Anavex Life Sciences Reports Fiscal 2024 Fourth Quarter Financial Results and Provides Business Update

December 23 2024 - 6:30AM

Anavex Life Sciences Corp. (“Anavex” or the “Company”) (Nasdaq:

AVXL), a clinical-stage biopharmaceutical company focused on

developing innovative treatments for Alzheimer's disease,

Parkinson's disease, schizophrenia, neurodevelopmental,

neurodegenerative, and rare diseases, including Rett syndrome, and

other central nervous system (CNS) diseases, today reported

financial results for its fourth quarter and fiscal year ended

September 30, 2024.

“We are excited about the potential to advance a

novel treatment for early Alzheimer’s disease with convenient oral

dosing and our team remains deeply committed to executing on our

momentum,” said Christopher U Missling, PhD, President and Chief

Executive Officer of Anavex. “I am proud of the strides the Anavex

team has made in the recent quarter to potentially making a

difference for individuals suffering from Alzheimer’s disease, by

presenting a scalable treatment alternative alongside the ease of

oral administration.”

Recent Highlights:

- On December 23, 2024, Anavex announced that the European

Medicines Agency (EMA) has accepted for review the Marketing

Authorization Application (MAA) for blarcamesine (ANAVEX®2-73), an

investigational drug for the treatment of Alzheimer’s disease.

- On December 9, 2024, Anavex announced its upcoming presentation

of topline long-term data from the Phase IIb/III ATTENTION-AD

Open-Label-Extension (OLE) trial at the J.P. Morgan 2025 Healthcare

Conference, taking place January 13–16, 2025, in San Francisco,

CA.

- On December 2, 2024, Anavex announced its participation in a

fireside chat which was held December 4th, 2024, at the 7th Annual

Evercore ISI HealthCONx Conference 2024 in Coral Gables, FL.

- On November 26, 2024, Anavex announced the submission of the

blarcamesine (ANAVEX®2-73) MAA (Marketing Authorization

Application) to the European Medicines Agency (EMA). The MAA

submission is for the treatment of Alzheimer’s Disease. There are

an estimated 7 million people in Europe with Alzheimer’s disease, a

number expected to double by 2030, according to the European Brain

Council.1

- On November 25, 2024, Anavex reported the acceptance of a

peer-reviewed manuscript titled “Blarcamesine for the treatment of

Early Alzheimer’s Disease: Results from the ANAVEX2-73-AD-004 Phase

IIB/III trial,” in a medical journal with focus on Alzheimer’s

disease. The publication date is expected around Q4 2024/Q1

2025.

- On October 31, 2024, Anavex presented new data from the Phase

IIb/III study showing blarcamesine (ANAVEX®2-73), once daily

orally, demonstrates pre-specified clinical efficacy through

upstream SIGMAR1 activation. Clinical data confirmed the mechanism

of action by pre-specified SIGMAR1 gene analysis in people with

early Alzheimer's disease. The data were presented by Marwan Noel

Sabbagh, MD, Professor of Neurology at Barrow Neurological

Institute and Chairman of the Anavex Scientific Advisory Board at

the Clinical Trials on Alzheimer’s Disease (CTAD) conference, in

Madrid, Spain.

- On October 17, 2024, Anavex announced encouraging preliminary

electroencephalography (EEG) biomarker results from Part A of the

ongoing placebo-controlled Phase 2 clinical study of ANAVEX®3-71

for the treatment of schizophrenia. Preliminary results

demonstrated a dose-dependent effect of ANAVEX®3-71 on two key EEG

biomarkers in patients with schizophrenia. Anavex expects

data from Part B of the placebo-controlled Phase 2 study, which

includes more participants and a longer treatment duration, in the

first half of 2025.

Financial Highlights:

- Cash and cash equivalents of $132.2 million at September 30,

2024 compared to $151.0 million at September 30, 2023. As of fiscal

year end, the Company anticipates at the current cash utilization

rate, a runway of approximately 4 years.

- General and administrative expenses for the fourth quarter of

$2.8 million compared to $2.6 million for the comparable quarter of

fiscal 2023.

- Research and development expenses for the fourth quarter of

$11.6 million compared to $10.1 million for the comparable quarter

of fiscal 2023.

- Net loss for the fourth quarter of $11.6 million, or $0.14 per

share, compared to a net loss of $10.1 million, or $0.12 per share

for the comparable quarter of fiscal 2023.

The financial information for the fiscal year

ended September 30, 2024, should be read in conjunction with the

Company’s consolidated financial statements, which will appear on

EDGAR, www.sec.gov and will be available on the Anavex website at

www.anavex.com.

Webcast / Conference Call Information:

The live webcast of the conference call will be available on

Anavex’s website at www.anavex.com.

The conference call can be also accessed by

dialing 1 929 205 6099 for participants in the U.S. using the

Meeting ID# 814 6482 4038 and reference passcode 336064. A replay

of the conference call will also be available on Anavex’s website

for up to 30 days.

About Anavex Life Sciences Corp.

Anavex Life Sciences Corp. (Nasdaq: AVXL) is a

publicly traded biopharmaceutical company dedicated to the

development of novel therapeutics for the treatment of

neurodegenerative, neurodevelopmental, and neuropsychiatric

disorders, including Alzheimer's disease, Parkinson's disease,

schizophrenia, Rett syndrome, and other central nervous system

(CNS) diseases, pain, and various types of cancer. Anavex's lead

drug candidate, ANAVEX®2-73 (blarcamesine), has successfully

completed a Phase 2a and a Phase 2b/3 clinical trial for

Alzheimer's disease, a Phase 2 proof-of-concept study in

Parkinson's disease dementia, and both a Phase 2 and a Phase 3

study in adult patients and one Phase 2/3 study in pediatric

patients with Rett syndrome. ANAVEX®2-73 is an orally available

drug candidate designed to restore cellular homeostasis by

targeting SIGMAR1 and muscarinic receptors. Preclinical studies

demonstrated its potential to halt and/or reverse the course of

Alzheimer's disease. ANAVEX®2-73 also exhibited anticonvulsant,

anti-amnesic, neuroprotective, and anti-depressant properties in

animal models, indicating its potential to treat additional CNS

disorders, including epilepsy. The Michael J. Fox Foundation for

Parkinson's Research previously awarded Anavex a research grant,

which fully funded a preclinical study to develop ANAVEX®2-73 for

the treatment of Parkinson's disease. We believe that ANAVEX®3-71,

which targets SIGMAR1 and M1 muscarinic receptors, is a promising

clinical stage drug candidate demonstrating disease-modifying

activity against the major hallmarks of Alzheimer's disease in

transgenic (3xTg-AD) mice, including cognitive deficits, amyloid,

and tau pathologies. In preclinical trials, ANAVEX®3-71 has shown

beneficial effects on mitochondrial dysfunction and

neuroinflammation. Further information is available at

www.anavex.com. You can also connect with the Company on Twitter,

Facebook, Instagram, and LinkedIn.

Forward-Looking Statements

Statements in this press release that are not

strictly historical in nature are forward-looking statements. These

statements are only predictions based on current information and

expectations and involve a number of risks and uncertainties.

Actual events or results may differ materially from those projected

in any of such statements due to various factors, including the

risks set forth in the Company’s most recent Annual Report on Form

10-K filed with the SEC. Readers are cautioned not to place undue

reliance on these forward-looking statements, which speak only as

of the date hereof. All forward-looking statements are qualified in

their entirety by this cautionary statement and Anavex Life

Sciences Corp. undertakes no obligation to revise or update this

press release to reflect events or circumstances after the date

hereof.

|

Anavex Life Sciences Corp. |

|

Consolidated Statements of Operations and Comprehensive Loss |

|

(in thousands, except share and per share amounts) |

| |

| |

Three months ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

| Operating

Expenses |

|

|

| General and

administrative |

$ |

2,781 |

|

$ |

2,592 |

|

| Research and development |

|

11,555 |

|

|

10,061 |

|

| Total operating

expenses |

|

14,336 |

|

|

12,653 |

|

| Operating

loss |

|

(14,336 |

) |

|

(12,653 |

) |

| |

|

|

| Other income

(expense) |

|

|

| Grant income |

|

75 |

|

|

- |

|

| Research and development

incentive income |

|

700 |

|

|

670 |

|

| Interest income, net |

|

1,759 |

|

|

1,958 |

|

| Foreign exchange gain

(loss) |

|

117 |

|

|

(186 |

) |

| Gain on write-off of accounts

payable |

|

(59 |

) |

|

- |

|

| Total other income,

net |

|

2,592 |

|

|

2,442 |

|

| Net loss before provision for

income taxes |

|

(11,744 |

) |

|

(10,211 |

) |

| Income tax recovery,

current |

|

124 |

|

|

64 |

|

| Net loss and

comprehensive loss |

$ |

(11,620 |

) |

$ |

(10,147 |

) |

| |

|

|

| Net loss per share |

|

|

|

Basic and diluted |

$ |

(0.14 |

) |

$ |

(0.12 |

) |

| |

|

|

| Weighted average

number of shares outstanding |

|

|

Basic and diluted |

|

84,795,517 |

|

|

81,973,250 |

|

|

Anavex Life Sciences Corp. |

|

Consolidated Statements of Operations and Comprehensive Loss |

|

(in thousands, except share and per share amounts) |

| |

| |

Twelve months ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

| Operating

Expenses |

|

|

| General and

administrative |

$ |

11,039 |

|

$ |

12,039 |

|

| Research and development |

|

41,838 |

|

|

43,717 |

|

| Total operating

expenses |

|

52,877 |

|

|

55,756 |

|

| Operating

loss |

|

(52,877 |

) |

|

(55,756 |

) |

| |

|

|

| Other income

(expense) |

|

|

| Grant income |

|

75 |

|

|

25 |

|

| Research and development

incentive income |

|

2,291 |

|

|

2,718 |

|

| Interest income, net |

|

7,320 |

|

|

6,519 |

|

| Other financing expense |

|

- |

|

|

(964 |

) |

| Foreign exchange gain

(loss) |

|

189 |

|

|

(40 |

) |

| Total other income,

net |

|

9,875 |

|

|

8,258 |

|

| Net loss before provision for

income taxes |

|

(43,002 |

) |

|

(47,498 |

) |

| Income tax expense,

current |

|

- |

|

|

(7 |

) |

| Net loss and

comprehensive loss |

$ |

(43,002 |

) |

$ |

(47,505 |

) |

| |

|

|

| Net loss per share |

|

|

|

Basic and diluted |

$ |

(0.52 |

) |

$ |

(0.60 |

) |

| |

|

|

| Weighted average

number of shares outstanding |

|

|

Basic and diluted |

|

83,468,049 |

|

|

79,787,596 |

|

|

|

|

Anavex Life Sciences Corp. |

|

Consolidated Balance Sheets |

|

(in thousands, except share and per share amounts) |

| |

|

|

| |

September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

Assets |

|

|

|

Current |

|

|

|

Cash and cash equivalents |

$ |

132,187 |

|

$ |

151,024 |

|

|

Incentive and tax receivables |

|

2,449 |

|

|

2,709 |

|

|

Prepaid expenses and other current assets |

|

931 |

|

|

653 |

|

|

Total Assets |

$ |

135,567 |

|

$ |

154,386 |

|

|

|

|

|

|

Liabilities and stockholders' equity |

|

|

|

Current Liabilities |

|

|

|

Accounts payable |

$ |

9,627 |

|

$ |

4,322 |

|

|

Accrued liabilities |

|

4,835 |

|

|

7,295 |

|

|

Deferred grant income |

|

842 |

|

|

917 |

|

|

Total Liabilities |

|

15,304 |

|

|

12,534 |

|

|

Capital Stock |

|

85 |

|

|

82 |

|

|

Additional paid-in capital |

|

456,249 |

|

|

434,839 |

|

|

Accumulated deficit |

|

(336,071 |

) |

|

(293,069 |

) |

|

Total Stockholders' Equity |

|

120,263 |

|

|

141,852 |

|

|

Total Liabilities and Stockholders' Equity |

$ |

135,567 |

|

$ |

154,386 |

|

| |

|

|

|

|

|

|

For Further Information:Anavex

Life Sciences Corp.Research & Business DevelopmentToll-free:

1-844-689-3939Email: info@anavex.com

Investors:

Andrew J. BarwickiInvestor

RelationsTel: 516-662-9461Email: andrew@barwicki.com

1 https://www.braincouncil.eu/projects/rethinking-alzheimers-disease/

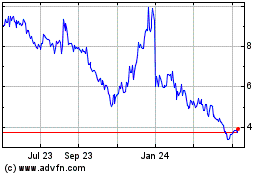

Anavex Life Sciences (NASDAQ:AVXL)

Historical Stock Chart

From Jan 2025 to Feb 2025

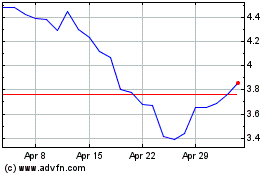

Anavex Life Sciences (NASDAQ:AVXL)

Historical Stock Chart

From Feb 2024 to Feb 2025