- Net sales of $341 million

- Operating margin of 8.4%; and adjusted operating margin of

10.4%

- Diluted EPS of $0.96 and adjusted diluted EPS of $1.19

- Year-to-date cash flow from operations of $95 million

- Completed UW Solutions acquisition

Apogee Enterprises, Inc. (Nasdaq: APOG) today reported

its results for the third quarter of fiscal 2025. The Company

reported the following selected financial results:

Three Months Ended

(Unaudited, $ in thousands, except per

share amounts)

November 30, 2024

November 25, 2023

% Change

Net sales

$

341,344

$

339,714

0.5

%

Operating income

$

28,629

$

37,647

(24.0

)%

Operating margin

8.4

%

11.1

%

Net earnings

$

20,989

$

26,974

(22.2

)%

Diluted earnings per share

$

0.96

$

1.23

(22.0

)%

Additional Non-GAAP Measures1

Adjusted operating income

$

35,414

$

37,647

(5.9

)%

Adjusted operating margin

10.4

%

11.1

%

Adjusted diluted earnings per share

$

1.19

$

1.23

(3.3

)%

Adjusted EBITDA

$

45,803

$

47,281

(3.1

)%

Adjusted EBITDA margin

13.4

%

13.9

%

Ty R. Silberhorn, Chief Executive Officer stated, “Our team

remains focused on strengthening our operating foundation and

positioning the company for long-term growth, despite continued

pressure from soft demand in our end markets which is impacting

results in the near term. During the quarter, we completed our

acquisition of UW Solutions, expanding the capabilities and market

opportunity in our LSO segment and creating a platform we expect to

drive future growth.”

Closing of UW Solutions Acquisition

On November 4, 2024, the Company completed the acquisition of UW

Interco, LLC (“UW Solutions”), a vertically integrated manufacturer

of high-performance coated substrates used in graphic arts,

building products, and other applications, for $242 million in

cash.

Consolidated Results (Third Quarter Fiscal 2025 compared

to Third Quarter Fiscal 2024)

- Net sales increased 0.5% to $341.3 million, driven by $8.8

million of inorganic sales contribution from the acquisition of UW

Solutions and a more favorable mix of projects in Architectural

Services, partially offset by less favorable mix in Architectural

Framing Systems and lower volume in Architectural Glass.

- Gross margin decreased 50 basis points to 26.1%, primarily

driven by the unfavorable sales leverage impact of lower volume, a

less favorable product mix primarily in Architectural Framing

Systems, higher incentive compensation expense, and higher lease

expense, partially offset by a more favorable mix of projects in

Architectural Services, lower quality related expense, and lower

insurance-related costs.

- Selling, general and administrative (SG&A) expenses as a

percent of net sales increased 220 basis points to 17.7%, primarily

due to acquisition-related expenses associated with the UW

Solutions transaction, restructuring expenses related to Project

Fortify, and the unfavorable sales leverage impact of lower

volume.

- Operating income declined to $28.6 million, and operating

margin decreased to 8.4%. Adjusted operating income was $35.4

million and adjusted operating margin decreased by 70 basis points

to 10.4%. The lower adjusted operating margin was primarily driven

by the unfavorable sales leverage impact of lower volume, less

favorable product mix, higher incentive compensation expense, and

higher lease expense, partially offset by a more favorable mix of

projects in Architectural Services and lower insurance-related

costs.

- Diluted earnings per share (EPS) was $0.96, compared to $1.23.

Adjusted diluted EPS decreased to $1.19, primarily driven by lower

adjusted operating income.

Segment Results (Third Quarter Fiscal 2025 Compared to

Third Quarter Fiscal 2024)

Architectural Framing Systems

Architectural Framing Systems net sales were $138.0 million,

compared to $139.6 million, primarily reflecting a less favorable

product mix, partially offset by increased volume. Operating income

was $12.7 million. Adjusted operating income was $13.6 million, or

9.8% of net sales, compared to $17.0 million, or 12.2% of net

sales. The lower adjusted operating margin was primarily driven by

the less favorable product mix as well as higher freight and

compensation costs.

Architectural Glass

Architectural Glass net sales were $70.2 million, compared to

$91.0 million, primarily reflecting reduced volume due to lower

end-market demand. Operating income was $10.1 million, or 14.4% of

net sales, compared to $15.2 million, or 16.7% of net sales. The

lower operating margin was primarily driven by the unfavorable

sales leverage impact of lower volume, partially offset by improved

productivity, favorable freight costs, and lower quality related

expense.

Architectural Services

Architectural Services net sales grew 10.8% to $104.9 million,

primarily due to a more favorable mix of projects and increased

volume. Operating income improved to $9.7 million. Adjusted

operating income increased to $9.0 million, or 8.6% of net sales,

compared to $5.3 million, or 5.6% of net sales. The improvement in

adjusted operating margin was primarily driven by a more favorable

mix of projects, partially offset by higher incentive compensation

and lease expenses. Segment backlog2 at the end of the quarter was

$742.2 million, compared to $792.1 million at the end of the second

quarter.

Large-Scale Optical

Large-Scale Optical net sales grew 27.6% to $33.2 million,

compared to $26.0 million, which included $8.8 million of inorganic

sales contribution from the acquisition of UW Solutions. Operating

income was $4.8 million, or 14.6% of net sales, which included $1.3

million of acquisition-related costs. Adjusted operating income was

$6.2 million, or 18.6% of net sales, and included $1.1 million

related to UW Solutions. Adjusted operating income in the prior

year period was $7.1 million, or 27.3% of net sales. The lower

adjusted operating margin was primarily driven by the unfavorable

sales leverage impact of lower organic volume and the dilutive

impact of lower adjusted operating margin from UW Solutions.

Corporate and Other

Corporate and other expense increased to $8.8 million, compared

to $6.9 million, primarily driven by $4.5 million of

acquisition-related costs and $0.8 million of restructuring

charges, partially offset by lower incentive compensation costs and

lower insurance-related expenses.

Financial Condition

Net cash provided by operating activities in the third quarter

was $31.0 million, compared to $66.7 million in the prior year

period. The decrease was primarily driven by an increase in cash

used for working capital. Fiscal year-to-date, net cash provided by

operating activities was $95.1 million, compared to $129.3 million

last year, primarily reflecting increased cash used for working

capital. Net cash used by investing activities increased to $257.1

million for the first nine months of fiscal 2025, primarily related

to $233.1 million used for the acquisition of UW Solutions. Fiscal

year-to-date, capital expenditures were $24.7 million, compared to

$27.0 million last year, and the Company has returned $31.3 million

of cash to shareholders through share repurchases and dividend

payments.

Quarter-end long-term debt increased to $272.0 million, as the

Company increased borrowings on its existing credit facility to

fund the acquisition of UW Solutions, which increased the

Consolidated Leverage Ratio3 (as defined in the Company’s credit

agreement) to 1.3x at the end of the quarter.

Fiscal 2025 Outlook

The Company now expects full-year net sales to decline

approximately 5%, which includes an expected $30 million

contribution from the acquisition of UW Solutions and the impact of

lower-than-expected volume in the fourth quarter. This outlook

continues to include approximately 2 percentage points of decline

related to fiscal 2025 reverting to a 52-week year, and

approximately 1 percentage point of decline related to the actions

of Project Fortify to eliminate certain lower-margin product and

service offerings.

The Company now expects full-year adjusted diluted EPS will be

at the bottom of its guidance range of $4.90 to $5.20. This

expectation includes the impact of approximately $0.05 of dilution

related to the acquisition of UW Solutions and lower-than-expected

volume in the fourth quarter. This outlook continues to include the

expectation that the impact of the reversion to a 52-week year will

reduce adjusted diluted EPS by approximately $0.20 compared to

fiscal 2024 and that there will be no material impact to adjusted

diluted EPS related to the adverse net sales impact of Project

Fortify.

The Company now expects a total of $16 million to $17 million of

pre-tax charges in connection with Project Fortify, leading to

annualized cost savings of $13 million to $14 million. The Company

continues to expect approximately 60% of these savings will be

realized in fiscal 2025, and the remainder in fiscal 2026, with

approximately 70% of the savings to be realized in Architectural

Framing Systems, 20% in Architectural Services, and 10% in

Corporate and Other. The Company now expects the plan to be

substantially complete in the fourth quarter of fiscal 2025.

The Company continues to expect an effective tax rate of

approximately 24.5%, and now expects capital expenditures between

$40 million to $45 million.

Conference Call Information

The Company will host a conference call today at 8:00 a.m.

Central Time to discuss this earnings release. This call will be

webcast and is available in the Investor Relations section of the

Company’s website, along with presentation slides, at

https://www.apog.com/events-and-presentations. A replay and

transcript of the webcast will be available on the Company’s

website following the conference call.

About Apogee Enterprises

Apogee Enterprises, Inc. (Nasdaq: APOG) is a leading provider of

architectural building products and services, as well as

high-performance coated materials used in a variety of

applications. Headquartered in Minneapolis, MN, our portfolio of

industry-leading products and services includes architectural

glass, windows, curtainwall, storefront and entrance systems,

integrated project management and installation services, and

high-performance coatings that provide protection, innovative

design, and enhanced performance. For more information, visit

www.apog.com.

Use of Non-GAAP Financial Measures

Management uses non-GAAP measures to evaluate the Company’s

historical and prospective financial performance, measure

operational profitability on a consistent basis, as a factor in

determining executive compensation, and to provide enhanced

transparency to the investment community. Non-GAAP measures should

be viewed in addition to, and not as a substitute for, the reported

financial results of the Company prepared in accordance with GAAP.

Other companies may calculate these measures differently, limiting

the usefulness of the measures for comparison with other companies.

This release and other financial communications may contain the

following non-GAAP measures:

- Adjusted operating income, adjusted operating margin, adjusted

net earnings, and adjusted diluted EPS are used by the Company to

provide meaningful supplemental information about its operating

performance by excluding amounts that are not considered part of

core operating results to enhance comparability of results from

period to period.

- Adjusted EBITDA represents adjusted net earnings before

interest, taxes, depreciation, and amortization. The Company

believes adjusted EBITDA and adjusted EBITDA margin metrics provide

useful information to investors and analysts about the Company’s

core operating performance.

- Free cash flow is defined as net cash provided by operating

activities, minus capital expenditures. The Company considers this

measure an indication of its financial strength. However, free cash

flow does not fully reflect the Company’s ability to freely deploy

generated cash, as it does not reflect, for example, required

payments on indebtedness and other fixed obligations.

- Consolidated Leverage Ratio is calculated as Consolidated

Funded Indebtedness minus Unrestricted Cash at the end of the

current period, divided by Consolidated EBITDA (calculated as

EBITDA plus certain non-cash charges and allowed addbacks, less

certain non-cash income, plus the pro forma effect of acquisitions

and certain pro forma run-rate cost savings for acquisitions and

dispositions, as applicable for the trailing twelve months ended as

of the current period). All capitalized and undefined terms used in

this bullet are defined in the Company’s credit agreement. The

Company is unable to present a quantitative reconciliation of

forward-looking expected Consolidated Leverage Ratio to its most

directly comparable forward-looking GAAP financial measure because

such information is not available, and management cannot reliably

predict all the necessary components of such GAAP financial measure

without unreasonable effort or expense. In addition, the Company

believes such reconciliation would imply a degree of precision that

would be confusing or misleading to investors.

- Backlog is an operating measure used by management to assess

future potential sales revenue. Backlog is defined as the dollar

amount of signed contracts or firm orders, generally as a result of

a competitive bidding process, which is expected to be recognized

as revenue. It is most meaningful for the Architectural Services

segment, due to the longer-term nature of their projects. Backlog

is not a term defined under U.S. GAAP and is not a measure of

contract profitability. Backlog should not be used as the sole

indicator of future revenue because the Company has a substantial

number of projects with short lead times that book-and-bill within

the same reporting period that are not included in backlog.

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of the safe harbor provisions of the U.S. Private

Securities Litigation Reform Act of 1995. The words “may,”

“believe,” “expect,” “anticipate,” “intend,” “estimate,”

“forecast,” “project,” “should,” “will,” “continue,” and similar

expressions are intended to identify “forward-looking statements”.

These statements reflect Apogee management’s expectations or

beliefs as of the date of this release. The Company undertakes no

obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise. All forward-looking statements are qualified by

factors that may affect the results, performance, financial

condition, prospects and opportunities of the Company, including

the following: (A) North American and global economic conditions,

including the cyclical nature of the North American and Latin

American non-residential construction industries and the potential

impact of an economic downturn or recession; (B) U.S. and global

instability and uncertainty arising from events outside of our

control; (C) actions of new and existing competitors; (D) departure

of key personnel and ability to source sufficient labor; (E)

product performance, reliability and quality issues; (F) project

management and installation issues that could affect the

profitability of individual contracts; (G) dependence on a

relatively small number of customers in one operating segment; (H)

financial and operating results that could differ from market

expectations; (I) self-insurance risk related to a material product

liability or other events for which the Company is liable; (J)

maintaining our information technology systems and potential

cybersecurity threats; (K) cost of regulatory compliance, including

environmental regulations; (L) supply chain disruptions, including

fluctuations in the availability and cost of materials used in our

products and the impact of trade policies and regulations,

including potential future tariffs; (M) integration and future

operating results of acquisitions, including but not limited to the

acquisition of UW Solutions, and management of acquired contracts;

(N) impairment of goodwill or indefinite-lived intangible assets;

(O) our ability to successfully manage and implement our enterprise

strategy; (P) our ability to maintain effective internal controls

over financial reporting; (Q) our judgements regarding the

accounting for tax positions and the resolution of tax disputes;

(R) the impact of cost inflation and interest rates; and (S) the

impact of changes in capital and credit markets on our liquidity

and cost of capital. The Company cautions investors that actual

future results could differ materially from those described in the

forward-looking statements and that other factors may in the future

prove to be important in affecting the Company’s results,

performance, prospects, or opportunities. New factors emerge from

time to time, and it is not possible for management to predict all

such factors, nor can it assess the impact of each factor on the

business or the extent to which any factor, or a combination of

factors, may cause actual results to differ materially from those

contained in any forward-looking statements. More information

concerning potential factors that could affect future financial

results is included in the Company’s Annual Report on Form 10-K for

the fiscal year ended March 2, 2024, and in subsequent filings with

the U.S. Securities and Exchange Commission.

____________________________

1 Adjusted operating income, adjusted

operating margin, adjusted diluted earnings per share (EPS),

adjusted EBITDA, and adjusted EBITDA margin are non-GAAP financial

measures. See Use of Non-GAAP Financial Measures and

reconciliations to the most directly comparable GAAP measures later

in this press release.

2 Backlog is a non-GAAP financial measure.

See Use of Non-GAAP Financial Measures later in this press release

for more information.

3 Consolidated Leverage Ratio is a

non-GAAP financial measure. See Use of Non-GAAP Financial Measures

later in this press release for more information.

Apogee Enterprises,

Inc.

Consolidated Condensed

Statements of Income

(Unaudited)

Three Months Ended

Nine Months Ended

(In thousands, except per share

amounts)

November 30, 2024

November 25, 2023

% Change

November 30, 2024

November 25, 2023

% Change

Net sales

$

341,344

$

339,714

0.5

%

$

1,015,300

$

1,055,102

(3.8

)%

Cost of sales

252,195

249,409

1.1

%

729,975

776,440

(6.0

)%

Gross profit

89,149

90,305

(1.3

)%

285,325

278,662

2.4

%

Selling, general and administrative

expenses

60,520

52,658

14.9

%

173,350

166,695

4.0

%

Operating income

28,629

37,647

(24.0

)%

111,975

111,967

—

%

Interest expense, net

1,044

1,454

(28.2

)%

2,634

5,720

(54.0

)%

Other (income) expense, net

(60

)

890

(106.7

)%

(493

)

(3,722

)

(86.8

)%

Earnings before income taxes

27,645

35,303

(21.7

)%

109,834

109,969

(0.1

)%

Income tax expense

6,656

8,329

(20.1

)%

27,268

26,092

4.5

%

Net earnings

$

20,989

$

26,974

(22.2

)%

$

82,566

$

83,877

(1.6

)%

Basic earnings per share

$

0.96

$

1.24

(22.6

)%

$

3.79

$

3.83

(1.0

)%

Diluted earnings per share

$

0.96

$

1.23

(22.0

)%

$

3.76

$

3.80

(1.1

)%

Weighted average basic shares

outstanding

21,782

21,819

(0.2

)%

21,789

21,889

(0.5

)%

Weighted average diluted shares

outstanding

21,917

22,013

(0.4

)%

21,937

22,093

(0.7

)%

Cash dividends per common share

$

0.25

$

0.24

4.2

%

$

0.75

$

0.72

4.2

%

% of Sales

Gross margin

26.1

%

26.6

%

28.1

%

26.4

%

Selling, general and administrative

expenses

17.7

%

15.5

%

17.1

%

15.8

%

Operating margin

8.4

%

11.1

%

11.0

%

10.6

%

Apogee Enterprises,

Inc.

Business Segment

Information

(Unaudited)

Three Months Ended

Nine Months Ended

(In thousands)

November 30, 2024

November 25, 2023

% Change

November 30, 2024

November 25, 2023

% Change

Segment net sales

Architectural Framing Systems

$

138,039

$

139,585

(1.1

)%

$

412,561

$

462,548

(10.8

)%

Architectural Glass

70,236

90,964

(22.8

)%

247,040

282,262

(12.5

)%

Architectural Services

104,921

94,662

10.8

%

301,966

272,144

11.0

%

Large-Scale Optical

33,196

26,009

27.6

%

74,232

72,110

2.9

%

Intersegment eliminations

(5,048

)

(11,506

)

(56.1

)%

(20,499

)

(33,962

)

(39.6

)%

Net sales

$

341,344

$

339,714

0.5

%

$

1,015,300

$

1,055,102

(3.8

)%

Segment operating income (loss)

Architectural Framing Systems

$

12,710

$

16,981

(25.2

)%

$

48,187

$

57,986

(16.9

)%

Architectural Glass

10,118

15,164

(33.3

)%

48,277

49,119

(1.7

)%

Architectural Services

9,730

5,288

84.0

%

21,483

8,211

161.6

%

Large-Scale Optical

4,842

7,100

(31.8

)%

13,481

17,288

(22.0

)%

Corporate and other

(8,771

)

(6,886

)

27.4

%

(19,453

)

(20,637

)

(5.7

)%

Operating income

$

28,629

$

37,647

(24.0

)%

$

111,975

$

111,967

—

%

Segment operating margin

Architectural Framing Systems

9.2

%

12.2

%

11.7

%

12.5

%

Architectural Glass

14.4

%

16.7

%

19.5

%

17.4

%

Architectural Services

9.3

%

5.6

%

7.1

%

3.0

%

Large-Scale Optical

14.6

%

27.3

%

18.2

%

24.0

%

Corporate and other

N/M

N/M

N/M

N/M

Operating margin

8.4

%

11.1

%

11.0

%

10.6

%

N/M - Indicates calculation is not

meaningful

- Segment net sales is defined as net sales for a certain segment

and includes revenue related to intersegment transactions.

- Net sales intersegment eliminations are reported separately to

exclude these sales from our consolidated total.

- Segment operating income is equal to net sales, less cost of

goods sold, SG&A, and any asset impairment charges associated

with the segment.

- Segment operating income includes operating income related to

intersegment sales transactions and excludes certain corporate

costs that are not allocated at a segment level. We report these

unallocated corporate costs separately in Corporate and Other.

- Operating income does not include any other income or expense,

interest expense or a provision for income taxes.

Apogee Enterprises,

Inc.

Consolidated Condensed Balance

Sheets

(Unaudited)

(In thousands)

November 30, 2024

March 2, 2024

Assets

Current assets

Cash and cash equivalents

$

43,855

$

37,216

Receivables, net

187,799

173,557

Inventories, net

97,003

69,240

Contract assets

57,545

49,502

Other current assets

45,119

29,124

Total current assets

431,321

358,639

Property, plant and equipment, net

269,063

244,216

Operating lease right-of-use assets

63,663

40,221

Goodwill

234,814

129,182

Intangible assets, net

140,390

66,114

Other non-current assets

41,269

45,692

Total assets

$

1,180,520

$

884,064

Liabilities and shareholders'

equity

Current liabilities

Accounts payable

96,372

84,755

Accrued compensation and benefits

39,432

53,801

Contract liabilities

46,165

34,755

Operating lease liabilities

14,958

12,286

Other current liabilities

66,982

59,108

Total current liabilities

263,909

244,705

Long-term debt

272,000

62,000

Non-current operating lease

liabilities

54,188

31,907

Non-current self-insurance reserves

33,303

30,552

Other non-current liabilities

35,051

43,875

Total shareholders’ equity

522,069

471,025

Total liabilities and shareholders’

equity

$

1,180,520

$

884,064

Apogee Enterprises,

Inc.

Consolidated Statement of Cash

Flows

(Unaudited)

Nine Months Ended

(In thousands)

November 30, 2024

November 25, 2023

Operating Activities

Net earnings

$

82,566

$

83,877

Adjustments to reconcile net earnings to

net cash provided by operating activities:

Depreciation and amortization

30,798

31,185

Share-based compensation

8,067

6,644

Deferred income taxes

5,109

1,296

Loss (gain) on disposal of assets

159

(50

)

Settlement of New Markets Tax Credit

transaction

—

(4,687

)

Non-cash lease expense

9,926

8,742

Other, net

1,800

10

Changes in operating assets and

liabilities:

Receivables

(2,191

)

(846

)

Inventories

(8,284

)

8,256

Contract assets

(8,168

)

11,194

Accounts payable

6,796

(1,902

)

Accrued compensation and benefits

(20,958

)

(7,015

)

Contract liabilities

11,499

7,635

Operating lease liability

(9,387

)

(9,214

)

Accrued income taxes

(6,498

)

(7,587

)

Other current assets and liabilities

(6,104

)

1,714

Net cash provided by operating

activities

95,130

129,252

Investing Activities

Capital expenditures

(24,696

)

(26,956

)

Proceeds from sales of property, plant and

equipment

744

247

Purchases of marketable securities

(2,394

)

(969

)

Sales/maturities of marketable

securities

2,370

1,370

Acquisition of business, net of cash

acquired

(233,125

)

—

Net cash used by investing activities

(257,101

)

(26,308

)

Financing Activities

Proceeds from revolving credit

facilities

95,201

195,851

Repayment on revolving credit

facilities

(115,201

)

(265,000

)

Proceeds from term loans

250,000

—

Repayment of term loans

(20,000

)

—

Payments of debt issuance costs

(3,798

)

—

Repurchase of common stock

(15,061

)

(11,821

)

Dividends paid

(16,238

)

(15,690

)

Other, net

(5,884

)

(3,781

)

Net cash provided (used) by financing

activities

169,019

(100,441

)

Effect of exchange rates on cash

(409

)

(569

)

Increase in cash and cash equivalents

6,639

1,934

Cash and cash equivalents at beginning of

period

37,216

21,473

Cash and cash equivalents at end of

period

$

43,855

$

23,407

Apogee Enterprises,

Inc.

Reconciliation of Non-GAAP

Financial Measures

Adjusted Net Earnings and

Adjusted Diluted Earnings per Share

(Unaudited)

Three Months Ended

Nine Months Ended

(In thousands)

November 30, 2024

November 25, 2023

November 30, 2024

November 25, 2023

Net earnings

$

20,989

$

26,974

$

82,566

$

83,877

Acquisition-related costs (1)

Transaction

3,748

—

3,748

—

Integration

941

—

941

—

Backlog amortization

805

—

805

—

Inventory step-up

379

—

379

—

Total Acquisition-related costs

5,873

—

5,873

—

Restructuring charges (2)

912

—

3,213

—

NMTC settlement gain (3)

—

—

—

(4,687

)

Income tax impact on above adjustments

(4)

(1,662

)

—

(2,226

)

1,148

Adjusted net earnings

$

26,112

$

26,974

$

89,426

$

80,338

Three Months Ended

Nine Months Ended

November 30, 2024

November 25, 2023

November 30, 2024

November 25, 2023

Diluted earnings per share

$

0.96

$

1.23

$

3.76

$

3.80

Acquisition-related costs (1)

Transaction

0.17

—

0.17

—

Integration

0.04

—

0.04

—

Backlog amortization

0.04

—

0.04

—

Inventory step-up

0.02

—

0.02

—

Total Acquisition-related costs

0.27

—

0.27

—

Restructuring charges (2)

0.04

—

0.15

—

NMTC settlement gain (3)

—

—

—

(0.21

)

Income tax impact on above adjustments

(4)

(0.08

)

—

(0.10

)

0.05

Adjusted diluted earnings per share

$

1.19

$

1.23

$

4.08

$

3.64

Weighted average diluted shares

outstanding

21,917

22,013

21,937

22,093

(1)

Acquisition-related costs include:

- Transaction costs related to the UW Solutions acquisition.

- Integration costs related to one-time expenses incurred to

integrate the UW Solutions acquisition.

- Backlog amortization is related to the value attributed to

contracting the backlog purchased in the UW Solutions acquisition.

These costs will be amortized in SG&A over the period that the

contracted backlog is shipped.

- Inventory step-up is related to the incremental cost to value

inventory acquired as part of the UW Solutions acquisition at fair

value. These costs will be expensed to cost of goods sold over the

period the inventory is sold.

(2)

Restructuring charges related to Project

Fortify, including $0.4 million of employee termination costs and

$0.5 million of other costs incurred in the third quarter of fiscal

2025, and $1.3 million of employee termination costs, $0.1 million

of contract termination costs and $1.8 million of other costs

incurred in the first nine months of fiscal 2025.

(3)

Realization of a New Market Tax Credit

(NMTC) benefit during the second quarter of fiscal 2024, which was

recorded in other expense (income), net.

(4)

Income tax impact calculated using an

estimated statutory tax rate of 24.5%, which reflects the estimated

blended statutory tax rate for the jurisdictions in which the

charge or income occurred.

Apogee Enterprises,

Inc.

Reconciliation of Non-GAAP

Financial Measures

Adjusted Operating Income

(Loss) and Adjusted Operating Margin

(Unaudited)

Three Months Ended November

30, 2024

(In thousands)

Architectural Framing

Systems

Architectural Glass

Architectural Services

LSO

Corporate and Other

Consolidated

Operating income (loss)

$

12,710

$

10,118

$

9,730

$

4,842

$

(8,771

)

$

28,629

Acquisition-related costs (1)

Transaction

—

—

—

—

3,748

3,748

Integration

—

—

—

147

794

941

Backlog amortization

—

—

—

805

—

805

Inventory step-up

—

—

—

379

—

379

Total Acquisition-related costs

—

—

—

1,331

4,542

5,873

Restructuring charges (2)

842

—

(717

)

—

787

912

Adjusted operating income (loss)

$

13,552

$

10,118

$

9,013

$

6,173

$

(3,442

)

$

35,414

Operating margin

9.2

%

14.4

%

9.3

%

14.6

%

N/M

8.4

%

Acquisition-related costs (1)

Transaction

—

—

—

—

N/M

1.1

Integration

—

—

—

0.4

N/M

0.3

Backlog amortization

—

—

—

2.4

N/M

0.2

Inventory step-up

—

—

—

1.1

N/M

0.1

Total Acquisition-related costs

—

—

—

4.0

N/M

1.7

Restructuring charges (2)

0.6

—

(0.7

)

—

N/M

0.3

Adjusted operating margin

9.8

%

14.4

%

8.6

%

18.6

%

N/M

10.4

%

Three Months Ended November

25, 2023

(In thousands)

Architectural Framing

Systems

Architectural Glass

Architectural Services

LSO

Corporate and Other

Consolidated

Operating income (loss)

$

16,981

$

15,164

$

5,288

$

7,100

$

(6,886

)

$

37,647

Operating margin

12.2

%

16.7

%

5.6

%

27.3

%

N/M

11.1

%

(1)

Acquisition-related costs include:

- Transaction costs related to the UW Solutions acquisition.

- Integration costs related to one-time expenses incurred to

integrate the UW Solutions acquisition.

- Backlog amortization is related to the value attributed to

contracting the backlog purchased in the UW Solutions acquisition.

These costs will be amortized in SG&A over the period that the

contracted backlog is shipped.

- Inventory step-up is related to the incremental cost to value

inventory acquired as part of the UW Solutions acquisition at fair

value. These costs will be expensed to cost of goods sold over the

period the inventory is sold.

(2)

Restructuring charges related to Project

Fortify, including $0.4 million of employee termination costs and

$0.5 million of other costs incurred in the third quarter of fiscal

2025.

Apogee Enterprises,

Inc.

Reconciliation of Non-GAAP

Financial Measures

Adjusted Operating Income

(Loss) and Adjusted Operating Margin

(Unaudited)

Nine Months Ended November 30,

2024

(In thousands)

Architectural Framing

Systems

Architectural Glass

Architectural Services

LSO

Corporate and Other

Consolidated

Operating income (loss)

$

48,187

$

48,277

$

21,483

$

13,481

$

(19,453

)

$

111,975

Acquisition-related costs (1)

Transaction

—

—

—

—

3,748

3,748

Integration

—

—

—

147

794

941

Backlog amortization

—

—

—

805

—

805

Inventory step-up

—

—

—

379

—

379

Total Acquisition-related costs

—

—

—

1,331

4,542

5,873

Restructuring charges (2)

2,755

—

(459

)

—

917

3,213

Adjusted operating income (loss)

$

50,942

$

48,277

$

21,024

$

14,812

$

(13,994

)

$

121,061

Operating margin

11.7

%

19.5

%

7.1

%

18.2

%

N/M

11.0

%

Acquisition-related costs (1)

Transaction

—

—

—

—

N/M

0.4

Integration

—

—

—

0.2

N/M

0.1

Backlog amortization

—

—

—

1.1

N/M

0.1

Inventory step-up

—

—

—

0.5

N/M

—

Total Acquisition-related costs

—

—

—

1.8

N/M

0.6

Restructuring charges (2)

0.7

—

(0.2

)

—

N/M

0.3

Adjusted operating margin

12.3

%

19.5

%

7.0

%

20.0

%

N/M

11.9

%

Nine Months Ended November 25,

2023

(In thousands)

Architectural Framing

Systems

Architectural Glass

Architectural Services

LSO

Corporate and Other

Consolidated

Operating income (loss)

$

57,986

$

49,119

$

8,211

$

17,288

$

(20,637

)

$

111,967

Operating margin

12.5

%

17.4

%

3.0

%

24.0

%

N/M

10.6

%

(1)

Acquisition-related costs include:

- Transaction costs related to the UW Solutions acquisition.

- Integration costs related to one-time expenses incurred to

integrate the UW Solutions acquisition.

- Backlog amortization is related to the value attributed to

contracting the backlog purchased in the UW Solutions acquisition.

These costs will be amortized in SG&A over the period that the

contracted backlog is shipped.

- Inventory step-up is related to the incremental cost to value

inventory acquired as part of the UW Solutions acquisition at fair

value. These costs will be expensed to cost of goods sold over the

period the inventory is sold.

(2)

Restructuring charges related to Project

Fortify, including $1.3 million of employee termination costs, $0.1

million of contract termination costs and $1.8 million of other

costs incurred in the first nine months of fiscal 2025.

Apogee Enterprises,

Inc.

Reconciliation of Non-GAAP

Financial Measures

Adjusted EBITDA and Adjusted

EBITDA Margin

(Earnings before interest,

taxes, depreciation and amortization)

(Unaudited)

Three Months Ended

Nine Months Ended

(In thousands)

November 30, 2024

November 25, 2023

November 30, 2024

November 25, 2023

Net earnings

$

20,989

$

26,974

$

82,566

$

83,877

Income tax expense

6,656

8,329

27,268

26,092

Interest expense, net

1,044

1,454

2,634

5,720

Depreciation and amortization

11,134

10,524

30,798

31,185

EBITDA

$

39,823

$

47,281

$

143,266

$

146,874

Acquisition-related costs (1)

Transaction

3,748

—

3,748

—

Integration

941

—

941

—

Inventory step-up

379

—

379

—

Total Acquisition-related costs

5,068

—

5,068

—

Restructuring charges (2)

912

—

3,213

—

NMTC settlement gain (3)

—

—

—

(4,687

)

Adjusted EBITDA

$

45,803

$

47,281

$

151,547

$

142,187

EBITDA Margin

11.7

%

13.9

%

14.1

%

13.9

%

Adjusted EBITDA Margin

13.4

%

13.9

%

14.9

%

13.5

%

(1)

Acquisition-related costs include:

- Transaction costs related to the UW Solutions acquisition.

- Integration costs related to one-time expenses incurred to

integrate the UW Solutions acquisition.

- Inventory step-up is related to the incremental cost to value

inventory acquired as part of the UW Solutions acquisition at fair

value. These costs will be expensed to cost of goods sold over the

period the inventory is sold.

(2)

Restructuring charges related to Project

Fortify, including $0.4 million of employee termination costs and

$0.5 million of other costs incurred in the third quarter of fiscal

2025, and $1.3 million of employee termination costs, $0.1 million

of contract termination costs and, $1.8 million of other costs

incurred in the first nine months of fiscal 2025.

(3)

Realization of a New Market Tax Credit

(NMTC) benefit during the second quarter of fiscal 2024, which was

recorded in other expense (income), net.

Apogee Enterprises,

Inc.

Fiscal 2025 Outlook

Reconciliation of Fiscal 2025

outlook of estimated

Diluted Earnings per Share to

Adjusted Diluted Earnings per Share

(Unaudited)

Fiscal Year Ending March 1,

2025

Low Range

High Range

Diluted earnings per share

$

4.40

$

4.64

Acquisition-related costs (1)

Transaction

0.18

0.19

Integration

0.09

0.12

Backlog amortization

0.07

0.07

Inventory step-up

0.15

0.15

Total Acquisition-related costs

0.49

0.53

Restructuring charges (2)

0.17

0.21

Income tax impact on above adjustments per

share

(0.16

)

(0.18

)

Adjusted diluted earnings per share

$

4.90

$

5.20

(1)

Acquisition-related costs include:

- Transaction costs related to the UW Solutions acquisition.

- Integration costs related to one-time expenses incurred to

integrate the UW Solutions acquisition.

- Backlog amortization is related to the value attributed to

contracting the backlog purchased in the UW Solutions acquisition.

These costs will be amortized in SG&A over the period that the

contracted backlog is shipped.

- Inventory step-up is related to the incremental cost to value

inventory acquired as part of the UW Solutions acquisition at fair

value. These costs will be expensed to cost of goods sold over the

period the inventory is sold.

(2)

Restructuring charges related to Project

Fortify.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250107425231/en/

Jeff Huebschen Vice President, Investor Relations &

Communications 952.487.7538 ir@apog.com

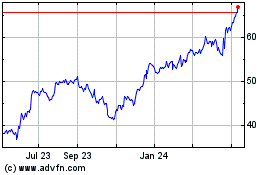

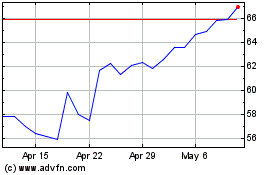

Apogee Enterprises (NASDAQ:APOG)

Historical Stock Chart

From Jan 2025 to Feb 2025

Apogee Enterprises (NASDAQ:APOG)

Historical Stock Chart

From Feb 2024 to Feb 2025