| | | | | | | | | | | | | | |

| | | | |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549

|

FORM 6-K

|

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the Month of February 2025

Commission File Number: 001-38097

|

| ARGENX SE |

| (Translation of registrant’s name into English) |

Laarderhoogtweg 25

1101 EB Amsterdam, the Netherlands |

(Address of principal executive offices)

|

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ⌧ Form 40-F ☐

|

| | | | |

| Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b) (1): ☐ |

| | | | |

| Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐ |

| | | | |

| | | | |

| | | | | | | | | | | | | | |

| EXPLANATORY NOTE |

On February 27, 2025, argenx SE (the “Company’’) issued a press release, an investor presentation and its full year 2024 financial results, copies of which are attached hereto as Exhibits 99.1, Exhibit 99.2 and Exhibit 99.3, respectively, and are incorporated by reference herein. |

The information contained in this Current Report on Form 6-K, including Exhibit 99.1, Exhibit 99.2 and Exhibit 99.3, shall be deemed to be incorporated by reference into the Company’s Registration Statements on Form S-8 (File Nos. 333-225375, 333-258253, and 333-274721), and to be part thereof from the date on which this Current Report on Form 6-K is filed, to the extent not superseded by documents or reports subsequently filed or furnished. |

| | | | | | | | |

| EXHIBITS |

| Exhibit | | Description |

| | |

| 99.2 | | |

| 99.3 | | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| | ARGENX SE |

Date: February 27, 2025 | By: | /s/ Hemamalini (Malini) Moorthy |

| | Name: Hemamalini (Malini) Moorthy |

| | Title: General Counsel |

| | |

argenx Reports Full Year 2024 Financial Results and Provides Fourth Quarter Business Update

$737 million in fourth quarter and $2.2 billion in full year global product net sales

Received positive CHMP recommendation for VYVGART pre-filled syringe for gMG, enabling launch in the EU; FDA PDUFA (gMG and CIDP) on track for April 10

10 Phase 3 and 10 Phase 2 studies across pipeline ongoing in 2025, positioning for next wave of growth

Recognized one-time tax benefit of $725 million related to previously unrecognized deferred tax assets

Management to host conference call today at 2:30 PM CET (8:30 AM ET)

February 27, 2025 7:00 AM CET

Amsterdam, the Netherlands – argenx SE (Euronext & Nasdaq: ARGX), a global immunology company committed to improving the lives of people suffering from severe autoimmune diseases, today reported financial results for the full year 2024 and provided a fourth quarter business update.

"In 2024, we significantly expanded our global patient reach with VYVGART, surpassing 10,000 patients across three indications,” said Tim Van Hauwermeiren, Chief Executive Officer of argenx. “We are extremely proud of the initial launch efforts of VYVGART Hytrulo in CIDP, where the strength of our data has driven early positive feedback from both patients and physicians. This execution has contributed to our position of financial strength as we expect to become a profitable company in 2025. We are now more committed than ever to advancing our mission of transforming the autoimmune treatment landscape by investing in innovation, and leading with our science. Momentum across our business is off to a strong start this year as we continue to execute on our Vision 2030. We are focused on maximizing commercial opportunities in gMG and CIDP, including advancing the pre-filled syringe in multiple regions, expanding our label in MG, and deepening relationships within the CIDP community to explore VYVGART Hytrulo’s long-term potential. With an expansive pipeline, we are also excited to drive forward 10 Phase 3 and 10 Phase 2 studies in 2025 across efgartigimod, empasiprubart, and ARGX-119, to unlock significant opportunities in high unmet need areas.”

Advancing Vision 2030

argenx has established its commercial and clinical strategic priorities to advance “Vision 2030”. Through this vision, argenx aims to treat 50,000 patients globally with its medicines, secure 10 labeled indications across all approved medicines, and advance five pipeline candidates into Phase 3 development by 2030.

Expand the global VYVGART opportunity and launch VYVGART SC as a pre-filled syringe

VYVGART® (IV: efgartigimod alfa-fcab and SC: efgartigimod alfa and hyaluronidase-qvfc) is a first-in-class FcRn blocker approved in three indications, including generalized myasthenia gravis (gMG) globally, primary immune thrombocytopenia (ITP) in Japan, and chronic inflammatory demyelinating polyneuropathy (CIDP) in the U.S., Japan, and China. argenx plans to drive commercial growth by expanding into new regions; innovating on the patient experience by advancing its pre-filled syringe (PFS) in multiple markets for CIDP and gMG in 2025 and autoinjector in 2027; and reaching broader MG populations with ongoing studies in seronegative, ocular, and pediatric MG.

•Generated global product net sales (inclusive of both VYVGART and VYVGART SC) of $737 million in fourth quarter and $2.2 billion in full year of 2024

•Multiple VYVGART regulatory submissions completed for gMG, including:

◦Ministry of Food and Drug Safety approved VYVGART (IV) for gMG in South Korea through Handok Inc.

◦Therapeutic Goods Association (TGA) approved VYVGART (IV and SC) for gMG in Australia

•Four key regulatory decisions on approval for PFS on track for 2025:

◦Received positive CHMP recommendation for approval of PFS for gMG, enabling launch in the EU

◦FDA review ongoing of PFS for gMG and CIDP with Prescription Drug User Fee Act (PDUFA) target action date of April 10, 2025

◦PFS decision on approval for CIDP in the EU expected in first half of 2025

◦PFS decision on approval for gMG and CIDP expected in Japan and Canada in second half of 2025

•Evidence generation through Phase 4 and label-enabling studies in MG, CIDP and ITP:

◦Topline results expected in second half of 2025 for seronegative gMG (ADAPT-SERON) and first half of 2026 for ocular and pediatric MG (ADAPT-OCULUS, JR)

◦Phase 4 switch study ongoing in CIDP to inform treatment decisions when switching patients on IVIg to VYVGART SC

◦ADVANCE-NEXT topline results expected in second half of 2026 to support FDA submission of VYVGART IV for primary ITP

Execute 10 registrational and 10 proof-of-concept studies across efgartigimod, empasiprubart and ARGX-119 to advance the next wave of launches

argenx continues to demonstrate breadth and depth within its immunology pipeline, advancing multiple first-in-class product candidates with potential across high-need indications. argenx is solidifying its leadership in FcRn biology with efgartigimod, complement inhibition with empasiprubart and in the role of MuSK at the neuromuscular junction with ARGX-119.

Efgartigimod Development

Efgartigimod is being evaluated in 15 severe autoimmune diseases (including MG, CIDP, and ITP), exploring the significance of FcRn biology across neurology and rheumatology indications, as well as new therapeutic areas.

•Registrational ALKIVIA study ongoing evaluating three myositis subsets (immune-mediated necrotizing myopathy (IMNM), anti-synthetase syndrome (ASyS), and dermatomyositis (DM)); topline results expected in second half of 2026

•Two registrational UplighTED studies ongoing in thyroid eye disease (TED); topline results expected in second half of 2026

•Registrational UNITY study ongoing in primary Sjögren’s disease; topline results expected in 2027

•Proof-of-concept studies ongoing in lupus nephritis (LN), systemic sclerosis (SSc) and antibody mediated rejection (AMR); topline results expected in LN in fourth quarter of 2025, SSc in second half of 2026, and AMR in 2027

•Next nominated indications include autoimmune encephalitis (AIE) and one that is undisclosed

Empasiprubart Development

Empasiprubart is currently being evaluated in four diseases, including registrational studies in multifocal motor neuropathy (MMN) and CIDP and proof-of-concept studies in delayed graft function (DGF) and DM.

•Registrational EMPASSION study ongoing in MMN evaluating empasiprubart head-to-head versus IVIg; topline results expected in second half of 2026

•Registrational EMVIGORATE study in CIDP evaluating empasiprubart head-to-head versus IVIg expected to start in first half of 2025

•Proof-of-concept studies ongoing in DGF and DM; topline results expected for DGF in second half of 2025 and for DM in first half of 2026

ARGX-119 Development

ARGX-119 is being evaluated in congenital myasthenic syndromes (CMS), amyotrophic lateral sclerosis (ALS), and spinal muscular atrophy (SMA).

•Phase 1b proof-of-concept study ongoing in CMS; topline results expected in second half of 2025

•Phase 2a proof-of-concept study ongoing in ALS; topline results expected in first half of 2026

•SMA proof-of-concept study on track to start in 2025

Advance four new pipeline molecules and generate sustainable value through continued investment in Immunology Innovation Program

argenx continues to invest in its Immunology Innovation Program (IIP) to drive long-term sustainable pipeline growth. Through the IIP, four new pipeline candidates have been nominated, including: ARGX-213, targeting FcRn and further solidifying argenx’s leadership in this new class of medicine; ARGX-121, a first-in-class molecule targeting IgA; ARGX-109, targeting IL-6, which plays an important role in inflammation, and ARGX-220, a first-in-class sweeping antibody for which the target has not yet been disclosed.

•Phase 1 results expected for ARGX-109 in second half of 2025 and for ARGX-213 and ARGX-121 in first half of 2026

Don deBethizy to retire as non-executive director, Chair of the Remuneration Committee, and Vice Chair of the Company’s Board of Directors, effective May 27, 2025.

Mr. deBethizy has served as a non-executive director since 2015. He will be succeeded by Ana Cespedes as Chair of the Remuneration Committee and Tony Rosenberg as Vice Chair of the Board of Directors.

“I would like to express my deep gratitude to Don for his significant contributions during his tenure with argenx. He has been a true champion of our culture, guiding us through several key milestones on our growth journey, while supporting our entrepreneurial spirit and commitment to innovation.” commented Mr. Van Hauwermeiren.

FOURTH QUARTER AND FULL YEAR 2024 FINANCIAL RESULTS

argenx SE

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF PROFIT OR LOSS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Twelve Months Ended |

| | December 31 | | December 31 |

| (in thousands of $ except for shares and EPS) | | 2024 | | 2023 | | 2024 | | | 2023 |

| Product net sales | | $ | 736,968 | | | $ | 374,351 | | | $ | 2,185,883 | | | $ | 1,190,783 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Collaboration revenue | | | 1,443 | | | | 32,486 | | | | 4,348 | | | | 35,533 | |

| Other operating income | | | 22,809 | | | | 11,003 | | | | 61,808 | | | | 42,278 | |

| Total operating income | | | 761,220 | | | | 417,840 | | | | 2,252,039 | | | | 1,268,594 | |

| | | | | | | | | | | | |

| Cost of sales | | $ | (72,656) | | | $ | (39,477) | | | $ | (227,289) | | | $ | (117,835) | |

| Research and development expenses | | | (297,228) | | | | (306,373) | | | | (983,423) | | | | (859,492) | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Selling, general and administrative expenses | | | (285,945) | | | | (208,826) | | | | (1,055,337) | | | | (711,905) | |

| Loss from investment in a joint venture | | | (2,350) | | | | (1,788) | | | | (7,644) | | | | (4,411) | |

| Total operating expenses | | | (658,179) | | | | (556,464) | | | | (2,273,693) | | | | (1,693,643) | |

| | | | | | | | | | | | |

| Operating profit/(loss) | | $ | 103,041 | | | $ | (138,624) | | | $ | (21,654) | | | $ | (425,049) | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Financial income | | $ | 39,095 | | | $ | 40,308 | | | $ | 157,509 | | | $ | 107,386 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Financial expense | | | (704) | | | | (280) | | | | (2,464) | | | | (906) | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Exchange (losses)/gains | | | (54,923) | | | | 37,418 | | | | (48,211) | | | | 14,073 | |

| | | | | | | | | | | | |

| Profit/(loss) for the period before taxes | | $ | 86,509 | | | $ | (61,178) | | | $ | 85,180 | | | $ | (304,496) | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Income tax benefit/(expense) | | $ | 687,652 | | | $ | (37,994) | | | $ | 747,860 | | | $ | 9,443 | |

| Profit/(loss) for the period | | $ | 774,161 | | | $ | (99,172) | | | $ | 833,040 | | | $ | (295,053) | |

| Profit/(loss) for the period attributable to: | | | | | | | | | | | | |

| Owners of the parent | | $ | 774,161 | | | $ | (99,172) | | | $ | 833,040 | | | $ | (295,053) | |

| Weighted average number of shares outstanding used for basic profit/loss per share | | | 60,517,968 | | | | 59,118,827 | | | | 59,855,585 | | | | 57,169,253 | |

Weighted average number of shares outstanding used for diluted profit/loss per share | | | 65,661,428 | | | | 59,118,827 | | | | 65,177,815 | | | | 57,169,253 | |

| Basic profit/(loss) per share (in $) | | $ | 12.79 | | | $ | (1.68) | | | $ | 13.92 | | | $ | (5.16) | |

| Diluted profit/(loss) per share (in $) | | $ | 11.79 | | | $ | (1.68) | | | $ | 12.78 | | | $ | (5.16) | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

DETAILS OF THE FINANCIAL RESULTS

Total operating income for the three and twelve months ended December 31, 2024 was $761 million and $2,252 million, respectively, compared to $418 million and $1,269 million for the same periods in 2023, and mainly consists of:

•Product net sales of VYVGART and VYVGART SC for the three and twelve months ended December 31, 2024 were $737 million and $2,186 million, respectively, compared to $374 million and $1,191 million for the same periods in 2023.

•Collaboration revenue for the three and twelve months ended December 31, 2024 was $1 million and $4 million, respectively, compared to $32 million and $36 million for the same periods in 2023. Collaboration revenue for 2024 mainly relates to our collaboration with Zai Lab in China.

•Other operating income for the three and twelve months ended December 31, 2024 was $23 million and $62 million, respectively, compared to $11 million, and $42 million for the same periods in 2023. The other operating income primarily relates to research and development tax incentives and payroll tax rebates.

Total operating expenses for the three and twelve months ended December 31, 2024 were $658 million and $2,274 million, respectively, compared to $556 million and $1,694 million for the same periods in 2023, and mainly consists of:

•Cost of sales for the three and twelve months ended December 31, 2024 was $73 million and $227 million, respectively, compared to $39 million and $118 million for the same periods in 2023. The cost of sales was recognized with respect to the sale of VYVGART and VYVGART SC.

•Research and development expenses for the three and twelve months ended December 31, 2024 were $297 million and $983 million, respectively, compared to $306 million and $859 million for the same periods in 2023. The expenses mainly relate to:

◦the clinical development and expansion of efgartigimod in 15 severe autoimmune diseases including MG, CIDP and ITP

◦the ramp-up of studies for our development of empasiprubart into MMN, DGF, DM and CIDP

◦the investments for ARGX-119 in proof-of-concept studies ongoing in ALS and CMS

◦other discovery and preclinical pipeline candidates

•Selling, general and administrative expenses for the three and twelve months ended December 31, 2024 were $286 million and $1,055 million, respectively, compared to $209 million and $712 million for the same periods in 2023. The selling, general and administrative expenses mainly relate to professional and marketing fees linked to global commercialization of the VYVGART franchise, and personnel expenses.

Financial income for the three and twelve months ended December 31, 2024 was $39 million and $158 million, respectively, compared to $40 million and $107 million for the same periods in 2023.

Exchange losses for the three and twelve months ended December 31, 2024 were $55 million and $48 million respectively, compared to exchange gains of $37 million and $14 million for the same periods in 2023. Exchange gains or losses are mainly attributable to unrealized exchange rate gains or losses on the cash, cash equivalents and current financial assets position in Euro.

Income tax benefit

The Company recorded a deferred tax benefit of $802 million for the year ended December 31, 2024 of which $725 million relates to a one-time non-recurring recognition of previously unrecognized deferred tax assets existing as of December 31, 2023. This recognition results from the Company’s determination, in the fourth quarter of 2024, that it was probable that future taxable profits will be available for use of unrecognized deferred tax assets.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Twelve Months Ended |

| | December 31 | | December 31 |

| (in millions of $) | | 2024 | | 2023 | | 2024 | | | 2023 |

| Current tax (expense)/benefit | | $ | (25) | | | | 12 | | | | (54) | | | | (12) | |

| Deferred tax benefit/(expense) | | | 713 | | | | (50) | | | | 802 | | | | 21 | |

| Income tax benefit/(expense) | | $ | 688 | | | | (38) | | | | 748 | | | | 9 | |

Profit for the period of the three and twelve months ended December 31, 2024 was $774 million and $833 million, respectively, compared to a loss of $99 million and $295 million over the prior periods. On a per weighted average share basis, the basic profit per share was $13.92 for the year ended December 31, 2024, compared to a basic loss per share of $5.16 for the year ended December 31, 2023.

FINANCIAL GUIDANCE

Based on its current operating plans, argenx expects its combined research and development and selling, general and administrative expenses in 2025 to be approximately $2.5 billion.

EXPECTED 2025 FINANCIAL CALENDAR

•May 8, 2025: Q1 2025 financial results and business update

•May 27, 2025: Annual General Meeting of Shareholders in Amsterdam, the Netherlands

•July 31, 2025: Half Year and Second Quarter 2025 Financial Results and Business Update

•October 30, 2025: Q3 2025 financial results and business update

CONFERENCE CALL DETAILS

The full year 2024 financial results and business update will be discussed during a conference call and webcast presentation today at 2:30 pm CET/8:30 am ET. A webcast of the live call and replay may be accessed on the Investors section of the argenx website at argenx.com/investors.

Dial-in numbers:

Please dial in 15 minutes prior to the live call.

Belgium 32 800 50 201

France 33 800 943355

Netherlands 31 20 795 1090

United Kingdom 44 800 358 0970

United States 1 800 715 9871

Japan 81 3 4578 9081

Switzerland 41 43 210 11 32

This press release contains inside information within the meaning of Article 7(1) of the EU Market Abuse Regulation (Regulation 596/2014).

About argenx

argenx is a global immunology company committed to improving the lives of people suffering from severe autoimmune diseases. Partnering with leading academic researchers through its Immunology Innovation Program (IIP), argenx aims to translate immunology breakthroughs into a world-class portfolio of novel antibody-based medicines. argenx developed and is commercializing the first approved neonatal Fc receptor (FcRn) blocker and is evaluating its broad potential in multiple serious autoimmune diseases while advancing several earlier stage experimental medicines within its therapeutic franchises. For more information, visit www.argenx.com and follow us on LinkedIn, X/Twitter, Instagram, Facebook, and YouTube.

For further information, please contact:

Media:

Ben Petok

bpetok@argenx.com

Investors:

Alexandra Roy (US)

aroy@argenx.com

Lynn Elton (EU)

lelton@argenx.com

Forward-looking Statements

The contents of this announcement include statements that are, or may be deemed to be, “forward-looking

statements.” These forward-looking statements can be identified by the use of forward-looking terminology,

including the terms “advance,” “aim,” “believe,” “continue,” “drive,” “expand,” “expect,” “plan,” “position,” “start,”

and “strive” and include statements argenx makes regarding its expected profitability in 2025; its mission to

transform the autoimmune treatment landscape by investing in innovation and its goal to lead in science; its

focus on maximizing commercial opportunities in gMG and CIDP, including by advancing PFS in multiple

regions, expanding its label in gMG and deepening relationships within the CIDP community; its plan to unlock

significant opportunities in high unmet need areas; its long-term commitments, including its Vision 2030 goals of

treating 50,000 patients globally with its medicines, securing 10 labeled indications across all approved

medicines, and advancing five pipeline candidates into Phase 3 development by 2030; its plans to drive

commercial growth by expanding VYVGART into new regions, advance its PFS in multiple markets for CIDP and

MG in 2025 and autoinjector in 2027, and reach broader MG populations with ongoing studies in seronegative,

ocular, and pediatric MG; the advancement of anticipated clinical development, data readouts and regulatory

milestones and plans, including: (1) four key regulatory decisions on approval for PFS expected in 2025; (2)

PFS decision on approval for gMG and CIDP expected in Japan and Canada in second half of 2025 and for

CIDP expected in the EU in first half of 2025; and (3) ongoing evidence generation through Phase 4 and

label-enabling studies in MG, CIDP and ITP, including topline results for seronegative gMG expected in second

half of 2025 and those for ocular and pediatric MG expected in first half of 2026, ongoing Phase 4 switch study

in CIDP, and ongoing ADVANCE-NEXT confirmatory study of VYVGART IV in primary ITP with topline results

expected in second half of 2026; its plans to execute 10 registrational and 10 proof-of-concept studies across

efgartigimod, empasiprubart and ARGX-119 in 2025 to advance the next wave of launches; its plans to develop

efgartigimod, including: (1) the ongoing registrational ALKIVIA study evaluating IMNM, ASyS, and DM, with

topline results expected in second half of 2026; (2) two ongoing registrational UplighTED studies in TED, with

topline results expected in second half of 2026; (3) Registrational UNITY study in primary Sjögren’s disease,

with topline results expected in 2027; (4) ongoing proof-of-concept studies in LN, SSc, and AMR, with topline

results expected in fourth quarter of 2025, second half of 2026, and 2027, respectively; and (5) the next

nominated indications of AIE and one undisclosed disease to enter clinical studies; its plans to develop

empasiprubart, including: (1) registrational EMPASSION study in MMN, with topline results expected in second

half of 2026; (2) registrational EMVIGORATE study in CIDP, expected to start in first half of 2025; and (3)

proof-of-concept studies in DGF and DM, with topline results expected in second half of 2025 and first half of

2026, respectively; its plans to develop ARGX-119, including: (1) proof-of-concept study in CMS, with topline

results expected in second half of 2025; (2) Phase 2a proof-of-concept study in ALS, with topline results

expected in first half of 2026; and (3) SMA proof-of-concept study, expected to start in 2025; the expected start

and timeline of Phase 1 studies of ARGX-109 in second half of 2025 and ARGX-213 and ARGX-121 in first half

of 2026; the expected change from Mr. deBethizy to Ms. Cespedes as the Chair of the Remuneration

Committee; the potential of its continued investment in its IIP to drive long-term sustainable pipeline growth; its

future financial and operating performance, including its anticipated research and development, selling, general

and administrative expenses for 2025; and its goal of translating immunology breakthroughs into a world-class

portfolio of novel antibody-based medicines. By their nature, forward-looking statements involve risks and

uncertainties and readers are cautioned that any such forward-looking statements are not guarantees of future

performance. argenx’s actual results may differ materially from those predicted by the forward-looking

statements as a result of various important factors, including but not limited to, the results of argenx’s clinical

trials; expectations regarding the inherent uncertainties associated with the development of novel drug

therapies; preclinical and clinical trial and product development activities and regulatory approval requirements;

the acceptance of its products and product candidates by its patients as safe, effective and cost-effective; the

impact of governmental laws and regulations on its business; its reliance on third-party suppliers, service

providers and manufacturers; inflation and deflation and the corresponding fluctuations in interest rates; and

regional instability and conflicts. A further list and description of these risks, uncertainties and other risks can be

found in argenx’s U.S. Securities and Exchange Commission (SEC) filings and reports, including in argenx’s

most recent annual report on Form 20-F filed with the SEC as well as subsequent filings and reports filed by

argenx with the SEC. Given these uncertainties, the reader is advised not to place any undue reliance on such

forward-looking statements. These forward-looking statements speak only as of the date of publication of this

document. argenx undertakes no obligation to publicly update or revise the information in this press release,

including any forward-looking statements, except as may be required by law.

Reaching Patients Through Immunology Innovation 4 Q 2 0 2 4 F I N A N C I A L R E S U L T S C A L L F E B R U A R Y 2 7 , 2 0 2 5

Forward Looking Statements This presentation has been prepared by argenx se (“argenx” or the “company”) for informational purposes only and not for any other purpose. Nothing contained in this presentation is, or should be construed as, a recommendation, promise or representation by the presenter or the company or any director, employee, agent, or adviser of the company. This presentation does not purport to be all- inclusive or to contain all of the information you may desire. Certain information contained in this presentation relates to or is based on studies, publications, surveys and other data obtained from third- party sources and the company’s own internal estimates and research. While argenx believes these third-party studies, publications, surveys and other data to be reliable as of the date of this presentation, it has not independently verified, and makes no representation as to the adequacy, fairness, accuracy or completeness of, any information obtained from third-party sources. In addition, no independent source has evaluated the reasonableness or accuracy of argenx’s internal estimates or research, and no reliance should be made on any information or statements made in this presentation relating to or based on such internal estimates and research. Certain statements contained in this presentation, other than present and historical facts and conditions independently verifiable at the date hereof, may constitute forward-looking statements. These forward-looking statements can be identified by the use of forward-looking terminology, including the terms “advance,” “expand,” “fuel,” “grow,” “plan,” and “reach,” and include statements argenx makes regarding its 2025 strategic priorities, including reaching more patients with VYVGART and its PFS launch, fueling pipeline growth with 10 Phase 3 and 10 Phase 2 studies, and expanding the next wave of innovation through four new molecules in Phase 1 studies; its plans to drive commercial growth by expanding VYVGART use through ongoing registrational studies in seronegative gMG and ocular MG, upcoming global approvals for CIDP, the CIDP switch study, and developing empasiprubart in CIDP; its plans to advance various pipelines through 10 Phase 2 and 10 Phase 3 studies across efgartigimod, empasiprubart and ARGX-119; its plans to advance 4 INDs into Phase 1 studies, including ARGX-213, ARGX-121, ARGX-109, and ARGX-220; its plans to maintain sustainable growth through relentless focus on advancing innovation; its plans to grow its VYVGART leadership in MG; its expectations regarding the increase of the MG Total Addressable Market in the U.S. in 2030 to 60,000 addressable patients; its goal to expand globally through multiple planned CIDP launches in 2025; the advancement of anticipated clinical development, data readouts and regulatory milestones and plans, including its expectation about Saudi Arabia’s decision for VYVGART in gMG in 2025, its expectation about the EU’s decision for VYVGART Hytrulo in CIDP in 2025, its expectations about EU’s decision for VYVGART Hytrulo PFS in CIDP in 2025 and the United States’, Japan’s and China’s decisions for VYVGART Hytrulo PFS in gMG and CIDP in 2025; and the 2030 Vision goal of treating 50,000 patients by 2030. By their nature, forward-looking statements involve risks and uncertainties and readers are cautioned that any such forward-looking statements are not guarantees of future performance. argenx’s actual results may differ materially from those predicted by the forward-looking statements as a result of various important factors, including but not limited to, the results of argenx’s clinical trials; expectations regarding the inherent uncertainties associated with the development of novel drug therapies; preclinical and clinical trial and product development activities and regulatory approval requirements; the acceptance of argenx’s products and product candidates by patients as safe, effective and cost-effective; the impact of governmental laws and regulations on its business; disruptions caused by its reliance on third-party suppliers, service providers and manufacturers; inflation and deflation and the corresponding fluctuations in interest rates; and regional instability and conflicts. A further list and description of these risks, uncertainties and other risks can be found in argenx’s U.S. Securities and Exchange Commission (the “SEC”) filings and reports, including in argenx’s most recent annual report on Form 20-F filed with the SEC as well as subsequent filings and reports filed by argenx with the SEC. Given these uncertainties, the reader is advised not to place any undue reliance on such forward-looking statements. These forward-looking statements speak only as of the date of publication of this document. argenx undertakes no obligation to publicly update or revise the information in this presentation, including any forward-looking statements, except as may be required by law. This presentation contains trademarks, trade names and service marks of other companies, which are the property of their respective owners. 2

Fuel pipeline growth 2025 Strategic Priorities PFS Launch Expand next wave of innovation 4 New Molecules in Phase 1 3 Reach more patients with VYVGART 10 Phase 3s 10 Phase 2s

VYVGART is Setting a New Standard for Patients ECI STAGE A 4 Seronegative gMG and Ocular MG registrational trials Growth momentum continued PFS Positive CHMP opinion PDUFA April 10th CIDP switch study Empasiprubart in CIDP Global decisions on approvals ahead for CIDP MG MSE = MG-ADL SCORE of 0 or 1 MG-ADL SCORE ≤ 5 Response rate1 No/minimal symptoms1 Meaningful response2 54% 8/10 CIDP 7/10 Fred, MG Patient Jamilah, CIDP Patient Substantial improvement in functional ability2 34% ≥2 POINT DECREASE IN INCAT FROM RUN-IN BASELINE 1.ADAPT/ADAPT+ combined real world and clinical data 2.ADHERE clinical data

Advancing Our Pipeline 10 Phase 3s and 10 Phase 2s sngMG & oMG IMNM, ASyS, DM TED Sjögren’s Disease ITP Empasiprubart MMN CIDP DM DGF ARGX-119 CMS Ph1b ALS Ph2a SMA PoC Proof-of-Concept studies AMRLN SSc AIE Registrational studies Proof-of-Concept studies Proof-of-Concept studies Registrational studies 5 VYVGART

4 INDs Advancing into Phase 1 Continued Leadership with Broad Immune System Targets ARGX-213 FcRn ARGX-121 IgA ARGX-220 Target Undisclosed ARGX-109 IL-6 Fc-ABDEGTM Potential for monthly dosing Rapid, deep IgA reduction Best-in-class potency NHance® First-in-class sweeper Convenient dosing Prolonged IgG reduction Fc-ABDEGTM α-albumin VHH Leverages FcRn biologyEnables flexible dosing 6

Product Net Sales: Q4 of $737 million 7 21 0 100 200 300 400 500 600 700 800 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 75 131 173 218 269 329 374 398 478 573 737 China RoW Japan US 7 7 2 14 11 12 1 6 11 12 26 24 31 36 46 49 2 6 8 10 13 15 17 18 20 24 27 21 73 124 159 197 244 280 326 347 407 492 649 $’m Q4 2024: growth of 29% vs Q3 2024 *All growth is operational and excludes the impact of FX (in millions of $) Q4 2024 Q3 2024 QoQ % Growth * US 649 492 32% Japan 27 24 19% RoW 49 46 9% China supply 12 11 14% Total 737 573 29% Total excluding China 725 562 30% (in millions of $) Q4 2024 Q4 2023 Growth % * US 649 326 99% Japan 27 17 66% RoW 49 24 105% China supply 12 7 65% Total 737 374 98% Q4 2024: growth of 98% vs Q4 2023Product Net Sales by Quarter *Net sales growth % excludes the impact of FX.

Q4 2024 Financial Summary 2025 Financial Guidance * Alternative Performance Measure (APM): Cash reflects cash, cash equivalents and current financial assets. Refer to the APM statement. $1.5 billion in cash and cash equivalents and $1.9 billion in current financial assets Ended Q4 with cash of $3.4B Cash* Relentless Focus on Advancing Innovation and Building Sustainable Growth. Twelve months ended December 31 2024 2023 Three months ended December 31 2024 2023in million of $ Summary P/L Product net sales 737 374 2,186 1,191 Collaboration revenue 1 32 4 36 Other operating income 23 11 62 42 Total operating income 761 418 2,252 1,269 Cost of sales (73) (39) (227) (118) Research and development expenses (297) (306) (983) (859) Selling, general and administrative expenses (286) (209) (1,055) (712) Loss from investment in joint venture (2) (2) (8) (4) Total operating expenses (658) (556) (2,274) (1,694) Operating profit/(loss) 103 (139) (22) (425) Financial income 39 40 158 107 Financial expense (1) - (2) (1) Exchange gains/(losses) (55) 37 (48) 14 Profit/(Loss) for the period before taxes 87 (61) 85 (304) Income tax benefit/(expense) 688 (38) 748 9 Profit/(Loss) for the period 774 (99) 833 (295) 8 Combined R&D and SG&A expenses 2025 = ~ $2.5B *Alternative Performance Measure (APM). Refer to the APM statement.

Innovation has no value unless it provides meaningful benefit to patients 9

Growing VYVGART Leadership in MG U.S. Addressable MG Patients Total Addressable Market in 2030 Addressable Market at Launch 17K +11K +7K +25K 60K Seronegative Ocular Growth in Biologics Share of Market Path to 60K Addressable Patients Consistent QoQ growth VYVGART has set a high bar 10 Source: argenx market research Evidence generation Label expansion studies PFS decisions on approvals #1 BRANDED BIOLOGIC Driving earlier line adoption

Continued Momentum in CIDP Patients Physicians Payors ~1,000 Patients on Therapy 90% Lives Covered Majority policies favorable 25% New Prescribers Global Expansion Multiple planned launches in 2025 Breadth and depth of prescribersMajority IVIg-experienced 11

Reaching Patients Across the Globe EU • Reimbursement complete in 13 countries • CHMP recommendation for PFS in gMG US • CIDP launched with >1,000 patients on treatment as of end of Q4 Japan • CIDP launched with positive early feedback China • Continued expansion with VYVGART and VYVGART Hytrulo VYVGART Hytrulo is marketed as VYVGART-SC in Europe and VYVDURA® in Japan Australia • Approval for gMG (IV and SC) DECISIONS PENDING FOR 2025 gMG Saudi Arabia DECISIONS PENDING FOR 2025 CIDP Europe DECISIONS PENDING FOR 2025 VYVGART Hytrulo PFS CIDP EU gMG & CIDP US Japan Canada 12

Wave 2 (2026-2027) Wave 3 (2028-2030)Wave 1: TODAY TED Myositis oMG snMG Sjogren’s gMG CIDP ITP DM MMN CMS CIDP 50K 13 Strong Growth Trajectory to 50K Patients VYVGART Empasiprubart ARGX-119

We are On a Bold Mission Humility Innovation Excellence Co-Creation Empowerment 14

Alternative Performance Measure In this document, argenx's financial results are provided in accordance with IFRS® Accounting Standards (IFRS) and using a non-IFRS financial measure, Cash, cash equivalents and current financial assets. This value should not be viewed as a substitute for the company’s IFRS financial information and is provided as a complement to financial information provided in accordance with IFRS and should be read in conjunction with the most comparable IFRS financial information as set out below. Management believes this non-IFRS financial measure is useful for securities analysts, investors and other interested parties to gain a more complete understanding of the company's available financial liquidities given that the company’s current financial assets are held in term accounts with an initial maturity of more than three months but less than twelve and to be used for meeting its financial obligations. Such non-IFRS financial information, as calculated herein, may not be comparable to similarly named measures used by other companies and should not be considered comparable to IFRS financial measures. Non-IFRS financial measures have limitations as an analytical tool and should not be considered in isolation from, or as a substitute for, an analysis of the company's financial results as reported under IFRS. A reconciliation of the IFRS financial information to non-IFRS financial information is included below: Cash, cash equivalents and current financial assets totaled $3.4 billion as of December 31, 2024, compared to $3.2 billion as of December 31, 2023. The balance as of year ended December 31, 2024 consists of $1.5 billion in cash and cash equivalents and $1.9 billion in current financial assets. 15

ARGENX SE

UNAUDITED CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As of December 31, |

| (in thousands of $) | | 2024 | | 2023 | | 2022 |

| Assets | | | | | | | | | |

| Non‑current assets | | | | | | | | | |

| Property, plant and equipment | | $ | 43,517 | | | $ | 22,675 | | | $ | 16,234 | |

| Intangible assets | | | 181,445 | | | | 125,228 | | | | 174,901 | |

| Deferred tax assets | | | 924,299 | | | | 97,211 | | | | 79,222 | |

| | | | | | | | | |

| | | | | | | | | |

| Research and development incentive receivables | | | 94,854 | | | | 76,706 | | | | 47,488 | |

| Investment in a joint venture | | | 9,268 | | | | 9,912 | | | | 1,323 | |

| Prepaid expenses | | | 23,643 | | | | 47,327 | | | | — | |

| Other non-current assets | | | 42,393 | | | | 39,662 | | | | 40,894 | |

| Total non‑current assets | | $ | 1,319,419 | | | $ | 418,721 | | | $ | 360,064 | |

| | | | | | | | | |

| Current assets | | | | | | | | | |

| Inventories | | $ | 407,233 | | | $ | 310,550 | | | $ | 228,353 | |

| Prepaid expenses | | | 187,948 | | | | 134,072 | | | | 76,022 | |

| | | | | | | | | |

| | | | | | | | | |

| Trade and other receivables | | | 904,471 | | | | 496,687 | | | | 275,697 | |

| Research and development incentive receivables | | | 4,625 | | | | 2,584 | | | | 1,578 | |

| Financial assets | | | 1,878,890 | | | | 1,131,000 | | | | 1,391,808 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Cash and cash equivalents | | | 1,499,936 | | | | 2,048,844 | | | | 800,740 | |

| Total current assets | | $ | 4,883,103 | | | $ | 4,123,737 | | | $ | 2,774,197 | |

| | | | | | | | | |

| Total assets | | $ | 6,202,522 | | | $ | 4,542,458 | | | $ | 3,134,261 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | As of December 31, |

| (in thousands of $) | | | 2024 | | 2023 | | 2022 |

| Equity and liabilities | | | | | | | | | | |

| Equity | | | | | | | | | | |

| Equity attributable to owners of the parent | | | | | | | | | | |

| Share capital | | | $ | 7,227 | | | $ | 7,058 | | | $ | 6,640 | |

| Share premium | | | | 5,948,916 | | | | 5,651,497 | | | | 4,309,880 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Translation differences | | | | 126,832 | | | | 131,543 | | | | 129,280 | |

| Accumulated losses | | | | (1,571,804) | | | | (2,404,844) | | | | (2,109,791) | |

| | | | | | | | | | |

| | | | | | | | | | |

| Other reserves | | | | 987,112 | | | | 712,253 | | | | 477,691 | |

| Total equity | | | $ | 5,498,283 | | | $ | 4,097,507 | | | $ | 2,813,699 | |

| | | | | | | | | | |

| Non-current liabilities | | | | | | | | | | |

| Provisions for employee benefits | | | $ | 1,803 | | | $ | 1,449 | | | $ | 870 | |

| Lease liabilities | | | | 32,520 | | | | 15,354 | | | | 9,009 | |

| Deferred tax liabilities | | | | — | | | | 5,155 | | | | 8,406 | |

| Total non-current liabilities | | | | 34,323 | | | | 21,958 | | | | 18,285 | |

| | | | | | | | | | |

| Current liabilities | | | | | | | | | | |

| Lease liabilities | | | $ | 6,533 | | | $ | 4,646 | | | $ | 3,417 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Trade and other payables | | | | 649,993 | | | | 414,013 | | | | 295,679 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Tax liabilities | | | | 13,390 | | | | 4,334 | | | | 3,181 | |

| Total current liabilities | | | | 669,916 | | | | 422,993 | | | | 302,277 | |

| | | | | | | | | | |

| Total liabilities | | | $ | 704,239 | | | $ | 444,951 | | | $ | 320,562 | |

| | | | | | | | | | |

| Total equity and liabilities | | | $ | 6,202,522 | | | $ | 4,542,458 | | | $ | 3,134,261 | |

ARGENX SE

UNAUDITED CONSOLIDATED STATEMENTS OF PROFIT OR LOSS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, |

| (in thousands of $ except for shares and EPS) | | | 2024 | | 2023 | | 2022 |

| Product net sales | | | $ | 2,185,883 | | | $ | 1,190,783 | | | $ | 400,720 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Collaboration revenue | | | | 4,348 | | | | 35,533 | | | | 10,026 | |

| Other operating income | | | | 61,808 | | | | 42,278 | | | | 34,520 | |

| Total operating income | | | | 2,252,039 | | | | 1,268,594 | | | | 445,267 | |

| | | | | | | | | | |

| Cost of sales | | | | (227,289) | | | | (117,835) | | | | (29,431) | |

| Research and development expenses | | | | (983,423) | | | | (859,492) | | | | (663,366) | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Selling, general and administrative expenses | | | | (1,055,337) | | | | (711,905) | | | | (472,132) | |

| Loss from investment in a joint venture | | | | (7,644) | | | | (4,411) | | | | (677) | |

| Total operating expenses | | | | (2,273,693) | | | | (1,693,643) | | | | (1,165,607) | |

| | | | | | | | | | |

| Operating loss | | | $ | (21,654) | | | $ | (425,049) | | | $ | (720,341) | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Financial income | | | | 157,509 | | | | 107,386 | | | | 27,665 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Financial expense | | | | (2,464) | | | | (906) | | | | (3,906) | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Exchange (losses)/gains | | | | (48,211) | | | | 14,073 | | | | (32,732) | |

| | | | | | | | | | |

| Profit/(Loss) for the year before taxes | | | $ | 85,180 | | | $ | (304,496) | | | $ | (729,314) | |

| | | | | | | | | | |

| | | | | | | | | | |

| Income tax benefit | | | $ | 747,860 | | | $ | 9,443 | | | $ | 19,720 | |

| Profit/(Loss) for the year | | | $ | 833,040 | | | $ | (295,053) | | | $ | (709,594) | |

| Profit/(Loss) for the year attributable to: | | | | | | | | | | |

| Owners of the parent | | | | 833,040 | | | | (295,053) | | | | (709,594) | |

| Weighted average number of shares outstanding | | | | 59,855,585 | | | | 57,169,253 | | | | 54,381,371 | |

| Weighted average number of shares for purpose of diluted profit/(loss) per share | | | | 65,177,815 | | | | 57,169,253 | | | | 54,381,371 | |

| Basic profit/(loss) per share (in $) | | | | 13.92 | | | | (5.16) | | | | (13.05) | |

| Diluted profit/(loss) per share (in $) | | | | 12.78 | | | | (5.16) | | | | (13.05) | |

ARGENX SE

UNAUDITED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME OR LOSS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, |

| (in thousands of $) | | 2024 | | 2023 | | 2022 |

| Profit/(Loss) for the year | | $ | 833,040 | | | $ | (295,053) | | | $ | (709,594) | |

| | | | | | | | | |

| Items that may be reclassified subsequently to profit or loss, net of tax | | | | | | | | | |

| Currency translation differences, arisen from translating foreign activities | | | (4,711) | | | | 2,263 | | | | (2,404) | |

| Items that will not be reclassified subsequently to profit or loss, net of tax | | | | | | | | | |

| Fair value gain/(loss) on investments in equity instruments designated as FVTOCI | | | (648) | | | | (1,915) | | | | (18,267) | |

| | | | | | | | | |

| Other comprehensive profit/(loss), net of income tax | | $ | (5,359) | | | $ | 348 | | | $ | (20,671) | |

| | | | | | | | | |

| Total comprehensive profit/(loss) attributable to: | | | | | | | | | |

| Owners of the parent | | $ | 827,681 | | | $ | (294,705) | | | $ | (730,266) | |

ARGENX SE

UNAUDITED CONSOLIDATED STATEMENTS OF CASH FLOWS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, |

| (in thousands of $) | | 2024 | | 2023 | | 2022 |

| Operating profit/(loss) | | $ | (21,654) | | | $ | (425,049) | | | $ | (720,341) | |

| Adjustments for non-cash items | | | | | | | | | |

| Amortization of intangible assets | | | 10,282 | | | | 105,674 | | | | 99,766 | |

| Depreciation of property, plant and equipment | | | 7,245 | | | | 5,633 | | | | 4,576 | |

| Provisions for employee benefits | | | 432 | | | | 573 | | | | 459 | |

| Expense recognized in respect of share-based payments | | | 235,179 | | | | 232,974 | | | | 157,026 | |

| Fair value gains on financial assets at fair value through profit or loss | | | (3,834) | | | | — | | | | (4,256) | |

| | | | | | | | | |

| Loss from investment in a joint venture | | | 7,644 | | | | 4,411 | | | | 677 | |

Other non-cash (benefit)/expenses | | | (277) | | | | 2,074 | | | | — | |

| | $ | 235,017 | | | $ | (73,710) | | | $ | (462,093) | |

| Movements in current assets/liabilities | | | | | | | | | |

| (Increase)/decrease in trade and other receivables | | | (423,112) | | | | (185,694) | | | | (222,260) | |

| (Increase)/decrease in inventories | | | (95,996) | | | | (83,030) | | | | (119,277) | |

| (Increase)/decrease in other current assets | | | (56,154) | | | | (59,024) | | | | (18,294) | |

| Increase/(decrease) in trade and other payables | | | 246,336 | | | | 95,600 | | | | 329 | |

| | | | | | | | | |

| Movements in non-current assets/liabilities | | | | | | | | | |

| (Increase)/decrease in other non‑current assets | | | (19,930) | | | | (29,416) | | | | (16,220) | |

| (Increase)/decrease in non-current prepaid expense | | | 23,683 | | | | (47,327) | | | | — | |

| | | | | | | | | |

| | | | | | | | | |

| Net cash flows used in operating activities, before interest and taxes | | $ | (90,156) | | | $ | (382,601) | | | $ | (837,815) | |

| | | | | | | | | |

| Interest paid | | | (392) | | | | (211) | | | | (851) | |

| Income taxes received/(paid) | | | 7,801 | | | | (37,515) | | | | (24,141) | |

| | | | | | | | | |

| Net cash flows used in operating activities | | $ | (82,747) | | | $ | (420,327) | | | $ | (862,807) | |

| | | | | | | | | |

| Purchase of intangible assets | | | (66,500) | | | | (43,000) | | | | (102,986) | |

| Purchase of property, plant and equipment | | | (1,801) | | | | (812) | | | | (837) | |

| | | | | | | | | |

| Purchase of current financial assets | | | (2,183,542) | | | | (1,271,730) | | | | (1,694,046) | |

| Sale of current financial assets | | | 1,429,600 | | | | 1,543,999 | | | | 1,325,540 | |

| Interest received | | | 111,649 | | | | 92,753 | | | | 13,146 | |

| Investment in a joint venture | | | (7,000) | | | | (13,000) | | | | (2,000) | |

| | | | | | | | | |

| Net cash flows from/(used in) investing activities | | $ | (717,594) | | | $ | 308,210 | | | $ | (461,184) | |

| | | | | | | | | |

| Principal elements of lease payments | | | (7,638) | | | | (3,801) | | | | (4,165) | |

| Proceeds from issue of new shares, gross amount | | | — | | | | 1,196,731 | | | | 760,953 | |

| Issue costs paid | | | — | | | | (821) | | | | (781) | |

| Exchange (losses)/gains from currency conversion on proceeds from issue of new shares | | | — | | | | (1,507) | | | | 410 | |

| Payment of employee withholding taxes relating to restricted stock unit awards | | | (21,868) | | | | (12,138) | | | | (5,855) | |

| Proceeds from exercise of stock options | | | 309,265 | | | | 158,263 | | | | 93,195 | |

| | | | | | | | | |

| Net cash flows from financing activities | | $ | 279,759 | | | $ | 1,336,727 | | | $ | 843,757 | |

| | | | | | | | | |

| Increase/(decrease) in cash and cash equivalents | | $ | (520,582) | | | $ | 1,224,610 | | | $ | (480,234) | |

| | | | | | | | | |

| Cash and cash equivalents at the beginning of the year | | $ | 2,048,844 | | | $ | 800,740 | | | $ | 1,334,676 | |

| Exchange gains/(losses) on cash and cash equivalents | | $ | (28,326) | | | $ | 23,494 | | | $ | (53,702) | |

| Cash and cash equivalents at the end of the year | | $ | 1,499,936 | | | $ | 2,048,844 | | | $ | 800,740 | |

ARGENX SE

UNAUDITED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Attributable to owners of the parent |

| (in thousands of $) | | Share capital | | Share premium | | Accumulated losses | | Translation differences | | Share-based payment and income tax deduction on share-based payments | | Fair value movement on investment in equity instruments designated as at FVTOCI | | Total equity attributable to owners of the parent | | | | Total equity |

| Balance on January 1, 2022 | | $ | 6,233 | | | $ | 3,462,775 | | | $ | (1,400,197) | | | $ | 131,684 | | | $ | 373,019 | | | $ | (39,290) | | | $ | 2,534,224 | | | | | $ | 2,534,224 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Loss for the year | | | | | | | | | (709,594) | | | | | | | | | | | | | (709,594) | | | | | | (709,594) | |

| Other comprehensive income/(loss) | | | | | | | | | | | | (2,404) | | | | | | | (18,267) | | | | (20,671) | | | | | | (20,671) | |

| Total comprehensive income/(loss) for the year | | | — | | | | — | | | | (709,594) | | | | (2,404) | | | | — | | | | (18,267) | | | | (730,266) | | | | | | (730,266) | |

| Income tax benefit from excess tax deductions related to share-based payments | | | | | | | | | | | | | | | 3,946 | | | | | | | 3,946 | | | | | | 3,946 | |

| Share-based payment | | | | | | | | | | | | | | | 158,282 | | | | | | | 158,282 | | | | | | 158,282 | |

| Issue of share capital | | | 294 | | | | 760,659 | | | | | | | | | | | | | | | | 760,953 | | | | | | 760,953 | |

| Transaction costs for equity issue | | | | | | (781) | | | | | | | | | | | | | | | | (781) | | | | | | (781) | |

| Exercise of stock options | | | 113 | | | | 93,082 | | | | | | | | | | | | | | | | 93,195 | | | | | | 93,195 | |

| Ordinary shares withheld for payment of employees’ withholding tax liability | | | | | | (5,855) | | | | | | | | | | | | | | | | (5,855) | | | | | | (5,855) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance on December 31, 2022 | | $ | 6,640 | | | $ | 4,309,880 | | | $ | (2,109,791) | | | $ | 129,280 | | | $ | 535,247 | | | $ | (57,557) | | | $ | 2,813,699 | | | | | $ | 2,813,699 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Loss for the year | | | | | | | | | (295,053) | | | | | | | | | | | | | (295,053) | | | | | | (295,053) | |

| Other comprehensive income/(loss) | | | | | | | | | | | | 2,263 | | | | | | | (1,915) | | | | 348 | | | | | | 348 | |

| Total comprehensive income/(loss) for the year | | | — | | | | — | | | | (295,053) | | | | 2,263 | | | | — | | | | (1,915) | | | | (294,705) | | | | | | (294,705) | |

| Income tax benefit from excess tax deductions related to share-based payments | | | | | | | | | | | | | | | 2,310 | | | | | | | 2,310 | | | | | | 2,310 | |

| Share-based payment | | | | | | | | | | | | | | | 234,168 | | | | | | | 234,168 | | | | | | 234,168 | |

| Issue of share capital | | | 288 | | | | 1,196,444 | | | | | | | | | | | | | | | | 1,196,732 | | | | | | 1,196,732 | |

| Transaction costs for equity issue | | | | | | (821) | | | | | | | | | | | | | | | | (821) | | | | | | (821) | |

| Exercise of stock options | | | 130 | | | | 158,133 | | | | | | | | | | | | | | | | 158,263 | | | | | | 158,263 | |

| Ordinary shares withheld for payment of employees’ withholding tax liability | | | | | | (12,139) | | | | | | | | | | | | | | | | (12,139) | | | | | | (12,139) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance on December 31, 2023 | | $ | 7,058 | | | $ | 5,651,497 | | | $ | (2,404,844) | | | $ | 131,543 | | | $ | 771,725 | | | $ | (59,472) | | | $ | 4,097,507 | | | | | $ | 4,097,507 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Profit for the year | | | | | | | | | 833,040 | | | | | | | | | | | | | 833,040 | | | | | | 833,040 | |

| Other comprehensive income/(loss) | | | | | | | | | | | | (4,711) | | | | | | | (648) | | | | (5,359) | | | | | | (5,359) | |

| Total comprehensive income/(loss) for the year | | | — | | | | — | | | | 833,040 | | | | (4,711) | | | | — | | | | (648) | | | | 827,681 | | | | | | 827,681 | |

| Income tax benefit from excess tax deductions related to share-based payments | | | | | | | | | | | | | | | 39,650 | | | | | | | 39,650 | | | | | | 39,650 | |

| Share-based payment | | | | | | | | | | | | | | | 235,856 | | | | | | | 235,856 | | | | | | 235,856 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Exercise of stock options | | | 169 | | | | 319,288 | | | | | | | | | | | | | | | | 319,457 | | | | | | 319,457 | |

| Ordinary shares withheld for payment of employees’ withholding tax liability | | | | | | (21,869) | | | | | | | | | | | | | | | | (21,869) | | | | | | (21,869) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance on December 31, 2024 | | $ | 7,227 | | | $ | 5,948,916 | | | $ | (1,571,804) | | | $ | 126,832 | | | $ | 1,047,231 | | | $ | (60,119) | | | $ | 5,498,283 | | | | | $ | 5,498,283 | |

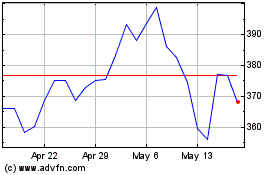

argenx (NASDAQ:ARGX)

Historical Stock Chart

From Feb 2025 to Mar 2025

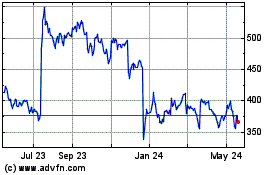

argenx (NASDAQ:ARGX)

Historical Stock Chart

From Mar 2024 to Mar 2025