Ark Restaurants Corp. (NASDAQ:ARKR) today reported financial

results for the fourth quarter and fiscal year ended September 30,

2023.

The Company’s fiscal year ends on the Saturday nearest September

30. The fiscal years ended September 30, 2023 and October 1, 2022

both included 52 weeks and the quarters ended September 30, 2023

and October 1, 2022 both included 13 weeks.

Financial Results

Total revenues for the 13 weeks ended September 30, 2023 were

$44,400,000 versus $46,884,000 for the 13 weeks ended October 1,

2022.

Total revenues for the year ended September 30, 2023 were

$184,793,000 versus $183,674,000 for the year ended October 1,

2022. As required by our lease, Gallagher's Steakhouse at the New

York-New York Hotel and Casino in Las Vegas, NV was substantially

closed for renovation for the period from February 5, 2023 through

April 27, 2023. Revenues for the period of closure were $1,026,000

as compared to $3,251,000 for the comparable prior period.

Company-wide same store sales decreased 4.7% for the 13-weeks

ended September 30, 2023 as compared to the same period of last

year. For the year ended September 30, 2023, company-wide same

store sales, excluding Gallagher's Steakhouse which was closed for

part of the year, increased 1.4% as compared to last year.

The Company's EBITDA, excluding a non-cash goodwill impairment

charge in the amount of $10,000,000 (as explained below) and

adjusted for other items all as set out in the table below, for the

13 weeks ended September 30, 2023 was $585,000 versus $2,352,000

for the 13 weeks ended October 1, 2022. Net loss attributable to

Ark Restaurant Corp. for the 13 weeks ended September 30, 2023,

which includes the goodwill impairment charge and related tax

benefit, was $(10,364,000) or $(2.88) per basic and diluted share

compared to net income of $762,000 or $0.21 per basic and diluted

share, for the 13 weeks ended October 1, 2022. EBITDA is a Non-GAAP

Financial Measure. Please see "Non-GAAP Financial Information" at

the end of this news release.

The Company's EBITDA, excluding the non-cash goodwill impairment

charge of $10,000,000, gains on the forgiveness of Paycheck

Protection Program Loans (the "PPP Loan Forgiveness") and adjusted

for other items all as set out in the table below, for the year

ended September 30, 2023 was $9,266,000 versus $13,987,000 for the

year ended October 1, 2022. Net loss attributable to Ark Restaurant

Corp. for the year ended September 30, 2023, which includes the

goodwill impairment charge and related tax benefit and PPP Loan

Forgiveness of $272,000, was $(5,928,000), or $(1.65) per basic and

diluted share, compared to net income of $9,281,000, which includes

PPP Loan Forgiveness of $2,420,000, or $2.61 and $2.58 per basic

and diluted share, respectively, for the year ended October 1,

2022. EBITDA is a Non-GAAP Financial Measure. Please see "Non-GAAP

Financial Information" at the end of this news release.

As of September 30, 2023, the Company had cash and cash

equivalents of $13,415,000 and total outstanding debt of

$7,222,000.

Other Matters

In performing its goodwill impairment test as of September 30,

2023, the Company determined that a triggering event had occurred.

Due to the volatility of the Company's stock price in the fourth

quarter of fiscal 2023, the upcoming expiration of the current

Bryant Park Grill & Cafe and The Porch at Bryant Park leases on

April 30, 2025 and the related requests for proposals from the

landlord for both locations received in July 2023 and September

2023, respectively (see Note 11 - Commitments and Contingencies to

the Consolidated Financial Statements), the Company determined that

there were indicators of potential impairment of its goodwill as of

September 30, 2023. As such, the Company performed a qualitative

and quantitative assessment for its goodwill. The fair value of the

equity was determined using the income approach. Given the

relatively low volume of shares traded and the lack of reliable

market data as of September 30, 2023, the Company determined the

income approach provided the best approximation of fair value. In

the income approach, we utilized a discounted cash flow analysis,

which involved estimating the expected future after-tax cash flows

generated and then discounting those cash flows to present value,

reflecting the relevant risks associated with the achievement of

projected cash flows, the possibility that the Bryant Park Grill

& Cafe and The Porch at Bryant Park leases may not be renewed

beyond their expirations on April 30, 2025 (see Note 11 -

Commitments and Contingencies), and the time value of money. This

approach requires the use of significant estimates and assumptions,

including forecasted revenue growth rates, forecasted cash flows

from operations, and discount rates that reflect the risk inherent

in the future cash flows.

Based on the impairment analysis, the carrying amount of our

equity exceeded its estimated fair value, which indicated an

impairment of the carrying value of our goodwill. Accordingly,

during the fourth quarter of fiscal 2023, the Company recorded a

pre-tax non-cash goodwill impairment charge of $10,000,000.

About Ark Restaurants Corp.

Ark Restaurants owns and operates 17 restaurants and bars, 16

fast food concepts and catering operations primarily in New York

City, Florida, Washington, DC, Las Vegas, Nevada and the gulf coast

of Alabama. Four restaurants are located in New York City, one is

located in Washington, DC, five are located in Las Vegas, Nevada,

one is located in Atlantic City, New Jersey, four are located on

the east coast of Florida and two are located on the Gulf Coast of

Alabama. The Las Vegas operations include four restaurants within

the New York-New York Hotel & Casino Resort and operation of

the hotel's room service, banquet facilities, employee dining room

and six food court concepts and one restaurant within the Planet

Hollywood Resort and Casino. In Atlantic City, New Jersey, the

Company operates a restaurant in the Tropicana Hotel and Casino.

The Florida operations include the Rustic Inn in Dania Beach,

Shuckers in Jensen Beach, JB’s on the Beach in Deerfield Beach,

Blue Moon Fish Company in Lauderdale-by-the-Sea and the operation

of four fast food facilities in Tampa and six fast food facilities

in Hollywood, each at a Hard Rock Hotel and Casino operated by the

Seminole Indian Tribe at these locations. In Alabama, the Company

operates two Original Oyster Houses, one in Gulf Shores and one in

Spanish Fort.

Cautionary Note Regarding Forward-Looking Statements

Except for historical information, this news release contains

forward-looking statements, within the meaning of Section 27A of

the Securities Act of 1933, as amended and Section 21E of the

Securities Exchange Act of 1934, as amended. These statements

involve unknown risks, and uncertainties that may cause the

Company's actual results or outcomes to be materially different

from those anticipated and discussed herein. Important factors that

might cause such differences are discussed in the Company's filings

with the Securities and Exchange Commission. The Company disclaims

any intention or obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise. Actual results could differ materially from those

anticipated in these forward-looking statements, if new information

becomes available in the future.

Non-GAAP Financial Information

This news release includes non-generally accepted accounting

principles ("GAAP") performance measures. Although EBITDA is not a

measure of performance or liquidity calculated in accordance with

GAAP, the Company believes the use of this non-GAAP financial

measure enhances an overall understanding of the Company's past

financial performance as well as providing useful information to

the investor because of its historical use by the Company as both a

performance measure and measure of liquidity, and the use of EBITDA

by virtually all companies in the restaurant sector as a measure of

both performance and liquidity. However, investors should not

consider this measure in isolation or as a substitute for net

income (loss), operating income (loss), cash flows from operating

activities or any other measure for determining the Company's

operating performance or liquidity that is calculated in accordance

with GAAP as it may not necessarily be comparable to similarly

titled measure employed by other companies.

ARK RESTAURANTS CORP.

Consolidated Statements of

Operations

(In Thousands, Except per share

amounts)

13 Weeks Ended

September 30,

2023

13 Weeks Ended October 1,

2022

52 Weeks Ended

September 30,

2023

52 Weeks Ended

October 1,

2022

TOTAL REVENUES

$

44,400

$

46,884

$

184,793

$

183,674

COSTS AND EXPENSES:

Food and beverage cost of sales

12,152

13,036

49,624

52,573

Payroll expenses

17,295

16,074

66,322

60,000

Occupancy expenses

5,884

6,367

23,472

22,181

Other operating costs and expenses

5,940

5,850

23,498

21,823

General and administrative expenses

2,752

3,082

12,407

12,936

Goodwill impairment

10,000

—

10,000

—

Depreciation and amortization

1,080

1,052

4,310

4,297

Total costs and expenses

55,103

45,461

189,633

173,810

OPERATING INCOME (LOSS)

(10,703

)

1,423

(4,840

)

9,864

OTHER (INCOME) EXPENSE:

Interest expense, net

161

305

906

1,083

Other income

(26

)

(37

)

(52

)

(421

)

Gain on forgiveness of PPP Loans

—

—

(272

)

(2,420

)

Total other (income) expense, net

135

268

582

(1,758

)

INCOME (LOSS) BEFORE PROVISION (BENEFIT)

FOR INCOME TAXES

(10,838

)

1,155

(5,422

)

11,622

Provision (benefit) for income taxes

(370

)

157

(64

)

1,448

CONSOLIDATED NET INCOME (LOSS)

(10,468

)

998

(5,358

)

10,174

Net (income) loss attributable to

non-controlling interests

104

(236

)

(570

)

(893

)

NET INCOME (LOSS) ATTRIBUTABLE TO ARK

RESTAURANTS CORP.

$

(10,364

)

$

762

$

(5,928

)

$

9,281

NET INCOME (LOSS) PER ARK RESTAURANTS

CORP. COMMON SHARE:

Basic

$

(2.88

)

$

0.21

$

(1.65

)

$

2.61

Diluted

$

(2.88

)

$

0.21

$

(1.65

)

$

2.58

WEIGHTED AVERAGE NUMBER OF COMMON SHARES

OUTSTANDING:

Basic

3,602

3,566

3,601

3,556

Diluted

3,602

3,616

3,601

3,603

EBITDA Reconciliation:

Income (loss) before provision (benefit)

for income taxes

$

(10,838

)

$

1,155

$

(5,422

)

$

11,622

Depreciation and amortization

1,080

1,052

4,310

4,297

Interest expense, net

161

305

906

1,083

EBITDA (a)

$

(9,597

)

$

2,512

$

(206

)

$

17,002

EBITDA, adjusted:

EBITDA (as defined) (a)

$

(9,597

)

$

2,512

$

(206

)

$

17,002

Non-cash stock option expense

78

76

314

298

Goodwill impairment

10,000

—

10,000

—

Gain on forgiveness of PPP Loans

—

—

(272

)

(2,420

)

Net (income) loss attributable to

non-controlling interests

104

(236

)

(570

)

(893

)

EBITDA, as adjusted

$

585

$

2,352

$

9,266

$

13,987

(a)

EBITDA is defined as earnings before interest, taxes, depreciation

and amortization. A reconciliation of EBITDA to the most comparable

GAAP financial measure, pre-tax income, is included above.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231218063402/en/

Anthony J. Sirica (212) 206-8800

ajsirica@arkrestaurants.com

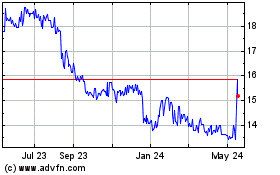

Ark Restaurants (NASDAQ:ARKR)

Historical Stock Chart

From Feb 2025 to Mar 2025

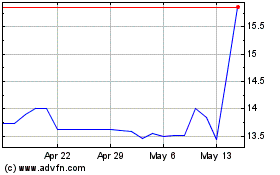

Ark Restaurants (NASDAQ:ARKR)

Historical Stock Chart

From Mar 2024 to Mar 2025