Agrify Announces $25.9 Million Non-Brokered Private Placement

November 21 2024 - 6:00AM

Agrify Corporation (Nasdaq: AGFY) (“Agrify” or the “Company”), a

leading provider of branded innovative solutions for the cannabis

and hemp industries, today announced the Company has entered into

securities purchase agreements with institutional and accredited

investors in a non-brokered private placement priced at $22.30 per

share for aggregate proceeds of approximately $25.9 million. The

Company intends to use the proceeds from the private placement for

general corporate purposes, including, among other things, working

capital and business development. The private placement is expected

to close on November 21, 2024, subject to the satisfaction of

customary closing conditions. Benjamin Kovler, Chairman and Interim

Chief Executive Officer, participated in the private placement to

purchase 10,000 shares of common stock at a purchase price of

$38.76 in compliance with applicable Nasdaq requirements.

“This funding is a strong move for Agrify and our shareholders

as we were able to raise approximately $26 million in a

non-brokered deal (gross equals net),” said Chairman and Interim

CEO Ben Kovler. “We plan to allocate this capital into

opportunities within our circle of competence to benefit

stockholders. We are excited about the opportunity set and current

consumer trends in cannabis and hemp. The team continues to work

hard to close the previously announced Señorita transaction, and it

remains on track for closing at or around year end.”

Investors in the private placement will receive pre-funded

warrants to the extent any investor’s beneficial ownership of

Agrify common stock following the offering would exceed 4.99%. The

securities sold in the private placement have not been registered

under the Securities Act of 1933, as amended, or state securities

laws and may not be offered or sold in the United States absent

registration with the Securities and Exchange Commission (the

“SEC”) or an applicable exemption from such registration

requirements. A resale registration statement relating to the

common stock and the shares of common stock issuable upon the

exercise of the pre-funded warrants will be filed with the SEC

within forty-five days of the date when Agrify receives a demand

for such registration from the investors.

This press release does not constitute an offer to sell or the

solicitation of an offer to buy any securities in the private

placement. There shall not be any sale of these securities in any

state or jurisdiction in which such offering, sale, or solicitation

would be unlawful prior to registration or qualification under the

securities laws of any such state or jurisdiction.

About Agrify (Nasdaq: AGFY)

Agrify Corporation (“Agrify” or the “Company”) is a developer of

branded innovative solutions for the cannabis and hemp industries

in extraction, cultivation and more. Agrify’s proprietary

micro-environment-controlled Vertical Farming Units (VFUs) enable

cultivators to produce the highest quality products with unmatched

consistency, yield, and return on investment at scale. Agrify’s

comprehensive extraction product line, which includes hydrocarbon,

ethanol, solventless, post-processing, and lab equipment, empowers

producers to maximize the quantity and quality of extract required

for premium concentrates. For more

information, please visit Agrify at http://www.agrify.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of 1995

concerning Agrify and other matters. All statements contained in

this press release that do not relate to matters of historical fact

should be considered forward-looking statements including, without

limitation, statements regarding future financial results,

potential growth opportunities, Agrify’s ability to deliver

solutions and services, and the ability to timely satisfy the

closing conditions and close the private placement, the use of

proceeds from the private placement, and the ability to close the

Señorita transaction on a timely basis or at all. In some cases,

you can identify forward-looking statements by terms such as “may,”

“will,” “should,” “expects,” “plans,” “anticipates,” “could,”

“intends,” “targets,” “projects,” “contemplates,” “believes,”

“estimates,” “predicts,” “potential” or “continue” or the negative

of these terms or other similar expressions. The forward-looking

statements in this press release are only predictions. We have

based these forward-looking statements largely on our current

expectations and projections about future events and financial

trends that we believe may affect our business, financial condition

and results of operations. Forward-looking statements involve known

and unknown risks, uncertainties and other important factors that

may cause our actual results, performance or achievements to be

materially different from any future results, performance or

achievements expressed or implied by the forward-looking

statements. You should carefully consider the risks and

uncertainties that affect our business, including those described

in our filings with the Securities and Exchange Commission (“SEC”),

including under the caption “Risk Factors” in our Annual Report on

Form 10-K filed for the year ended December 31, 2023 with the SEC,

which can be obtained on the SEC website at www.sec.gov. These

forward-looking statements speak only as of the date of this

communication. Except as required by applicable law, we do not plan

to publicly update or revise any forward-looking statements,

whether as a result of any new information, future events or

otherwise. You are advised, however, to consult any further

disclosures we make on related subjects in our public announcements

and filings with the SEC.

Contact

Agrify Investor RelationsIR@agrify.com(857) 256-8110

Agrify (NASDAQ:AGFY)

Historical Stock Chart

From Nov 2024 to Dec 2024

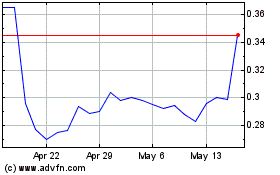

Agrify (NASDAQ:AGFY)

Historical Stock Chart

From Dec 2023 to Dec 2024