shares.

2.

REPRESENTATIONS AND WARRANTIES.

2.1

REPRESENTATIONS AND WARRANTIES BY SELLER. Seller represents and warrants to Buyer as follows as of the date hereof:

(a)

Requisite Power and Authority. Seller has all necessary power and authority to execute and deliver this Agreement and the other

agreements and instruments entered into or delivered by any of the parties hereto in connection with the transactions contemplated hereby

(the “Transaction Documents”) and to carry out their provisions. All action on Seller’s part required

for the execution and delivery of this Agreement and the other Transaction Documents has been taken. Upon its execution and delivery,

this Agreement and the other Transaction Documents will be valid and binding obligations of Seller, enforceable in accordance with their

respective terms, except (a) as limited by applicable bankruptcy, insolvency, reorganization, moratorium or other laws of general application

affecting enforcement of creditors’ rights, and (b) as limited by general principles of equity that restrict the availability of

equitable remedies.

(b)

No Violations. The execution and delivery of the Transaction Documents, and the consummation by Seller of the transactions contemplated

thereby, does not result in a violation of any law, rule, regulation, order, judgment or decree (foreign or domestic and including federal

and state securities laws and regulations) applicable to the Seller or by which any material property or asset of Seller is bound or

affected other than any of the foregoing which would not have a Material Adverse Effect.

(c)

Good Title. The DSS Shares are owned free and clear of any lien, encumbrance, adverse claim, restriction on sale, transfer or

voting (other than restrictions imposed by applicable securities laws), preemptive right, option or other right to purchase, and upon

the consummation of the sale of such DSS Shares as contemplated hereby, Buyer will have good title to such DSS Shares, free and clear

of any lien, encumbrance, adverse claim, restriction on sale, transfer or voting (other than restrictions imposed by applicable securities

laws), preemptive right, option or other right to purchase.

(d)

Investment Representations.

| |

(i) |

Seller

understands that the AEI Shares have not been registered under the Securities Act of 1933, as amended (the “Securities Act”)

or any other applicable securities laws. Seller also understands that the AEI Shares are being offered pursuant to an exemption from

the registration requirements of the Securities Act, under Section 4(2) and/or Regulation D of the Securities Act. Seller acknowledges

that Buyer will rely on Seller’s representations, warranties and certifications set forth below for purposes of determining

Seller’s suitability as an investor in the AEI Shares and for purposes of confirming the availability of the Section 4(2) and/or

Regulation D exemption from the registration requirements of the Securities Act. |

| |

|

|

| |

(ii) |

Seller

has received all the information it considers necessary or appropriate for deciding whether to acquire the AEI Shares. Seller understands

the risks involved in an investment in the AEI Shares. Seller further represents that it, through its authorized representatives,

has had an opportunity to ask questions and receive answers from Buyer regarding the terms and conditions of the offering of the

AEI Shares and the business, properties, prospects, and financial condition of Alset Inc. and to obtain such additional information

(to the extent Buyer possessed such information or could acquire it without unreasonable effort or expense) necessary to verify the

accuracy of any information furnished to Seller or to which Seller had access. Seller further represents that it is an “accredited

investor” within the meaning of Rule 501(a) of the Securities Act. |

| |

(iii) |

Seller

is acquiring the AEI Shares for its own account for investment purposes and not with a view to the distribution thereof. Seller has

had access to such information concerning the AEI Shares as it has deemed appropriate in connection with the acquisition of the AEI

Shares hereunder, and by reason of its business and financial experience, it has such knowledge, sophistication and experience in

business and financial matters as to be capable of evaluating the merits and risks of the prospective investment in the AEI Shares,

is able to bear the economic risk of such investment and is able to afford a complete loss of such investment. |

| |

|

|

| |

(iv) |

Seller

understands that the AEI Shares may not be offered, sold or otherwise transferred except in compliance with the registration requirements

of the Securities Act, as amended, and any other applicable securities laws or pursuant to an exemption therefrom, and in each case

in compliance with the conditions set forth in this Agreement. Seller acknowledges and is aware that the AEI Shares may not be sold

pursuant to Rule 144 adopted under the Securities Act unless certain conditions are met and until Seller has held the AEI Shares

for the applicable holding period under Rule 144. |

| |

|

|

| |

(v) |

Seller

acknowledges and agrees that each certificate representing the AEI Shares, or book entry made in lieu of certificates, shall bear

a legend substantially in the following form: |

| |

|

|

| |

|

“THE

SECURITIES REPRESENTED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”),

OR THE SECURITIES LAWS OF ANY STATE. THE SECURITIES MAY NOT BE TRANSFERRED EXCEPT PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT

UNDER SUCH ACT AND APPLICABLE STATE SECURITIES LAWS OR PURSUANT TO AN APPLICABLE EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF

SUCH ACT AND SUCH LAWS.” |

(e)

No Reliance. Seller has not relied on and is not relying on any representations, warranties or other assurances regarding Alset

Inc. other than the representations and warranties expressly set forth in this Agreement.

(f)

No Solicitation. Neither the Seller nor any person participating on the Seller’s behalf in the transactions contemplated

hereby has conducted any “general solicitation,” as such term is defined in Regulation D promulgated under the Securities

Act, with respect to any of the securities being offered hereby.

(g)

Risk Factors. Seller understands the various risks of an investment in AEI, and has carefully reviewed the various risk factors

described in AEI’s filings with the SEC.

(h)

Stockholder Approval. Seller understands and agrees that the issuance of the AEI Shares is subject to approval of AEI’s

stockholders in accordance with applicable rules of the Nasdaq Stock Exchange (“Nasdaq”) and that the Closing contemplated

by this Agreement is contingent upon the receipt of such stockholder approval.

(i)

Accurate Information. Seller agrees and acknowledges that the information it has provided to Buyer herein is true and accurate

in all respects.

2.2

REPRESENTATIONS AND WARRANTIES BY BUYER. Buyer represents and warrants to Seller, as of the date hereof, as follows:

(a)

Organization and Good Standing. Buyer is duly organized, validly existing and in good standing under the laws of its jurisdiction

of incorporation or organization, as the case may be.

(b)

Requisite Power and Authority. Buyer has all necessary power and authority to execute and deliver this Agreement and the other

Transaction Documents and to carry out their provisions; all action on Buyer’s part required for the execution and delivery of

this Agreement and the other Transaction Documents has been taken, except as provided in subsection (c) of this Section 2.2. Upon its

execution and delivery, this Agreement and the other Transaction Documents will be valid and binding obligations of Buyer, enforceable

in accordance with their respective terms, except (a) as limited by applicable bankruptcy, insolvency, reorganization, moratorium or

other laws of general application affecting enforcement of creditors’ rights, and (b) as limited by general principles of equity

that restrict the availability of equitable remedies.

(c)

Stockholder Approval. AEI understands and agrees that the issuance of the AEI Shares is subject to approval of AEI’s stockholders

in accordance with applicable rules of Nasdaq and that the Closing contemplated by this Agreement is contingent upon the receipt of such

stockholder approval. AEI will seek such stockholder approval.

(d)

Issuance of AEI Shares. The AEI Shares have been duly authorized and, upon issuance in accordance with the terms hereof, shall

be validly issued and free from all taxes, liens, encumbrance, adverse claim, restriction on sale, transfer or voting (other than restrictions

imposed by applicable securities laws), preemptive right, option or other right to purchase, and the AEI Shares shall be fully paid and

non-assessable with the holder being entitled to all rights accorded to a holder of the common stock of AEI.

(e)

No Reliance. Buyer has not relied on and is not relying on any representations, warranties or other assurances regarding DSS other

than the representations and warranties expressly set forth in this Agreement.

(f)

Accredited Investor. Buyer is an Accredited Investor, within the meaning of Rule 501 of Regulation D promulgated under the Securities

Act, and has such knowledge and experience in financial and business matters that it is capable of evaluating the merits and risks of

investing in DSS.

(g)

Accurate information. Buyer agrees and acknowledges that the information it has provided to Seller herein is true and accurate

in all respects.

(h)

Not a Bad Actor. Buyer hereby represents that neither Buyer nor any of its Rule 506(d) Related Parties is a “bad actor”

within the meaning of Rule 506(d) promulgated under the Securities Act. For purposes of this Agreement, “Rule 506(d) Related Party”

shall mean a person or entity covered by the “Bad Actor disqualification” provision of Rule 506(d) of the Securities Act.

(i)

Risk Factors. Buyer understands the various risks of an investment in DSS, and has carefully reviewed the various risk factors

described in the DSS’s filings with the SEC.

(j)

Unregistered Shares. Buyer understands that certain of the DSS Shares are restricted and have not been registered under the Securities

Act or any other applicable securities laws.

2.3

SURVIVAL OF REPRESENTATIONS AND WARRANTIES. The representations and warranties contained in section 2.1 and 2.2 above, shall survive

the Closing for a period of 12 months and shall be fully enforceable at law or in equity against the parties and each party’s successors

and assigns.

3.

CLOSING.

3.1

Conditions to Seller’s Obligations. The obligations of Seller under this Agreement, (including, without limitation, the obligation

to transfer the DSS Shares) shall be subject to satisfaction of the following conditions, unless waived by Seller: (i) Buyer shall have

performed in all material respects all agreements, and satisfied in all material respects all conditions on its part to be performed

or satisfied hereunder, at or prior to the Closing; (ii) all of the representations and warranties of Buyer herein shall have been true

and correct in all respects when made, shall have continued to have been true and correct in all respects at all times subsequent thereto,

and shall be true and correct in all material respects on and as of the Closing as though made on, as of, and with reference to such

Closing; (iii) Buyer shall have executed and delivered to Seller all documents necessary to issue the AEI Shares to Seller, as contemplated

by this Agreement; (iv) Buyer shall have obtained or made, as applicable, all consents, authorizations and approvals from, and all declarations,

filings and registrations required to consummate the transactions contemplated by this Agreement, including all items required under

the incorporation document and bylaws of Buyer; (v) Buyer shall have reviewed this Agreement and the transactions contemplated herein,

including the issuance of the AEI Shares with Nasdaq and received reasonable assurances that the transactions contemplated hereby do

not violate Nasdaq’s listing rules; and (vi) the stockholders of Buyer shall have approved this Agreement and the transactions

contemplated hereby as and to the extent required by applicable laws, the rules and regulations of Nasdaq and by the provisions of any

governing instruments.

3.2

Conditions to Buyer’s Obligations. The obligations of Buyer under this Agreement, (including, without limitation, the obligation

to issue the AEI Shares as payment for the transfer by Seller of the DSS Shares) shall be subject to satisfaction of the following conditions,

unless waived by Buyer: (i) Seller shall have performed in all respects all agreements, and satisfied in all respects all conditions

on his part to be performed or satisfied hereunder, at or prior to the Closing; (ii) all of the representations and warranties of Seller

herein shall have been true and correct in all material respects when made, shall have continued to have been true and correct in all

material respects at all times subsequent thereto, and shall be true and correct in all material respects on and as of the Closing as

though made on, as of, and with reference to such Closing; (iii) Seller shall have executed and delivered to Buyer all documents necessary

to transfer the DSS Shares to Buyer, as contemplated by this Agreement; (iv) Seller shall have obtained or made, as applicable, all consents,

authorizations and approvals from, and all declarations, filings and registrations required to consummate the transactions contemplated

by this Agreement; (v) Buyer shall have reviewed this Agreement and the transactions contemplated herein, including the issuance of the

AEI Shares with Nasdaq and received reasonable assurances that the transactions contemplated hereby do not violate Nasdaq’s listing

rules; and (vi) the stockholders of Buyer shall have approved this Agreement and the transactions contemplated hereby as and to the extent

required by applicable laws, the rules and regulations of Nasdaq and by the provisions of any governing instruments.

3.3

Closing Documents. At the Closing:

(a)

Seller shall deliver to Buyer, in form and substance reasonably satisfactory to Buyer a duly executed copy of this Agreement, together

with any other Transaction Documents; and certificates evidencing the DSS Shares, together with stock powers duly for such certificates

to allow such certificates to be registered in the name of Buyer, or evidence of such book-entry transfer of the DSS Shares to Buyer.

(b)

Buyer shall deliver to Seller, in form and substance reasonably satisfactory to Seller (i) a duly executed copy of this Agreement, together

with any other Transaction Documents; (ii) certificates evidencing the AEI Shares, together with stock powers duly for such certificates

to allow such certificates to be registered in the name of Seller, or evidence of such book-entry transfer of the AEI Shares to Seller;

and (iii) copies of resolutions adopted by the board of directors of Buyer and certified by the Secretary of Buyer authorizing the execution

and delivery of, and performance of Buyer’s obligations under, this Agreement.

4.

MISCELLANEOUS.

4.1

ADDRESSES AND NOTICES. Any and all notices or other communications or deliveries required or permitted to be provided hereunder shall

be in writing and shall be deemed given and effective on the earliest of (a) the date of transmission, if such notice or communication

is delivered via e-mail transmission prior to 5:00 P.M., New York City time, on a trading day, (b) the next trading day after the date

of transmission, if such notice or communication is delivered via e-mail transmission on a day that is not a trading day or later than

5:00 P.M., New York City time, on any trading day, (c) the trading day following the date of mailing, if sent by U.S. nationally recognized

overnight courier service with next day delivery specified, or (d) upon actual receipt by the party to whom such notice is required to

be given. The address and e-mail address for such notices and communications shall be as follows:

| If

to Buyer to: |

|

Alset

Inc. |

| |

|

4800

Montgomery Lane, Suite 210 |

| |

|

Bethesda, Maryland 20814

Attention: Rongguo Wei

Telephone: 301-971-3955 |

| |

|

Email:

ronald@alsetinternational.com |

| |

|

|

| If

to Seller to: |

|

Chan

Heng Fai |

| |

|

9

Temasek Boulevard #16-04, Suntec Tower Two, Singapore 038989 |

| |

|

Telephone:

+65-6333-9181 |

| |

|

Email:

fai@alsetinternational.com |

Any

such person may by notice given in accordance with this Section 4.1 to the other parties hereto designate another address or person

for receipt by such person of notices hereunder.

4.2

TITLES AND CAPTIONS. TITLES AND CAPTIONS. All Article and Section titles or captions in this Agreement are for convenience only.

They shall not be deemed part of this Agreement and do not in any way define, limit, extend or describe the scope or intent of any provisions

hereof.

4.3

ASSIGNABILITY. This Agreement is not transferable or assignable by the undersigned.

4.4

PRONOUNS AND PLURALS. Whenever the context may require, any pronoun used herein shall include the corresponding masculine, feminine

or neuter forms. The singular form of nouns, pronouns and verbs shall include the plural and vice versa.

4.5

FURTHER ACTION. The parties shall execute and deliver all documents, provide all information and take or forbear from taking all

such action as may be necessary or appropriate to achieve the purposes of this Agreement. Each party shall bear its own expenses in connection

therewith.

4.6

APPLICABLE LAW. This Agreement shall be construed in accordance with and governed by the laws of the State of New York without regard

to its conflict of law rules.

4.7

BINDING EFFECT. This Agreement shall be binding upon and inure to the benefit of the parties hereto and their respective heirs, administrators,

successors, legal representatives, personal representatives, permitted transferees and permitted assigns. If the undersigned is more

than one person, the obligation of the undersigned shall be joint and several and the agreements, representations, warranties and acknowledgments

herein contained shall be deemed to be made by and be binding upon each such person and such person’s heirs, executors, administrators

and successors.

4.8

INTEGRATION. This Agreement constitutes the entire agreement among the parties pertaining to the subject matter hereof and supersedes

and replaces all prior and contemporaneous agreements and understandings, whether written or oral, pertaining thereto, including without

limitation, the Prior Agreement. No covenant, representation or condition not expressed in this Agreement shall affect or be deemed to

interpret, change or restrict the express provisions hereof.

4.9

AMENDMENT. Neither this Agreement nor any term or provision hereof may be amended, modified, waived or supplemented orally, but only

by a written consent executed by the parties hereto.

4.10

CREDITORS. None of the provisions of this Agreement shall be for the benefit of or enforceable by creditors of any party.

4.11

WAIVER. No failure by any party to insist upon the strict performance of any covenant, agreement, term or condition of this Agreement

or to exercise any right or remedy available upon a breach thereof shall constitute a waiver of any such breach or of such or any other

covenant, agreement, term or condition.

4.12

RIGHTS AND REMEDIES. The rights and remedies of each of the parties hereunder shall be mutually exclusive, and the implementation

of one or more of the provisions of this Agreement shall not preclude the implementation of any other provision.

4.13

COUNTERPARTS. This Agreement may be executed in one or more counterparts, each of which will be deemed to be an original copy of

this Agreement and all of which, when taken together, will be deemed to constitute one and the same agreement. In the event that any

signature is delivered by facsimile transmission or by e-mail delivery of a “.pdf” format data file, such signature shall

create a valid and binding obligation of the party executing (or on whose behalf such signature is executed) with the same force and

effect as if such facsimile or “.pdf” signature page were an original thereof.

SIGNATURES

ON THE FOLLOWING PAGES

IN

WITNESS WHEREOF, the parties have caused this Agreement to be duly executed by their respective representatives hereunto authorized as

of the day and year first above written.

| |

By

Seller: |

| |

|

|

| |

By: |

/s/

Chan Heng Fai |

| |

Name: |

Chan

Heng Fai |

| |

|

|

| |

HENG

FAI HOLDINGS LIMITED |

| |

|

|

| |

By: |

/s/

Chan Heng Fai |

| |

Name: |

Chan

Heng Fai |

| |

Title: |

Director |

| |

|

|

| |

By

Buyer: |

| |

|

|

| |

ALSET

INC. |

| |

|

|

| |

By: |

/s/

Rongguo Wei |

| |

Name: |

Rongguo

Wei |

| |

Title: |

Co-Chief

Financial Officer |

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

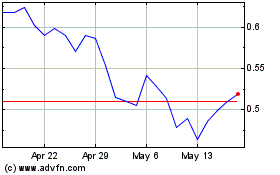

Alset (NASDAQ:AEI)

Historical Stock Chart

From Feb 2025 to Mar 2025

Alset (NASDAQ:AEI)

Historical Stock Chart

From Mar 2024 to Mar 2025