0001835856FALSE12/3112/3100018358562023-08-212023-08-210001835856us-gaap:CommonClassAMember2023-08-212023-08-210001835856betr:WarrantsExercisableForOneShareOfClassACommonStockMember2023-08-212023-08-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or Section 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 21, 2023

BETTER HOME & FINANCE HOLDING COMPANY

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-40143 | 93-3029990 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification Number) |

3 World Trade Center

175 Greenwich Street, 57th Floor

New York, NY 10007

(Address of principal executive offices, including zip code)

(415) 523-8837

Registrant’s telephone number, including area code

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation to the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

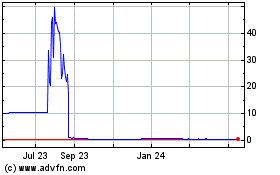

| Class A common stock, par value $0.0001 per share | | BETR | | The Nasdaq Stock Market LLC |

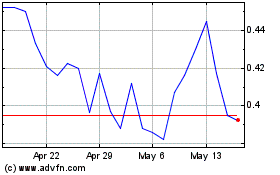

Warrants exercisable for one share of Class A common stock at an exercise price of $11.50 | | BETRW | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

INTRODUCTORY NOTE

Domestication and Merger

As previously announced, Aurora Acquisition Corp., prior to the Domestication described below, a Cayman Islands exempted company with limited liability, company number 366813 (prior to the Business Combination described below “Aurora” and, after the Business Combination, “Better Home & Finance” or the “Company”), entered into an Agreement and Plan of Merger, dated as of May 10, 2021, as amended as of October 27, 2021, November 9, 2021, November 30, 2021, August 26, 2022, February 24, 2023 and June 23, 2023 (as amended, the “Merger Agreement”) by and among Aurora, Better Holdco, Inc., a Delaware corporation (“Better”) and Aurora Merger Sub I, Inc., formerly a Delaware corporation and wholly owned subsidiary of Aurora (“Merger Sub”).

On August 21, 2023, as contemplated by the Merger Agreement, and as described in the section titled “Domestication Proposal” beginning on page 248 of the final prospectus and definitive proxy statement, dated July 27, 2023 (the “Proxy Statement/Prospectus”), filed with the U.S. Securities and Exchange Commission (the “SEC”), Aurora filed a notice of deregistration with the Cayman Islands Registrar of Companies, together with the necessary accompanying documents, and filed a certificate of incorporation and a certificate of corporate domestication with the Secretary of State of the State of Delaware, under which Aurora was transferred by way of continuation from the Cayman Islands and domesticated as a Delaware corporation (the “Domestication”). As a result of and upon the effective time of the Domestication, (1) each of the then-issued and outstanding Class A ordinary shares, par value $0.0001 per share, of Aurora (the “Aurora Class A ordinary shares”) converted automatically, on a one-for-one basis, into a share of Class A common stock, par value $0.0001 per share, of Better Home & Finance (the “Better Home & Finance Class A common stock”), (2) each of the then-issued and outstanding Class B ordinary shares, par value $0.0001 per share, of Aurora (the “Aurora Class B ordinary shares”) converted automatically, on a one-for-one basis, into a share of Better Home & Finance Class A common stock, (3) a new class of non-voting stock, the Better Home & Finance Class C common stock, par value $0.0001 per share, was created (the “Better Home & Finance Class C common stock”) and a sufficient number of shares thereof authorized to effect the transactions contemplated under the Merger Agreement and under the Ancillary Agreements (as defined in the Merger Agreement), (5) each then-issued and outstanding warrant of Aurora converted automatically into a Better Home & Finance Warrant, pursuant to the Warrant Agreement, dated as of March 3, 2021, by and between Aurora and Continental Stock Transfer & Trust Company and (6) each then-issued and outstanding Aurora unit separated automatically into one share of Better Home & Finance Class A common stock and one-quarter of one Better Home & Finance Warrant.

Following the Domestication, on August 22, 2023, as previously announced and as contemplated by the Merger Agreement, and as described in the section titled “BCA Proposal” beginning on page 198 of the Proxy Statement/Prospectus, Merger Sub merged with and into Better, with Better surviving the merger (the “First Merger”) and Better merged with and into Aurora, with Aurora surviving the merger and changing its name to “Better Home & Finance Holding Company” (hereinafter referred to as “Better Home & Finance” or the “Company”) (such merger, the “Second Merger,” and together with the First Merger and the Domestication, the “Business Combination”).

The foregoing description of the Business Combination does not purport to be complete and is qualified in its entirety by the full text of the Merger Agreement, which is attached hereto as Exhibit 2.1 to this Current Report on Form 8-K (this “Report”), as well as Amendments No. 1, 2, 3, 4, 5, and 6 to the Merger Agreement, which are attached hereto as Exhibits 2.2-2.7 to this Report, and the amended and restated certificate of incorporation of Better Home & Finance (the “Amended and Restated Certificate of Incorporation”), each of which is incorporated herein by reference.

Item 3.03Material Modification to Rights of Security Holders.

Following the Domestication on August 21, 2023, immediately prior to the consummation of the Business Combination, the Company filed the Amended and Restated Certificate of Incorporation with the Secretary of State of the State of Delaware. The material terms of the Amended and Restated Certificate of Incorporation and Better Home & Finance’s bylaws (the “Bylaws”) and the general effect upon the rights of holders of Better Home & Finance’s capital stock are discussed in the sections titled “Domestication Proposal” beginning on page 248 and

“Organizational Documents Proposal” beginning on page 251 of the Proxy Statement/Prospectus, which are incorporated by reference herein.

The disclosures set forth under the “Introductory Note,” in Item 1.01 and in Item 2.01 of this Report are also incorporated herein by reference. Copies of the Amended and Restated Certificate of Incorporation and the Bylaws are included as Exhibit 3.1 and 3.2, respectively, to this Report and are incorporated herein by reference.

Item 4.01Changes in Registrant’s Certifying Accountant.

(a)Dismissal of independent registered public accounting firm.

On August 22, 2023, the Audit Committee dismissed Marcum LLP (“Marcum”), the Company’s independent registered public accounting firm prior to consummation of the Business Combination, as the Company’s independent registered public accounting firm.

Marcum’s report on Aurora’s, the Company’s legal predecessor, financial statements as of December 31, 2022 and 2021 and for the years ended December 31, 2022 and December 31, 2021, did not contain an adverse opinion or a disclaimer of opinion, and were not qualified or modified as to uncertainties, audit scope or accounting principles, except for an explanatory paragraph regarding Aurora’s ability to continue as a going concern. During the fiscal years ended December 31, 2022 and December 31, 2021, and through June 30, 2023, there were no disagreements between Aurora or the Company, as applicable, and Marcum on any matter of accounting principles or practices, financial disclosure or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of Marcum, would have caused it to make reference to the subject matter of the disagreements in its reports on Aurora’s financial statements for such period. During the fiscal years ended December 31, 2022 and December 31, 2021, and through June 30, 2023, there were no “reportable events” (as defined in Item 304(a)(1)(v) of Regulation S-K under the Exchange Act), other than the material weaknesses in Aurora’s internal controls over financial reporting identified by management related to the accounting for complex financial instruments and unusual transactions, including in connection with the classification of Aurora’s underwriters’ over-allotment option in connection with Aurora’s initial public offering, and reconciliations surrounding expenses paid by related parties and accounts payable, which resulted in the restatement of Aurora’s previously issued financial statements as of and for the fiscal year ended December 31, 2021 and the quarterly periods ended September 30, 2021, March 31, 2022, June 30, 2022 and September 30, 2022.

The Company has provided Marcum with a copy of the foregoing disclosures and has requested that Marcum furnish the Company with a letter addressed to the SEC stating whether it agrees with the statements made by the Company set forth above. A copy of Marcum’s letter, dated August 25, 2023, is filed as Exhibit 16.1 to this Report.

(b)Disclosures regarding the new independent registered public accounting firm.

On August 22, 2023, the Audit Committee approved the engagement of Deloitte & Touche LLP (“Deloitte”) as the Company’s independent registered public accounting firm, subject to Deloitte’s customary client acceptance procedures and execution of an engagement letter. Deloitte served as independent registered public accounting firm of Better beginning in 2019. During the years ended December 31, 2022 and 2021 and the subsequent interim period through June 30, 2023, Aurora, the Company or Better, as applicable, did not consult with Deloitte with respect to (i) the application of accounting principles to a specified transaction, either completed or proposed, the type of audit opinion that might be rendered on Aurora, the Company’s or Better’s financial statements, and neither a written report nor oral advice was provided to Aurora, the Company or Better, as applicable, that Deloitte concluded was an important factor considered by Aurora, the Company or Deloitte, as applicable, in reaching a decision as to any accounting, auditing, or financial reporting issue, or (ii) any other matter that was the subject of a disagreement or a reportable event (each as defined above).

Item 5.03Amendments to the Articles of Incorporation or Bylaws; Change in Fiscal Year.

Following the Domestication on August 21, 2023, immediately prior to the consummation of the Business Combination, the Company filed the Amended and Restated Certificate of Incorporation with the Secretary of State of the State of Delaware. The material terms of the Amended and Restated Certificate of Incorporation and the

Bylaws and the general effect upon the rights of holders of Better Home & Finance’s capital stock are discussed in the sections titled “Domestication Proposal” beginning on page 248 and “Organizational Documents Proposal” beginning on page 251, which are incorporated by reference herein.

The disclosures set forth under the “Introductory Note” of this Report are also incorporated herein by reference. Copies of the Amended and Restated Certificate of Incorporation and the Bylaws are included as Exhibit 3.1 and 3.2, respectively, to this Report and are incorporated herein by reference.

(d)Exhibits:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Incorporated by Reference |

| Exhibit | | Description | | Form | | Exhibit | | Filing Date |

| 2.1* | | | | 8-K | | 2.1 | | May 14, 2021 |

| 2.2 | | | | 8-K | | 2.1 | | October 29, 2021 |

| 2.3 | | | | S-4/A | | 2.4 | | November 12, 2021 |

| 2.4 | | | | 8-K | | 2.1 | | December 2, 2021 |

| 2.5 | | | | 8-K | | 2.1 | | August 29, 2022 |

| 2.6 | | | | 8-K | | 2.1 | | March 2, 2023 |

| 2.7 | | | | 8-K | | 2.1 | | June 26, 2023 |

| 3.1 | | | | | | | | |

| 3.2 | | | | | | | | |

| 16.1 | | | | | | | | |

__________________

*Certain of the exhibits and schedules to this Exhibit have been omitted in accordance with Regulation S-K Item 601(a)(5). The Registrant agrees to furnish a copy of all omitted exhibits and schedules to the SEC upon its request.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| Date: August 25, 2023 |

| |

| Better Home & Finance Holding Company |

| |

| By: | /s/ Kevin Ryan |

| Name: | Kevin Ryan |

| Title: | Chief Financial Officer and President |

CERTIFICATE OF INCORPORATION

OF BETTER HOME & FINANCE HOLDING COMPANY

ARTICLE I

The name of this corporation is Better Home & Finance Holding Company (the “Corporation”).

ARTICLE II

The address of the Corporation’s registered office in the State of Delaware is 108 West 13th Street, in the City of Wilmington, County of New Castle, 19801. The name of its registered agent at such address is [Business Filings Incorporated.

ARTICLE III

The nature of the business or purposes to be conducted or promoted by the Corporation is to engage in any lawful act or activity for which corporations may be organized under the General Corporation Law of the State of Delaware (the “General Corporation Law”).

ARTICLE IV

Section 4.1 Total Authorized Capital Stock.

(a) The total number of shares of all classes of stock that the Corporation has authority to issue is 3,400,000,000 shares, consisting of four (4) classes: 1,800,000,000 shares of Class A Common Stock, $0.0001 par value per share (“Class A Common Stock”), 700,000,000 shares of Class B Common Stock, $0.0001 par value per share (“Class B Common Stock”), 800,000,000 shares of Class C Common Stock, $0.0001 par value per share (“Class C Common Stock” and, together with the Class A Common Stock and the Class B Common Stock, the “Common Stock”) and 100,000,000 shares of Preferred Stock, $0.0001 par value per share (“Preferred Stock”).

(b) The number of authorized shares of Class A Common Stock, Class B Common Stock or Class C Common Stock may be increased or decreased (but not below the number of shares thereof then outstanding) by the affirmative vote of the holders of capital stock representing a majority of the voting power of all the then-outstanding shares of capital stock of the Corporation entitled to vote thereon, irrespective of the provisions of Section 242(b)(2) of the General Corporation Law, and no vote of the holders of any class of Common Stock voting separately as a class shall be required therefor.

(c) Except for the issuance of shares of Class B Common Stock issuable in respect of Options or Convertible Securities (each as defined below) outstanding immediately prior to the Effectiveness Date, a dividend payable in accordance with Section 4.3(c) of Article IV, or a subdivision, combination or reclassification in accordance with Section 4.3(d) of Article IV, the Corporation shall not at any time after the Effectiveness Date issue any additional shares of Class B Common Stock.

Section 4.2 Preferred Stock.

(a) The Corporation’s Board of Directors (the “Board”) is authorized, subject to any limitations prescribed by the law of the State of Delaware, by resolution or resolutions adopted from time to time, to provide for the issuance of shares of Preferred Stock in one (1) or more series, and, by filing a certificate of designation pursuant to the applicable law of the State of Delaware (the “Certificate of Designation”), to establish from time to time the number of shares to be included in each such series, to fix the designation, vesting, powers (including voting powers), preferences and relative, participating, optional or other rights (and the qualifications, limitations or restrictions thereof) of the shares of each such series and to increase (but not above the total number of authorized shares of the class) or decrease (but not below the number of shares of such series then outstanding) the number of shares of any such series. The number of authorized shares of Preferred Stock may also be increased or decreased (but not below the number of shares thereof then outstanding) by the affirmative vote of the holders of a majority of the voting power of all the then-outstanding shares of capital stock of the Corporation entitled to vote thereon, without a separate vote of the holders of the Preferred Stock or any series thereof, irrespective of the provisions of Section 242(b)(2) of the General Corporation Law, unless a vote of any such holders is required pursuant to the terms of any Certificate of Designation designating a series of Preferred Stock.

(b) Except as otherwise expressly provided in any Certificate of Designation designating any series of Preferred Stock pursuant to the foregoing provisions of this Article IV, (i) any new series of Preferred Stock may be designated, fixed and determined as provided herein by the Board without approval of the holders of Common Stock or the holders of Preferred Stock, or any series thereof, and (ii) any such new series may have powers, preferences and rights, including, without limitation, voting rights, dividend rights, liquidation rights, redemption rights and conversion rights, senior to, junior to or pari passu with the rights of the Common Stock, the Preferred Stock or any future class or series of Preferred Stock or Common Stock.

Section 4.3 Rights of Common Stock.

(a) Except as otherwise provided in this Certificate of Incorporation or required by applicable law, shares of Class A Common Stock, Class B Common Stock and Class C Common Stock shall have the same rights and powers, rank equally (including as to dividends and distributions, and upon any liquidation, dissolution or winding up of the Corporation), share ratably and be identical in all respects and as to all matters.

(b) Except as otherwise expressly provided by this Certificate of Incorporation or as required by applicable law, the holders of shares of Class A Common Stock, Class B Common Stock and Class C Common Stock shall be entitled to notice of any stockholders’ meeting in accordance with the Bylaws of the Corporation (the “Bylaws”), and the holders of shares of Class A Common Stock and Class B Common Stock shall (i) at all times vote together as a single class on all matters (including the election of directors) submitted to a vote of the stockholders of the Corporation and (ii) be entitled to vote upon such matters and in such manner as may be provided by applicable law; provided, however, that, except as otherwise required by law, holders of shares of Class A Common Stock and Class B Common Stock shall not be entitled to vote on any amendment to this Certificate of Incorporation (including any Certificate of Designation relating to any series of Preferred Stock) that relates solely to the terms of one (1) or more outstanding series of Preferred Stock if the holders of such affected series are entitled, either separately or together as a class with the holders of one (1) or more other such series, to vote thereon pursuant to this Certificate of Incorporation (including any Certificate of Designation relating to any series of Preferred Stock). Except as otherwise expressly provided herein or required by applicable law, each holder of Class A Common Stock shall have the right to one (1) vote per share of Class A Common Stock held of record by such holder and each holder of Class B Common Stock shall have the right to three (3) votes per share of Class B Common Stock held of record by such holder. Except as otherwise required by applicable law or provided in this Certificate of Incorporation, shares of Class C Common Stock will not be entitled to vote with respect to any matter and will not entitle the record holder thereof to any voting powers.

(c) Shares of Class A Common Stock, Class B Common Stock and Class C Common Stock shall be treated equally, identically and ratably, on a per share basis, with respect to any dividends or distributions as may be declared and paid from time to time by the Board out of any assets of the Corporation legally available therefor; provided, however, that in the event a dividend is paid in the form of shares of Class A Common Stock, Class B Common Stock or Class C Common Stock (or rights to acquire such shares), then holders of Class A Common Stock shall receive shares of Class A Common Stock (or rights to acquire such shares, as the case may be), holders of Class B Common Stock shall receive shares of Class B Common Stock (or rights to acquire such shares, as the case may be) and holders of Class C Common Stock shall receive shares of Class C Common Stock (or rights to acquire such shares, as the case may be), with holders of shares of Class A Common Stock, Class B Common Stock and Class C Common Stock receiving, on a per share basis, an identical number of shares of Class A Common Stock, Class B Common Stock or Class C Common Stock, as applicable. Notwithstanding the foregoing, the Board may pay or make a disparate dividend or distribution per share of Class A Common Stock, Class B Common Stock or Class C Common Stock (whether in the amount of such dividend or distribution payable per share, the form in which such dividend or distribution is payable, the timing of the payment, or otherwise) if such disparate dividend or distribution is approved in advance by the affirmative vote of the holders of a majority of the then-outstanding shares of Class A Common Stock, Class B Common Stock and Class C Common Stock, each voting separately as a class.

(d) Shares of Class A Common Stock, Class B Common Stock or Class C Common Stock may not be subdivided, combined or reclassified unless the shares of the other classes are concurrently therewith proportionately subdivided, combined or reclassified in a manner that maintains the same proportionate equity ownership between the holders of the outstanding Class A Common Stock, Class B Common Stock and Class C Common Stock on the record date for such subdivision, combination or reclassification; provided, however, that shares of one (1) such class may be subdivided, combined or reclassified in a different or disproportionate manner if such subdivision, combination or reclassification is approved in advance by the affirmative vote of the holders of a majority of the then-outstanding shares of Class A Common Stock, Class B Common Stock and Class C Common Stock, each voting separately as a class.

(e) Subject to any preferential or other rights of any holders of Preferred Stock then outstanding, upon the liquidation, dissolution or winding up of the Corporation, whether voluntary or involuntary, holders of Class A Common Stock, Class B Common Stock and Class C Common Stock will be entitled to receive ratably all assets of the Corporation available for distribution to its stockholders unless disparate or different treatment of the shares of each such class with respect to distributions upon any such liquidation, dissolution or winding up is approved in advance by the affirmative vote of the holders of a majority of the then-outstanding shares of Class A Common, Class B Common Stock and Class C Common Stock, each voting separately as a class.

(f) In the case of any distribution or payment in respect of the shares of Class A Common Stock, Class B Common Stock or Class C Common Stock upon the merger or consolidation of the Corporation with or into any other entity, or in the case of any other transaction having an effect on stockholders substantially similar to that resulting from a merger or consolidation, such distribution or payment shall be made ratably on a per share basis among the holders of the Class A Common Stock, Class B Common Stock and Class C Common Stock as a single class; provided, however, that shares of one (1) such class may receive different or disproportionate distributions or payments in connection with such merger, consolidation or other transaction if (i) the only difference in the per share distribution to the holders of the Class A Common Stock, Class B Common Stock and Class C Common Stock is that any securities distributed to such holders have rights and obligations substantially similar to those set forth in this Certificate of Incorporation, including that the holder of a share Class B Common Stock have three (3) times the voting power of any securities distributed to the holder of a share of Class A Common Stock and any securities distributed to the holder of Class C Common Stock have no voting power except as otherwise required by applicable law or consistent with this Certificate of Incorporation, or (ii) such merger, consolidation or other transaction is approved by the affirmative vote of the holders of a majority of the then-outstanding shares of Class A Common Stock, Class B Common Stock and Class C Common Stock, each voting separately as a class.

ARTICLE V

Section 5.1 Optional Conversions of Common Stock.

(a) Each share of Class B Common Stock shall be convertible into one (1) fully paid and nonassessable share of Class A Common Stock or Class C Common Stock at the option of the holder thereof at any time upon written notice to the Corporation. Before any holder of Class B Common Stock shall be entitled to convert any of such holder’s shares of such Class B Common Stock into shares of Class A Common Stock or Class C Common Stock, such holder shall deliver an instruction, duly signed and authenticated in accordance with any procedures set forth in the Bylaws or any policies of the Corporation then in effect, at the principal corporate office of the Corporation or of any transfer agent for the Class B Common Stock, and shall give written notice to the Corporation at its principal corporate office of such holder’s election to convert the same and shall state therein the name or names in which the shares of Class A Common Stock or Class C Common Stock issuable on conversion thereof are to be registered on the books of the Corporation. The Corporation shall, as soon as practicable thereafter, register on the Corporation’s books ownership of the number of shares of Class A Common Stock or Class C Common Stock to which such record holder of Class B Common Stock, or to which the nominee or nominees of such record holder, shall be entitled as aforesaid.

(b) Each share of Class C Common Stock shall be convertible into one (1) fully paid and nonassessable share of Class A Common Stock at the option of the holder thereof at any time upon written notice to the Corporation. Before any holder of Class C Common Stock shall be entitled to convert any of such holder’s shares of such Class C Common Stock into shares of Class A Common Stock, such holder shall deliver an instruction, duly signed and authenticated in accordance with any procedures set forth in the Bylaws or any policies of the Corporation then in effect, at the principal corporate office of the Corporation or of any transfer agent for the Class C Common Stock, and shall give written notice to the Corporation at its principal corporate office of such holder’s election to convert the same and shall state therein the name or names in which the shares of Class A Common Stock issuable on conversion thereof are to be registered on the books of the Corporation. The Corporation shall, as soon as practicable thereafter, register on the Corporation’s books ownership of the number of shares of Class A Common Stock to which such record holder of Class C Common Stock, or to which the nominee or nominees of such record holder, shall be entitled as aforesaid. Any conversion described in this Section 5.1 or Article V shall be deemed to have occurred immediately prior to the close of business on the date such notice of the election to convert is received by the Corporation, and the person or persons entitled to receive the applicable shares of Common Stock issuable upon such conversion shall be treated for all purposes as the record holder or holders of such shares of Common Stock as of such date.

Section 5.2 Mandatory Class B Conversions.

(a) Each share of Class B Common Stock shall automatically, without further action by the Corporation or the holder thereof, be converted into one (1) fully paid and nonassessable share of Class A Common Stock at 5:00 p.m. in New York City, New York on the:

(i) trading day falling on or immediately after the date on which the number of shares of Class B Common Stock outstanding cease to be at least 5% of the total number of the then-outstanding shares of Common Stock,

(ii) trading day falling on or immediately after the date of the affirmative vote of the holders of Class B Common Stock representing at least eighty-five percent (85%) of the voting power of the then-outstanding shares of Class B Common Stock, voting as a single class, elect to convert all the then-outstanding shares of Class B Common Stock to Class A Common Stock; and

(iii) on any trading day specified by the Board no less than sixty and no more than 180 days following the date of the death or Permanent Disability of the Founder (each of the events referred to in clauses (i), (ii) and (iii) are referred to herein as an “Automatic Conversion” and, the date on which no shares of Class B Common Stock remain outstanding is referred to herein the “Final Class B Conversion Date”).

The Corporation shall provide notice of the Automatic Conversion of shares of Class B Common Stock pursuant to this Section 5.2 of Article V to record holders of such shares of Class B Common Stock as soon as practicable following the Automatic Conversion. Such notice shall be provided by any means then permitted by the General Corporation Law; provided, however, that no failure to give such notice nor any defect therein shall affect the validity of the Automatic Conversion. Upon and after the Automatic Conversion, the person(s) registered on the Corporation’s books as the record holder of the shares of Class B Common Stock so converted immediately prior to the Automatic Conversion shall be registered on the Corporation’s books as the record holder(s) of the shares of Class A Common Stock issued upon Automatic Conversion of such shares of Class B Common Stock, without further action on the part of any such record holder thereof. Immediately upon the effectiveness of the Automatic Conversion, the rights of the holders of shares of Class B Common Stock as such shall cease, and such holders shall be treated for all purposes as having become the record holder or holders of such shares of Class A Common Stock into which such shares of Class B Common Stock were converted.

(b) Each share of Class B Common Stock shall automatically, without further action by the Corporation or the holder thereof, be converted into one (1) fully paid and nonassessable share of Class A Common Stock, upon the occurrence of a Transfer (as defined below), other than a Permitted Transfer (as defined below), of such share of Class B Common Stock.

Section 5.3 Mandatory Class C Conversion.

(a) Following the Final Class B Conversion Date, on the date or time (including a time determined by the happening of a future event) specified by (i) the holders of a majority of the then-outstanding shares of Class C Common Stock, voting as a separate class, or (ii) two-thirds of the Whole Board (as defined below), each outstanding share of Class C Common Stock shall automatically, without further action by the Corporation or the holders thereof, convert into one (1) fully paid and nonassessable share of Class A Common Stock.

(b) Each share of Class C Common Stock shall automatically, without further action by the Corporation or the holder thereof, be converted into one (1) fully paid and nonassessable share of Class A Common Stock, upon the occurrence of a Transfer (as defined below), other than a Transfer by a holder of such share as of the Effectiveness Date or such holder’s Affiliate to an Affiliate of the holder of such share as of the Effectiveness Date, of such share of Class C Common Stock; provided that in the event that such transferee of such share ceases to be an Affiliate, then a Transfer shall be deemed to occur and such share shall automatically convert without further action by the Corporation or the holder thereof.

Section 5.4 Administrative Matters. The Corporation may, from time to time, establish such policies and procedures, not in violation of applicable law or this Certificate of Incorporation or the Bylaws, relating to the administration of the conversion of shares of the Class B Common Stock and Class C Common Stock into shares of Class A Common Stock as it may deem necessary or advisable. With respect to Class B Common Stock, if the Corporation has reason to believe that a Transfer that is not a Permitted Transfer has occurred, the Corporation may

request that the purported transferor furnish affidavits or other evidence to the Corporation as it reasonably deems necessary to determine whether a Transfer that is not a Permitted Transfer has occurred, and if such transferor does not within ten (10) days after the date of such request furnish sufficient (as determined in good faith by the Board) evidence to the Corporation (in the manner provided in the request) to enable the Corporation to determine that no such Transfer has occurred, any such shares of Class B Common Stock, to the extent not previously converted, shall be automatically converted into shares of Class A Common Stock with deemed effect from the date of such Transfer and such conversion shall thereupon be registered on the books and records of the Corporation. Any actions taken by such Transferee in its capacity as a stockholder of shares of Class B Common Stock after such purported Transfer and before conversion thereof shall be deemed null and void ab initio. In connection with any action of stockholders taken at a meeting, the stock ledger of the Corporation shall be presumptive evidence as to who are the stockholders entitled to vote in person or by proxy at any meeting of stockholders and the classes of shares held by each such stockholder and the number of shares of each class held by such stockholder.

Section 5.5 Definitions.

(a) “Affiliate” means, with respect to any specified person, any other person who or which, directly or indirectly, controls, is controlled by, or is under common control with such specified person, including any general partner, managing member, officer, director or manager of such person and any venture capital, private equity, investment advisor or other investment fund now or hereafter existing that is controlled by one or more general partners or managing members of, or is under common investment management (or shares the same management, advisory company or investment advisor) with, such person.

(b) “Convertible Security” means any evidences of indebtedness, shares or other securities (other than shares of Class B Common Stock) convertible into or exchangeable for Class B Common Stock, either directly or indirectly.

(c) “Effectiveness Date” means the date on which the First Effective Time (as defined in the Merger Agreement) occurs.

(d) “Founder” means Vishal Garg.

(e) “Family Member” means, with respect to a Qualified Stockholder, (i) the spouse of such Qualified Stockholder, (ii) the parents, grandparents, lineal descendants, siblings or lineal descendants of siblings of such Qualified Stockholder or (iii) the parents, grandparents, lineal descendants, siblings or lineal descendants of siblings of the spouse of such Qualified Stockholder. Lineal descendants and siblings shall include adopted persons, but only so long as they are adopted during their minority.

(f) “Merger Agreement” means that certain agreement and plan of merger, dated as of May 10, 2021, by and between Aurora Acquisition Corp., Aurora Merger Sub I, Inc. and Better Holdco, Inc.

(g) “Option” means any rights, options, restricted stock units or warrants to subscribe for, purchase or otherwise acquire Class B Common Stock or any Convertible Security.

(h) “Permanent Disability” means a permanent and total disability such that the Founder is unable to engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment which would reasonably be expected to result in death within twelve (12) months or which has lasted or would reasonably be expected to last for a continuous period of not less than twelve (12) months as determined by a licensed medical practitioner. In the event of a dispute whether the Founder has suffered a Permanent Disability, no Permanent Disability of the Founder shall be deemed to have occurred unless and until an affirmative ruling regarding such Permanent Disability has been made by a court of competent jurisdiction, and such ruling has become final and nonappealable.

(i) “Permitted Entity” means, with respect to a Qualified Stockholder, (i) any general partnership, limited partnership, limited liability company, corporation, trust or other entity only so long as one or more Qualified Stockholders hold direct or indirect Voting Control of such entity or (ii) solely with respect to a Qualified Stockholder that is a venture capital, private equity or similar private investment fund, any general partner, managing member, officer or director of such Qualified Stockholder or an affiliated investment fund now or hereafter existing that is controlled by one or more general partners or managing members of, or shares the same management or advisory company with, such Qualified Stockholder; or (iii) any other corporation, partnership, limited liability company, trust, individual or other person approved by the Board.

(j) “Permitted Family Member” means, with respect to a Qualified Stockholder, a Family Member of such Qualified Stockholder for only so long as such Qualified Stockholder retains Voting Control with respect to the shares of Class B Common Stock held by such Family Member.

(k) “Permitted Foundation” means, with respect to a Qualified Stockholder, a trust or corporation that is tax-exempt under the Code (as defined below) only so long as (i) one or more Qualified Stockholders have Voting Control with respect to the shares of Class B Common Stock held by such trust or corporation and (ii) the Transfer to such trust or organization does not involve any payment of cash, securities, property or other monetary consideration to such Qualified Stockholder.

(l) “Permitted IRA” means an Individual Retirement Account, as defined in Section 408(a) of the Internal Revenue Code (the “Code”), or a pension, profit sharing, stock bonus or other type of plan or trust of which a Qualified Stockholder is a participant or beneficiary and which satisfies the requirements for qualification under Section 401 of the Code but only so long as in each case such Qualified Stockholder has Voting Control with respect to the shares of Class B Common Stock held in such account, plan or trust.

(m) “Permitted Transfer” means any Transfer of a share of Class B Common Stock:

(i) by a Qualified Stockholder to (A) any Permitted Trust of such Qualified Stockholder, (B) any Permitted IRA of such Qualified Stockholder, (C) any Permitted Entity of such Qualified Stockholder, (D) any Permitted Foundation of such Qualified Stockholder, and (E) any Permitted Family Member of such Qualified Stockholder; or

(ii) by a Permitted Trust, Permitted IRA, Permitted Entity or Permitted Foundation of a Qualified Stockholder to (A) such Qualified Stockholder, or (B) any other Permitted Trust, Permitted IRA, Permitted Entity or Permitted Foundation of such Qualified Stockholder. For the avoidance of doubt, (1) a Transfer to any broker or other nominee of a Qualified Stockholder or its Permitted Trust, Permitted IRA, Permitted Entity or Permitted Foundation, acting in such nominee or agent role, shall be deemed a Permitted Transfer hereunder; (2) a Transfer to any custodian, executor, personal representative or other fiduciary who shall be a Qualifying Fiduciary for the account of the Qualified Stockholder or any Family Member shall be deemed a Permitted Transfer hereunder to such Qualified Stockholder or Family Member, as the case may be, (3) the direct Transfer of any share of Class B Common Stock by a holder thereof to any other person shall qualify as a “Permitted Transfer”, if such Transfer could have been completed indirectly through one or more transactions involving more than one Transfer, so long as each Transfer in such transaction or transactions would otherwise have qualified as a “Permitted Transfer”; and (4) a Transfer may qualify as a “Permitted Transfer” under any one or more than one of the clauses of this Section 5.5 of Article V as may be applicable to such Transfer, without regard to any proviso in, or requirement of, any other clause(s) of this Section 5.5 of Article V.

(n) “Permitted Transferee” means a transferee of shares of Class B Common Stock received in a Permitted Transfer.

(o) “Permitted Trust” means, with respect to a Qualified Stockholder, a trust of which each trustee is a Qualifying Fiduciary and which (i) is for the benefit of such Qualified Stockholder and/or persons other than such Qualified Stockholder, or (ii) under its terms such Qualified Stockholder has retained a “qualified interest” within the meaning of Section 2702(b)(1) of the Code or a reversionary interest, in either case (i) or (ii), only so long as such Qualified Stockholder holds Voting Control with respect to the shares of Class B Common Stock held by such trust.

(p) “Qualifying Fiduciary” means a person who (i) is an executor, personal representative, administrator, trustee (including a trustee of a voting trust), manager, managing member, general partner, director, officer or any other agent and is acting in such capacity and (ii) manages, controls or otherwise has decision-making authority in such capacity, but, in each case, only so long as one or more Qualified Stockholders holds Voting Control with respect to any shares of Class B Common Stock held by such person acting in such capacity.

(q) “Qualified Stockholder” means (i) each record holder of a share of Class B Common Stock on the Effectiveness Date (including, for the avoidance of doubt, each holder that received shares of Class B Common Stock pursuant to the Merger Agreement); (ii) each initial registered holder of any shares of Class

B Common Stock originally issued by the Corporation after the Effectiveness Date pursuant to the exercise or conversion of any Option or Convertible Security that, in each case, was outstanding as of the Effectiveness Date; (iii) each natural person who, prior to the Effectiveness Date, Transferred shares of capital stock of Better HoldCo, Inc. to a Permitted Trust, Permitted IRA, Permitted Entity, Permitted Foundation or Permitted Family Member.

(r) “Transfer” means any sale, assignment, transfer, conveyance, hypothecation or other transfer or disposition of such share or any legal or beneficial interest in such share, whether or not for value and whether voluntary or involuntary or by operation of law, of Common Stock, including, without limitation, a transfer of a share of Common Stock to a broker or other nominee (regardless of whether there is a corresponding change in beneficial ownership), or the transfer of, or entering into a binding agreement with respect to, Voting Control over such share by proxy or otherwise; provided, however, that the following shall not be considered a “Transfer” within the meaning of this Article V:

(i) the granting of a revocable proxy to officers or directors of the Corporation at the request of the Board in connection with actions to be taken at an annual or special meeting of stockholders or any other action of the stockholders permitted by this Certificate of Incorporation;

(ii) entering into or amending a voting trust, agreement or arrangement (with or without granting a proxy) solely with stockholders who are holders of Class B Common Stock that (A) is disclosed either in a Schedule 13D filed with the Securities and Exchange Commission or in writing to the Secretary of the Corporation, (B) either has a term not exceeding one (1) year or is terminable by the holder of the shares subject thereto at any time and (C) does not involve any payment of cash, securities, property or other consideration to the holder of the shares subject thereto other than the mutual promise to vote shares in a designated manner;

(iii) the granting of a proxy by SVF II Beaver (DE) LLC, a Delaware limited liability company, or its Permitted Transferees, in favor of Founder as contemplated by that certain Irrevocable Voting Proxy, dated as of April 7, 2021, by and between SVF II Beaver (DE) LLC and the Founder (as amended before the Effectiveness Date);

(iv) entering into a voting trust, agreement or arrangement (with or without granting a proxy) pursuant to a written agreement to which the Corporation is a party;

(v) the pledge of shares of Common Stock or granting a lien with respect thereto by a stockholder that creates a mere security interest in such shares pursuant to a bona fide loan or indebtedness transaction for so long as such stockholder continues to exercise Voting Control over such pledged shares; provided, however, that a foreclosure on such shares or other similar action by the pledgee shall constitute a Transfer unless such foreclosure or similar action qualifies as a Permitted Transfer;

(vi) the fact that, as of the Effectiveness Date or at any time after the Effectiveness Date, the spouse of any holder of Common Stock possesses or obtains an interest in such holder’s shares of Common Stock arising solely by reason of the application of the community property laws of any jurisdiction, so long as no other event or circumstance shall exist or have occurred that constitutes a Transfer of such shares of Common Stock (including a Transfer by operation of law pursuant to a qualified domestic order or in connection with a divorce settlement or any other court order);

(vii) in connection with a merger or consolidation of the Corporation with or into any other person, or in the case of any other transaction having an effect on stockholders substantially similar to that resulting from a merger or consolidation, that has been approved by the Board, the entering into a support, voting, tender or similar agreement or arrangement (in each case, with or without the grant of a proxy) that has also been approved by the Board;

(viii) the entering into a trading plan pursuant to Rule 10b5-1 under the Securities Exchange Act of 1934, as amended, with a broker or other nominee where the holder entering into the plan retains all voting control over the shares; provided, however, that a Transfer of such shares of Class B Common Stock by such broker or other nominee shall constitute a “Transfer” at the time of such Transfer; or

(ix) the entry into any legally binding contract or other arrangement providing for the Transfer of any share of Class B Common Stock during the period between (A) the entry into such contract or other arrangement and (B) the settlement of such Transfer; provided that (x) such settlement period does not exceed 180 days (or such longer period approved by the Board) and (y) the settlement of such Transfer, if such settlement occurs, occurs within such 180-day settlement period (or such longer period as may be approved by the Board).

A Transfer shall also be deemed to have occurred with respect to a share of Class B Common Stock beneficially held by an entity that is a Permitted Trust, Permitted IRA, Permitted Entity or Permitted Foundation, if there occurs any act or circumstance that causes such entity to no longer be a Permitted Trust, Permitted IRA, Permitted Entity or Permitted Foundation, as of the date that such entity is no longer a Permitted Trust, Permitted IRA, Permitted Entity or Permitted Foundation.

(s) “Voting Control” means, with respect to a share of Common Stock, the exclusive power to vote or direct the voting of such share by proxy, voting agreement, retained right, delegation or otherwise.

Section 5.6 Retirement of Converted Shares. In the event any shares of Class B Common Stock or Class C Common Stock are converted into shares of Class A Common Stock pursuant to this Article V, the shares of Class B Common Stock or Class C Common Stock so converted shall be retired and shall not be reissued by the Corporation.

Section 5.7 Dividends and Distributions. Notwithstanding anything to the contrary in Sections 5.1, 5.2, 5.3 or 5.4 of this Article V, if the date on which any share of Class B Common Stock or Class C Common Stock is converted into Class A Common Stock pursuant to this Article V occurs after the record date for the determination of the holders of Class B Common Stock or Class C Common Stock entitled to receive any dividend or distribution to be paid on the shares of Class B Common Stock or Class C Common Stock, the holder of such shares of Class B Common Stock or Class C Common Stock as of such record date will be entitled to receive such dividend or distribution on such payment date; provided, that, notwithstanding any other provision of this Certificate of Incorporation, to the extent that any such dividend or distribution is payable in shares of Class B Common Stock or Class C Common Stock, such dividend or distribution shall be deemed to have been declared, and shall be payable in, shares of Class A Common Stock and no shares of Class B Common Stock or Class C Common Stock shall be issued in payment thereof.

Section 5.8 Reserved Authorized Share Capital. The Corporation shall at all times reserve and keep available, out of its authorized and unissued shares of Class A Common Stock, solely for the purpose of effecting conversions of shares of Class B Common Stock and Class C Common Stock into Class A Common Stock, such number of duly authorized shares of Class A Common Stock as shall from time to time be sufficient to effect the conversion of all then-outstanding shares of Class B Common Stock and Class C Common Stock. If at any time the number of authorized and unissued shares of Class A Common Stock shall not be sufficient to effect the conversion of all then-outstanding shares of Class B Common Stock and Class C Common Stock, the Corporation shall promptly take such corporate action as may be necessary to increase its authorized but unissued shares of Class A Common Stock to such number of shares as shall be sufficient for such purpose, including, without limitation, obtaining the requisite stockholder approval of any necessary amendment to this Certificate of Incorporation. All shares of Class A Common Stock which are so issuable shall, when issued, be duly and validly issued, fully paid and non-assessable shares. The Corporation shall take all such action as may be necessary to ensure that all such shares of Class A Common Stock may be so issued without violation of any applicable law or regulation.

ARTICLE VI

Section 6.1 Board Powers. The business and affairs of the Corporation shall be managed by or under the direction of the Board, except as otherwise provided by law. In addition to the powers and authority expressly conferred upon them by statute or by this Certificate of Incorporation or the Bylaws, the directors are hereby empowered to exercise all such powers and do all such acts and things as may be exercised or done by the Corporation.

Section 6.2 Board Composition. Subject to the rights of the holders of any series of Preferred Stock to elect additional directors under specified circumstances, the total number of directors constituting the Whole Board shall be fixed from time to time exclusively by resolution adopted by a majority of the Whole Board. For purposes of this Certificate of Incorporation, the term “Whole Board” shall mean the total number of authorized directors whether or not there exist any vacancies in previously authorized directorships. Subject to the special rights of the holders of any series of Preferred Stock to elect additional directors under specified circumstances, each director of the Corporation shall be elected at each annual meeting of stockholders. No stockholder entitled to vote at an election for directors of the Corporation may cumulate votes. Each director shall hold office until the next annual meeting and until such director’s successor is elected and qualified, or until such director’s earlier death, resignation, disqualification or removal. Any director of the Corporation may be removed from office by the stockholders of the Corporation as provided in Section 141(k) of the General Corporation Law. Any director of the Corporation may resign at any time upon notice to the Corporation given in writing or by any electronic transmission permitted by the Bylaws.

Section 6.3 Board Vacancies. Subject to the special rights of the holders of any series of Preferred Stock to elect additional directors under specified circumstances, any vacancy occurring in the Board for any cause, and any newly created directorship resulting from any increase in the authorized number of directors, shall, unless (a) the Board determines by resolution that any such vacancies or newly created directorships shall be filled by the stockholders or (b) as otherwise provided by law, be filled only by the affirmative vote of a majority of the directors then in office, even if less than a quorum, or by a sole remaining director, and not by the stockholders. Any director elected in accordance with the preceding sentence shall hold office for a term expiring at the next annual meeting of stockholders or until such director’s successor shall have been duly elected and qualified, or until such director’s earlier death, resignation, disqualification or removal. No decrease in the authorized number of directors shall shorten the term of any incumbent director.

Section 6.4 Board Quorum. A quorum for the transaction of business by the directors shall be set forth in the Bylaws.

Section 6.5 Director Election. Election of directors need not be by written ballot unless the Bylaws shall so provide.

ARTICLE VII

Section 7.1 Corporate Opportunities. Except as set forth in Section 7.2 of this Article VII, to the extent permitted by the General Corporation Law, if any non-employee director (or any of his or her affiliates) of the Corporation acquires knowledge of a potential transaction or matter which may be a corporate opportunity in the same or similar activity or line of business as the Corporation, the Corporation shall have no interest or expectancy in being offered by such non-employee director any opportunity to participate in such corporate opportunity, any such interest or expectancy being hereby renounced, so that, as a result of such renunciation and without limiting the scope of such renunciation, such person (a) shall have no duty to communicate or present such corporate opportunity to the Corporation and (b) shall have the right to hold any such corporate opportunity for its (and its officers’, directors’, agents’, stockholders’ or affiliates’) own account or to recommend, sell, assign or transfer such corporate opportunity to any individual, corporation (including not-for-profit), general or limited partnership, limited liability company, joint venture, estate, trust, association, organization, governmental entity or other entity of any kind or nature other than the Corporation; provided, however, that the foregoing shall not preclude or prevent the Corporation from pursuing any corporate opportunity that may be presented to it by any means.

Section 7.2 Non-Employee Directors. Notwithstanding the provisions of Section 7.1 of this Article VII, the Corporation does not renounce any interest or expectancy it may have in any corporate opportunity that is offered to any non-employee director, if such opportunity is expressly offered to such non-employee director (or his or her affiliates) solely in, and as a direct result of, his or her capacity as a director of the Corporation.

ARTICLE VIII

The Corporation hereby elects not to be governed by Section 203 of the General Corporation Law.

ARTICLE IX

Section 9.1 Director Liability. To the fullest extent permitted by law, no director of the Corporation shall be personally liable to the Corporation or its stockholders for monetary damages for breach of fiduciary duty as a director. Without limiting the effect of the preceding sentence, if the General Corporation Law is hereafter amended to authorize the further elimination or limitation of the liability of a director, then the liability of a director of the Corporation shall be eliminated or limited to the fullest extent permitted by the General Corporation Law, as so amended.

Section 9.2 Effect of Amendments. Neither any amendment nor repeal of this Article IX, nor the adoption of any provision of this Certificate of Incorporation inconsistent with this Article IX, shall eliminate, reduce or otherwise adversely affect any limitation on the personal liability of a director of the Corporation existing at the time of such amendment, repeal or adoption of such an inconsistent provision.

Section 9.3 Indemnification. To the fullest extent permitted by applicable law, the Corporation may provide indemnification of (and advancement of expenses to) directors, officers, and other agents of the Corporation (and any other persons to which applicable law permits the Corporation to provide indemnification) through the Bylaws, agreements with such directors, officers, agents or other persons, vote of stockholders or disinterested directors or otherwise.

ARTICLE X

The Board shall have the power to adopt, amend or repeal the Bylaws. Any adoption, amendment or repeal of the Bylaws by the Board shall require the approval of a majority of the Whole Board. The stockholders shall also have power to adopt, amend or repeal the Bylaws by the affirmative vote of the holders of at least a majority of the voting power of all of the then-outstanding shares of capital stock of the Corporation entitled to vote generally in the election of directors, voting together as a single class; provided, however, that, notwithstanding any other provision of this Certificate of Incorporation (including any Certificate of Designation) or any provision of law that might otherwise permit a lesser or no vote, but in addition to any vote of the holders of any class or series of stock of the Corporation required by applicable law or by this Certificate of Incorporation (including any Preferred Stock issued pursuant to any Certificate of Designation), any time after the Final Class B Conversion Date, the affirmative vote of the holders of at least two-thirds (2/3) of the voting power of all of the then-outstanding shares of the capital stock of the Corporation entitled to vote generally in the election of directors, voting together as a single class, shall be required to adopt, amend or repeal any provision of the Bylaws; provided, further, that if two-thirds (2/3) of the Whole Board has approved such adoption, amendment or repeal of any provisions of the Bylaws, then only the affirmative vote of the holders of at least a majority of the voting power of all of the then-outstanding shares of the capital stock of the Corporation entitled to vote generally in the election of directors, voting together as a single class, shall be required to adopt, amend or repeal any provision of the Bylaws.

ARTICLE XI

Section 11.1 Stockholder Actions. Subject to the rights of any series of Preferred Stock then outstanding, any action required or permitted to be taken by the stockholders of the Corporation must be effected at a duly called annual or special meeting of stockholders of the Corporation and may not be effected by any consent in writing by such stockholders; provided, that prior to the trading day falling on or immediately after the date on which the number of shares of Class B Common Stock outstanding cease to be at least 15% of the total number of the then-outstanding shares of Common Stock, any action required or permitted to be taken at any annual or special meeting of stockholders of the Corporation may be taken without a meeting, without prior notice and without a vote, if a consent or consents in writing, setting forth the action so taken, is signed by or on behalf of the holders of outstanding stock having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted and shall be delivered to the Corporation in accordance with the General Corporation Law.

Section 11.2 Special Meetings. Special meetings of stockholders of the Corporation may be called only by the Chairperson of the Board, the Chief Executive Officer, the Lead Independent Director (as defined in the Bylaws) or any two (2) Directors, and may not be called by any other person or persons; provided, however, that at any time before the Final Class B Conversion Date, special meetings of the stockholders of the Corporation for any purpose or purposes shall also be promptly called by the Chairperson of the Board, the Chief Executive Officer, or the Lead Independent Director upon the written request of holders of at least fifty percent (50%) in voting power of the stock of the Corporation entitled to vote generally in the election of directors. Only such business shall be considered at a special meeting of stockholders as shall have been stated in the notice for such meeting.

Section 11.3 Notice of Director Nominations. Advance notice of stockholder nominations for the election of directors and of business to be brought by stockholders before any meeting of the stockholders of the Corporation shall be given in the manner and to the extent provided in the Bylaws.

ARTICLE XII

Unless the Corporation consents in writing to the selection of an alternative forum, the Court of Chancery of the State of Delaware (or, if the Court of Chancery does not have jurisdiction, the federal district court for the District of Delaware) shall, to the fullest extent permitted by law, be the sole and exclusive forum for (a) any derivative action or proceeding brought on behalf of this corporation, (b) any action asserting a claim of breach of a fiduciary duty owed by any director, officer or other employee of this corporation to this corporation or this corporation’s stockholders, (c) any action arising pursuant to any provision of the General Corporation Law or this Certificate of Incorporation or the Bylaws (as either may be amended from time to time), or (d) any action asserting a claim governed by the internal affairs doctrine, except for, as to each of (a) through (d) above, any claim as to which the Court of Chancery determines that there is an indispensable party not subject to the jurisdiction of the Court of Chancery (and the indispensable party does not consent to the personal jurisdiction of the Court of Chancery within ten (10) days following such determination), which is vested in the exclusive jurisdiction of a court or forum other than the Court of Chancery, or for which the Court of Chancery does not have subject matter jurisdiction. Any person or entity purchasing or otherwise acquiring or holding any interest in shares of capital stock of this Corporation shall be deemed to have notice of and consented to the provisions of this Article XII. This Article XII shall not apply to suits brought to enforce a duty or liability created by the Securities Act of 1933, as

amended, or the Securities Exchange Act of 1934, as amended, or any other claim for which the federal courts have exclusive jurisdiction.

If any action the subject matter of which is within the scope of this Article XII is filed in a court other than a court located within the State of Delaware (a “Foreign Action”) in the name of any stockholder, such stockholder shall be deemed to have consented to (i) the personal jurisdiction of the state and federal courts located within the State of Delaware in connection with any action brought in any such court to enforce this Article XII (an “Enforcement Action”) and (ii) having service of process made upon such stockholder in any such Enforcement Action by service upon such stockholder’s counsel in the Foreign Action as agent for such stockholder.

If any provision or provisions of this Article XII shall be held to be invalid, illegal or unenforceable as applied to any person or entity or circumstance for any reason whatsoever, then, to the fullest extent permitted by law, the validity, legality and enforceability of such provisions in any other circumstance and of the remaining provisions of this Article XII (including, without limitation, each portion of any sentence of this Article XII containing any such provision held to be invalid, illegal or unenforceable that is not itself held to be invalid, illegal or unenforceable) and the application of such provision to other persons or entities and circumstances shall not in any way be affected or impaired thereby.

ARTICLE XIII

If any provision of this Certificate of Incorporation shall be held to be invalid, illegal or unenforceable, then such provision shall nonetheless be enforced to the maximum extent possible consistent with such holding and the remaining provisions of this Certificate of Incorporation (including without limitation, all portions of any section of this Certificate of Incorporation containing any such provision held to be invalid, illegal or unenforceable, that are not themselves invalid, illegal or unenforceable) shall remain in full force and effect.

ARTICLE XIV

Section 14.1 Amendment - General. The Corporation reserves the right to amend or repeal any provision contained in this Certificate of Incorporation in the manner prescribed by the laws of the State of Delaware and all rights conferred upon stockholders are granted subject to this reservation; provided, however, that, notwithstanding any other provision of this Certificate of Incorporation (including any Certificate of Designation) or any provision of law that might otherwise permit a lesser vote or no vote, but in addition to any vote of the holders of any class or series of the stock of the Corporation required by law or by this Certificate of Incorporation (including any Certificate of Designation), and subject to Sections 4.1 and 4.2(a) of Article IV, the affirmative vote of the holders of at least two-thirds (2/3) of the voting power of all of the then-outstanding shares of the capital stock of the Corporation entitled to vote generally in the election of directors, voting together as a single class, shall be required to amend or repeal or adopt, whether by merger or otherwise, any provision inconsistent with Sections 4.1(b), 4.1(c), 4.2 and, after the Final Class B Conversion Date, 4.3 of Article IV, Article V (other than Section 5.2 of Article V), Article VI, Article X, Article XI, Article XII, Article XIII, Article XIV, or this Section 14.1 of this Article XIV (the “Specified Provisions”); provided, further, that if two-thirds (2/3) of the Whole Board has approved such amendment or repeal of, or any provision inconsistent with, the Specified Provisions, then only the affirmative vote of the holders of at least a majority of the voting power of all of the then-outstanding shares of the capital stock of the Corporation entitled to vote generally in the election of directors, voting together as a single class, shall be required to amend or repeal, or adopt, whether by merger or otherwise, any provision inconsistent with, the Specified Provisions.

Section 14.2 Amendment - Class B Vote. Notwithstanding any other provision of this Certificate of Incorporation (including any Certificate of Designation) or any provision of law that might otherwise permit a lesser vote or no vote, but in addition to any vote of the holders of any class or series of the stock of the Corporation required by law or by this Certificate of Incorporation (including any Certificate of Designation), at any time prior to the Final Class B Conversion Date, the affirmative vote of the holders of Class B Common Stock representing at least eighty-five percent (85%) of the voting power of the then-outstanding shares of Class B Common Stock, voting separately as a single class, shall be required to amend or repeal or adopt, whether by merger or otherwise, any provision inconsistent with, Section 4.3 of Article IV (insofar as such amendment or provision would affect the voting power of the shares of Class B Common Stock) and Section 5.2 of Article V. For the avoidance of doubt, at any time after the Final Class B Conversion Date, this Section 14.2 of Article XIV shall no longer be in effect.

IN WITNESS WHEREOF, said Corporation has caused this Certificate of Incorporation to be signed by its duly authorized officer this 22nd day of August, 2023 and the foregoing facts stated herein are true and correct.

| | | | | |

| /s/ Kevin Ryan |

| Kevin Ryan | |

| Chief Financial Officer |

Better Home & Finance Holding Company

(a Delaware corporation)

BYLAWS

As Adopted August 22, 2023 and

As Effective August 22, 2023

Table of Contents

| | | | | | | | | | | |

| | | Page |

| | | |

| Article I - Stockholders | 4 |

| | | |

| 1.1 | Annual Meetings. | 4 |

| 1.2 | Special Meetings. | 4 |

| 1.3 | Notice of Meetings. | 5 |

| 1.4 | Adjournments. | 5 |

| 1.5 | Quorum. | 5 |

| 1.6 | Organization. | 6 |

| 1.7 | Voting; Proxies. | 6 |

| 1.8 | Fixing Date for Determination of Stockholders of Record. | 7 |

| 1.9 | List of Stockholders Entitled to Vote. | 7 |

| 1.10 | Inspectors of Elections. | 8 |

| 1.11 | Notice of Stockholder Business; Nominations. | 8 |

| | | |

| Article II - Board Of Directors | 15 |

| | | |

| 2.1 | Number; Qualifications. | 15 |

| 2.2 | Election; Resignation; Removal; Vacancies. | 15 |

| 2.3 | Regular Meetings. | 15 |

| 2.4 | Special Meetings. | 15 |

| 2.5 | Remote Meetings Permitted. | 15 |

| 2.6 | Quorum; Vote Required for Action. | 16 |

| 2.7 | Organization. | 16 |

| 2.8 | Unanimous Action by Directors in Lieu of a Meeting. | 16 |

| 2.9 | Powers. | 16 |

| 2.10 | Compensation of Directors. | 16 |

| | | |

| Article III - Committees | 16 |

| | | |

| 3.1 | Committees. | 16 |

| 3.2 | Committee Rules. | 17 |

| | | |

| Article IV - Officers; Chairperson; Lead Independent Director | 17 |

| | | |

| 4.1 | Generally. | 17 |

| 4.2 | Chief Executive Officer. | 18 |

| 4.3 | Chairperson of the Board. | 18 |

| 4.4 | Lead Independent Director. | 18 |

| 4.5 | President. | 18 |

| 4.6 | Chief Financial Officer. | 19 |

| 4.7 | Treasurer. | 19 |

| 4.8 | Vice President. | 19 |

| 4.9 | Secretary. | 19 |

| 4.10 | Delegation of Authority. | 19 |

| | | | | | | | | | | |

| 4.11 | Removal. | 19 |

| | | |

| Article V - Stock | 20 |

| | | |

| 5.1 | Certificates; Uncertificated Shares. | 20 |

| 5.2 Lost, Stolen or Destroyed Stock Certificates; Issuance of New Certificates or Uncertificated Shares. | 20 |

| 5.3 | Other Regulations. | 20 |

| | | |

| Article VI - Indemnification | 20 |

| | | |

| 6.1 | Directors and Executive Officers. | 20 |

| 6.2 | Other Officers, Employees and Other Agents. | 21 |

| 6.3 | Expenses. | 21 |

| 6.4 | Enforcement. | 22 |

| 6.5 | Non-Exclusivity of Rights. | 22 |

| 6.6 | Survival of Rights. | 23 |

| 6.7 | Insurance. | 23 |

| 6.8 | Amendments. | 23 |

| 6.9 | Saving Clause. | 23 |

| 6.10 | Certain Definitions and Construction of Terms. | 23 |

| | | |

| Article VII - Notices | 24 |

| | | |

| 7.1 | Notice. | 24 |

| 7.2 | Waiver of Notice. | 25 |

| | | |

| Article VIII - Interested Directors | 25 |

| | | |

| 8.1 | Interested Directors. | 25 |

| 8.2 | Quorum. | 25 |

| | | |

| Article IX - Miscellaneous | 26 |

| | | |

| 9.1 | Fiscal Year. | 26 |

| 9.2 | Seal. | 26 |

| 9.3 | Form of Records. | 26 |

| 9.4 | Reliance Upon Books and Records. | 26 |

| 9.5 | Certificate of Incorporation Governs. | 26 |

| 9.6 | Severability. | 26 |

| 9.7 | Time Periods. | 26 |

| | | |

| Article X - Amendment | 27 |

Better Home & Finance Holding Company

(a Delaware corporation)

BYLAWS

As Adopted August 22, 2023 and

As Effective August 22, 2023

Article I - Stockholders

1.1 Annual Meetings.

An annual meeting of stockholders shall be held for the election of directors at such date and time as the Board of Directors (the “Board”) of Better Home & Finance Holding Company (the “Corporation”) shall each year fix. The meeting may be held either at a place, within or without the State of Delaware as permitted by the Delaware General Corporation Law (the “General Corporation Law”), or by means of remote communication as the Board in its sole discretion may determine. Any proper business may be transacted at the annual meeting.

1.2 Special Meetings.

Special meetings of stockholders for any purpose or purposes shall be called in the manner set forth in the Certificate of Incorporation of the Corporation (as the same may be amended and/or restated from time to time, the “Certificate of Incorporation”). For so long as stockholders have the right under the Certificate of Incorporation to a call a special meeting of stockholders, stockholders holding the requisite percentage of the voting power of the Corporation specified in the Certificate of Incorporation on the record date established pursuant to Section 1.8 of these Bylaws and who otherwise comply with the requirement of this Sections 1.2 and 1.11 of these Bylaws may call a special meeting of stockholders. The person or persons calling any such meeting or requesting such meeting be called shall concurrently specify the purpose of such meeting and the business proposed to be transacted at such meeting. In connection with any request for a special meeting by the stockholders in accordance with the provisions of this Section 1.2, such request shall be in writing sent by registered mail to the Chairperson of the Board of Directors, the Chief Executive Officer, the Lead Independent Director, or the Secretary of the Corporation, or delivered to any such officer in person, and shall include the information required by Section 1.11 of these Bylaws. Subject to the immediately succeeding sentence, the Board shall cause notice of a meeting requested by the stockholders in accordance with this Section 1.2 to be given in accordance with Section 1.3 of these Bylaws as promptly as reasonably practicable and, in connection therewith, establish the time, date and place of such meeting which shall be held not more than one hundred twenty (120) nor less than thirty five (35) days after the Board has determined the stockholder or stockholders shall have satisfied the requirements in Section 1.11 of these Bylaws. Within five (5) business days after receiving all of the information specified in Section 1.11 of these Bylaws from a stockholder or stockholders of the Corporation, the Board shall determine whether such stockholder or stockholders have satisfied the requirements for calling a special meeting of the stockholders and notify the requesting party or parties of its finding. Any special meeting may be held either at a place, within or without the State of Delaware, or by means of remote communication as the Board in its sole discretion may determine. Only such business shall be conducted at a special meeting of stockholders as shall have been brought before the meeting pursuant to the Corporation’s notice of such meeting. Nominations of

persons for election to the Board may be made at a special meeting of stockholders at which directors are to be elected pursuant to the Corporation’s notice of such meeting (a) by or at the direction of the Board or any committee thereof or (b) provided that the Board has determined that directors shall be elected at such meeting, by any stockholder of the Corporation who is a stockholder of record at the time of giving of notice of the special meeting, who shall be entitled to vote at the meeting and who complies with the notice and other procedures set forth in Section 1.11 in all applicable respects.

1.3 Notice of Meetings.